Rates as of 05:00 GMT

Market Recap

As usual, a wildly volatile day in US stocks leading to a volatile day in currencies as well. The market surged +2.2% at the opening, then suddenly turned around to trade -1.6%, but resumed rising to hit +5.1% at one point, but then the rally faded and it closed +1.2%. So it had a 6.6% range on the day.

This morning S&P 500 futures are trading down 1.3%.

Nonetheless, it should be noted that the market gained two days in a row, the first time that’s happened in over a month. Some equity analysts are coming out with “buy the dip” recommendations. Is this the bottom of a panic sell-off, or a dead-cat bounce? I won’t express an opinion as it is now a medical issue and I have no qualifications to opine on medical issues.

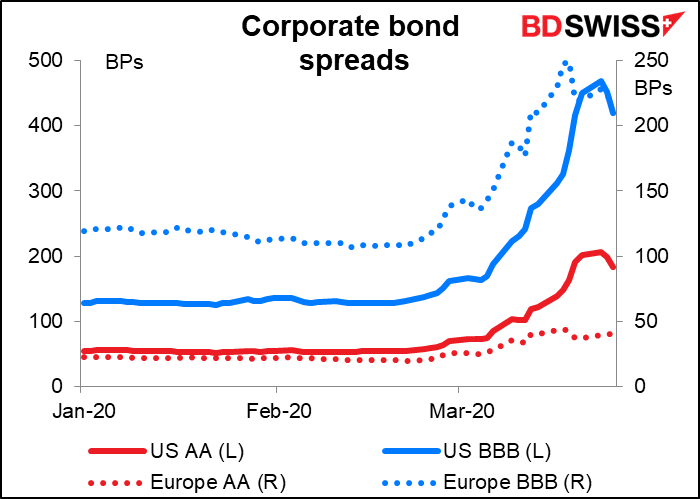

We are seeing some signs that the extraordinary measures are starting to work their magic. Corporate bond spreads are starting to come in on both sides of the Atlantic, indicating either that companies are getting more money and/or the panic is starting to die down. Eurozone peripheral bond spreads also narrowed noticeably.

The reason the US stock market was less-than-euphoric is that the stimulus bill was being held up in the Senate because four Republicans (said they) were concerned that providing unemployment benefits for people in financial trouble will incentivize people to go on unemployment rather than work.* However it did finally pass late at night in the US and now goes to the House, where a vote is scheduled for Friday. The $2tn package is much larger than the $800bn package passed after the 2008 financial crisis, but of course back then the Republicans were worried that all the debt would destroy the US economy, whereas now the Republicans are worried about reelection.

(*Note that one of the senators who objected, Rick Scott of Florida, is reportedly worth $255mn. He was the co-founder and chief executive of a company that was fined $1.7bn for defrauding Medicare, Medicaid and other federal programs.)

Meanwhile, Germany is moving faster to enact a massive aid package. The Bundestag (lower house) voted to set aside constitutional limits on the amount of debt the country could issue so that they can pay for emergency relief to boost the economy. The Bundesrat or upper house votes on Friday. The package totals more than EUR 750bn. In addition, they are evaluating a stimulus program that would kick in after the pandemic is contained.

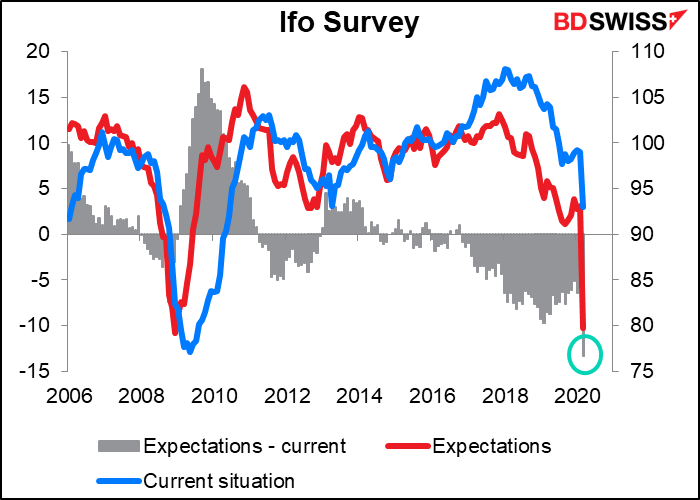

The reason for the German government’s haste to cease plowing the furrow of Teutonic rectitude was clear in yesterday’s final Ifo business climate figures, which were all revised down even further. What’s particularly noticeable about the survey is that the gap between the current situation and expectations – i.e., how much and in what direction they expect things to change – is much much worse than it was back in 2008. The lowest it got back then was -7.4 in October 2008, which was right after the Lehman Bros. shock (Sep 2008). Now it’s -13.3, meaning people don’t think all the scheisse has hit the fan yet by any means.

Meanwhile, we got a taste of what’s to come when Singapore announced its Q1 GDP figures, the first Q1 GDP announcement in the world. GDP was down an astonishing 10.6% qoq SAAR and could be revised down even further, as this preliminary estimate is compiled mostly from January & February data. This was worse than the 9.9% qoq SAAR drop in Q1 2009 during the Global Financial Crisis.

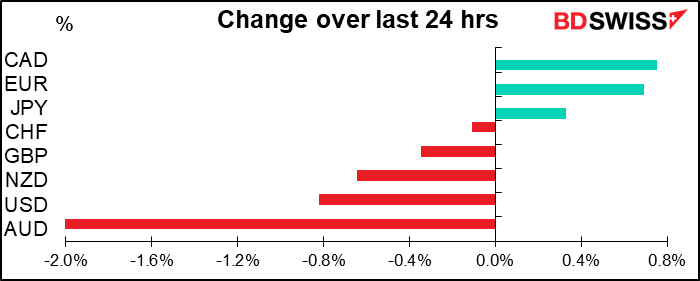

As for the FX market, things have changed even since I started writing this and made that table above, which was calculated before the Senate vote. AUD and CAD are recovering somewhat as risk comes back into fashion now that the Senate stalemate is passed – but NZD continues to weaken. And although AUD is strengthening, so too is JPY, and AUD/JPY is a bit lower (ie, indicating a “risk off” environment). I think while the financial and monetary aspects of the crisis are now well in hand, people are still worried about the medical aspects, and rightly so, in my view. I don’t expect a full “risk on” mood to prevail until everyone is dancing in the streets again. That may explain why the S&P futures are down this morning.

Market attention will now focus on the debate about how long people can or should stay in lockdown. Some experts are urging people to remain at home, while Trump is talking about getting everyone back in church by Easter Sunday (12 April in the US, 19 April in Cyprus by the way).

Today’s market

The Bank of England meeting was going to be the big event today, but after two emergency meetings that resulted in the lowest Bank Rate in 326 years, plus an addition to their QE program, I can’t see what changes they could make. The interesting point then will be not their decision, which is likely to be “unchanged,” but rather the minutes of the meeting, which promise a more extensive look into their thinking.

Shortly after the BoE meeting, Fed Chair Powell will be interviewed on the NBC Today show, one of the country’s main morning TV programs. The Fed chair rarely appears on TV like this. It’s also Powell’s first public comments since he had a teleconference on Sunday, 15 March, after the Fed cut rates in a surprise weekend meeting.

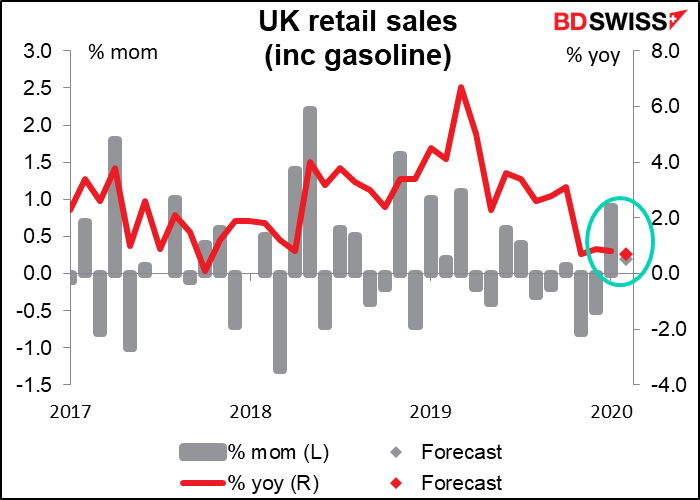

Before that, we get UK retail sales for February. Of only historical interest, I’d say.

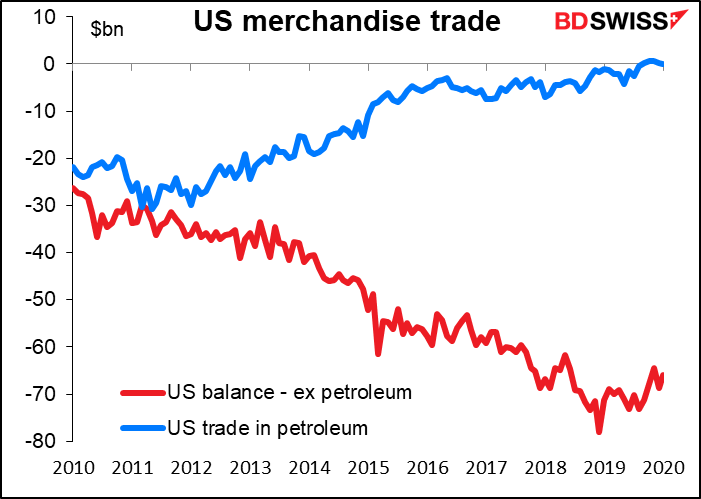

The US merchandise trade deficit is expected to continue narrowing in February.

The improvement seems to be twofold: one, the country no longer runs a huge deficit on petroleum – on the contrary, it runs a small surplus. Secondly, even the balance in non-petroleum trade is improving. Ordinarily this would all be great news and people would be cheering and there would be a ticker-tape parade in NYC etc etc, but as I’ve said many times, this is all just FYI now because it all comes down to the virus.

In fact, I’m not even going to bother making a graph for the third and final revision of US Q4 GDP, because Q4 is so much ancient history now. I had never even heard of a coronavirus back in Q4. Can you imagine?

Now comes the biggie – the biggest and baddest statistic: the weekly jobless claims. This is the most up-to-date statistic we have for the US economy as it comes out every week (today is for the week ended 21 March). The market is predicting an unprecedented 1640k claims. That’s more than double the previous record amount (695k, set in October 1982).

Some firms are warning of even more – estimates this week range from 400k (hah!) to 4000k (that’s 4mn unemployed persons!!!). (FYI the standard deviation of the 42 estimates is 868k for a statistic that last week was only 281k.) The 4mn estimate is an outlier by the way – there are two people there, then the next highest is three people at 3mn.

Of course, the US population is substantially larger than it was when the previous record high was hit back in 1982. Even adjusting for that, there’s still no comparison: it would be 0.80% of the working-age population (ages 15-64), vs 0.47% back in 1982.

This of course is why the Republicans in the US Senate finally decided to break down, give in on all their principles, abandon everything that’s dear to them, and actually – gasp! – vote to help working people. Given that Trump’s margin of victory in several crucial states was under 100k, having 1.6mn unemployed persons would certainly not help his – or the Senators’, for that matter – reelection chances. Remember that 40% of American households told the Fed some time ago that they would have trouble covering an unexpected expense of $400. So how do you think they’ll fare covering, say, a month or so out of work? Remember what Bob Marley said: a hungry mob is an angry mob.

OK, leaving the reggae behind and back to the indicators: same same with Tokyo CPI. In the best of times the Bank of Japan’s reaction function is stuck in neutral – now prices are the least of their worries.

There’s a big debate going on about just why there aren’t more virus cases in Japan. The country is a big tourist destination for Chinese, there was that disaster with the Diamond Princess cruise ship, and it’s a crowded place where millions pack into the trains every day to commute. Why aren’t they all sick?

Some explanations are cultural: Japanese don’t shake hands or kiss; they wash their hands a lot (I can vouch for that as my wife is Japanese and she’s always washed her hands & gargled as soon as she comes home), and they already had a culture of wearing masks. These customs have also been adduced as reasons why Singapore, Taiwan and South Korea have kept their epidemics under control.

Then there’s the structural explanation: the government is meticulous in chasing down contacts. While they might not be confining people to their homes, they do trace all contacts with anyone who has the virus. They announce on the news that “there was a case at such-and-such a restaurant” and ask everyone who ate there to come in. My daughter, who’s in university in Kyoto, has an app that pings her now and then with an announcement like that.

Finally, there’s the fact that Japan has a lot of elderly people and so was already well prepared for people with respiratory diseases – elderly people tend to catch pneumonia a lot, so if you have to catch pneumonia, Japan is probably the best place in the world to do so, because they’re very well prepared to deal with it.

Of course the other explanation is that the government is lying and hiding the real numbers. But we are not among those who would think such a thing, are we?