Previous Trading Day’s Events (21.08.2024)

Crude Oil Inventories: US crude oil inventories decreased by 4.649M barrels, outperforming the 2.72M forecast, with Cushing stocks falling by 560K barrels. Gasoline saw a larger-than-expected drop of 1.606M barrels, exceeding the 1M estimate, while distillates fell by 3.312M barrels, contrasting with a projected 40K barrel increase.

FOMC Meeting Minutes: The Fed maintained the federal funds rate at 5.25%-5.50% for the 8th consecutive meeting, with inflation still above 2%. Rate cuts remain a possibility if inflation meets targets, with scenarios ranging from multiple cuts to none this year.

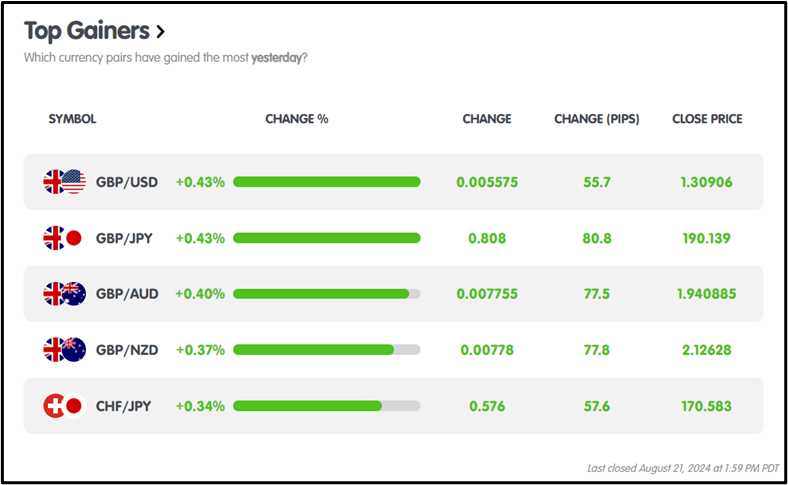

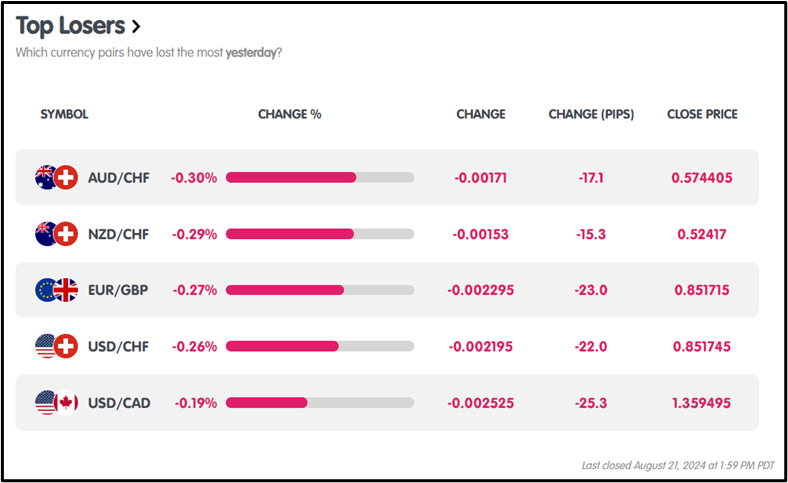

Winners Vs Losers In The Forex Market

On August 21, 2024, in the forex market, GBPUSD led the gainers, rallying +0.43% and adding +55.7 pips, while AUD/CHF was the top laggard, dropping -0.30% with a loss of -17.1 pips.

On August 21, 2024, in the forex market, GBPUSD led the gainers, rallying +0.43% and adding +55.7 pips, while AUD/CHF was the top laggard, dropping -0.30% with a loss of -17.1 pips.

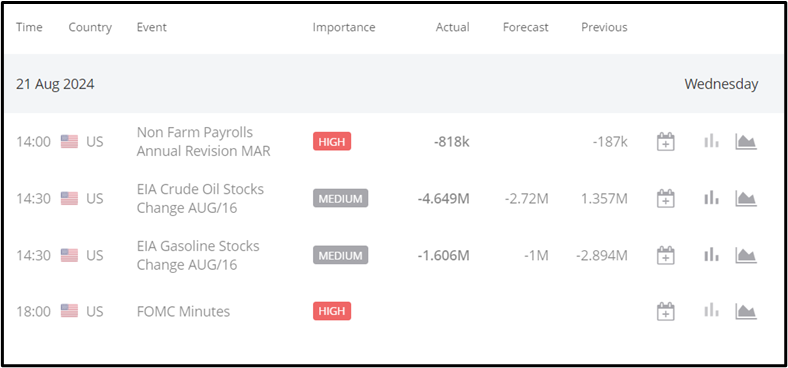

News Reports Monitor – Previous Trading Day (21.08.2024)

Server Time / Timezone EEST (UTC+03:00)

- Tokyo Session: No significant news

- London Session: No significant news

- New York Session:

Crude Oil Inventories: Bullish USD impact; crude down 4.649M vs. 2.72M forecast, Cushing down 560K, gasoline down 1.606M vs. 1M estimate, distillates down 3.312M vs. 40K increase.

FOMC Meeting Minutes: Bearish USD; Fed held rates at 5.25%-5.50% for the 8th meeting, inflation above 2%, potential for future rate cuts if inflation targets are met.

General Verdict:

FOREX MARKETS MONITOR

EURUSD (21.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD showed bullish momentum, opening at 1.11216 and closing at 1.11492, with a daily high of 1.11741 and a low of 1.10994.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (21.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD showed a bullish trend, opening at $59,373.37 and closing at $61,267.88, with a daily high of $61,890.36 and a low of $58,723.83.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

APPLE (21.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Apple traded bearish, opening at $226.50 and closing slightly lower at $226.29, with an intraday high of $228.00 and a low of $225.17.

EQUITY MARKETS MONITOR

EQUITY MARKETS MONITOR

S&P 500 (21.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

The S&P 500 exhibited bullish momentum, opening at $5600.76 and closing higher at $5623.29, with an intraday peak of $5637.19 and a low of $5600.76.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

XAUUSD (21.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

XAUUSD showed a bearish trend, opening at $2513.23 and closing lower at $2511.66, with an intraday high of $2519.88 and a low of $2492.49

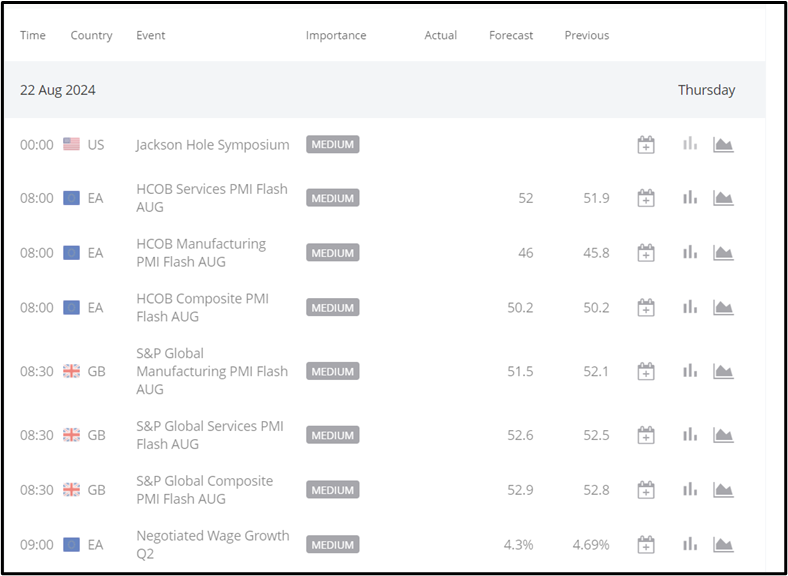

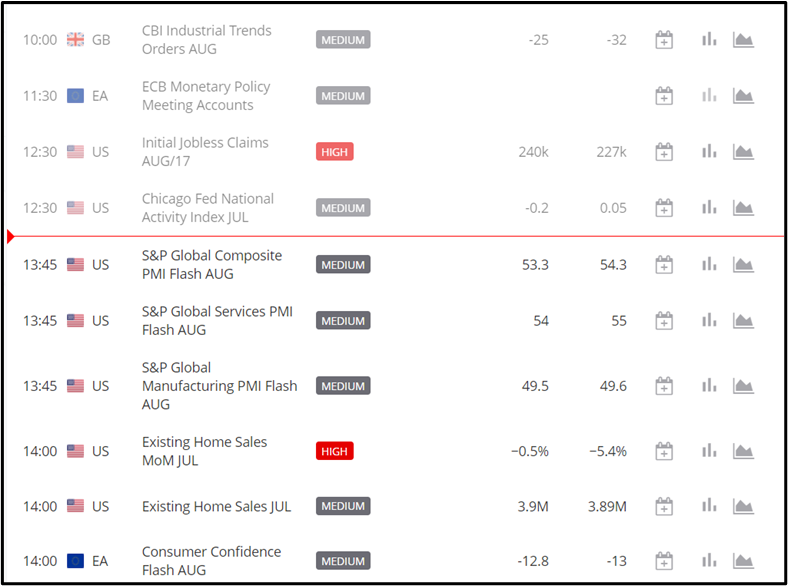

News Reports Monitor – Today Trading Day (22.08.2024)

News Reports Monitor – Today Trading Day (22.08.2024)

- Tokyo Session: No significant news

- London Session:

German Flash Manufacturing PMI: Forecast 43.4. Below forecast weakens EUR.

German Flash Services PMI: Forecast 52.3. Above forecast strengthens EUR.

Flash Manufacturing PMI: Forecast 52.1. Deviation affects GBP.

Flash Services PMI: Forecast 52.8. Deviation impacts GBP.

3. New York Session:

Unemployment Claims: Forecast 232K. Higher weakens USD.

Flash Manufacturing PMI: Forecast 49.5. Below weakens USD.

Flash Services PMI: Forecast 54.0. Above strengthens USD.

General Verdict:

Source :

http://www.federalreserve.gov/

https://km.bdswiss.com/economic-calendar/

Metatrader 4