Rates as of 05:00 GMT

Market Recap

A massive “risk-off” day as rising energy prices globally stoked fears of higher inflation and higher interest rates.

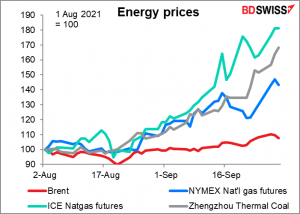

While the rise in oil prices has captured most of the attention, with Brent now back above $80/bbl, it’s the astonishing surge in natural gas and coal prices that’s the real problem. Natural gas is up 43% in the US and 81% in the UK just since the beginning of August. China coal prices are up 68%. This is in less than two months!

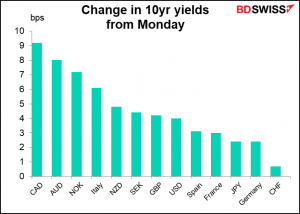

The result was steepening yield curves everywhere.

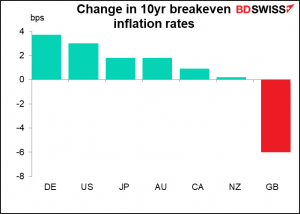

Breakeven inflation rates rose, but nowhere near as much as bond yields, meaning that real interest rates rose around the world.

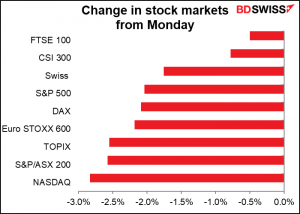

With energy costs and interest rates rising around the world, fears of the dreaded “stagflation” returned and stock markets came off.

Here’s a graph of the constituent sectors of the S&P 500. Everything was down except for energy. The largest losses were in high-growth sectors like semiconductors (-3.8%) media (-3.1%) and software (-3.1%), while the FANG+ index of ten top high-tech stocks was down -2.5% as nine of the 10 index members fell (Alibaba was up +1.5%).

The market faces other problems as well. A shutdown of the US government looms as the Republicans refuse to pass a measure raising the debt ceiling. Not one Republican in either the House or the Senate has voted to lift the debt ceiling – this despite the fact that they were happy to pass Trump’s pointless tax cuts. (Remember that next time people say that some Republicans are responsible leaders.) There is a process that the Democrats can use to pass the resolution, but it might take longer than the 48 hours that are left before the US government shuts down.

Meanwhile, the bipartisan infrastructure bill with $550bn of new spending is also coming up for a vote tomorrow. “Progressive” (= left-wing Democrats) members of the House of Representatives said they may try to block the infrastructure bill, even though it’s one of the Democrats major priorities, if it comes up before the debt ceiling problem is solved. So US politics is unsettling markets as well. (If you’re interested in the details I suggest you read them elsewhere as it’s too complicated to go into here.)

In their testimony to the Senate Banking Committee yesterday, both Fed Chair Powell and Treasury Secretary Yellen warned that a potential US default would be “catastrophic.” The Treasury Department now estimates that the US will hit the debt ceiling on Oct. 18.

Against this background, it was perhaps surprising that USD was the best-performing currency. It’s a sign perhaps of the confidence that people have in the US that even as the US government barrels toward a cliff like a car with a drunken driver who’s being beaten up by his even more drunk passenger, the dollar can strengthen. I presume this is because people have seen this movie before and they know how it ends (I mentioned in my Weekly Outlook that there have been at least four lengthy shutdowns before and neither the dollar nor the US stock market suffered particularly). Or perhaps in a time of global discomfort, the US is still the #1 “safe haven,” at least until Oct. 19th.

EUR also did surprisingly well. Much of the gain in the trade-weighted index was the result of the plunging GBP, but EUR still managed to gain vs other currencies, even the safe-haven CHF which is quite an accomplishment in these troubled times. That may have been due to flows out of GBP though going more into EUR than to CHF.

Reports say the pound collapsed after Bank of England Gov. Bailey hinted that the Bank wouldn’t hike rates any time soon as the economy isn’t strong enough to sustain higher rates. He observed in a speech to the Society of Professional Economists yesterday that the rate of recovery from the pandemic had slowed over recent months, adding: “And that slowing is continuing.” He noted the supply bottlenecks and various shortages, even including a shortage of wind to generate electricity (leading him to ask “and when are the locusts due to arrive?,” a reference to the Biblical 10 plagues.) Also, Monetary Policy Committee member Catherine Mann played down concerns about inflation, arguing that it’s “transitory, not troubling.”

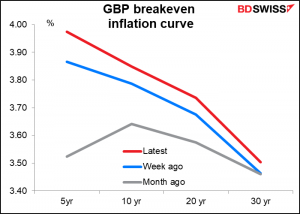

Maybe so, but the market disagrees. Inflation expectations in the UK have been rising recently (although as the graph above shows, they fell yesterday).

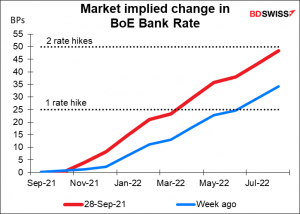

Gilts yields are rising and the curve steepening as a result.

As a result, the market has been pulling forward the date at which it expects the Bank to start tightening rates, but Bank officials seem to be pushing back against this idea.

If inflation is rising but the Bank of England doesn’t put up interest rates, then real yields will fall (at least at the short end). That explains why GBP is falling.

In my view, they’re in trouble either way. Either they tighten and the economy falls back into recession – a policy mistake, in my view – or they don’t and real interest rates fall. Either way the shortages and Brexit problems will continue and that is likely to be a drag on the economy, in my view. Britain is the #1 global candidate for stagflation, I’d say.

Japan election: Kishida wins

Fumio Kishida won the vote for head of Japan’s Liberal Democratic Party (LDP) and will therefore be the next Prime Minister of Japan.

The vote went to a run-off between Kishida and Kono after neither got a majority in the first round. Kishida got 256 votes total, Kono got 255, vs 384 necessary to win. As I expected, in the second round supporters of the incredibly conservative Takaichi (who got an amazing 114 votes from Diet members) threw their support behind Kishida to promote “stability” (which is exactly what Japan doesn’t need, but never mind).

This result is disappointing but not surprising in the least.

Kishida probably means lower Japanese stocks and a strong yen. But I wouldn’t be surprised if that’s already in the price.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

We have the second day of the European Central Bank’s Sintra symposium, including the big panel discussion this afternoon w. the head of the Bank of England, Bank of Japan, ECB and the Fed. A must-see as some central banks get more confident about the future and start to unwind the emergency measures that they put in place when the pandemic hit. In that respect, the lineup will be Bailey & Powell vs Lagarde and Kuroda. The Bank of England last week doubled down on its forward guidance that “some modest tightening of monetary policy over the forecast period is likely to be necessary,” while the Fed warned that “. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.” The ECB and the Bank of Japan on the other hand do not see inflation returning to their 2% targets any time soon (or even not so soon) and so are likely to be on hold for quite some time further.

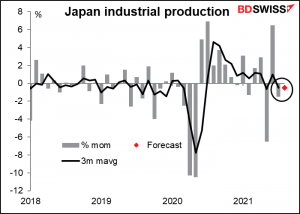

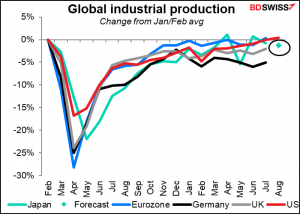

Overnight, Japan’s industrial production is expected to decline again.

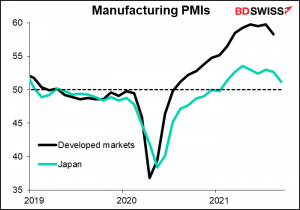

Still, Japan is doing OK relative to its peers – not as good as the US maybe but in line with the UK and better than Germany.

This despite the Japan manufacturing purchasing managers’ index (PMI) is far below the country’s peers.

Japan’s retail sales have been fairly trendless – the three-month moving average has been both positive and negative in recent months.

In this area, Japan is an international laggard – on this month’s forecast, their sales will be 1.2% below the pre-pandemic level. The difference in performance between manufacturing and retail sales shows the Japanese economy’s continued dependence on exports.

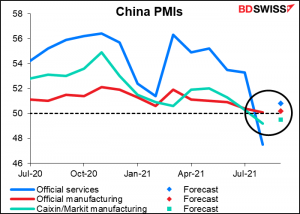

That’s why what happens in China is so important for Japan – China is Japan’s biggest trading partner, taking 26% of Japan’s exports and also supplying 26% of its imports ()vs 18% and 11%, respectively, for the US, which is #2). And what’s happening in China? Well, I’m glad you asked me that question, because next up is China’s official PMIs.

It’s hard to see what’s going on in that graph, so here’s a close-up view:

The Chinese PMIs are noticeably less volatile than those of other countries, which raises some…how shall I say this tactfully?…some questions about their methodology. This month however the market is forecasting a leap in the service-sector PMI back above the 50 “boom-or-bust” line between expansion and contraction.

I’m not sure why this is. I’d assume it’s because of a let-up in COVID-19 restrictions, but the Oxford Stringency Index shows no change from August. Nevertheless, it would be an encouraging sign that the Chinese economy still has momentum despite the problems of the real estate sector. That might be good for the commodity currencies.

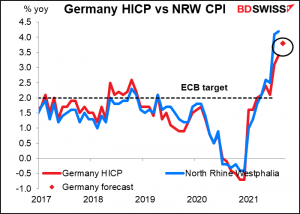

Then as morning comes to Europe, we start to get some early indicators from Germany. First is the consumer price index (CPI) from North Rhine Westphalia (no forecast), Germany’s biggest lander (state). Not a perfect match for the national harmonized index of consumer prices (HICP), but a pretty good one. It’ll give us some indication of what the national HICP will be later in the day.

Then we get the final version of Q2 GDP, which is normally not revised at all so I won’t even bother discussing it.

Then the German employment data is expected to show a small decline in the number of unemployed but no change in the unemployment rate. The European Central Bank doesn’t take employment into account the way other central banks do so a not-particularly-dramatic reading like this probably won’t have much impact on the currency.