Rates as of 05:00 GMT

Market Recap

Today we can demonstrate what the phrase “a sea of red” means when we look at Bloomberg page WEI (World Equity Indices)

It’s not clear what triggered the retreat, if anything. Sometimes to understand markets you have to understand natural behavior. Have you ever seen the way fish swim in a school? Sometimes the whole school changes direction for no apparent reason (at least, not that we humans can discern – the fish may well know why they’re changing direction. Perhaps because of new Brexit rules that make them happier to be British fish?)

The swing in sentiment was clear in the Euro STOXX 600, which swung from an early intraday high of +0.70% to end the session down -0.43%. US stocks were lower from the opening bell as a result and that’s carried through into Asian markets this morning.

The “flight to safety” sent investors into bonds. Yields were lower around the globe.

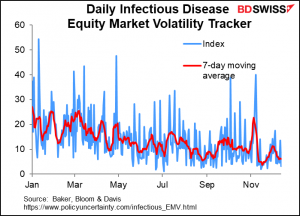

One would naturally ascribe the moves to news about the virus, but that hasn’t been increasing recently in the financial press. The Daily Infectious Disease Equity Market Volatility Tracker, which tracks references to the pandemic and other virus-related diseases in the financial news, hasn’t shown a notable uptick recently, which surprises me – I feel as if I’ve seen a lot more news about the omicron variant. But this index specifically refers to references linked to the equity market, not just news about the topic itself.

There has been some bad news about the virus in the general press, particularly from Britain, which seems to be a never-ending source of bad news on this topic. PM Boorish Johnson said that the Omicron variant was set to become the dominant strain in London and that at least one person in the country had already died from it. The 7-day moving average of cases rose to 51,455, near the peak of 59,829 back in January, but that severely underestimates the problem; Health Secretary Javid said it was actually closer to 200k a day. The National Health Service (NHS) was put on a crisis footing as hospitals in England were told to discharge as many patients as possible. Hotels are already being turned into temporary care facilities staffed with workers flown in from Spain and Greece to relieve rising pressure on NHS hospital beds. The British Medical Association (BMA) called for further restrictions to be imposed to stem the rise and the PM refused to rule this out.

And according to Reuters, at least 20 companies in Zhejiang province, one of China’s biggest manufacturing hubs, have suspended operations as local authorities try to contain a COVID-19 outbreak. The move has halted production of goods from batteries to textile dyes and plastics. It highlights the double-edged sword of the pandemic now: it slows economic activity (by forcing restrictions on businesses) while at the same time increasing inflationary pressures (by reducing supplies and exacerbating bottlenecks).

Meanwhile, China reported its first case of the Omicron variant on Monday in the city of Tianjin. How China reacts to the variant will be important for the markets in the coming weeks. If they go back into full lockdown, as they did at the beginning of the pandemic (including for example welding people’s doors shut – and many people in the West complain about wearing masks!) then the disruption to global supply chains will become worse and worse.

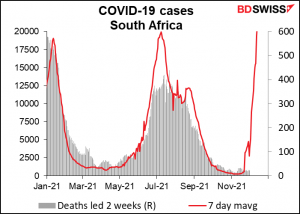

South Africa, the canary in the ICU ward for the Omicron variant, has seen new cases soar but not deaths – so far. There’s a lag of several weeks between new cases, new hospitalizations, and deaths.

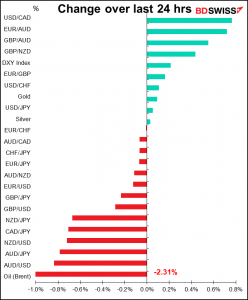

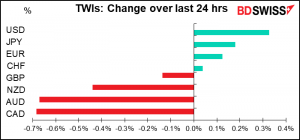

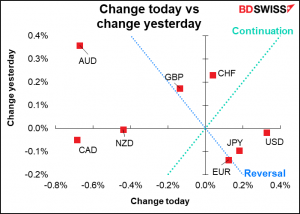

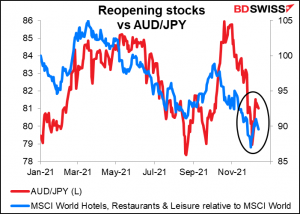

Against such a background, the risk-off mood hit the FX market as well. USD and JPY were up and the commodity currencies down – naturally.

The graph shows how AUD/JPY tracks investor behavior toward the virus as manifested in the stock market.

Oil fell on continuing concern over the virus’ impact on demand. The fall was cushioned somewhat by OPEC’s monthly oil report, which revised up the group’s estimate of oil consumption in Q1 by 1.1mn barrels a day (but says it still sees a surplus in the market). “The impact of the new Omicron variant is projected to be mild and short-lived, as the world becomes better equipped to manage Covid-19 and its related challenges” the group opined. From your mouth to God’s ear, as the saying goes.

Regular readers of this report will not be surprised to see a graph of USD/CAD vs the oil price appear at this point.

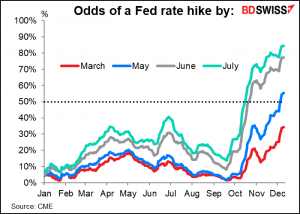

Despite the rising uncertainty, the odds of an early rate hike in the US – as early as March — continue to rise. Perhaps these people read OPEC research. In any case, USD is likely to remain underpinned by the contradictory currents of risk aversion and expectations of a tighter US monetary policy.

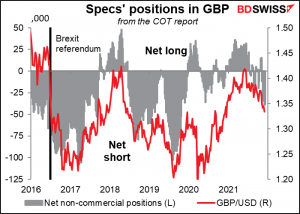

The only surprise in today’s market to me is how well GBP is holding up in all this. Positioning is by no means stretched. I imagine it’s because investors don’t want to take big positions this close to the year-end. I think GBP could be in for big trouble when markets get into full swing again in January.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

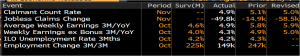

The UK employment data is already out. The unemployment rate fell as expected but employment missed estimates, suggesting that maybe the participation rate wasn’t as high as expected. The rate of growth in average weekly earnings fell but not as much as expected, meaning it’s still a threat to price stability. All told in normal days this probably would’ve been enough to push the Bank of England to tighten on Thursday, but these aren’t normal days. Tomorrow morning we have UK CPI, which I’ll get to at the end of this report.

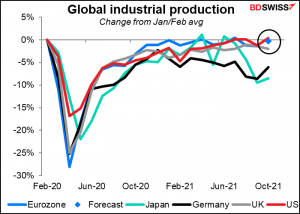

Next up is EU industrial production, which the Bloomberg relevance score tells us isn’t a biggie but I’ve seen it change the mood surrounding the euro so I always watch it.

IP Is expected to be up a pretty good 1.2% mom, but this follows two months of decline and so I’d say it’s a pretty lackluster bounce.

Still, the EU is holding up pretty well compared to other countries. At this rate it’ll be down only 0.3% from the pre-pandemic level, a little bit less than the US (+0.4%) but better than UK (-2.0%) or (shudder) Japan (-8.5%). And that’s with some drag coming from Germany, which would usually be the IP powerhouse.

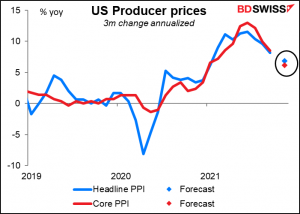

The US producer price index (PPI) is yet another inflation indicator for the market to get upset at. It’s expected to rise further to a disquieting 9.2% yoy, which is pretty high. This data series only goes back to Nov. 2010 so it’s not that stunning to say it’s a record high, although it is. A further rise in PPI will only spark thoughts of a further rise in the CPI, even though it’s not that simple (see The PPI and the CPI: what’s the connection?)

However if we take the 3-month change and annualize that, it’s turning down. Maybe price pressures are starting to wane? Some other indicators have suggested that (see my Weekly Outlook “Transitory” has to retire just as it starts to work.”

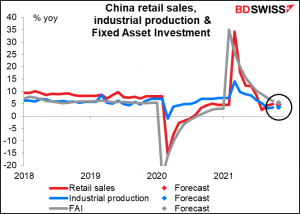

Overnight China announces the usual trio of retail sales, industrial production, and fixed-asset investment (FAI). Retail sales are forecast to rise at a slightly slower pace than in the previous month, while industrial production is expected to rise at a slightly faster pace. FAI growth is expected to slow a bit more. All in all it’s a pretty stable message, which could be reassuring as people worry about the impact of problems in the real estate industry on China’s economy. In that respect it could be positive for AUD.

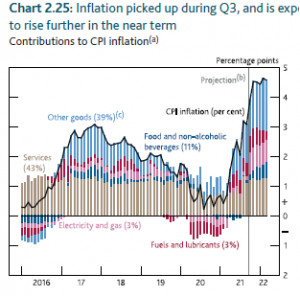

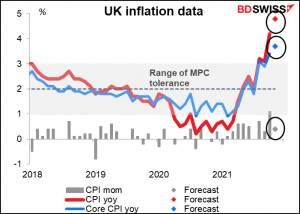

So that brings us to Wednesday morning at 7 o’clock as the day begins…the UK announces its consumer price index (CPI). It’s expected to rise further beyond the Monetary Policy Committee (MPC)’s 1%-3% range of tolerance.

The market forecast of 4.8% yoy is above the November Monetary Policy Report forecast of 4.5% for the month and indeed close to the peak that the MPC was expecting early next year. It’s clear to me that if the Government hadn’t declared “Plan B” in effect, the MPC would be hiking rates this week.