Previous Trading Day’s Events (20 Dec 2023)

Key measures including core and services inflation, also dropped.

British inflation is now closer to other rich nations and matches that of France.

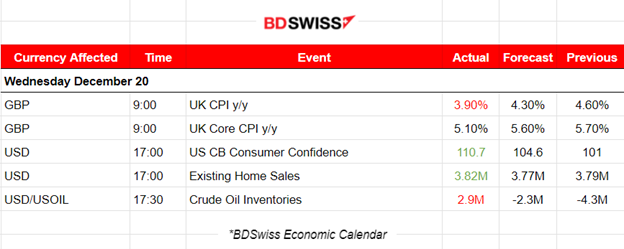

The Conference Board’s consumer confidence index increased to 110.7 this month, the highest reading since July, from a downwardly revised 101.0 in November.

“Consumer spirits are perking up for the holiday season which is a sign Christmas is still coming this year,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “This makes us more optimistic that economic growth will continue to stay in the plus column in the coming year.”

“The top issue affecting consumers remains rising prices in general, while politics, interest rates, and global conflicts all saw downticks as top concerns,” said Dana Peterson, the chief economist at the Conference Board in Washington.

Source: https://www.reuters.com/markets/us/us-consumer-confidence-perks-up-december-2023-12-20/

______________________________________________________________________

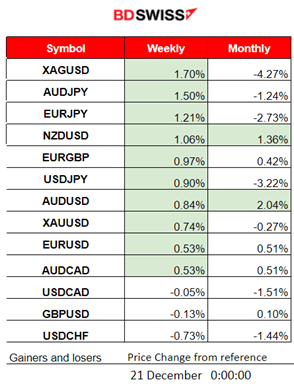

Winners vs Losers

XAGUSD managed to get the top place of the week’s winners with 1.7% gains so far followed by the AUDJPY with 1.5% gains. This month AUDUSD is on the top with 2.04% gains.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (20 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

The U.K.’s Consumer Prices Index (CPI) rose by 3.9% in the 12 months to November 2023, down from 4.6% in October. On a monthly basis, CPI fell by 0.2% in November 2023, compared with a rise of 0.4% in November 2022. Core inflation cooled unexpectedly, falling to 5.1% from 5.7%. This obviously fuels bets on Bank of England interest rate cuts next year. The market reacted with GBP depreciation at the time of the release. GBPUSD sharply dropped more than 50 pips so far.

CB Consumer Confidence report for the U.S. was released at 17:00 showing that confidence surged by the most since early 2021. The Conference Board’s index increased to 110.7 in December from a revised 101 reading in November. Consumers saw better business conditions, incomes and labour-market prospects. There was not a major impact recorded in the market at that time.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (20.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

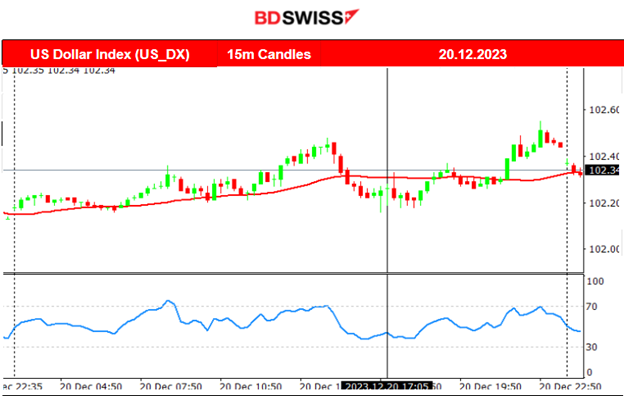

The pair moved to the downside early with low volatility since the start of the Asian session and saw more volatility later at the start of the European session. When volatility levels started to grow, the pair moved to the upside crossing the 30-period MA and finding resistance before reversing again back to the mean. In general, the pair closed lower as it was moving around the MA yesterday. Similar (mirror) path as the dollar index.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 18th Dec, Bitcoin’s price reversed remarkably to the upside. Bitcoin crossed the 30-period MA on its way up and moved beyond the 42300 USD resistance reaching eventually the next resistance at 43300 USD. Retracement took place eventually fully and bitcoin settled to a path around the 30-period MA and the mean near 42700 USD. Bitcoin managed to break the high resistance at 43300 USD reaching 44300 USD before retracing back to the previous resistance level that now became a support (43300).

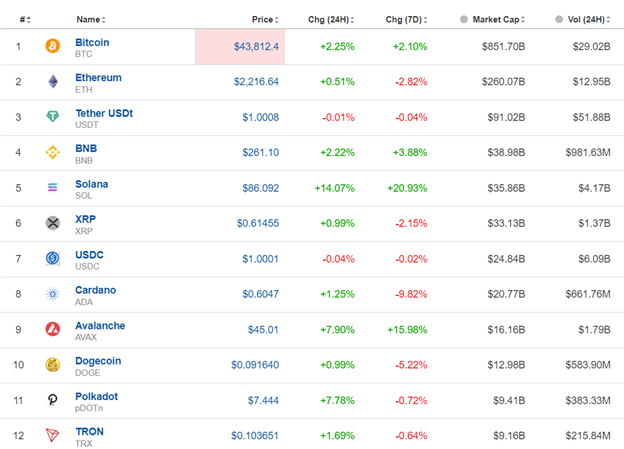

Crypto sorted by Highest Market Cap:

Just like bitcoin, the market is resilient enough to return to the upside retaking gains. All crypto experienced good performance the last 24 hours. Solana is the top performer for the last 7 days with nearly 21% gains so far.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The risk-on sentiment was fairly interrupted as market participants caused a crash intraday of the U.S. stock market yesterday after 21:00. According to the reports, the U.S. existing home sales rose unexpectedly in November, and, amid optimism about the labour market, the Conference Board said its consumer confidence index increased to 110.7 this month comparing well to economist expectations for 104.0 and November’s downwardly revised 101.0. In the U.S., 10-year Treasury yields fell to an almost five-month low as government bond yields fell globally after the British inflation data. NAS100 and other indices were clearly on an uptrend when suddenly indices fell dramatically. The NAS100 experienced a near 300-dollar fall before retracing.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

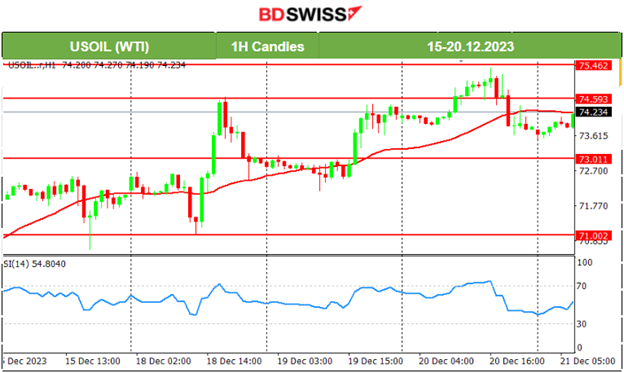

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The price 72.5 USD/b which served as a critical resistance level was broken on the 18th Dec. This level was tested many times without a breakout until that date. The path eventually remained sideways after the breakout and the retracement that followed. The price moved upwards breaking some intraday consolidation on the 19th Dec, testing again the resistance at near 74.6 USD/b. That level eventually was broken yesterday and the price reached the next resistance at near 75.5 USD/b before reversing back to the MA.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Since the 18th Dec, Gold has experienced an upward movement. It reached the 2046 USD/oz level on the 19th Dec but could not break it. It eventually moved downwards yesterday back to the support of 2030 USD/oz before retracing back to the 30-period MA and the mean around 2035 USD/oz.

______________________________________________________________

News Reports Monitor – Today Trading Day (21 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

At 15:30 CAD pairs could see intraday shock at the time of Canada’s retail sales figures release and at the same time the USD pairs could be affected greatly by the GDP and Unemployment Claims report.

General Verdict:

______________________________________________________________