Yesterday, (August 15) Walmart Inc. (NYSE: WMT) released its Q2 FY2025 earnings, with the results hitting the market at 6 a.m. CST (12 p.m. GMT). The earnings call was webcasted on their corporate site under the Second Quarter Earnings Release. Similarly, Alibaba Group Holding Limited (NYSE: BABA) disclosed its unaudited Q2 2024 financials before the U.S. markets opened, followed by a performance review in a conference call at 11:30 a.m. GMT (7:30 a.m. U.S. Eastern Time, 7:30 p.m. Hong Kong Time).

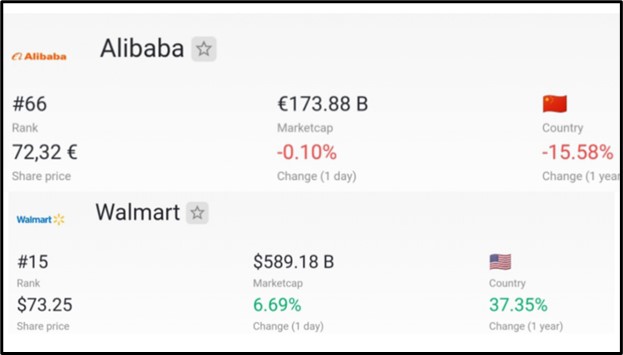

Market Cap

As of August 15, 2024, Alibaba’s market cap stood at €173.92 billion, ranking it as the 66th most valuable company globally, while Walmart’s market cap was $590.27 billion, placing it as the 15th most valuable company according to companiesmarketcap.com.

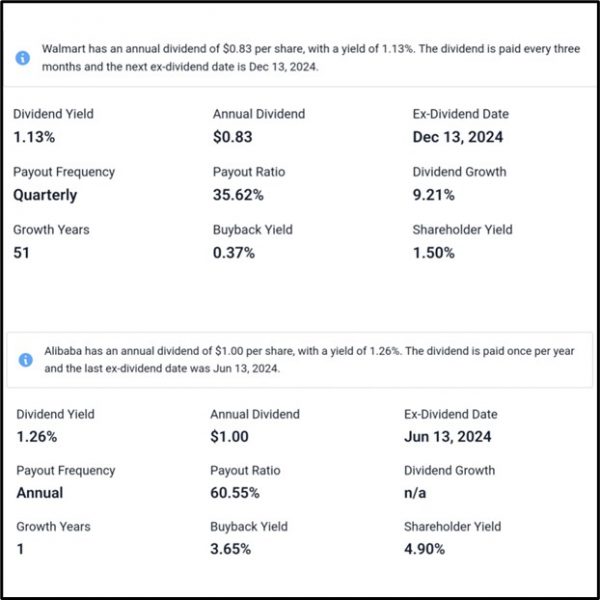

Dividend Information

Walmart offers an annual dividend of $0.83 per share with a yield of 1.13%, paid quarterly, and a payout ratio of 35.62%. The next ex-dividend date is December 13, 2024.

In contrast, Alibaba provides an annual dividend of $1.00 per share with a yield of 1.26%, paid annually, and a higher payout ratio of 60.55%. Alibaba’s most recent ex-dividend date was June 13, 2024.

Recent Development At Walmart Inc and Alibaba Group

Here are some recent updates from Walmart Inc. and Alibaba:

Walmart Inc.:

Enhances operational efficiency through tech upgrades and partnerships, aiming to cut food waste.

Advances supply chain modernization with new grocery network strategies.

Opens applications for Open Call 2024, continuing over a decade of support for U.S. jobs.

Drives retail transformation through innovation and integration to improve the customer experience.

Alibaba:

Introduces AI models specifically for math, surpassing existing LLMs from OpenAI and Google.

Unveils an advanced video generation tool using Sora’s open-source framework.

Plans to boost global online trade with an AI-driven sourcing engine for merchants.

Walmart Inc and Alibaba Group Earnings Report

Walmart and Alibaba Q2 Earnings Report

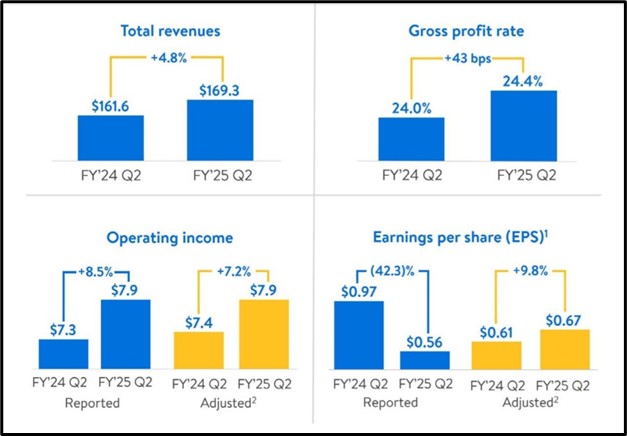

Walmart Inc. (NYSE: WMT)

Revenue Growth: $169.3 billion, up 4.8% (5.0% constant currency)

Margin Expansion: Gross margin rate increased by 43 bps; Operating income up 8.5% to $0.6 billion

ROA & ROI: ROA at 6.4%, ROI at 15.1%, up 230 bps

Sales & Inventory: Global eCommerce up 21%, advertising up 26%, inventory down 2.0%

Earnings Per Share: Diluted EPS at $0.56

Alibaba Group Holding Limited (NYSE: BABA)

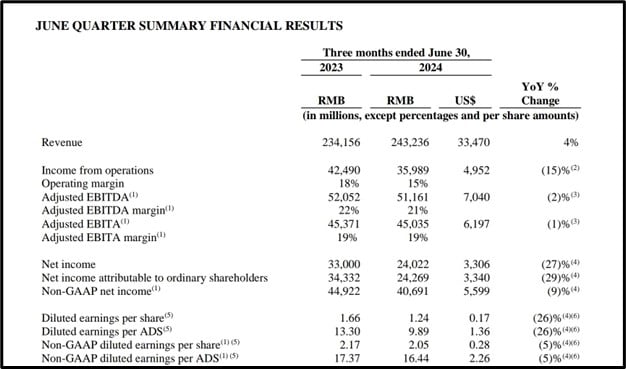

Revenue Growth: 4% increase to RMB 243,236 million (US$33,470 million).

Operational Income Decline: 15% drop to RMB35,989 million (US$4,952 million).

Earnings and Income Impact: Adjusted EBITA down 1%, net income down 27%.

Earnings Per Share: Diluted EPS at RMB9.89 (US$1.36); non-GAAP EPS down 5%.

Cash Flow Pressure: Free cash flow decreased by 56% due to higher investments and reduced direct sales.

Technical Analysis

Walmart Inc. (NYSE: WMT)

Opening and Closing: Walmart Inc. opened at $74.13 (+7.9%), up from $68.64, and closed at $73.18, with a high of $74.44 and a low of $72.77.

Resistance Breakout: A resistance breakout is observed at $71.39 on the 4-hour chart.

Potential Upside: If the breakout holds, prices may rise to $74.81 and $79.22.

Potential Downside: If the breakout fails, prices may drop to $68.63 and $66.48.

Apply Risk Management

Alibaba Group Holding Limited (NYSE: BABA)

Alibaba opened at $77.80 (-2%) after a previous close of $79.50, ending at $79.54, with a high of $81.88 and a low of $77.73.

A potential upside breakout from the downtrend line is identified on the 4-hour chart at $81.26.

If the breakout holds, the price could target $83.23 and $84.81.

Apply Risk Management

Conclusion

Walmart Inc. reported a revenue of $169.3 billion, reflecting a 4.8% year-over-year increase, and achieved an 8.5% rise in operating income. In contrast, Alibaba Group saw its revenue grow by 4% to RMB 243,236 million (US$33,470 million), but experienced a 27% decline in net income. Walmart’s earnings per share (EPS) reached $0.67, while Alibaba’s diluted EPS stood at RMB 9.89 (US$1.36).

Sources:

https://corporate.walmart.com/news/2024/08/15/walmart-releases-q2-fy25-earnings

https://www.alibabagroup.com/en-US/document-1760376653793460224

https://companiesmarketcap.com/eur/alibaba/marketcap/

https://companiesmarketcap.com/walmart/marketcap/

https://stockanalysis.com/stocks/baba/dividend/

https://stockanalysis.com/stocks/wmt/dividend/

https://images.app.goo.gl/9kUx5VvRfz3YEfWn6

https://images.app.goo.gl/3nLDef7gWTXevLw37

https://stock.walmart.com/financials/quarterly-results/default.aspx

https://www.alibabagroup.com/en-US/document-1760376653793460224