There has been a notable increase in speculation regarding the Bank of Japan’s potential move to raise interest rates this month, marking the first such action since 2007. This surge in speculation follows a series of reports and wage figures that have contributed to a rise in the yen’s value across the board. Concurrently, the dollar index experienced a decline to a five-week low on Thursday, remaining under heightened pressure due to growing expectations for rate cuts in June. These developments are expected to impact the USDJPY pair today, particularly during the release of the Non-Farm Employment Change news at 13:30 GMT.

There is increasing momentum behind expectations for the March 18-19 meeting, fueled by reports suggesting that some Bank of Japan officials are inclined towards an early rate hike, alongside support from certain government officials. Both economists and investors are largely aligned in their anticipation that the central bank will abandon its negative interest rate policy, the last of its kind globally, either within this month or by April.

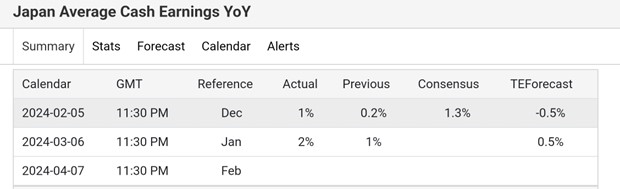

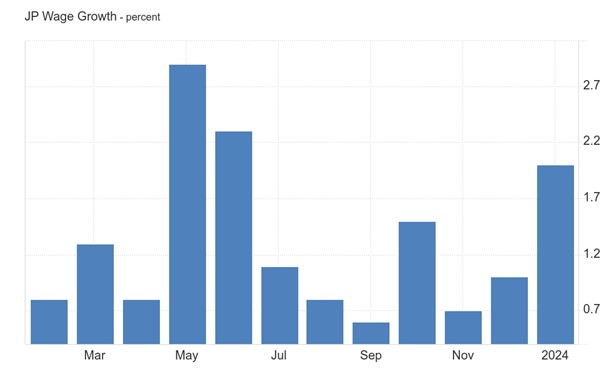

Furthermore, average cash earnings in Japan demonstrated a year-on-year increase of 2% in January 2024, marking an acceleration from the 1% gain observed in December and reaching the highest level in seven months. Nominal wage growth in the country also mirrored the 2% core consumer inflation rate recorded in January, resulting in the slowest rate of decline in inflation-adjusted real wages in 13 months, reported at -0.6%. Among the sectors driving this wage increase were electricity, gas, heat supply & water (9.6%), information & communication (4.8%), and finance & insurance (4.7%). Conversely, wages experienced declines in sectors such as mining & quarrying of stone & gravel (-2.3%) and accommodations, eating & drinking services (-0.2%).

Furthermore, average cash earnings in Japan demonstrated a year-on-year increase of 2% in January 2024, marking an acceleration from the 1% gain observed in December and reaching the highest level in seven months. Nominal wage growth in the country also mirrored the 2% core consumer inflation rate recorded in January, resulting in the slowest rate of decline in inflation-adjusted real wages in 13 months, reported at -0.6%. Among the sectors driving this wage increase were electricity, gas, heat supply & water (9.6%), information & communication (4.8%), and finance & insurance (4.7%). Conversely, wages experienced declines in sectors such as mining & quarrying of stone & gravel (-2.3%) and accommodations, eating & drinking services (-0.2%).

Fed Chair Powell’s dovish remarks hint at potential rate cuts later this year if the economy evolves as expected. Markets await today’s US labor report, with weaker February numbers likely to increase pressure on the dollar. Thursday’s downward movement broke through key Fibonacci support at 103.11, with further bearish signals indicating potential extensions towards support levels at 102.57 and 102.04. Technical indicators on the daily chart confirm a bearish outlook, although oversold conditions suggest a possible price adjustment. Resistance is expected at 103.51, while support levels are identified at 102.71 and 101.74.

From a technical analysis perspective using the daily chart of USDJPY, the currency pair has been in an uptrend. A trendline, drawn from 140.242 on December 28, 2023, acted as resistance when the exchange rate reached 145.918 on February 2, 2024, following a pullback from its upward movement. Subsequently, the exchange rate climbed to 150.895 before reversing and breaking below the trendline, currently hovering around 147.950.

The breach of the trendline to the downside suggests a likelihood of further downward movement in the exchange rate. However, if the exchange rate rises and breaks above the trendline, it could signal a continuation of the upward trend.

On the USDJPY 1-hour chart, the exchange rate has been trading within a range, with 148.304 acting as resistance and 147.517 as support. If the exchange rate breaches the support level, there is a strong possibility of further downward movement. Conversely, if the support level holds, there is a higher likelihood of the exchange rate rebounding towards the resistance. Should the exchange rate manage to break above the resistance, there is an increased probability of further upward movement. However, if the resistance level rejects the exchange rate, there is a heightened chance of it declining.

Sources:

https://www.forex.academy/understanding-the-fundamentals-of-usd-jpy-forex-pair/?amp=1

https://www.japantimes.co.jp/business/2024/03/07/boj-bets-swing-toward-march-rate-hike/

Ministry of Health, Labour and Welfare, Japan

USDJPY Daily Chart from Metatrader 4

USDJPY 1HR Chart from Metatrader 4