The Bank of Canada is likely to show patience at its interest rate announcement due to weakening economic conditions, paving the way for rate cuts in the coming months. Economists expect the central bank to maintain its key interest rate at 5%, with the first-rate cut anticipated around June. The Bank of Canada will assess the latest GDP figures to determine the future interest rate path. Economic slowdown aligns with the bank’s expectations, with concerns over lower domestic spending in the fourth quarter.

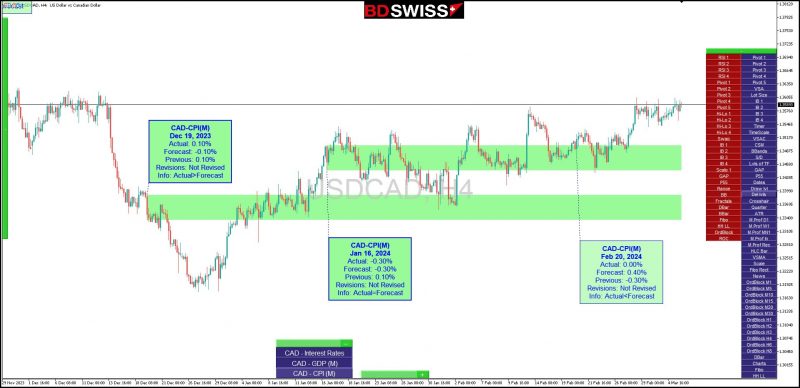

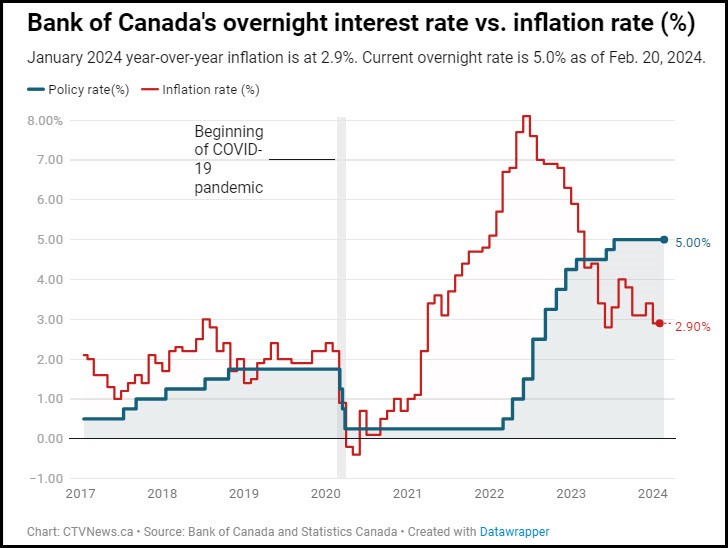

The recent announcement of Canada’s Consumer Price Index (CPI m/m) figures brought a glimmer of relief to the Bank of Canada (BoC) as inflation y/y softened to 2.9%, below the anticipated 3%. However, this slight dip doesn’t necessarily signify victory in the ongoing battle against inflation.Below is the image of CPI m/m.

The recent announcement of Canada’s Consumer Price Index (CPI m/m) figures brought a glimmer of relief to the Bank of Canada (BoC) as inflation y/y softened to 2.9%, below the anticipated 3%. However, this slight dip doesn’t necessarily signify victory in the ongoing battle against inflation.Below is the image of CPI m/m.

Consensus views indicate that market sentiments suggest the Bank of Canada (BoC) will keep its current interest rate at 5%. The possibility of a rate cut is not expected until Junely. However, markets hint at a potential rate cut as early as May.

Consensus views indicate that market sentiments suggest the Bank of Canada (BoC) will keep its current interest rate at 5%. The possibility of a rate cut is not expected until Junely. However, markets hint at a potential rate cut as early as May.

Understanding the Triggers

The real game-changer lies in the BoC’s communication strategy. Any indication of future rate adjustments or downward revisions in growth forecasts could significantly impact the currency markets.

Here’s a breakdown of the key triggers to watch out for:

Implications for CAD

Implications for CAD

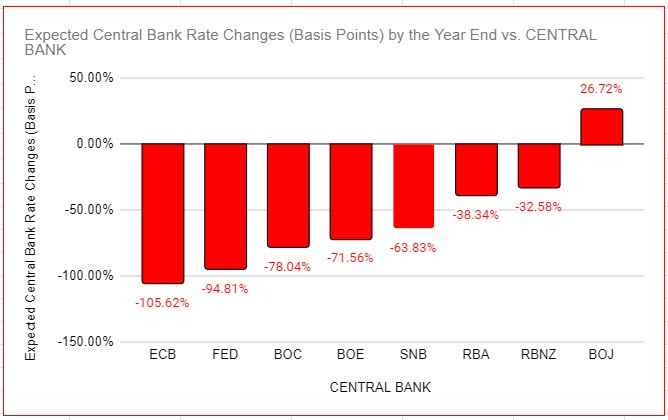

If these triggers align—lowered growth forecasts and hints of rate cuts or a shift in inflation concerns—CAD weakness can be expected. Below is image of expected central bank rate changes by the year end. BoC may cut rates by 78 bp. Technicals

Technicals  The USDCAD on H4 time frame is currently trading within the value area of the previous week and this level aligns with the Canada interest rate from December 6 as well.

The USDCAD on H4 time frame is currently trading within the value area of the previous week and this level aligns with the Canada interest rate from December 6 as well.

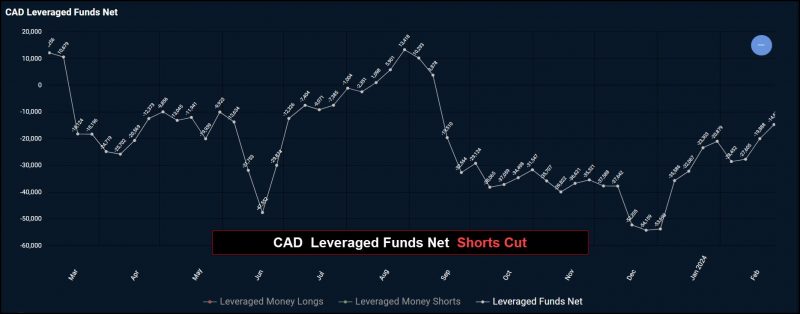

Bullish trend with 64% longs in GBP vs 65% shorts in CAD ( Leveraged Funds).

Sources:

Sources:

FXStreet – Canada CPI inflation falls to 2.9% vs. 3.3% expected

Economic Times – Fed pivot will dominate year of rate cuts in turn of global cycle