Previous Trading Day’s Events (29.08.2024)

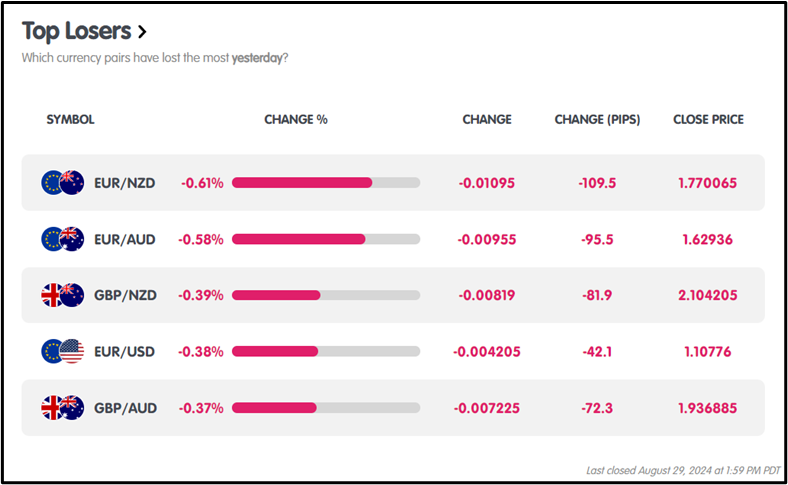

Japan Consumer Confidence: August index steady at 36.7, below the 36.9 forecast; highest since April with mixed sentiment on durable goods (+30.9) and income (-39.7).

US GDP Growth: Q2 2024 GDP revised to 3.0% from 2.8%, boosted by consumer spending and private inventory investment.

US Jobless Claims: Fell 2,000 to 231k, matching market expectations.

Japan Unemployment Rate: Unexpectedly rose to 2.7% in July from 2.5%.

Japan Retail Sales: July annual sales growth slowed to 2.6%, missing 2.9% expectations; MoM up 0.2%.

Tokyo CPI: Rose to 2.6% YoY in August from 2.2% in July.

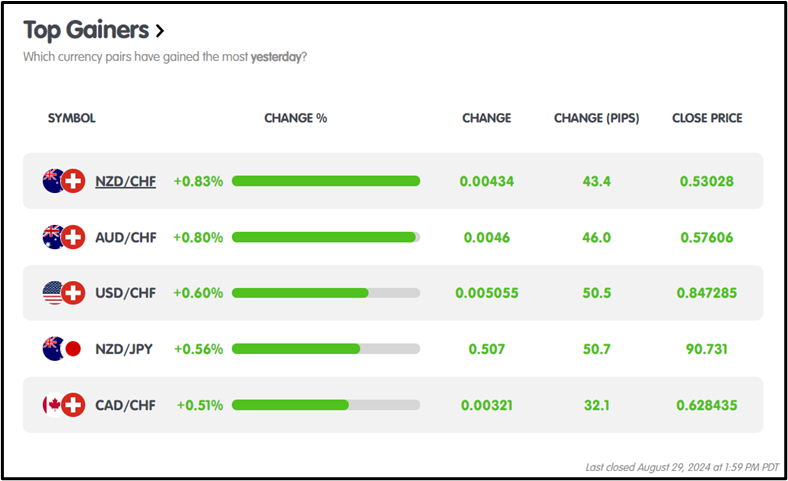

Winners Vs Losers In The Forex Market

On August 29, 2024, in forex trading, NZDCHF led the gains with a +0.83% move, adding +43.4 pips, while EURNZD was the biggest loser, dropping -0.61% with a -109.5 pip decline.

News Reports Monitor – Previous Trading Day (29.08.2024)

Server Time / Timezone EEST (UTC+03:00) Tokyo Session:

Tokyo Session:

Japan Consumer Confidence: JPY Bullish at 5:00 GMT, index steady at 36.7, below forecast. Durable goods sentiment positive (+30.9), income outlook weak (-39.7).

Japan Unemployment Rate: JPY Bullish at 23:30 GMT, unexpected rise to 2.7% in July from 2.5%.

Japan Retail Sales: JPY Bullish at 23:30 GMT, annual growth slowed to 2.6%, missing estimates; MoM up 0.2%.

Tokyo CPI: JPY Bullish at 23:50 GMT, CPI rose to 2.6% YoY in August from 2.2% in July.

London Session:

No major data releases affecting the session’s impact on currency.

New York Session:

US GDP Growth: USD Bullish at 12:30 GMT—revised to 3.0% from 2.8%, supported by consumer spending and inventory investment.

US Jobless Claims: USD Bullish at 12:30 GMT—claims fell by 2,000 to 231k, matching market forecasts.

General Verdict:

FOREX MARKET MONITOR

EURUSD (29.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD traded bearish, opening at 1.11184 and closing lower at 1.10741, with a daily high of 1.11406 and a low of 1.10545. CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (29.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD traded in bullish territory, opening at $59,359.01 and closing higher at $59,535.76. The pair reached an intraday high of $61,213.75, with a low of $58,777.96 during the session.

STOCKS MARKET MONITOR

STOCKS MARKET MONITOR

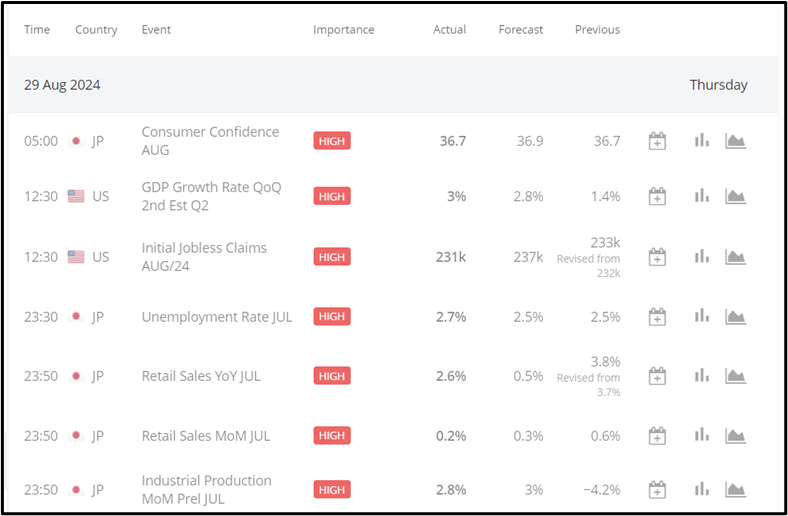

NVIDIA (29.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Nvidia faced bearish pressure, opening at $121.32, hitting a session high of $124.44 before declining to a low of $116.73, ultimately closing at $117.59 for the day.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

S&P500 (29.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The S&P 500 showed a bullish trend, opening at 5,570.77 and closing at 5,607.21, with an intraday high of 5,651.86 and a low of 5,548.37.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

USOIL (29.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL showed an overall bullish trend, opening at $73.83 and closing at $75.48, with an intraday high of $76.28 and a low of $73.47.

News Reports Monitor – Today Trading Day (30.08.2024)

News Reports Monitor – Today Trading Day (30.08.2024)

Tokyo Session:

Tokyo Session:

No significant economic indicators.

London Session:

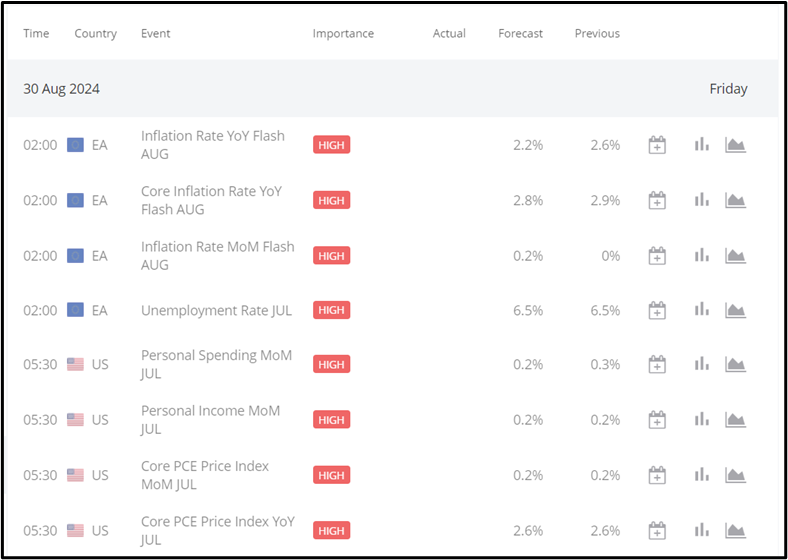

9:00 AM: EUR CPI Flash Estimate y/y; Forecast: 2.2%. Higher actual strengthens EUR. Lower actual weakens EUR.

New York Session:

12:30 PM: CAD GDP m/m; Forecast: 0.1%. Higher actual strengthens CAD. Lower actual weakens CAD.

12:30 PM: USD Core PCE Price Index m/m; Forecast: 0.2%. Higher actual strengthens USD. Lower actual weakens USD.

General Verdict:

Sources :