Rates as of 04:30 GMT

Market Recap

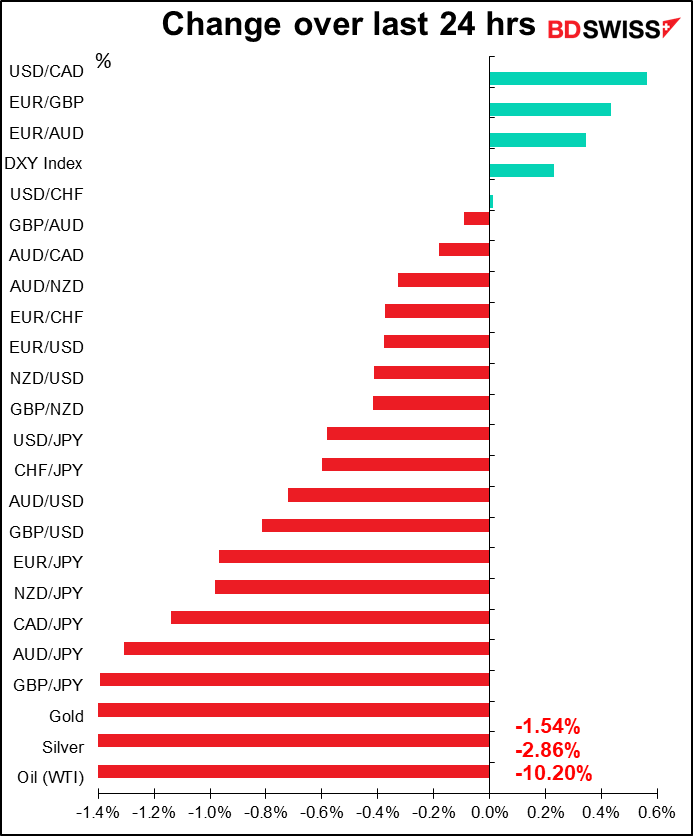

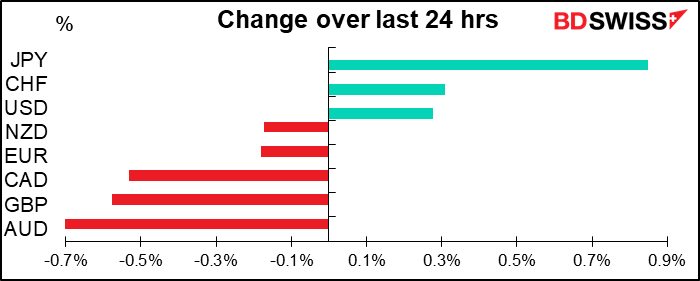

It’s the usual. US stocks collapsed (S&P 500 -4.9%), bringing the YTD fall to 15.2%. Asian stocks all deeply in the red today (except for one index in India.) Oil prices, which bounced a bit on Tuesday, collapsed another 10% yesterday. The FX market reaction was the usual: JPY and CHF rallied, AUD and the other commodity currencies plunged. Unusually, USD outperformed EUR and EUR/USD came down a bit.

The continued fall in gold is one of the notable features of this collapse. I don’t have a good explanation for it and I don’t know if anyone does. Perhaps it’s just general profit-taking – people with losses in one asset selling another one? But with uncertainty rising, interest rates collapsing and the dollar weakening, one could be forgiven for thinking that gold should be rallying hard.

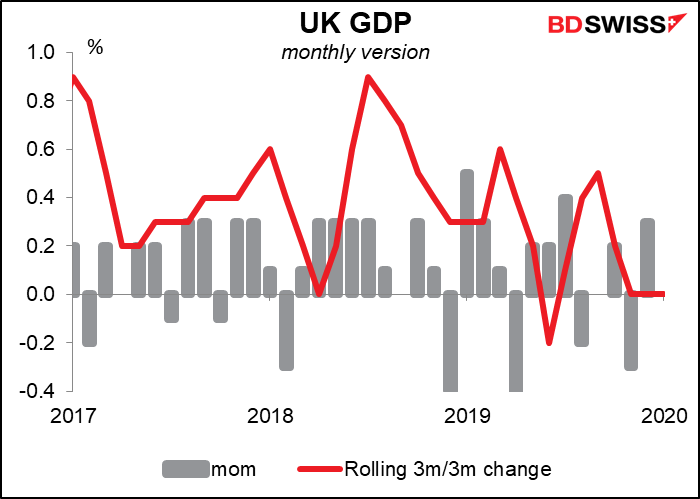

The UK budget included GBP 30bn of stimulus, of which GBP 12bn will be specifically designated to target the economic impact of the coronavirus, including at least GBP 5bn for the National Health Service and another GBP 7bn for businesses and workers. The Bank of England cut rates by 50 bps at the same time in what was clearly a coordinated move – the official BoE meeting isn’t until next week. GBP fell nevertheless as the stimulus package was smaller than anticipated and productivity and GDP forecasts for 2020 were downgraded. Not to mention that UK January GDP and industrial production were both weaker than expected – GDP was unchanged mom in January vs expectations of +0.2% — meaning the economy may not have been recovering as well before the virus hit as people had thought.

Other governments around the world continue to announce fiscal stimulus measures to help buffer their economies in the wake of the virus. However most of the major countries, except perhaps Italy, are not implementing measures large enough to preemptively support their economies. Canada for example plans to commit over CAD 1 bn to the coronavirus response. Sounds like a lot but the country’s GDP is around CAD 2.34tn/year, meaning this is tiny relative to the size of the economy.

One exception: Ireland is raising its paid sick leave allowance and reducing the requirements to make sure that everyone can stay home if they’re sick. This is really what’s necessary, especially in the US. So many people in the US do not get any paid sick leave at all and in fact will not only lose their income but maybe lose their job entirely if they miss work too much. Not to mention that they probably don’t have any health insurance to begin with. So they’ll continue to work while sick, spreading the virus to more and more people.This is why I think that the virus will eventually hit the US the hardest, sending the US into recession and clobbering USD.

Note that in just a few days, the official US view went from “hoax” to banning all travel from Europe (ex-UK) to the US for a month. I think the government’s incompetence and lies in this matter have totally discredited the Administration and will be the downfall of the Republican Party at the polls in November. Or is this just wishful thinking on my part?

In the EU, after downplaying the severity of the virus Tuesday, German Chancellor Merkel estimated that 60%-70% of her countrymen (58mn people!) might eventually be infected. She called for a coordinated European economic response and suggested breaking with the government’s “black zero” policy of not taking on any new debt. “It is a special situation. We will do what is necessary,” she said. This kind of fiscal response is what’s necessary, but unfortunately it will take time for governments to move.

The market now looks to the ECB meeting today, but fiscal policy not monetary policy is what’s necessary. Until that happens, the risk-off trade is likely to continue — and hard.

Today’s market

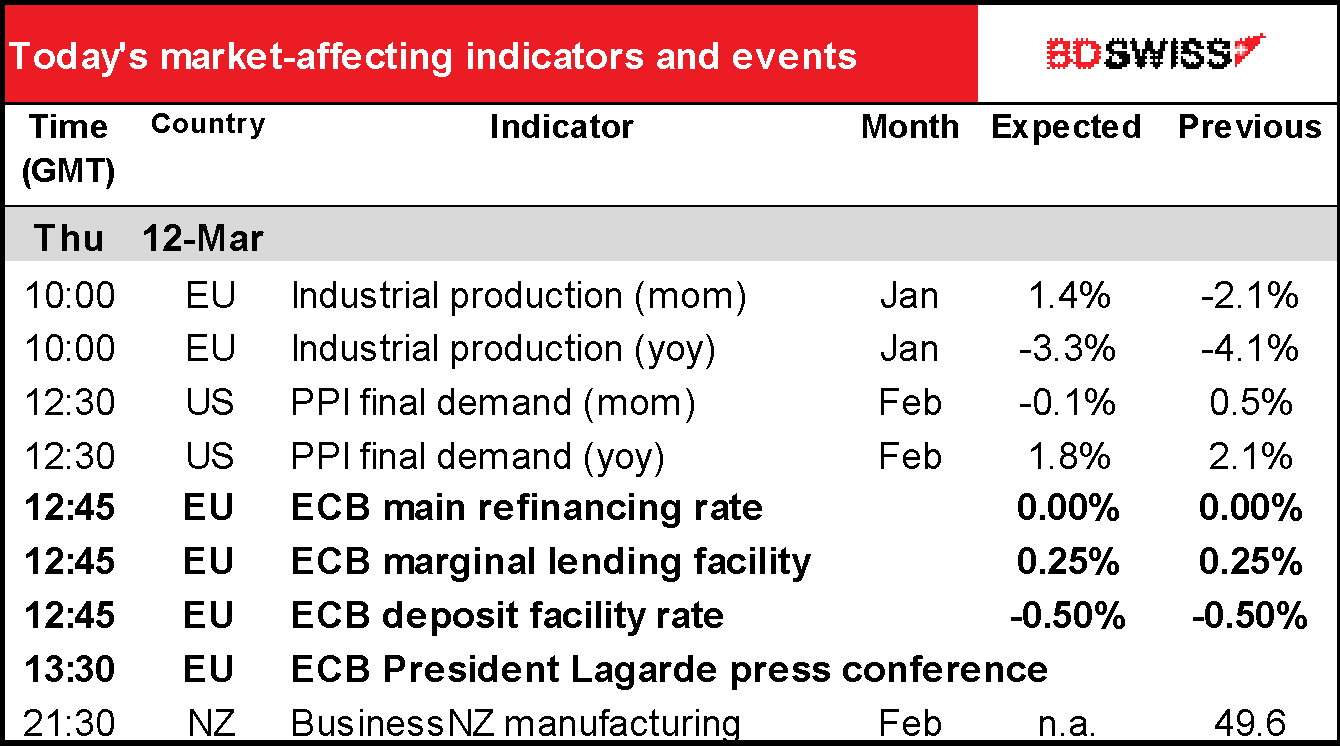

The focus today will of course be on the ECB meeting . They’re likely to take some action, as the Reserve Bank of Australia, the Fed, the Bank of Canada and the Bank of England did recently. The problem is thinking of just what they can do. With the deposit rate at -0.50% already, a quantitative easing program of EUR 20bn a month, and a third round of targeted longer-term refinancing operations (TLTROs), the pedal’s to the metal already.

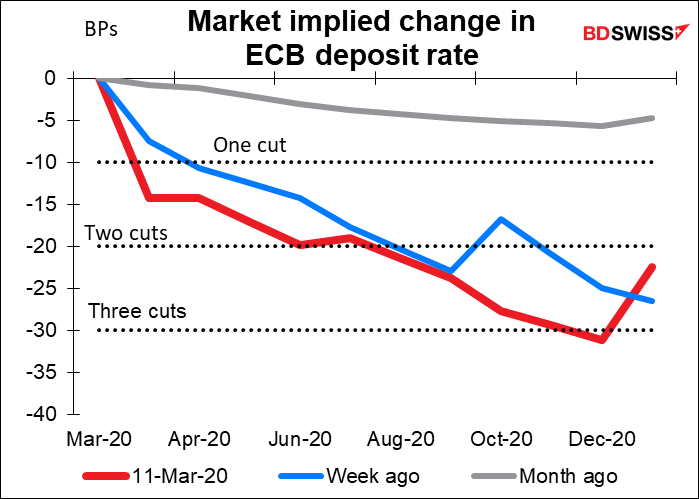

ECB President Lagarde has already stated that the Governing Council stands ready to take “appropriate and targeted measures”. “Targeted” is the key word here. I look for either a new round of TLTROs, or some adjustments to the existing ones to funnel them to SMEs in general or companies particularly affected by the coronavirus, such as hotels and restaurants. They could also choose to expand their bond purchases, perhaps concentrating them on corporate bonds to funnel money directly to the corporate sector. There may well also be a rate cut, although that’s likely to be of more symbolic value than anything else at this point. If they don’t cut rates this time, they’re likely to signal their willingness to do so in the near future if necessary. The market is forecasting at least one cut of 10 bps this time and about a 50-50 chance that they go 20 bps. They’re looking at 30bps total by the end of the year, bringing the deposit rate down to -0.80%.

I would also expect the Governing Council to make yet another plea for fiscal policy to play more of a supporting role, but when we’re talking about fiscal policy in Europe we of course run up against the famous Kissinger Question: “Who do I call if I want to speak to Europe?” (Although in fact Kissinger never actually did say this.) In this case it’s clearly Germany. Germany does in theory have room to expand its fiscal policy, although France and Germany are already dangerously close to the 3% limit. However, getting the German government to agree is likely to be neither easy nor quick, even with Merkel’s agreement. State loan guarantees or temporary tax holidays could be effective fiscal tools to help companies get over this period of reduced demand, but I wonder if governments can agree on such measures.

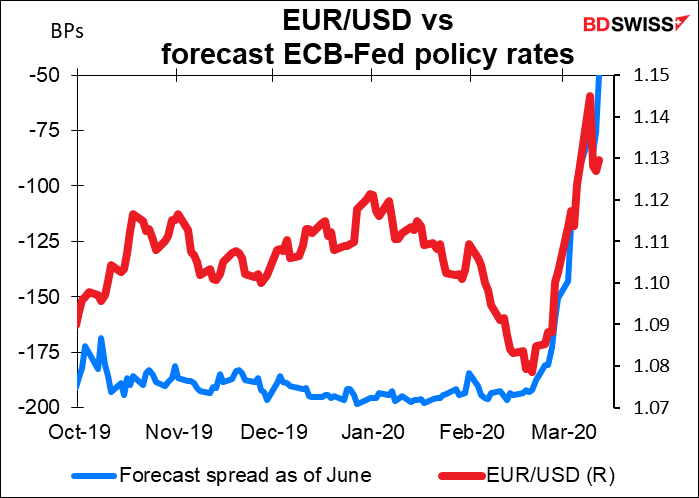

In any case, with the Fed having so much more room to cut rates than the ECB, the expected policy rate differential between the two zones is collapsing. That may drive EUR/USD higher still, at least temporarily.

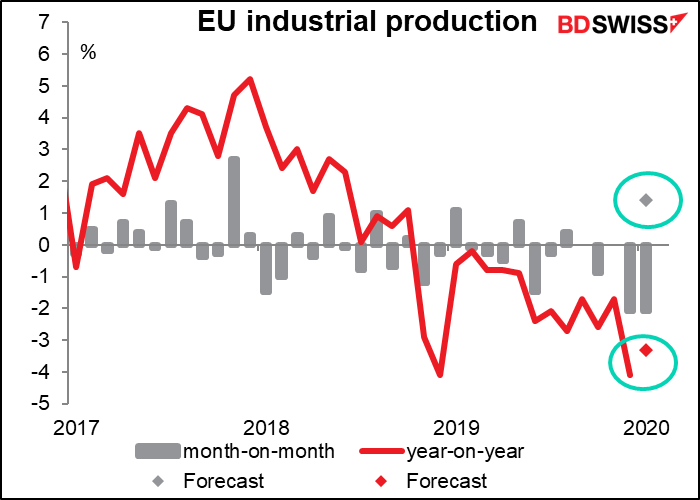

Aside from the ECB meeting, we have the EU-wide industrial production (IP) figures. In the past those haven’t been of much interest to the markets, but back in December the accelerating fall in German and other countries’ IP made people wonder if the dominant narrative of a trough in activity in Q4 followed by some rebound in Q1 was actually realistic. Well, today’s figures are forecast to show that that is still a possibility, at least it was in January – EU-wide IP is forecast to rebound significantly on a mom basis. It could be EUR-positive although it’s questionable whether people will expect the momentum to carry over from January to February.

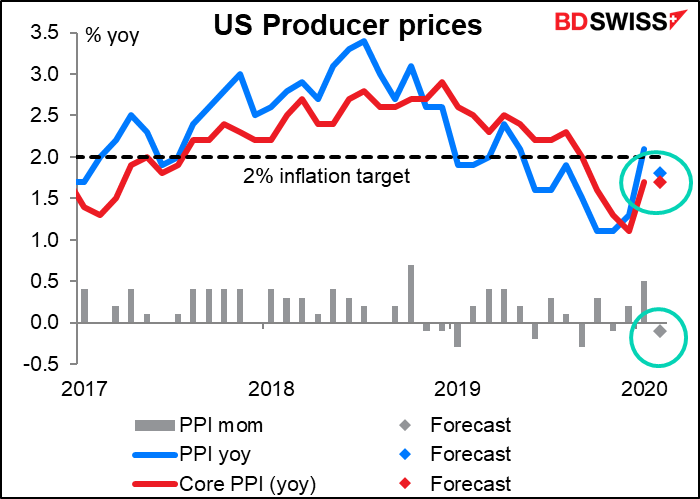

The US producer price index (PPI) is usually of some interest to the market, but as I said yesterday, the Fed isn’t so concerned about inflation at the moment, so I doubt if this precursor to inflation will be of much interest. If it is, it should be negative for USD in that it shows lessening inflationary pressures – as one might expect in current circumstances. And they’re likely to fall further too as the Chinese PPI falls (it was down 0.4% yoy in February) and oil prices collapse.