PREVIOUS TRADING DAY EVENTS – 02 Oct 2023

Manufacturing PMI increased to 47.6 last month from 46.4 in July. The index slumped to 46.0 in June, which was the lowest reading since May 2020.

______________________________________________________________________

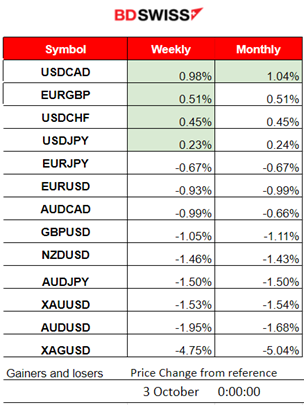

Winners and Losers

News Reports Monitor – Previous Trading Day (02 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements. No special scheduled figure releases.

- Morning–Day Session (European and N. American Session)

PMIs for the Manufacturing sector are released:

Eurozone PMIs:

According to the reports, the Italian manufacturing sector continues to show an economic downturn. The result was mainly due to weak demand conditions, sustained, but softer declines in production and new orders. The PMI remained in the contraction area with a slightly improved figure, 46.8 vs last month’s 45.4.

A similar grim picture is shown regarding French Manufacturing since downturns in output and new orders gather pace. Purchasing activity, inventories and employment are posting declines as well. The PMI remained also in the contraction area with a slightly improved figure, 44.2 vs previous month’s 43.6.

German manufacturing sector PMI remains in contraction territory as well with a worse PMI figure of 39.6 points. Output fell to the greatest extent for almost three-and-a-half years amid a further sharp drop in new orders and weaker demand across the sector.

The Eurozone PMI figure remains at 43.4 points, in the contraction area. The Eurozone is experiencing a deep downturn as factory orders see a sharp fall and the job loss rate is accelerating. Business strategies included sustained reductions in employment, purchasing activity and inventories.

U.K. PMI:

The U.K manufacturing sector remains in contraction and continues with the downturn. Output and new orders contract facing weak domestic and export markets. New orders and employment declined. The PMI figure was reported slightly higher, 44.3 against the 44.2 of the previous month.

U.S. PMI:

Just below the 50 threshold level, the U.S. PMI for manufacturing was reported at 49.8, a slight improvement of 1 point from the previous month. The reports showed further deterioration in overall operating conditions during September. A slower pace of contraction, however, since the sector experienced a small fall in new orders with a rise in output, greater hiring activity and expanded capacity. A more optimistic picture for this sector in the U.S.

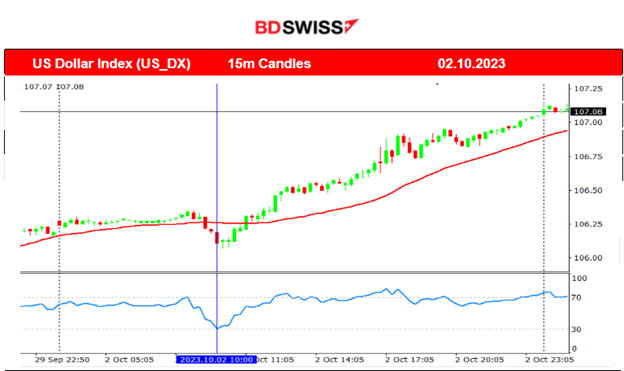

The market had not experienced major shocks at the time the figures were released. That is probably because the business conditions in that sector are well-known and predictable for the current period. However, the USD has gained more strength since a better picture is shown for U.S. manufacturing.

The U.S. ISM Manufacturing PMI figure was released at 17:00 showing an improvement, at 49 versus the previous 47.6 points of the previous month. Still in contraction though.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

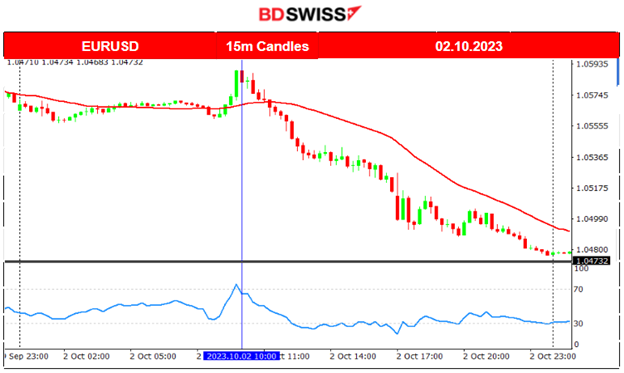

EURUSD (02.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD dropped since the PMI reports started to kick in after the start of the European session. The grim picture regarding business conditions in the manufacturing sector pushed the EURUSD to the downside. This drop was also the result of USD appreciation as shown above in the DXY chart. The U.S. manufacturing PMIs, even though still in the contraction area, show improved figures, causing the USD to gain strength.

___________________________________________________________________

CRYPTO MARKETS MONITOR

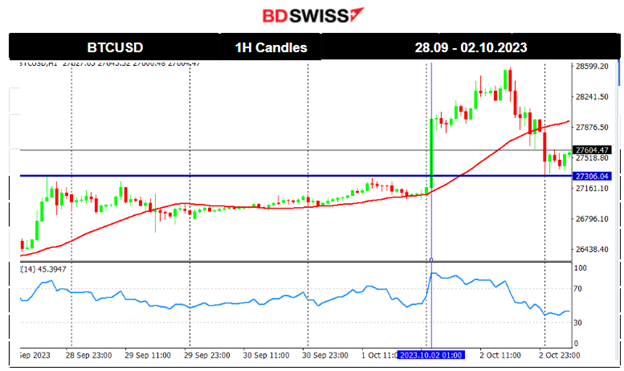

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A sudden jump on the 2nd Oct caused bitcoin to move upwards more than 900 USD after breaking the resistance at 27300. The market calmed down after that moving to lower levels. It reached 27300 again, this time serving as a support.

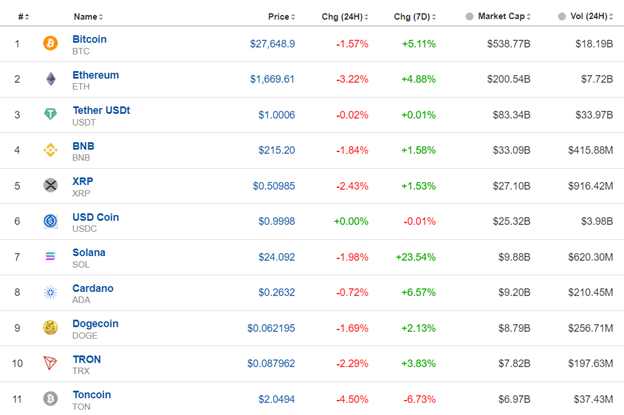

Crypto sorted by Highest Market Cap:

The 7 Days Change is still green. Almost all crypto experienced a surge in price on the 2nd Oct. early just after 1:00, but later settled at lower levels. Solana leads, having nearly 23.5% gains this period.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

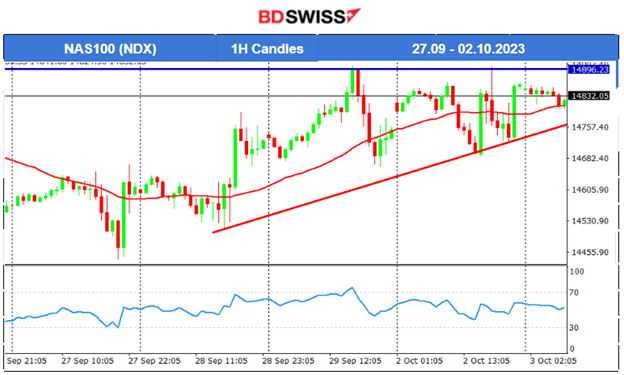

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 27th, the market reversed and started to move to the upside aggressively breaking resistance levels such as the 14660 showing a strong momentum upwards. It seems that the path turns more sideways instead of upwards and volatility levels are lowering amid NFP release this week. There seems to be, however, a triangle formation. The upper resistance level seems to be near 14896.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price continued on the 29th Sept. to move with high volatility, breaking the support at near 90.5 USD/b and moving further to the downside. 89.70 USD/b was broken yesterday causing Crude to dive. Now it found support at 86.70 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold keeps on breaking important support levels while it is moving on a clear downtrend. Even though the RSI is slowing down, staying close to the 30 level, there is no significant data to suggest that there will be a reversal or even a halt. Yesterday it moved lower and lower mainly due to the USD appreciation.

______________________________________________________________

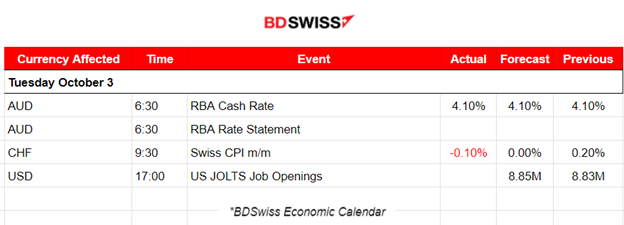

News Reports Monitor – Today Trading Day (03 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBA decided to keep rates unchanged. There was no significant shock observed at that time. The market did move but with less volatility than expected. The AUDUSD is currently moving to the downside.

- Morning–Day Session (European and N. American Session)

According to the Swiss CPI monthly figure, consumer prices decreased by 0.1% in September. A result due to several factors including lower prices for hotels and supplementary accommodation. The market did not react significantly to the release.

The JOLTS Job Openings figure for the U.S. will probably cause an impact at 17:00 upon release. The USD pairs will potentially experience a shock but the effect might not be huge since the market is waiting for the NFP to react greatly.

General Verdict:

______________________________________________________________