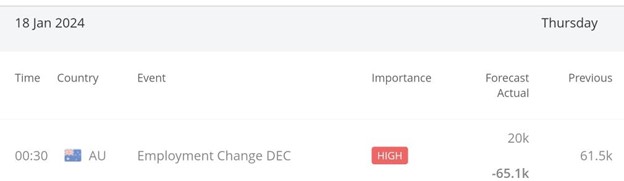

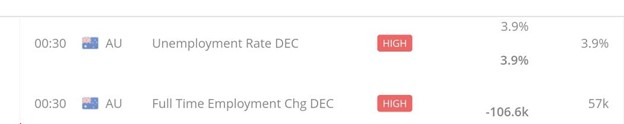

The economic scene unfolded as anticipated when Australia released the unemployment rate and unemployment change figures at 00:30 GMT. The forecasts were set at 3.9% for the unemployment rate and 20K for the unemployment change. However, the actual results surprised with a 3.9% unemployment rate and a notable 65.1K change in unemployment.

Source: https://global.bdswiss.com/economic-calendar/

In the realm of forex trading, the unemployment change metric measures the shift in the number of individuals employed in the previous month, while the unemployment rate quantifies the percentage of the total workforce actively seeking employment and unemployed during the same period. For the Australian Dollar (AUD), a released unemployment rate figure lower than the forecast is considered favourable, as is a higher-than-forecast unemployment change figure.

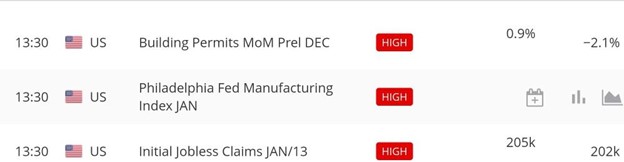

Shifting focus to the United States, the eagerly anticipated Initial Jobless Claims for January 13 are projected to be 205K, measuring the number of individuals filing for unemployment insurance for the first time in the past week. A release lower than the forecast is seen as positive for the United States Dollar (USD).

Source : https://global.bdswiss.com/economic-calendar/

Examining the technical aspects on the AUDUSD pair using a five-minute chart, the price exhibited a drop from 0.65485 to 0.65251 when the Australian employment news was unveiled. This impact was in line with expectations. On a Daily timeframe, AUDUSD appears to be in a range, with 0.68721 acting as resistance and 0.65251 as support. Following the Australian news, the support level rejected the price, and currently, the price hovers just above it.

5 minutes chart after the aud news

Looking ahead to the USD news scheduled for 13:30 GMT, traders are eyeing potential outcomes. If the news prompts a break below the support level, there are heightened chances of the AUDUSD price declining further. Conversely, if the support remains unbroken during the USD news and the AUDUSD price moves upward, the likelihood of an upward movement toward the resistance level increases.

As a trader, the question arises: What insights does your AUDUSD chart provide today in light of these unfolding economic developments? Analyzing these factors is essential for making informed decisions in the ever-dynamic forex market.