Today, Wednesday, August 7, 2024, The Walt Disney Company ( NYSE : DIS ) will hold a live audio Q&A webcast to discuss their Q3 2024 earnings, starting at 8:30 a.m. ET / 5:30 a.m. PT.

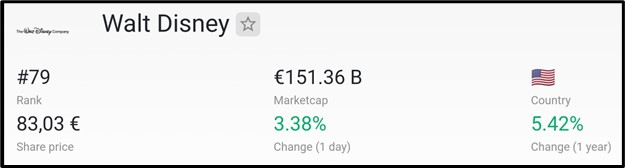

Market Cap

€151.36 billion marks Walt Disney’s market cap as of August 2024, positioning it as the 79th most valuable company globally according to companiesmarketcap.com.

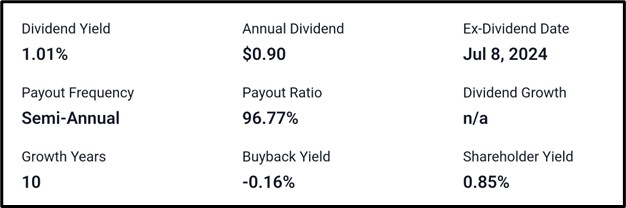

Dividend Information

Walt Disney offers a 1.01% dividend yield with a $0.90 annual dividend, paid semi-annually. With a payout ratio of 96.77% and 10 years of growth, the ex-dividend date was July 8, 2024. Despite a -0.16% buyback yield, the shareholder yield stands at 0.85%.

Recent Development At Disney

Here are the latest updates from Disney :

Safra A. Catz steps down from Disney’s Board of Directors.

Mickey & Friends debut their first single from Simple Plan’s new album featuring reimagined Disney classics.

Disney launches a worldwide celebration commemorating Donald Duck’s 90th anniversary.

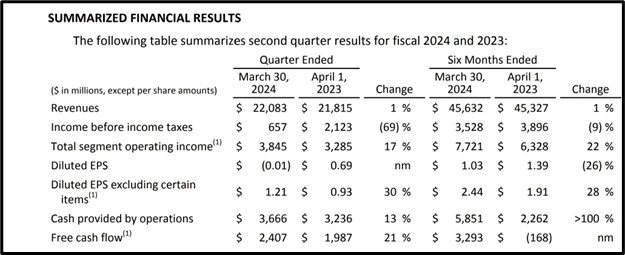

Q2 Earnings Report Recap

Disney’s Q2 FY2024 saw a 1% revenue increase to $22.08 billion and a 17% rise in total segment operating income to $3.85 billion. However, income before taxes dropped 69% to $657 million. Diluted EPS excluding certain items climbed 30% to $1.21, while cash flow from operations rose 13% to $3.67 billion. Free cash flow improved 21% to $2.41 billion. Over the first six months, revenues grew 1% to $45.63 billion, with a 22% increase in total segment operating income. Despite a 9% decline in income before taxes, free cash flow surged from -$168 million to $3.29 billion.

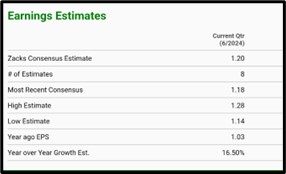

Q3 Earnings Report Analyst Forecast

For the current quarter ending June 2024, Zacks projects Disney’s EPS at $1.20, with estimates ranging from $1.14 to $1.28, reflecting a 16.50% year-over-year growth. Sales are estimated at $22.86 billion, with a range of $22.44 billion to $23.18 billion, marking a 2.37% increase from the previous year.

Investing.com forecasts Walt Disney Company (NYSE: DIS) to post an EPS of $1.20 and anticipates revenue hitting $23.08 billion.

Tradingview.com anticipates that Walt Disney Company (NYSE: DIS) will post an EPS of $1.20 and project revenue at $23.08 billion for the current quarter.

Tradingview.com anticipates that Walt Disney Company (NYSE: DIS) will post an EPS of $1.20 and project revenue at $23.08 billion for the current quarter.

Technical Analysis

Support Rejection: On the 4HR chart, Disney (NYSE: DIS) shows support rejection at $88.63.

Bullish Scenario: If the rejection holds, the price may rally to $96.11 and $101.98.

Bearish Scenario: If the rejection fails, the price could decline to $79.13 and $67.04.

Apply Risk Management

Conclusion

Walt Disney’s Q2 FY2024 showed modest revenue and operating income growth, despite a sharp decline in income before taxes. Analysts forecast a 16.5% year-over-year EPS increase to $1.20 and a revenue rise to $22.86 billion for Q3. Technically, the stock’s outlook is mixed, with potential upside to $96.11 and $101.98 if support at $88.63 holds, but possible downside to $79.13 and $67.04 if it fails.

Source:

https://thewaltdisneycompany.com/disneys-q3-fy24-earnings-results-webcast/

https://companiesmarketcap.com/eur/walt-disney/marketcap/

https://stockanalysis.com/stocks/dis/dividend/

https://images.app.goo.gl/mqavdRE15ZdXQQD87

https://thewaltdisneycompany.com/disneys-q2-fy24-earnings-results-webcast/

https://www.zacks.com/stock/quote/DIS/detailed-earning-estimates