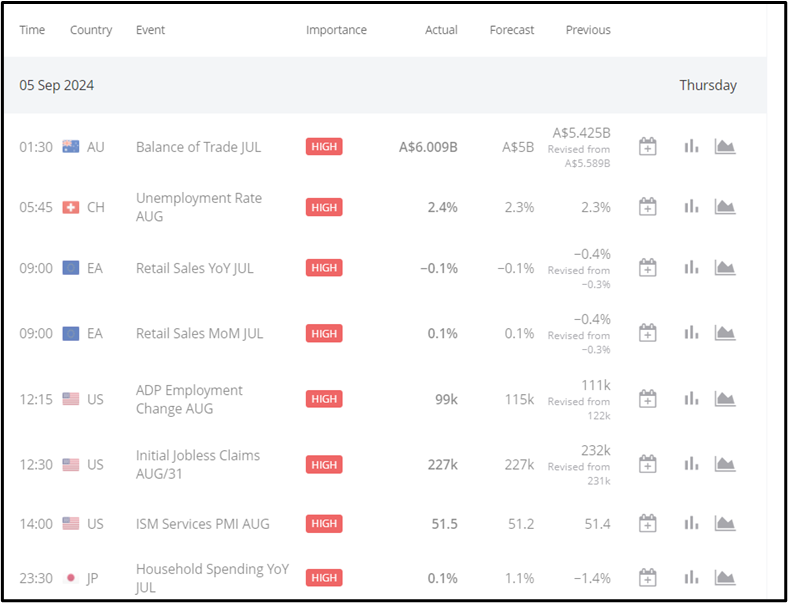

Previous Trading Day’s Events (05.09.2024)

Australia Balance of Trade: Released in July 2024 at AUD 6.01B, beating expectations of AUD 5B. Positive impact on AUD.

Switzerland Unemployment Rate: August 2024 release showed a rise to 2.4%, up from 2.3%. Negative impact on CHF.

Euro Area Retail Sales MoM: July 2024 saw a 0.10% increase. Minimal impact on EUR.

Euro Area Retail Sales YoY: Retail sales fell by 0.10% YoY in July 2024. Slightly negative impact on EUR.

US ADP Employment Change: Private sector added 99K jobs in August 2024, the lowest since Jan 2021, missing forecasts of 145K. July revised down to 111K.

US Initial Jobless Claims: Claims fell by 5K to 227K for the week ending Aug 31, below the 230K forecast, hitting a 7-week low.

US ISM Services PMI: PMI rose to 51.5 in August from 51.4, beating forecasts of 51.1. New orders increased (53), while production slowed (53.3). Employment edged up (50.2), avoiding a sixth monthly contraction. Prices rose further (57.3) amid higher costs in construction, food, and labour.

Japan Household Spending YoY: In July 2024, household spending rose by 0.1% YoY, rebounding from a 1.4% decline in June but missing the 1.2% growth forecast. It marked the first increase since April, with spending up in housing (17.3%), medical care (1.6%), education (8.9%), and culture & recreation (5.6%).

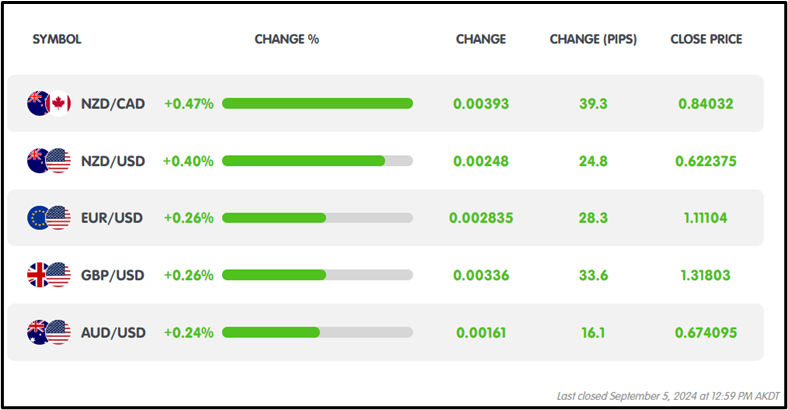

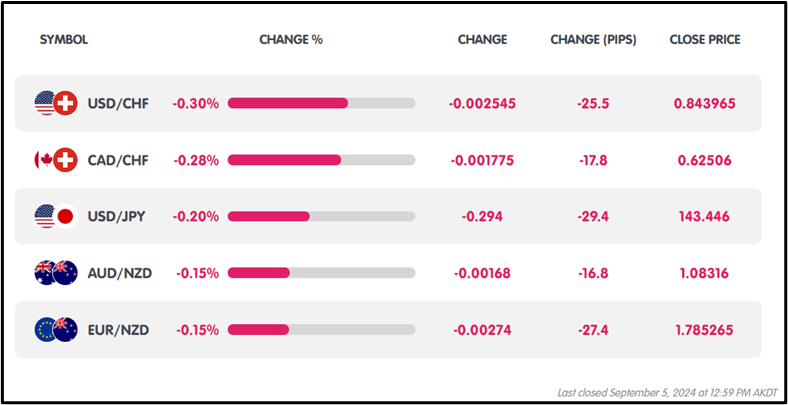

Winners and Losers In The Forex Market

On September 5th, 2024, NZDCAD led the forex market, gaining +0.47% and 39.3 pips, while USDCHF was the top loser, dropping -0.30% and -25.5 pips.

On September 5th, 2024, NZDCAD led the forex market, gaining +0.47% and 39.3 pips, while USDCHF was the top loser, dropping -0.30% and -25.5 pips.

News Reports Monitor – Previous Trading Day (05.09.2024)

Server Time / Timezone EEST (UTC+03:00)

1. Tokyo Session:

1. Tokyo Session:

Japan Household Spending YoY: Bullish JPY at 11pm GMT. July 2024 spending rose 0.1% YoY, recovering from a 1.4% drop in June.

2. London Session:

Australia Balance of Trade: Bullish AUD at 1:30 am GMT, with a July 2024 trade surplus of AUD 6.01B, surpassing the AUD 5B forecast. Positive for AUD.

Switzerland Unemployment Rate: Bearish CHF at 5:45 am GMT. August 2024 rate rose to 2.4% from 2.3%. Negative for CHF.

Euro Area Retail Sales MoM: Bearish EUR at 9:00 am GMT. July 2024 increase of 0.10%. Minimal impact on EUR.

Euro Area Retail Sales YoY: Bearish EUR at 9:00 am GMT. Retail sales dropped 0.10% YoY in July 2024. Slightly negative for EUR.

3. New York Session:

US ADP Employment Change: Bullish USD at 12:30 pm GMT. Private sector added 99K jobs in August, missing forecasts of 145K.

US Initial Jobless Claims: Bullish USD at 12:30 pm GMT. Claims fell by 5K to 227K, beating expectations of 230K.

US ISM Services PMI: Bullish USD at 14:00 pm GMT. PMI rose to 51.5, surpassing the forecast of 51.1.

General Verdict:

- The Tokyo and London sessions saw no significant market-moving events. However, the New York session was bullish for the USD, driven by key economic data. The US ADP Employment Change, Initial Jobless Claims, and ISM Services PMI all supported the dollar, with job gains, lower claims, and a stronger-than-expected PMI reading boosting USD sentiment.

FOREX MARKET MONITOR

EURUSD (05.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD showed a bullish trend, opening at 1.10785 and closing at 1.11088, with a daily low of 1.10729 and a high of 1.11196.

CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (05.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD showed a bearish trend, opening at $58,128.41 and closing at $56,044.46. The day’s low was $55,773.82, while the high reached $58,426.12.

STOCKS MARKET MONITOR

STOCKS MARKET MONITOR

NVIDIA (05.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Nvidia was bullish, opening at $106.01 and closing at $107.17. The intraday low was $105.40, and the high reached $109.65.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

NAS100 (05.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

NAS100 was generally bearish, opening at 18,959.87 and closing at 18,901.05. The day’s low was 18,805.10, while the high reached 19,119.34.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

XAUUSD (05.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Gold was bullish, opening at $2494.44 and closing at $2516.85. The high for the day was $2523.83, while the low was $2494.31.

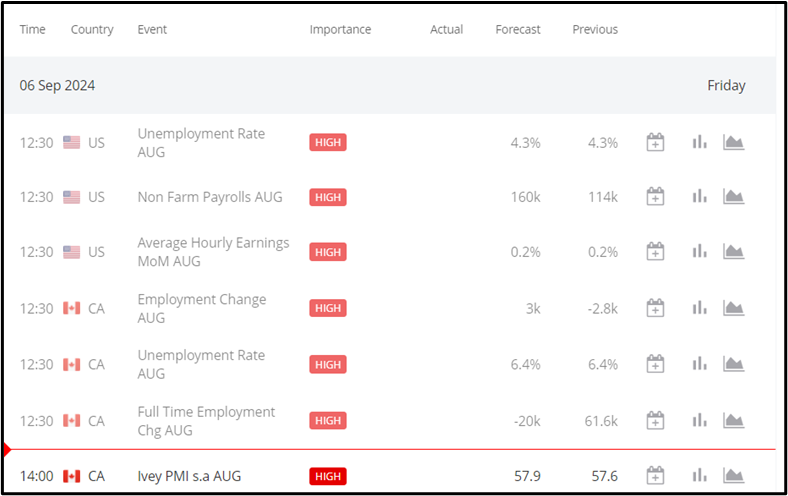

News Reports Monitor – Today Trading Day (06.09.2024)

News Reports Monitor – Today Trading Day (06.09.2024)

1. Tokyo Session: No significant economic indicators.

1. Tokyo Session: No significant economic indicators.

2. London Session: No significant economic indicators.

3. New York Session:

US Unemployment Rate (12:30 GMT): Forecast: 4.3%. Higher actual = USD bullish.

US Non-Farm Payrolls (12:30 GMT): Forecast: 160k. Higher actual = USD bullish.

US Average Hourly Earnings (12:30 GMT): Forecast: 0.2%. Higher actual = USD bullish.

Canada Employment Change (12:30 GMT): Forecast: 3k. Higher actual = CAD bullish.

Canada Unemployment Rate (12:30 GMT): Forecast: 6.4%. Higher actual = CAD bearish.

Canada Full-Time Employment Change (12:30 GMT): Forecast: -20k. Higher actual = CAD bullish.

General Verdict:

- USD and CAD may experience volatility, particularly if actual figures deviate significantly from forecasts during the New York session.

Source :

https://adpemploymentreport.com/

https://ec.europa.eu/eurostat/

https://ec.europa.eu/eurostat/

https://km.bdswiss.com/economic-calendar/

Metatrader 4 (MT4)