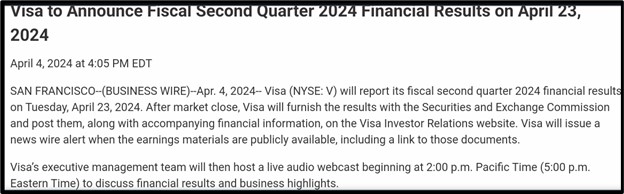

The Q2 2024 Visa Earnings Conference Call is set for April 23, 2024, at 21:00 GMT. It aims to delve into Visa’s earnings for the second quarter of 2024. As of April 2024, Visa boasts a market capitalization of $559.38 Billion, securing its position as the 13th most valuable company globally by market cap, as per companiesmarketcap.com.

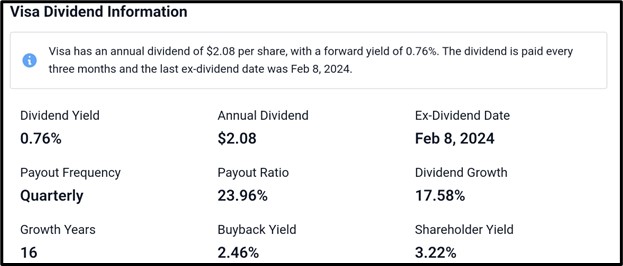

Visa Dividend Information

Visa provides an annual dividend of $2.08 per share, resulting in a forward yield of 0.76%. This dividend is paid every three months, with the most recent ex-dividend date being Feb 8, 2024. The company’s dividend yield is 0.76%, accompanied by a payout ratio of 23.96%. Impressively, Visa has demonstrated a dividend growth rate of 17.58%. With a buyback yield of 2.46% and a shareholder yield of 3.22%, Visa offers promising returns to its shareholders.

Recent Development At VISA

Visa and Western Union Announce Expanded Collaboration Transforming How Money Travels Cross-Border

On March 5, 2024, Visa (NYSE: V) revealed a 7-year pact with Western Union (NYSE: WU). This arrangement enables Western Union patrons to transfer funds to eligible Visa cards and bank accounts of their loved ones in 40 countries spanning five regions.

Visa Commences Exchange Offer for Class B-1 Common Stock

On April 8, 2024, Visa (NYSE: V) began its planned Exchange Offer for all outstanding Class B-1 common stock, offering a mix of Class B-2 common stock, Class C common stock, and cash for fractional shares.

Visa Completes Acquisition of Pismo

On Jan. 16, 2024, Visa (NYSE:V) finalized its acquisition of Pismo, a worldwide cloud-native issuer processing and core banking platform. This merger will offer clients comprehensive core banking and card-issuer processing services through cloud native APIs. Additionally, Pismo’s platform will facilitate Visa in extending support and connectivity for emerging payment schemes and RTP networks to its financial institution clients.

Visa Expands Its Digital Wallet Capabilities and Availability

On Feb. 12, 2024, Visa (NYSE:V), known for digital payments, expanded digital wallet features in Visa Commercial Pay, enhancing B2B payment solutions in collaboration with Conferma Pay, a top virtual payments tech provider, transforming global transaction management for businesses.

2024 Q1 Recap of VISA

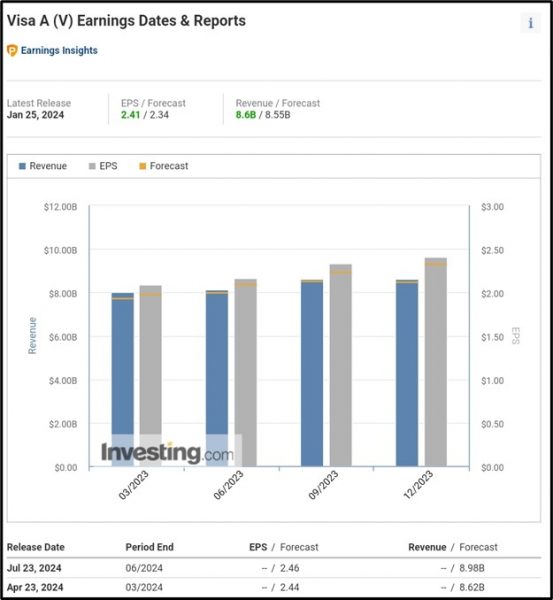

In the fiscal first quarter, GAAP net income totaled $4.9 billion or $2.39 per share, marking a 17% and 20% increase, respectively, over the prior year. This year’s results included $4 million of net gains from equity investments and $61 million from acquired intangible assets. Excluding certain items, non-GAAP net income for the quarter was $4.9 billion or $2.41 per share, up 8% and 11% from the prior year. Net revenues for the quarter were $8.6 billion, a 9% increase driven by growth in payments volume, cross-border volume, and processed transactions. Payments volume increased 9% over the prior year, while cross-border volume excluding Europe transactions grew by 16%. Total processed transactions were 57.5 billion, a 9% increase over the prior year. Fiscal first quarter service revenues rose 11% to $3.9 billion, and operating expenses decreased by 6% to $2.7 billion. Cash, cash equivalents, and investment securities stood at $21.4 billion at December 31, 2023, with 2.05 billion diluted shares outstanding.

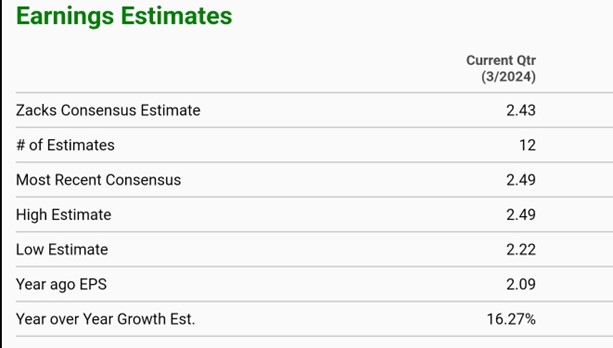

2024 Q2 Earnings Analyst Forecast

For the current quarter, earnings estimates show a Zacks Consensus Estimate of $2.43 per share, based on 12 estimates. The most recent consensus is slightly higher at $2.49, with both high and low estimates at $2.49 and $2.22, respectively. Compared to the previous year’s EPS of $2.09, the year-over-year growth estimate stands at 16.27%.

In terms of sales estimates for the same quarter, the Zacks Consensus Estimate projects $8.60 billion in sales, based on 10 estimates. The high estimate is $8.68 billion, while the low estimate is $8.30 billion. Compared to the year-ago sales of $7.99 billion, the year-over-year growth estimate is 7.66%

As per Investing.com, the projected earnings per share (EPS) for Visa Inc Class A (V) (NYSE: V) is forecasted at $2.44, alongside an anticipated revenue of $8.62 billion.

According to tradingview.com, Visa Inc (NYSE: V) is expected to achieve a projected earnings per share (EPS) of $2.44, with an anticipated revenue of $8.62 billion.

Technical Analysis

From a technical analysis perspective using the 4-hour chart of Visa Inc (NYSE: V) on tradingview, it’s evident that the price has been on a downtrend since March 21, 2024. A downtrend line drawn from the $290.90 price level rejected the price at $278.07 after it retraced from $272.20. Subsequently, the price continued its downward trajectory after the rejection, reaching $268.23, which is currently serving as support, before retracing to around $272.23.

If the downtrend line is breached to the upside, there will be a higher likelihood of the price ascending further. Conversely, if the downtrend line continues to reject the price, there’s a greater chance of the price declining further. Moreover, if the support level is breached, there will be increased chances of further downward movement, with the current support level potentially transforming into a new resistance level.

Conclusion

In conclusion, Visa’s Q2 2024 earnings call on April 23, 2024, provides insights into its robust performance and strategic initiatives. With a focus on dividend growth, expanded collaborations, acquisitions, and digital wallet advancements, Visa continues to position itself as a leader in the global payment industry. Despite recent technical trends indicating a downtrend, the company’s strong fundamentals and forward-looking strategies indicate promising prospects for investors.

Sources:

https://investor.visa.com/events-calendar/default.aspx

https://companiesmarketcap.com/visa/marketcap/

https://stockanalysis.com/stocks/v/dividend/

https://visa.gcs-web.com/news-releases/news-release-details/visa-completes-acquisition-pismo

https://investor.visa.com/financial-information/quarterly-earnings/default.aspx

https://www.zacks.com/stock/quote/V/detailed-earning-estimates

https://www.investing.com/equities/visa-inc-earnings