PREVIOUS TRADING DAY EVENTS –03 Nov 2023

The employment change was just 17,5K jobs in October. The average hourly wage for permanent employees rose 5.0% from a year earlier, down from 5.3% in September.

“In line with the more pronounced cooling in hiring, the annual pace of wage growth for permanent employees slowed three ticks to 5.0%,” said Royce Mendes, head of macro strategy at Desjardins. “While that’s still inconsistent with the Bank of Canada’s 2% inflation target, monetary policymakers will take the deceleration as a sign that their medicine is working,” he said. The Bank of Canada (BoC) held rates at a 22-year-high of 5.0% last month after having raised them 10 times between March of last year and July to try to bring inflation back to its 2% target. Annual inflation was 3.8% in September.

The softer-than-anticipated jobs report follows data out earlier this week indicating that the economy likely slipped into a shallow recession in the third quarter.

Source:

The data suggest that labour market momentum is slowing significantly and strengthened financial market expectations that the Federal Reserve is done raising interest rates for the current cycle, and improved the chances of the U.S. central bank engineering a “soft-landing” for the economy rather than plunging it into recession.

“This is a very Fed-friendly report,” said Sal Guatieri, a senior economist at BMO Capital Markets in Toronto. “The only wrinkle is that the labour force shrank. Still, the overall softness in the report will go a long way to keeping the Fed on the sidelines for a third straight meeting in December.”

“October’s employment report, in conjunction with the third-quarter report on productivity and costs, clearly indicates that the economy has converged already to potentially a more sustainable path of low inflation and solid potential growth,” said Brian Bethune, an economics professor at Boston College.

______________________________________________________________________

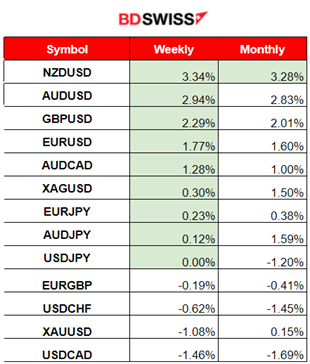

Winners and Losers

News Reports Monitor – Previous Trading Day (03 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

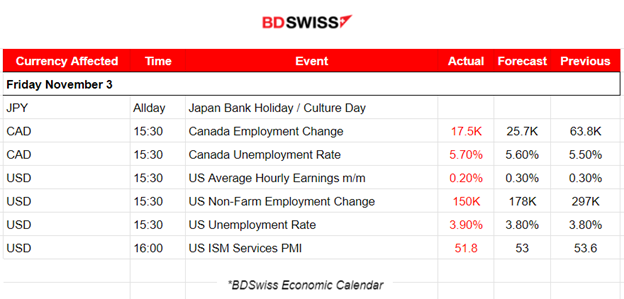

- Morning–Day Session (European and N. American Session)

At 15:30 the most important employment data for the U.S. were out. The NFP was expected to be reported lower than last time and the employment change was actually reported way lower at just 150K. The unemployment rate for the U.S. was reported higher than expected at 3.90%. The elevated interest rates seem to have a serious impact on the labour market. With such data into consideration, the market reacted with USD depreciation as the chance for higher interest rates in the future is eliminated.

The Canada data showed the same direction for labour as the employment change was just 17.5K while the unemployment rate increased significantly at 5.7% versus the previous 5.5%. The CAD pairs experienced depreciation at the time of the release.

The USDCAD fell 90 pips overall after the news releases though since the USD seemed to have weakened heavily, causing the USDCAD to drop also.

The ISM Services PMI stays in the expansion area but reported lower than expected and close to the 50-point threshold. The effects of elevated rates on business conditions are starting to show their huge impact.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

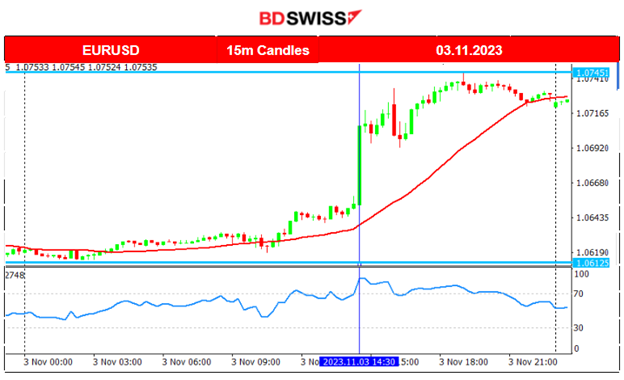

EURUSD (03.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced high volatility after the start of the European session and of course, was affected at the time of the NFP report. The USD has experienced depreciation at that time confirming persistent expectations for a slowdown. The unemployment rate rose to 3.9%, against expectations that it would hold steady at 3.8%. These pushed the pair upwards until the resistance was near 1.075. The pair did not show significant retracement after the shock.

USDCAD (03.11.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

USDCAD was affected both by the Canada and the U.S. employment data at the same time. Both currencies depreciated against other major currencies, however, the USD lost a lot of strength against the CAD. Thus, the pair dropped heavily after the news release. Some periodic short retracements took place until the end of the trading day.

___________________________________________________________________

___________________________________________________________________

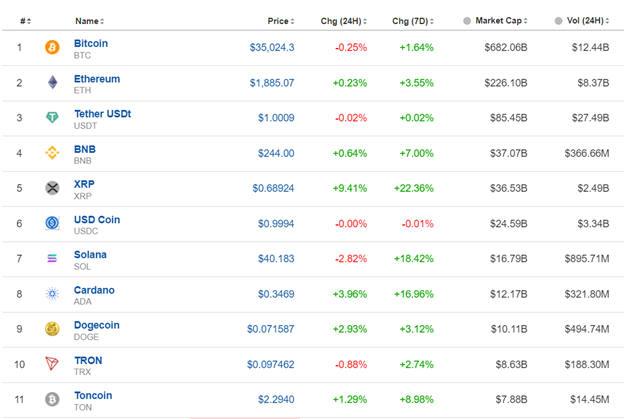

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

At the beginning of the month, 1st Nov, Bitcoin broke the resistance of 35000 and moved further to the upside while the USD depreciated heavily due to the Fed’s decision to keep rates unchanged. On its way up it found strong resistance again at near 36000 before it retraced back to the 61.8% of the rapid move upwards. It continued with low volatility remaining in the range of 36000 resistance and 34000 support. The employment data releases for the U.S. have not really affected the sideways path of the crypto even though the USD is depreciating heavily against major currencies.

Crypto sorted by Highest Market Cap:

Not only bitcoin but most crypto on this list have not moved significantly in the last 24 hours. Also, the gains for the last 7 days remain roughly the same as last time indicating that activity has not changed much from the recent announcements regarding U.S. business conditions.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

After the Fed news and the FOMC statement release, the U.S. indices experienced an upward movement. In fact, the Index experienced a strong reversal after a long period of several drops recently. This upward path now, though, is quite unusual, rapid and strong.

The weak NFP report and Unemployment rate have pushed the index higher after the news revealed that the labour market cooled significantly and that the effects of elevated interest rates are pretty strong. The chance of further hikes is somehow eliminated, the dollar lost strength significantly and stocks are picked up again as risk-on sentiment looks more positive.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

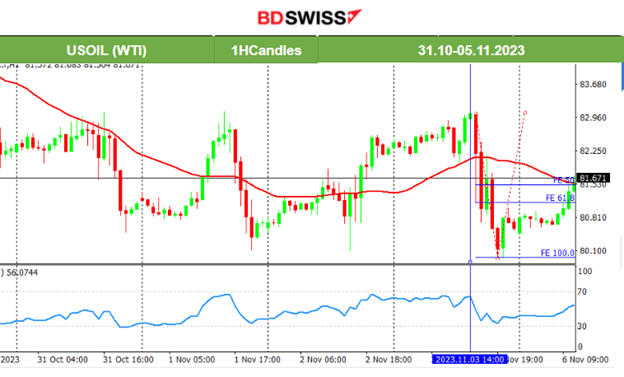

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil experienced extreme volatility lately as the fundamentals are causing it to deviate greatly from the mean, sometimes upwards and sometimes downwards. There are forces in place that are offsetting each other, one on the supply side and the other on production. The employment data for the U.S. had an effect on Friday causing the price to drop heavily with Crude testing the 80 USD/b level again. It remained on that level which proved to be strong again and eventually retraced back to the mean soon after.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold jumped during the NFP report and immediately reversed to the downside with mean reversal. During the jump it reached the resistance at near 2004 UD/oz, however, it showed that it remains lower and on the path around the mean.

______________________________________________________________

______________________________________________________________

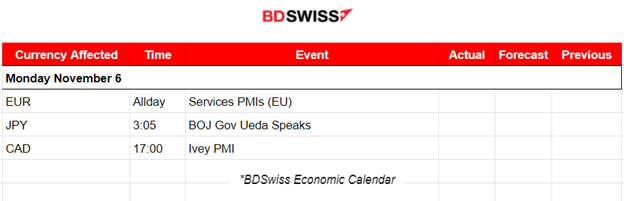

News Reports Monitor – Today Trading Day (06 Nov 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

PMI releases for the services sector in the Eurozone might cause more volatility than typically on a Monday.

General Verdict:

______________________________________________________________