PREVIOUS TRADING DAY EVENTS – 28 December 2023

Sources: https://www.reuters.com/markets/global-markets-wrapup-1-2023-12-29/

Today 29 December – Asian and European markets have continued mixed, following the flat handover from Wall Street with FX pairs trading in narrow ranges. The USD is recovering from 5-mth lows against most majors and even the 9-year low (0.8332) of the USDCHF proving a support level for now as the pair recovers 0.8400.

Data releases are very slim today on this final trading day of the year with the only point of interest being the Chicago PMI data which will be released at 14:45 (GMT) and is expected to show a decline to 50.1 from 55.8, but remain in expansion mode (over 50.0) for only the second month after 14 consecutive months of contraction. News from Ukraine and Gaza will continue to drive the political narrative into the New Year.

FOREX MARKETS MONITOR

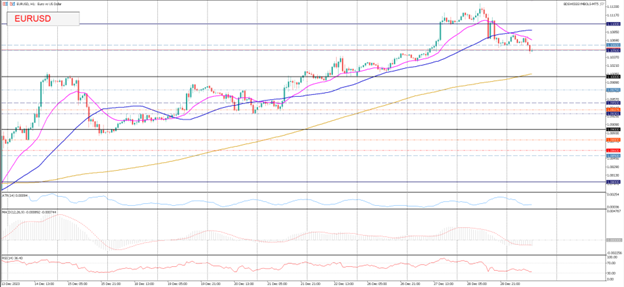

EURUSD (29.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD could not hold the psychological 1.1100 zone yesterday and trades below the 21-EMA (1.1071) and 50-EMA (1.1088) on the H1 chart today. 1.1050 is the initial support today with the 200-EMA 45 pips below at 1.1005.

Today’s Biggest FX Mover – AUDCHF (H1)

The AUDCHF is today’s biggest mover again, having declined -1.17% so far. It has broken out of a tight 10-day range as the Swiss Franc gains momentum. Yesterday, a breach under 0.5700 was recovered but additional selling today has seen the pair approach this key level for a second consecutive day. The next support is at 0.5670, 0.5640 and the October low is at 0.5615.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

XAUUSD (29.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold demand continued to benefit from weaker treasury yields and the Greenback Gold futures traded as high as $2094 before the cash market closed at $2070. Today, as the European trading day gets into full swing the market is weaker trading below the 50-hour moving average at $2074 and the 21-hour moving average at $2070. Next support is Thursday’s low at $2064, $2060 and the 200-hour moving average at $2054. $2081.34 represents the intra-day high back in May.