PREVIOUS TRADING DAY EVENTS – 10 July 2023

“It is crucial that we see the job through, meet our mandate to return inflation to its 2% target and provide the environment of price stability in which the UK economy can thrive,” Bailey said.

Bailey said there had been unexpected resilience in the labour market and a recession had been avoided so far.

“This is a good thing in many ways. No one wishes to see unemployment higher or growth weaker,” Bailey said.

“Both price and wage increases at current rates are not consistent with the inflation target,” Bailey said. “Currently at 8.7% in the latest data, consumer price inflation is unacceptably high, and we must bring it down to the 2% target.”

Source: https://www.reuters.com/world/uk/bank-englands-bailey-vows-see-job-through-inflation-2023-07-10/

______________________________________________________________________

News Reports Monitor – Previous Trading Day (10 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

No major news announcements, nor any significant scheduled releases.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

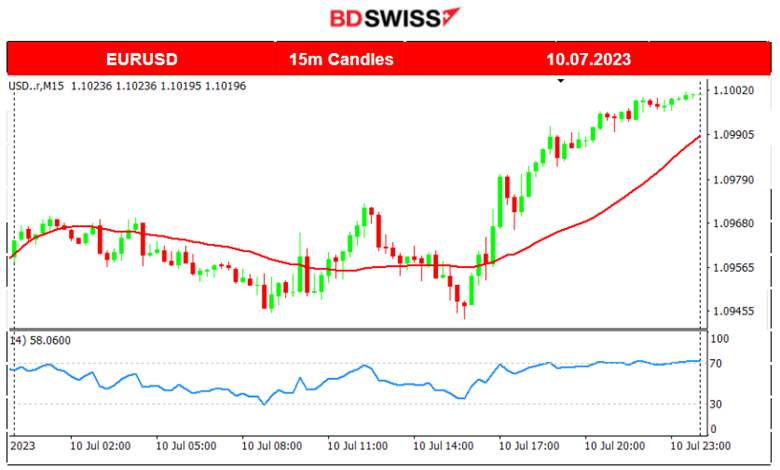

EURUSD (10.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD is mirroring the DXY chart, showing that USD is driving the market. The pair was moving sideways yesterday with increased volatility after the start of the European Session. While it was moving around the mean with high deviations, it eventually moved rapidly in one direction, upwards for the rest of the trading day as the USD was depreciating heavily against major currencies.

____________________________________________________________________

EQUITY MARKETS MONITOR

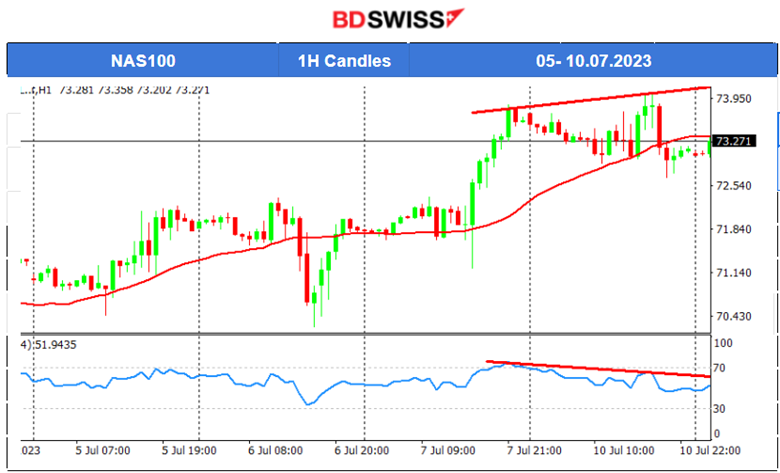

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index now stubbornly remains below the 30-period MA. For the last few days, the U.S. stock market has shown signs of reversal and breaking resilience. Even though we have high deviations from the mean in both directions, the trend seems downwards. High volatility governs the path though. The RSI shows signs of bullish divergence with its higher lows. A sideways path is more possible for now. 19940 seems to be the next support. 15086 is an important resistance.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

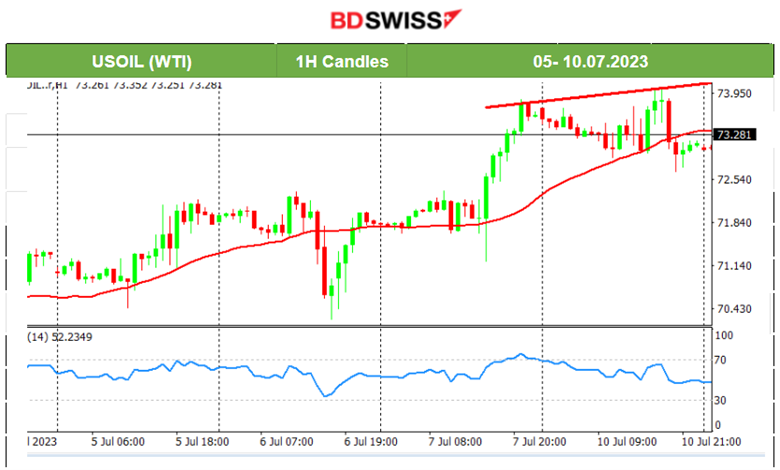

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Overall, we see that our initial expectation, that the oil price will eventually follow an upward path formed by the OPEC meetings’ recent statements, holds. Crude shows high volatility on its way up. The trend could pause for now and turn sideways since the RSI is slowing down showing lower highs.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The market reaction to the USD greatly affects the Gold price. On the 7th of July, the NFP figure was way different than the ADP figure, causing USD depreciation; thus, Gold jumped before eventually retracing back to the mean. That caused a price reversal, crossing the 30-period MA on its way upwards. We see that Gold moves more to the sideways path with high volatility and no clear direction yet. Yesterday, it experienced a fall during the European session but it immediately retraced fully. The 1935 USD/oz acts as an important resistance at the moment.

______________________________________________________________

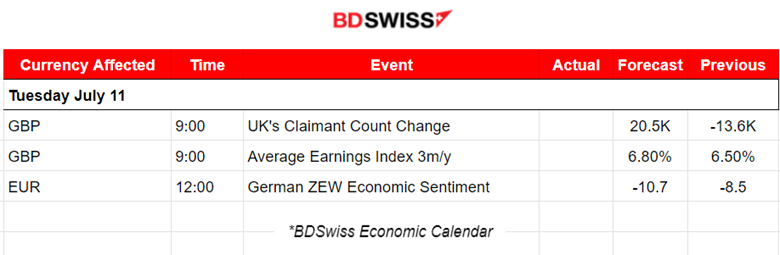

News Reports Monitor – Today Trading Day (11 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, nor any significant scheduled releases.

- Morning – Day Session (European)

The U.K. Unemployment-related Benefits Change figure (Claimant Count Change) is going to be announced at 9:00. It is expected higher, of course, since the central bank expects weaker labour market data. An intraday shock is expected.

The German ZEW Economic Sentiment would probably cause some more volatility but no major shocks. The German economic outlook is important for Europe and the ECBs decisions on rates.

General Verdict:

______________________________________________________________