PREVIOUS TRADING DAY EVENTS – 27 December 2023

Sources:

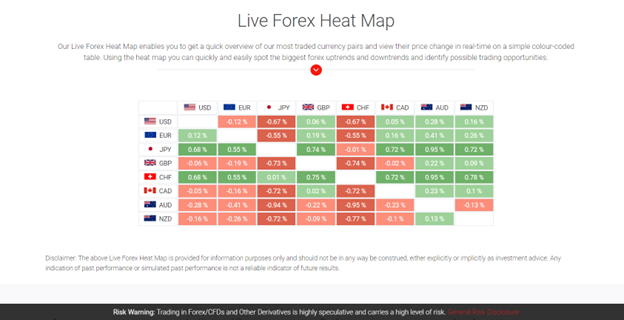

Today 28 December – Asian and European markets have continued to rally following the positive handover from Wall Street with FX pairs trading in narrow ranges and the USD under continued pressure. With many USD pairs at 5-month extremes, the USDCHF has moved even further to lows not seen since the 2015 removal of the EURCHF peg. USDCHF currently trades below 0.8400, a near -9.0% decline from early October.

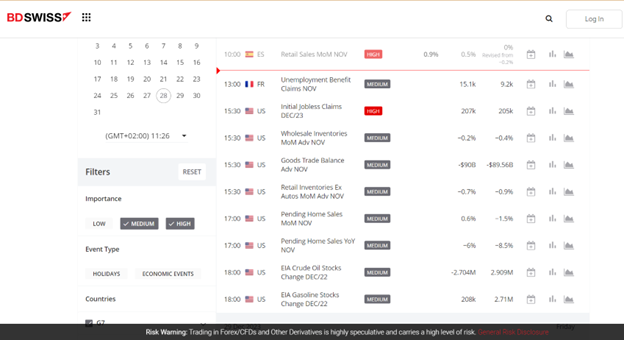

Data releases are slim today with the only two points of interest being the Weekly Unemployment Claims and Pending Home Sales. News from Ukraine and Gaza will continue to drive the political narrative into the New Year.

FOREX MARKETS MONITOR

EURUSD (28.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD remains bid after yesterday’s breach and break of key resistance at 1.1050 and the psychological 1.1100 zone. The next resistance zone is the 1.1120 level followed by 1.1200, 1.1225 and the 2023 intra-day high at 1.1275. Support could materialise today at the 21-EMA H1 area around 1.1100 below where sits the 50-EMA at 1.1060 and 1.1050.

Today’s Biggest FX Mover – AUDCHF (H1)

The AUDCHF is today’s biggest mover, having declined -0.95% so far. It has broken out of a tight 10-day range as the Swiss Franc gains momentum. Yesterday, a breach under 0.5800 has seen additional selling today, as it makes new December lows, and although volumes are low the next support is approaching 0.5700. The next support is at 0.5670, 0.5640 and the October low is at 0.5615.

COMMODITIES MARKETS MONITOR

XAUUSD (28.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold demand continued to benefit from weaker treasury yields and the Greenback Gold futures traded as high as $2088 before the cash market closed at $2077. Today, the $2088 level has once again been tested during the Asian trading session, before a significant decline to last night’s close at $2077 as the European trading day gets into full swing. The next major support today is the 50-hour moving average at $2070, $2060 and the 200-hour moving average at $2048. $2081.34 represents the intra-day high back in May.