XAUUSD from the commodities market, EURUSD from the forex market, BTCUSD from the cryptocurrency market, and NVIDIA from the stock market are worth examining today, on the third day of the trading week, to review their recent performance and current status, and to anticipate potential changes before the week concludes.

XAUUSD

Sentimental Analysis

From a sentiment analysis perspective on the BDSwiss mobile app, 98% of traders are long on XAUUSD, while 2% are short.

Technical Analysis

Uptrend line price rejection at $2325.75 on the 15-minute XAUUSD chart.

If rejection holds:

Target: $2338.16

Breakout above $2338.16 targets $2344.30

If rejection fails:

Target: $2329.53

Breakdown below $2329.53 targets $2326.86

Apply Risk Management

Fundamental Analysis

Gold prices dropped 0.90% in the mid-North American session on Tuesday, amid a risk-off mood and falling US Treasury yields. Recent US economic data indicates a slowing economy and potential lower interest rates, yet XAU/USD is trading lower at $2,328.

EURUSD

Sentimental Analysis

From sentiment analysis on the BDSwiss app, 53% of traders are short on EURUSD, while 47% are long.

Technical Analysis

EURUSD downtrend line potential breakout at 1.088561 on the 15-minute chart.

If breakout holds:

Target: 1.08928

Breakout above 1.08928 targets 1.09019

If breakout fails:

Target: 1.08725

Breakdown below 1.08725 targets 1.08593

Apply risk management

Fundamental Analysis

With the highly anticipated rate cut looming, EURUSD is under scrutiny. The ECB prepares for its first cut after rapid hikes to curb inflation. Yet, market response might be subdued as many officials eyed June for rate reduction initiation.

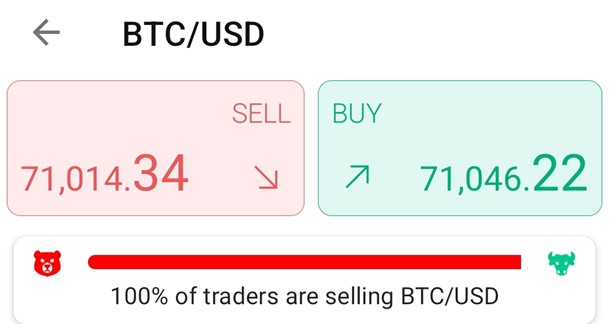

BTCUSD

Sentimental Analysis

According to sentiment analysis on the BDSwiss mobile app, all traders are short on BTCUSD.

Technical Analysis

Potential resistance breakout at $71303.50 on 15-minute BTCUSD chart.

If breakout holds:

Target: $72059.85

Breakout above $72059.85 targets $73021.97

If breakout fails:

Target: $70241.28

Breakdown below $70241.28 targets $69913.15

Apply risk management

Fundamental Analysis

Bitcoin ETFs see renewed inflows, with BlackRock’s IBIT surpassing $20B in AUM after recent flat to negative flows.

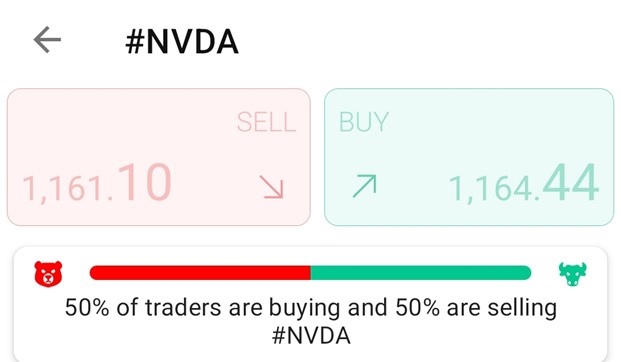

NVIDIA

Sentimental Analysis

As per sentiment analysis on the BDSwiss mobile app, there is a 50/50 split between traders buying and selling NVIDIA.

Technical Analysis

4HR Chart of Nvidia shows potential resistance breakout at $1166.81.

If breakout holds:

Target: $1278.58

Breakout above $1278.58 targets $1420.75.

If breakout fails:

Target: $1078.88

Breakdown below $1078.88 targets $1009.85.

Apply Risk Management

Fundamental Analysis

At Sapphire Orlando, SAP and NVIDIA introduce AI for ‘The Most Valuable Language’, enhancing business prospects by advancing Joule AI copilot’s consulting and coding abilities and enhancing sales procedures through industrial simulation.

Sources :

BDSwiss Mobile App

BDSwiss Academy Page on Tradingview