Today, let’s look at XAUUSD in commodities, EURUSD in forex, BTCUSD in cryptocurrency, and Nvidia in stocks. We’ll check how they’ve been doing lately, where they stand now, and what we might expect by week’s end.

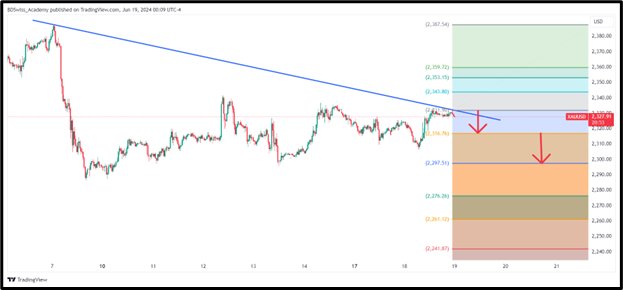

XAUUSD

Sentimental Analysis

BDSwiss Mobile App indicates 53% of traders are long on XAUUSD, while 47% are short.

Technical Analysis

XAUUSD downtrend line rejection at $2331.90 on 1-hour chart.

If rejection holds:

Potential downside targets: $2316.76, further to $2297.51 if $2316.76 breaks.

Alternatively, if rejection fails:

Potential upside targets: $2343.80, further to $2353.15 if $2343.80 breaks.

Apply Risk Management

Fundamental Analysis

Fed rate-cut uncertainty restrains traders from initiating new directional positions as gold price consolidates near the upper boundary of its recent trading range. Weak US Retail Sales on Tuesday weaken the USD, providing underlying support to gold.

EURUSD

Sentimental Analysis

According to BDSwiss Mobile App, sentiment shows 73% long positions on EURUSD and 27% short positions.

Technical Analysis  EURUSD downtrendline rejection at 1.07593 on the 1-hour chart.

EURUSD downtrendline rejection at 1.07593 on the 1-hour chart.

If rejection holds at 1.07593:

Potential downside targets: 1.07020 and further down to 1.06611 upon breaking 1.07020.

Alternatively, if rejection fails:

Potential upside targets: 1.07792 and further up to 1.07931 upon breaking 1.07792.

Apply risk management

Fundamental Analysis

As attention shifts back to Europe, France emerges as a focal point with upcoming elections. Market watchers speculate whether the ECB will intervene to stabilize widening bond spreads, especially given France’s substantial debt burden. Despite a temporary respite on Monday, EUR/USD fails to sustain gains, highlighting persistent downside risks in the near term.

BTCUSD According to the BDSwiss Mobile App, 98% of traders are long on BTCUSD, while 2% are short.

According to the BDSwiss Mobile App, 98% of traders are long on BTCUSD, while 2% are short.

Technical Analysis

BTCUSD support rejection at $64620.91 on the 4-hour chart.

If rejection holds at $64620.91:

Potential upside targets: $66179.54 and further up to $67419.74 upon breaking $66179.54.

Alternatively, if rejection fails:

Potential downside targets: $62591.28 and further down to $60036.77 upon breaking $62591.28.

Apply risk management

Fundamental Analysis

$24 million worth of short Bitcoin liquidations were recorded in the last 24 hours, contrasting with $61 million in long positions according to Coinglass data. Leveraged long crypto positions saw approximately $372 million liquidated, while short positions amounted to $61.8 million during the same period.

NVIDIA

According to BDSwiss Mobile App, NVIDIA has a 50% buy and 50% sell sentiment among traders.

According to BDSwiss Mobile App, NVIDIA has a 50% buy and 50% sell sentiment among traders.

Technical Analysis

Nvidia shows an uptrend pattern on the 4-hour chart with the current price at $136.51.

If $136.51 is breached to the upside:

Potential targets: $147.18 and further up to $160.77 upon breaking $147.18.

Conversely, if price reverses from $136.51:

Potential downside targets: $128.11 and further down to $121.51 upon breaking $128.11.

Apply risk management

Fundamental Analysis

3.29 trillion marks Apple’s market valuation, whereas Nvidia has recently overtaken both Microsoft and Apple to become the world’s most valuable publicly listed company with a market capitalization of $3.34 trillion.

Sources:

BDSwiss Mobile App

BDSwiss Academy Page on Tradingview

https://www.tradingview.com/u/BDSwiss_Academy/

https://www.fxstreet.com/markets/commodities/metals/gold

https://cointelegraph.com/news/traders-bitcoin-recovery-despite-drop-below-65k

https://cointelegraph.com/news/nvidia-world-most-valuable-publicly-traded-company