Rates as of 05:00 GMT

Market Recap

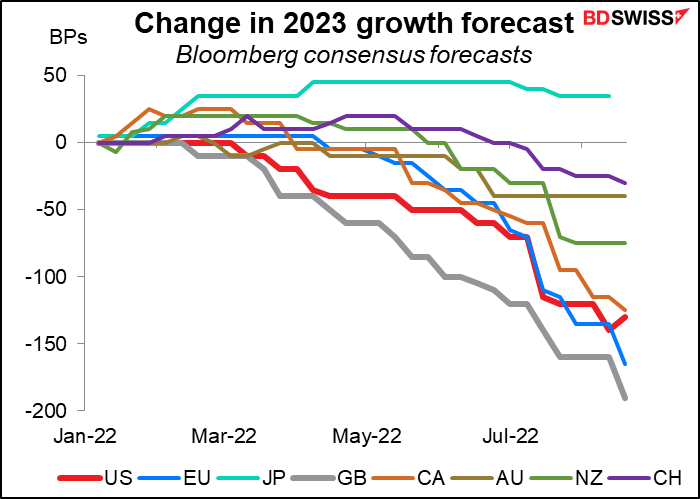

I learned in high school geometry class that you need two points to draw a line. Markets often try to draw a line with just one point, because investors don’t have the luxury of waiting until all the information is out to figure out what’s going on.

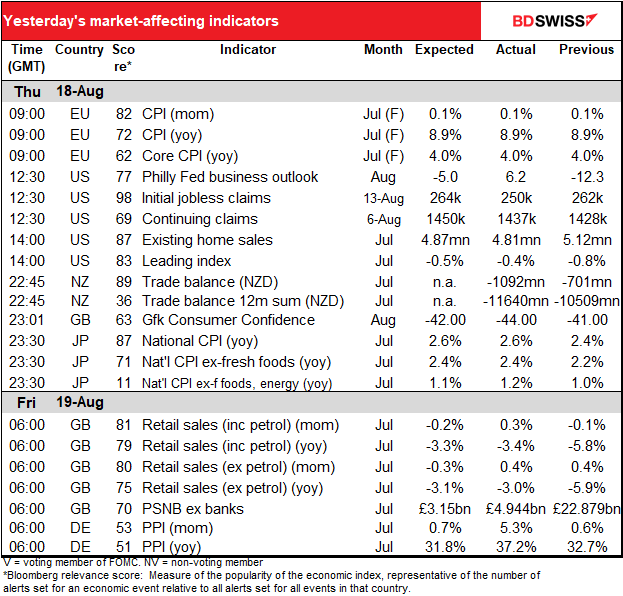

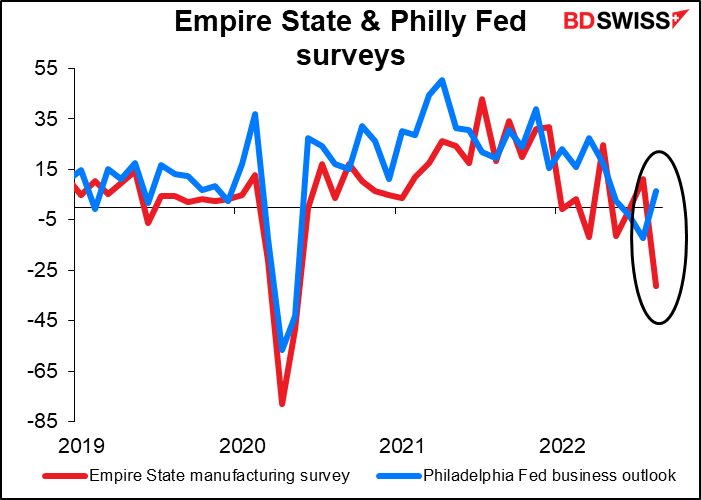

On Tuesday, the Empire State manufacturing survey showed the second-largest decline in its 20-year history, second only to the month that the pandemic hit. It looked like what would happen if a tsunami hit NYC. So there were naturally some concerns ahead of yesterday’s Philadelphia Fed business survey, as that’s the Empire State’s next-door neighbor. But in the event, the Philly Fed index substantially outperformed expectations, even moving into expansionary territory! (see table above). The two indices do move together most of the time (78%) but not always.

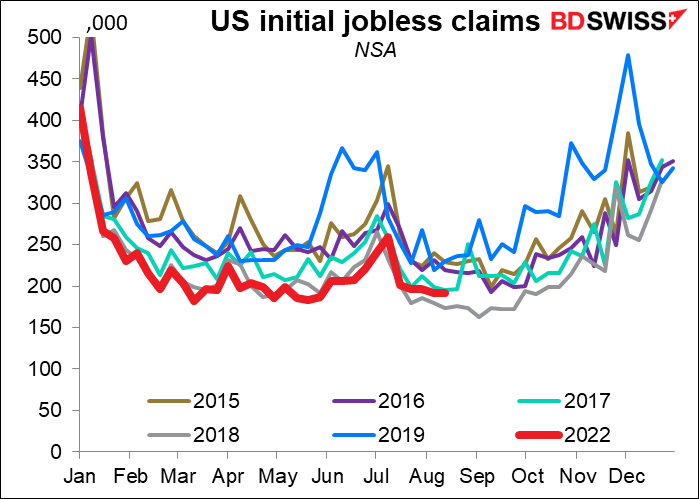

Meanwhile, the other point yesterday that would help the market draw a line: a big decline in initial jobless claims, plus a 10k downward revision to the previous week’s figure (not shown in the table). That put a major dent in the idea that the labor market was secretly crumbling. As always, I prefer to look at the seasonally unadjusted figures because the seasonal pattern has probably changed because of the pandemic. You can see that claims are about as low as they’ve been for this time of year in the last seven years. The labor market is still tight.

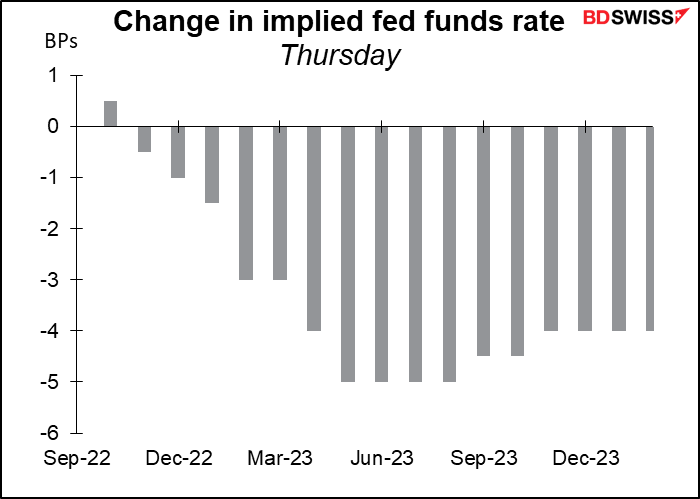

Yet for some reason fed funds rate expectations fell on the day.

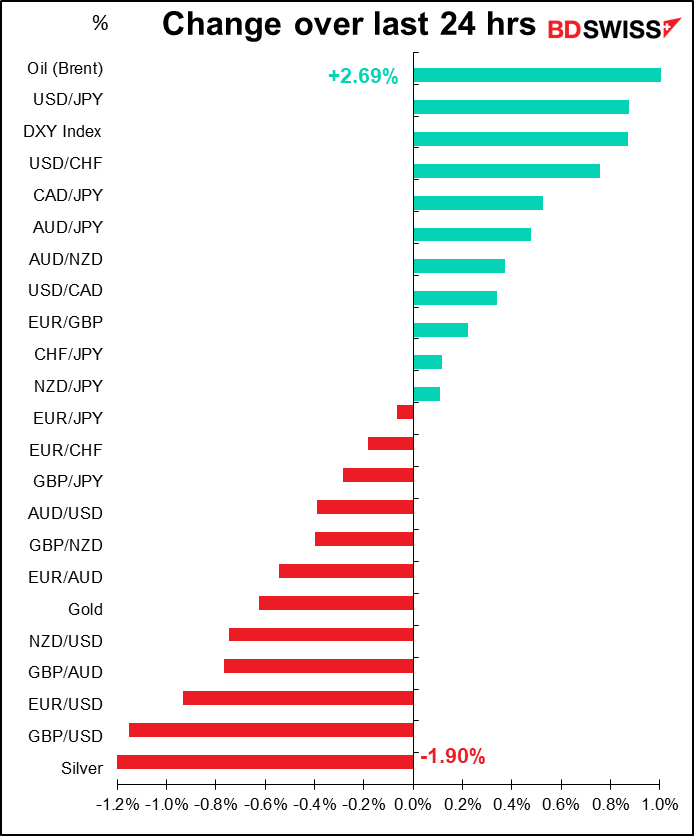

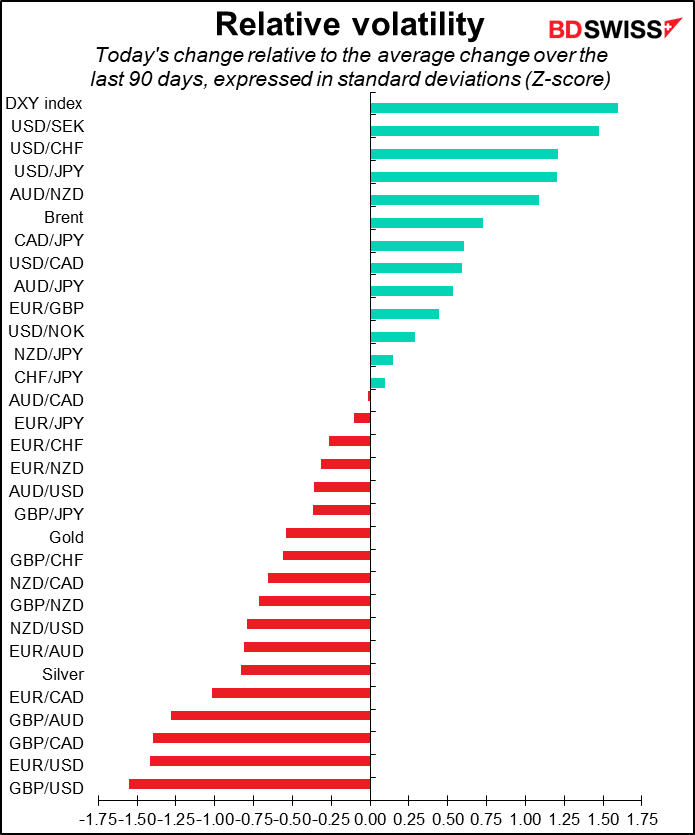

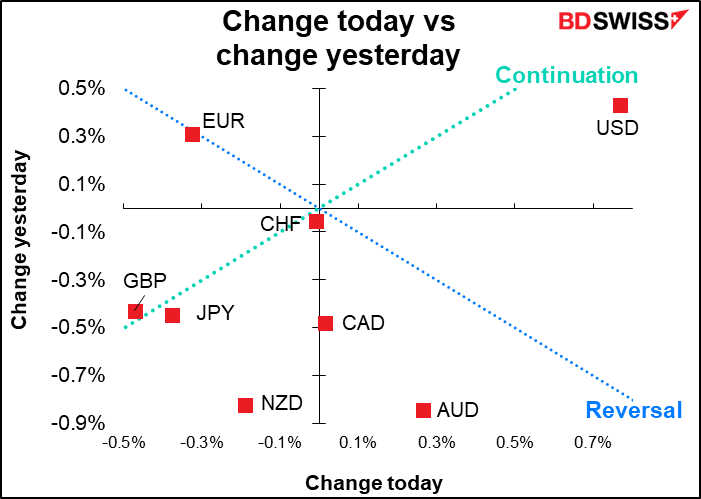

Nonetheless the dollar strengthened pretty much across the board. I wonder if we can connect the dollar’s strength despite lower rate expectations to GBP’s continued weakness despite higher rate expectations. GBP/USD fell below the 1.20 line yesterday.

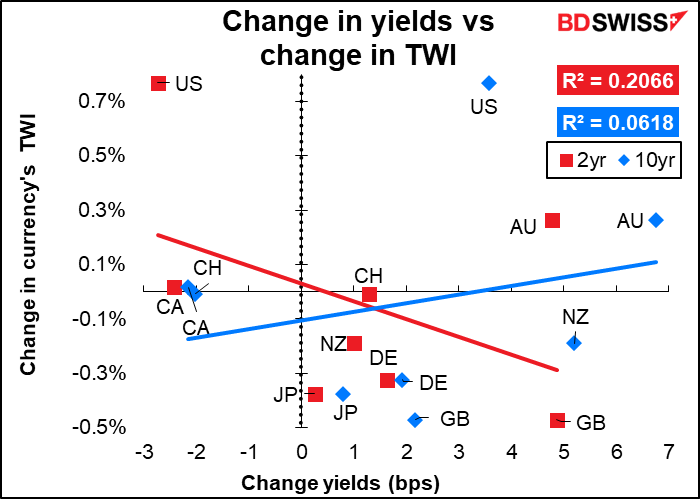

You can see that changes in interest rates played little if any role in the movement of currencies yesterday. You can also see how far away from the other currencies the USD was.

Nonetheless the dollar strengthened pretty much across the board. I wonder if we can connect the dollar’s strength despite lower rate expectations to GBP’s continued weakness despite higher rate expectations. GBP/USD fell below the 1.20 line yesterday.

You can see that changes in interest rates played little if any role in the movement of currencies yesterday. You can also see how far away from the other currencies the USD was.

The Fed confirmed yesterday that Fed Chair Powell will speak on the economic outlook next Friday at the Kansas City Fed’s annual Jackson Hole symposium. That speech, plus the Sep. 2nd US nonfarm payrolls and the Sep. 13th US CPI, are the main points of interest for the dollar ahead of the Sep. 21st meeting of the rate-setting Federal Open Market Committee (FOMC).

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

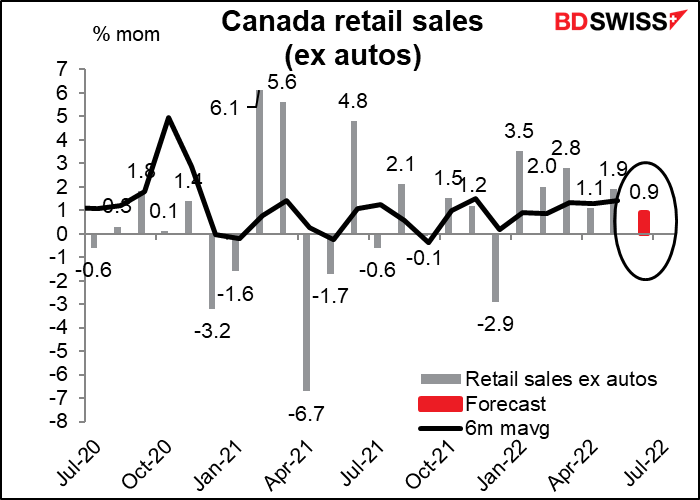

The main news of the day – UK retail sales – is already out. Now we just have to wait for Canadian retail sales.

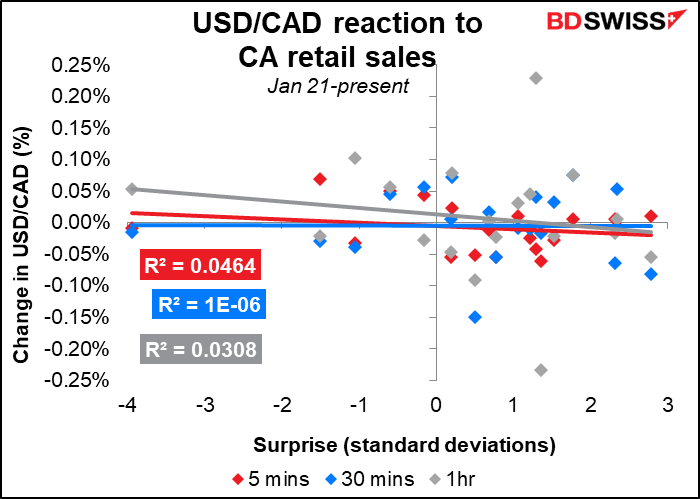

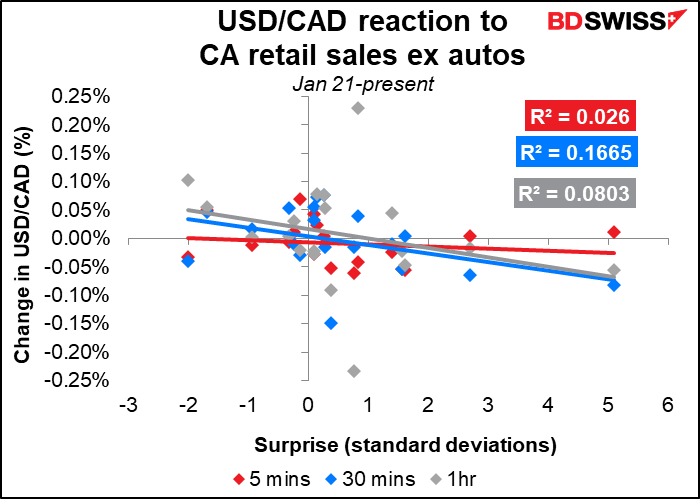

Which should you pay attention to: with autos or without autos? I’m not sure it matters that much because neither has that much of a correlation to the subsequent movement of USD/CAD. But in any case, we usually pay attention to the figure excluding auto sales (although in the US, people watch the headline figure, which does include autos).