Today, on the third day of the trading week, it’s a good time to examine the recent performance and current status of some of the most popular financial instruments: XAUUSD from the commodities market, EURUSD from the forex market, BTCUSD from the cryptocurrency market, and NVIDIA from the stocks market. This review can also help anticipate potential changes before the week concludes.

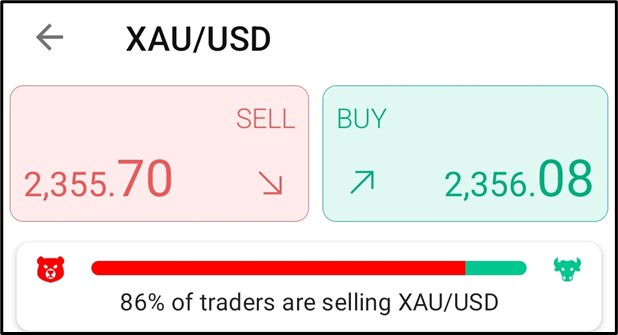

XAUUSD

Sentimental Analysis

As of 1:08 am GMT, the BDSwiss mobile app indicated that 86% of traders are selling XAUUSD, while 14% of traders are buying XAUUSD.

Technical Analysis

Based on technical analysis using the 4HR Chart of XAUUSD, the price has been in an uptrend since May 9, 2024. An uptrend line from $2307.26 resisted the price at $2336.43 after retracing from $2378.33, currently acting as resistance with the price at $2355.52. If the uptrend line holds, there’s potential for further upside, while breaking the resistance could lead to more upward movement. Conversely, if the uptrend line is breached downward, there’s a likelihood of further downside.

Fundamental Analysis

FxStreet.com – Amid mixed US PPI data and uncertainty from the Fed regarding inflation, gold prices strengthened. They surpassed the $2,359 mark on Tuesday following US Department of Labor data showing higher-than-expected factory gate inflation, indicating ongoing price elevation. However, US Treasury yields are declining, posing a challenge for the Greenback.

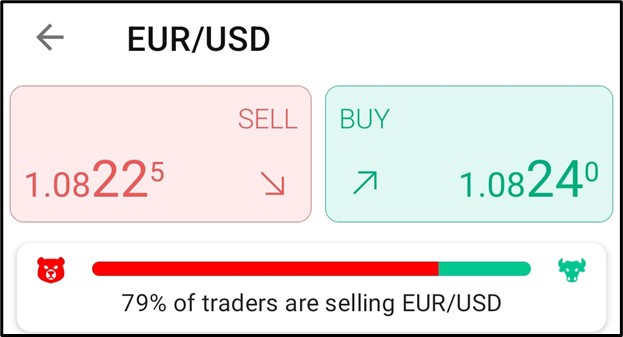

EURUSD

Sentimental Analysis

As of 2:10 AM GMT, the BDSwiss mobile app shows that 79% of traders are selling EUR/USD, while 21% are buying.

Technical Analysis

The 4HR EURUSD chart shows an upward trend since May 9, 2024. An ascending triangle pattern indicates that the exchange rate, after retracing from 1.08064, was rejected at 1.07673 but then broke past this resistance, which is now the new support. If this breakout holds, the price is likely to rise further. However, if the price reverses and breaks the new support, it may drop to the uptrend line, and breaking this line could lead to a further decline.

Fundamental Analysis

Investing.com – The foreign exchange market seems to be turning bearish on the U.S. dollar, according to Bank of America Securities, indicating that the EUR/USD pair is nearing a bullish breakout.

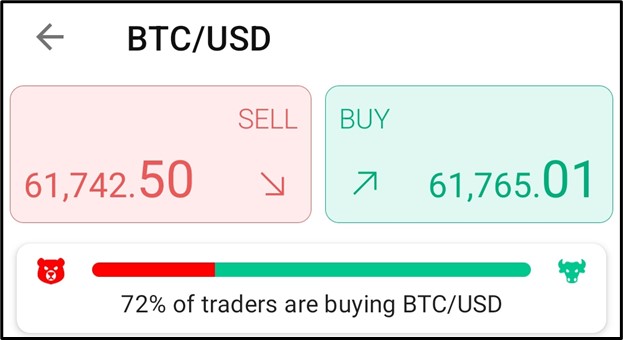

BTCUSD

Sentimental Analysis

As of 2:58 AM GMT, the BDSwiss mobile app shows that 72% of traders are buying BTC/USD, while 28% are selling.

Technical Analysis

From a technical analysis perspective, BTC/USD on the 4-hour chart has been consolidating between the resistance at $63,426.31 and the support at $60,129.80. A breakout above the resistance could signal a bullish move, while a breakdown below the support could indicate a bearish trend.

Fundamental Analysis

Binance News – According to Foresight News, El Salvador has successfully mined nearly 474 Bitcoins since 2021 using geothermal energy from the Tecapa Volcano. The country’s geothermal power plants produce 102 megawatts of electricity, with 1.5 megawatts dedicated to Bitcoin mining. This innovative approach marks a significant development in the cryptocurrency industry.

NVIDIA

Sentimental Analysis

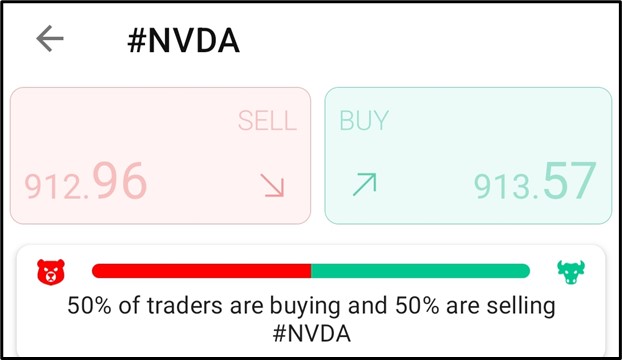

As of 3:58 AM GMT, the BDSwiss mobile app shows an even split among traders, with 50% buying and 50% selling NVIDIA.

Technical Analysis

From a technical analysis perspective using the 4-hour chart of NASDAQ: NVDA on TradingView, the price has been trending upwards since April 22, 2024. An uptrend line drawn from $761.16 saw price rejection at $784.83 after retracing from $841.13. The uptrend continued to $889.18, then retraced back to the uptrend line, which rejected the price again before the upward movement resumed to $923.92, now acting as resistance, with the current price around $913.57.

If the uptrend line holds, there’s a strong likelihood the price will move up to test the resistance. A breakout above this resistance could lead to further gains. Conversely, if the uptrend line is broken to the downside, the price is likely to decline further.

Fundamental Analysis

Nvidia.com – NVIDIA is partnering with Google DeepMind to advance large language model technology. Today, Google’s new open model, PaliGemma, launches with support from NVIDIA’s NIM inference microservices.

Sources :

BDSwiss Mobile App

Metatrader 4 ( MT4 )

https://www.fxstreet.com/markets/commodities/metals/gold

https://www.investing.com/news/forex-news/eurusd-on-verge-of-bullish-breakout–boa-securities-3439770

https://www.tradingview.com/chart/4IThf1h1/?symbol=NASDAQ%3ANVDA