Two momentous events during the week just ending: the US and China signed a “Phase One” agreement, calling a truce in their trade war, and the US House of Representatives sent the bill of impeachment to the Senate, starting the trial of Trump.

The impeachment process is so far a non-event for the FX market. It’s widely assumed that the Republicans will simply ignore the customary oath to “do impartial justice, according to law” and vote to acquit Trump no matter what the facts are.

Rather, the focus now is on the US-China trade agreement. Together with the USMCA (the US-Mexico-Canada Agreement, or the Trade Agreement Formerly Known as NAFTA), these two agreements will sharply reduce the level of uncertainty around US – and hence global – trade policy. There are still several other disputes pending, such as European autos, but those are relatively minor.

As you can see from the indicators of US economic policy uncertainty, trade is far and away from the biggest uncertainty facing the markets nowadays. For FX, monetary policy has traditionally been the most important uncertainty, but that appears to be a little less uncertain than usual nowadays.

The uncertainty has caused the global economy to slow, for two reasons. The direct reason of course is the reduced level of trade. The indirect reason is that the uncertainty has caused a global slowdown in investment, as companies were unsure what to do.

With the problems resolved, or at least on their way to being resolved, we can look forward to an improvement in the global economy driven by investment on two fronts. First, companies are likely to resume the domestic investment that they had put on hold for the time being. Secondly, I expect that they’ve begun to question the value of putting so many of their eggs in the Chinese basket and may therefore continue the process of diversifying their sources to other countries, such as Vietnam.

I think the Chinese have also learned the same lesson, and while the new agreement requires China to meet some aggressive targets for purchases of US goods, notably agricultural products, I doubt if they will return to previous levels. If I were the Chinese, I’d make sure I developed other suppliers and other markets in case something like this happens again.

The trade war was particularly damaging to emerging market (EM) currencies, as many of those countries rely on commodities and export-led growth. Oddly enough Asia was relatively less affected, probably because several of those currencies are managed floats and therefore not exposed completely to market forces. I would expect the EM currencies to recover somewhat as global growth picks up.

Enthusiasm over the accords – or at least, relief that things aren’t getting worse – has pushed global equity markets up to a record market capitalization.

However, we shouldn’t get too excited by the agreements, because a) it’s possible that China won’t fulfil its requirements, and b) as I mentioned, there are still other trade feuds pending. The American Bankers Association’s Economic Advisory Committee– a group of chief economists from major banks – this week forecast 2020 US GDP growth would be the same as the 1.9% pace of 2019, i.e. no pickup in the US at all from the agreement. The group cited lingering trade uncertainty as a major risk.

Nevertheless, for the time being, I think we are likely to see a revival of “risk-on” trades until such time as it’s seen that the trade agreements are not having an impact. That probably means a weaker JPY, particularly vs AUD. CHF/JPY is also moving up, not only from the “risk-on” factor but also because the US Treasury Department Monday added Switzerland to its “Monitoring List” of major trading partners that merit close attention to their currency practices.

As for carry trades, there’s been little to go for among the G10 currencies over the last two years as monetary policies converge and volatility falls. EM carry trades have been more successful, however. EM carry trades could be even more profitable in the future if, as I expect, EM currencies benefit from an improvement in the global trade outlook.

Upcoming week: BoJ, BoC, ECB, preliminary PMIs, Davos

The main point of interest during the coming week – besides the US political circus – will be three central bank meetings – the Bank of Japan (BoJ) (Tuesday), the Bank of Canada (BoC) (Wednesday), and the European Central Bank (ECB) (Thursday). No change in rates is expected from any of them, or indeed even seen as a possibility, so the main thing the market will be looking for is a change in bias. Since the global trade friction has been a major concern for all three of these banks – indeed, for policy makers everywhere – I think the agreements that have been reached are likely to result in a modest upgrade in their views and outlooks. That could lead to some appreciation for the currencies involved, particularly CAD, where the inflation picture is most promising.

I think the only one of the three meetings that’s likely to involve any suspense is the Bank of Canada. The market sees the ECB as being on hold for the rest of the year, while the Bank of Japan is seen as possibly cutting at some point but no one has any clear idea of when that might be. Only the BoC is seen as being more likely to cut rates over the course of the year.

However, I think the Bank of Canada is likely to upgrade its outlook further at this meeting. At its last meeting on 4 December, the BoC changed its view from fears of “the global slowdown spreading” to “nascent evidence that the global economy is stabilizing.” The main concern for Canada is of course the global trade picture, and with the passage of the USMCA, those fears have diminished considerably. That should lead them to upgrade their view.

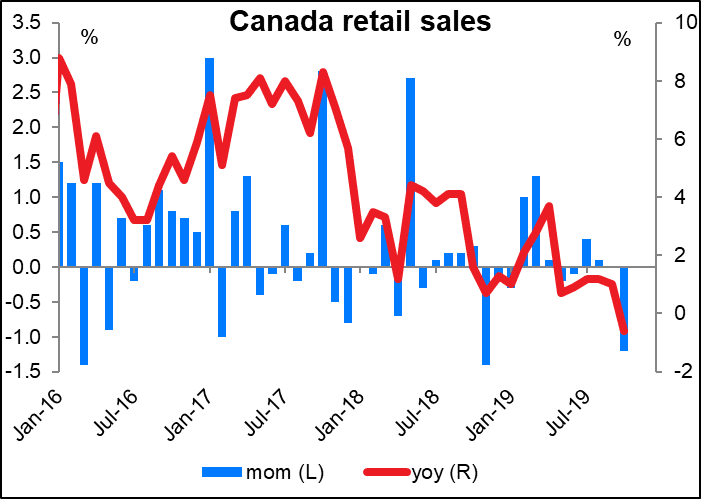

The BoC said at that meeting that “Future interest rate decisions will be guided by the Bank’s continuing assessment of the adverse impact of trade conflicts against the sources of resilience in the Canadian economy – notably consumer spending and housing activity.” While the trade picture has improved since then, the domestic news has been disappointing– both retail sales and housing starts have continued to slow.

On the other hand, with inflation on target and starting to trend higher, there’s certainly no urgency to cut rates. (The December CPI data will come out 1 ½ hours before the results of the meeting are announced – I’d expect the Committee members to have them at the meeting. No forecasts available yet.)

Net-net, I expect the BoC to adopt a more optimistic tone thanks to the improvement in the global trade outlook and for CAD to appreciate following the meeting.

As for the Bank of Japan, it too may well upgrade its assessment of overseas economies in its quarterly Outlook Report. The key point of interest will be whether that upgrade causes it to alter or even remove its rate-cut bias in the forward guidance contained in the statement it issues following the Monetary Policy Meeting. (“In particular, in a situation where downside risks to economic activity and prices, mainly regarding developments in overseas economies, are significant, the Bank will not hesitate to take additional easing measures if there is a greater possibility that the momentum toward achieving the price stability target will be lost.”) However, the turmoil in the Middle East and subsequent rise in oil prices may keep that statement intact for the time being.

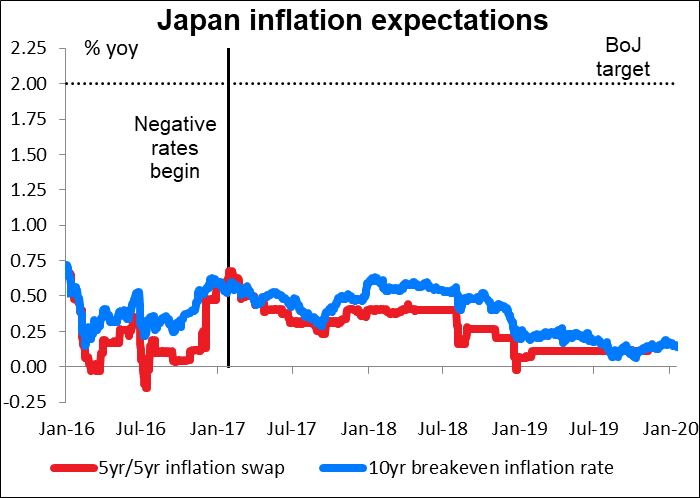

The BoJ may well upgrade its FY2020 growth forecast from October’s 0.7% rate as a result of the fiscal stimulus package that the government announced in December. Since that forecast was already above the BoJ’s estimate for Japan’s potential growth rate of 0.57%, they are likely to stick with their view that the output gap is expanding gradually and inflation should eventually move back towards their 2% target. (Good luck with that! is my personal view, and the view of the market too, but they have to retain a show of confidence in their hopeless quest.) Japan’s national inflation data comes out on Friday, but this is of less interest ever since they started announced the Tokyo figures about two weeks before the national figures.

Accordingly, I think the odds of a BoJ rate cut could also fall following the meeting, but I wouldn’t expect that to have much impact on the yen, because with inflation so far below their target, policy is likely to be on hold indefinitely. JPY neutral.

The ECB is probably the least interesting of the three meetings. I don’t think anyone expects very much from them at all for the time being. At their December meeting, they upgraded their view on the Eurozone economy somewhat – the statement said that “The risks surrounding the euro area growth outlook, related to geopolitical factors, rising protectionism and vulnerabilities in emerging markets, remain tilted to the downside, but have become somewhat less pronounced.” (emphasis added).Given the further improvement in the trade picture since then, they could well upgrade their view further, but I don’t think anyone believes they’re out of the woods yet – they’re still likely to retain their easing bias (“…the Governing Council continues to stand ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.”)

The ECB could be encouraged by a modest rise in the German and EU-wide manufacturing purchasing managers’ indices (PMIs) for January, but unfortunately, those aren’t due out until Friday, the day after the meeting, so they will have to comfort themselves with the forecasts. In any case,while the trend may be upward, they are still in contractionary territory and the expected improvement isn’t that much – probably a lot of the responses came before the US-China trade agreement was inked. Besides, while that problem may be on the back burner for now, the Trump regime is still taking aim at the crucial German auto industry, so the improvement in the outlook may be muted for now. EUR neutral.

The UK PMIs are also expected to improve, but I’m not sure that will have much impact on the currency.

Outgoing BoE Gov. Carney put the market on alert when he said recently that “there is a debate at the (monetary policy committee) over the relative merits of near-term stimulus to reinforce the expected recovery in UK growth and inflation.” Two MPC members – Silvana Tenreyro and Gertjan Vlieghe – subsequently said they’d vote for cutting rates if there are no signs of improvement in the economy. This would be in addition to the two members (Jonathan Haskel and Michael Saunders) who said at the December meeting that they would like to see a cut in rates. Two + two = four = nearly half of the nine-member committee.

The question here is whether the MPC members focus on the composite PMI – which tends to track the service-sector PMI closely, and is expected to poke its nose back above the 50 “boom or bust” line, or the more cyclical manufacturing PMI, which although it’s expected to improve, is forecast to remain in contractionary territory. I’m not sure whether they’ll consider “less of a contraction” to constitute an improvement. My guess is that they are concerned about the business cycle, and it’s the manufacturing PMI that correlates with the business cycle, and hence these figures will not show enough improvement to ally their fears. Accordingly, I’d say that they will be negative for GBP.

Finally, the Markit PMIs for the US are expected to be mixed – the manufacturing PMI is forecast to rise, but the services PMI is forecast to fall. Here too I think the manufacturing PMI is likely to be viewed as the more significant one and hence this result may be positive for the dollar, especially after this week’s better-than-expected Empire State manufacturing index and much-better-than-expected Philadelphia Fed business outlook.

Finally, we have the annual World Economic Forum at Davos, Switzerland from Tuesday to Friday. There’s no particular announcement that people are waiting for from this event. But with the global Great and Good assembled in one place, it’s non-stop interviewing on CNBC, Bloomberg and other news agencies. Someone is bound to say something market-moving at some point.