Let’s delve into the fundamental & technical analysis of USOIL (United States Crude Oil) with a specific focus on the 4-hour timeframe. Crude oil is a commodity that plays a pivotal role in the global economy, making it a key asset for traders and investors. Understanding its current technical and fundamentals is crucial for informed decision-making.

In a swift turn of events during the US trading session on Tuesday, oil prices witnessed a rapid decline. This market correction follows a recent ceasefire agreement between Israel and Palestine and significant data from the American Petroleum Institute, revealing a substantial increase in US Oil stockpiles. These combined factors exerted downward pressure on oil prices early on Wednesday.

In Tuesday evening’s report from the American Petroleum Institute (API), a significant overnight build-in stockpile. Numbers echoed a resounding message: the United States is vigorously increasing its oil production. With a notable surge of 9.047 million barrels, the data underscores the nation’s commitment to bolstering its energy output. This surge in U.S. production and stockpiles sets the stage for heightened expectations on OPEC (Organization of the Petroleum Exporting Countries). As Saudi Arabia’s efforts alone may not suffice, a collaborative and concerted effort from OPEC+ becomes imperative to maintain the current stability in oil prices. The spotlight is now on the upcoming discussions that may shape the direction of global oil markets.

Later, on Wednesday, the US Energy Information Administration (EIA) released the change in crude stockpiles. Projections suggested a modest build of 0.9 million barrels, a noteworthy shift from last week’s 3.6 million. The outcome of the report, however, showed a significant increase of nearly ten times the expected build, with 8.7 million barrels being reported. US Oil sank to a low of $73.80 following the data release, before closing the day at $76.70.

This weekend’s OPEC meeting in Vienna and OPEC+ announcements remain key events. Although markets are still expecting a surplus for 2024, noises from both Saudi Arabia and Russia on extended or even deeper production cuts to support prices persist.

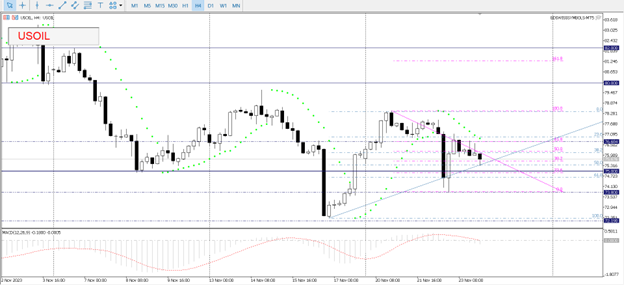

On the 4-hour chart, a strong bearish candle broke below $75.00 per barrel yesterday. This could be seen as a continuation of the recent downtrend, allowing traders to plan their entries around $75.68 (61.8 Fib level for this week) for a potential sell down to $73.80 and then the November low at $72.19. The Parabolic SAR remains biased lower and the MACD signal line is testing the 0 line as the MACD histogram turns negative. Should the price break and breach the $75.68 level to the upside, first resistance would be found at $78.50 before the psychological $80.00 and then the $82.00-83.00 zone, an important pivot zone in 2023.