Previous Trading Day’s Events (26.08.2024)

US Durable Goods Orders: A 9.9% surge in July 2024 flipped the prior month’s 6.9% dip, the strongest bounce since May 2020, outpacing the 5% forecast. Transportation goods powered the rebound (+4.8%, $102.2B), but orders excluding them edged down (-0.2%, $187.4B). Metal products ticked up (+0.2%, $36.3B) alongside defence aircraft (+12.9%, $5.5B). Conversely, computers (-0.7%, $24.9B) and primary metals (-0.9%, $24.5B) dropped. Ex-defence, orders jumped 10.4%.

Dallas Fed Manufacturing Index: August 2024 improved to -9.7 (from -17.5). Production rebounded (1.6 vs -1.3), orders improved (-4.2 vs -12.8), capacity usage rose (-2.5 vs -10), and shipments broke even (0.8 vs -16.3). Wages climbed (22 vs 21.2), and employment stagnated (-0.7 vs 7.1). Input costs accelerated (28.2 vs 23.1), pushing prices higher (8.5 vs 3.4).

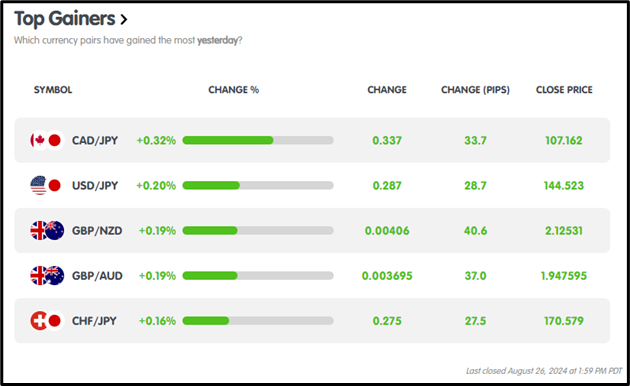

Winners Vs Losers In The Forex Market

On August 26th, 2024, CADJPY led the market with a +0.32% gain, advancing 33.7 pips, while NZDCAD lagged as the biggest loser, dropping -0.53% and shedding 44.3 pips.

News Reports Monitor – Previous Trading Day (26.08.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session: No Significant News

London Session: No Significant News

New York Session:

US Durable Goods Orders: Bearish USD at 12:30 pm GMT as Durable Goods Orders rose 9.9%, exceeding forecasts.

Dallas Fed Manufacturing Index: Bearish USD persists despite the Dallas Fed Index improving to -9.7 but remaining negative.

General Verdict:

FOREX MARKETS MONITOR

EURUSD (26.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD saw a bearish movement, opening at 1.11870 and closing lower at 1.11587. It hit a daily low of 1.11481 and peaked at 1.12003. CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (26.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTC/USD saw bearish movement, opening at $64,252.23 and closing lower at $63,398.91, with intraday highs of $65,085.22 and dipping to a low of $62,992.57.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

APPLE (26.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Apple showed bullish momentum, opening at $226.60, peaking at $227.25, dipping to a low of $223.78, and closing strong at $227.24.

INDICES MARKETS MONITOR

INDICES MARKETS MONITOR

S&P 500 (26.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The S&P 500 traded bearishly, opening at 5641.76, hitting a low of 5604.66, and peaking at 5655.68 before closing at 5613.36, signalling downward pressure throughout the session.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

XAUUSD (26.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

XAUUSD showed bullish momentum, opening at $2510.86 and closing at $2517.88, with a daily high of $2526.60 and a low of $2507.95.

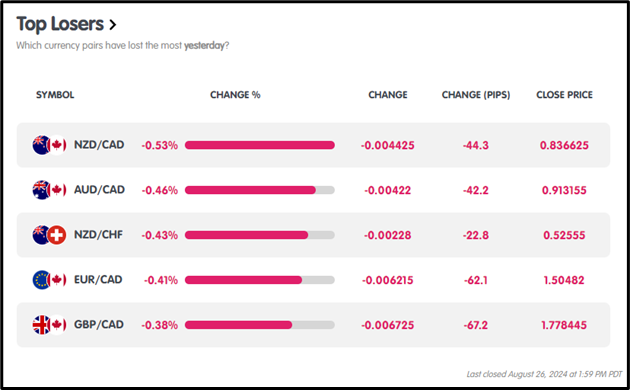

News Reports Monitor – Today Trading Day (27.08.2024)

Tokyo Session: No key data.

London Session: No key data.

New York Session:

CB Consumer Confidence:

A print above the 100 forecast could fuel USD bullish momentum, while a downside surprise may trigger bearish pressure.

Richmond Fed Index:

Forecast: -15; a better-than-expected outcome strengthens the USD, while a worse result exerts downward pressure on it.

General Verdict:

Source

https://km.bdswiss.com/economic-calendar/

Metatrader 4 ( MT4 )