PREVIOUS TRADING DAY EVENTS – 22 March 2023

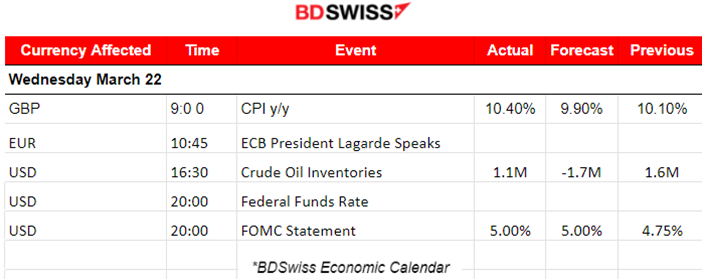

Announcements:

Source: BDSwiss Economic Calendar

Source: https://www.ecb.europa.eu/press/key/speaker/pres/html/index.en.html

Source: https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm#calendars

______________________________________________________________________

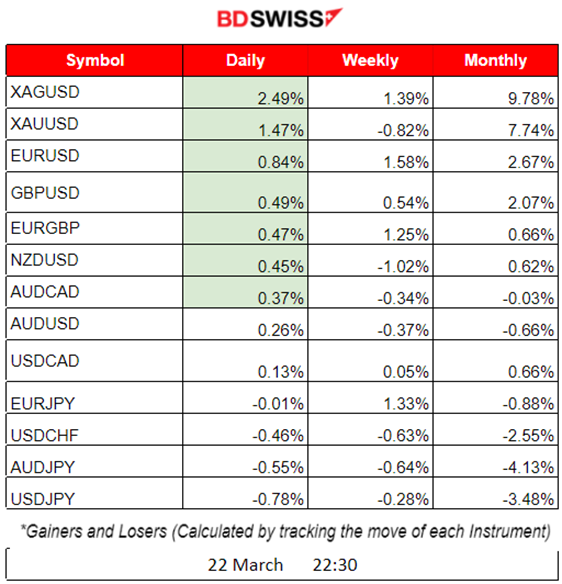

Summary Daily Moves – Winners vs Losers 22 March 2023

- The Figures show that metals have experienced the highest change for the day with Silver (XAGUSD) experiencing a 2.49% positive price change. EURUSD and GBPUSD follow while JPY pairs with JPY as quote currency have fallen greatly.

- For the last 3 days, the EUR pairs with EUR as base currency have been gaining ground along with Silver.

- This month the highest gainers so far are Silver and Gold. Also, EURUSD and GBPUSD seem to gain a lot of ground against other pairs.

News Reports Monitor – Previous Trading Day 22 March 2023

- Midnight > Night Session (Asian)

No important figures/release> No major impact.

- Morning – Day Session (European)

At 9:00 (GMT+2) the UK’s most important inflation data was released, expected to be lower than the previous figure; from 10.1% to 9.9%. However, the figure was surprisingly higher than expected, at 10.4%. This figure caused an intraday shock at 9:00 for the GBP pairs. GBPUSD headed upwards as traders expect further rate hikes in the future from BOE.

At 10:45 ECB President Lagarde gave her speech without causing any shocks in the market and no significant moves in the EUR pairs.

At 16:30 Crude Oil Inventories news showed that the change was positive instead of the expected negative. More barrels in inventories show less demand which is normal for the current month.

At 20:00 the release of the FOMC statement and the release of Federal Funds Rate figure increased the rate to 5% causing a shock even though the figure was exactly as expected. The FOMC statement caused the market to experience both shock and volatility. (See EURUSD, GBPUSD, USDJPY).

General Verdict:

– GBP Pairs experienced a shock during the CPI figure release.

– USD Pairs experienced a shock during the FOMC news.

– US Oil prices stabilising.

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Price Movement

The EURUSD continued its upward path following the decision of the FED for a rate hike on the 22nd of March. It seems that the figure pushed the EURUSD even further upwards. Since the 16th of March, the EURUSD has been experiencing an upward trend moving above the 30 period MA.

EURUSD 22.03.2023 Chart Summary

Price Movement

The pair was moving slowly during the Asian session and started to show some volatility when it was close to 9:00 (GMT+2) as it was approaching the European Markets’ opening. Apparently, the market had been expecting the FOMC news at 20:00. At the time of the release there was a clear shock upwards. It stopped at some point and the price reversed as per the chart.

Trading Opportunities

Fibonacci Expansion can help in identifying the retracement level of 61.8% as per the chart. When the shock ended it could be used to determine whether going short and when to set the TP. However, being cautious is significant as the market moves very rapidly during such releases and catching retracement is not easy.

GBPUSD 4-Day Chart Summary

Price Movement

The GBPUSD pair has been experiencing an upward move in general and a price reversal from the 21st to the 22nd of March. We can see that the pair changed from moving below the 30 period MA to moving above it during that time.

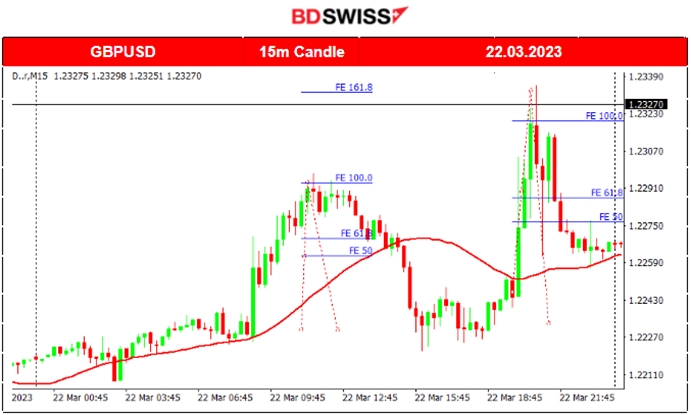

GBPUSD 22.03.2023 Chart Summary

Price Movement

The pair experienced volatility during the day. The upward movement on the 22nd was a result of the CPI release. Following the CPI release, we can see this upward movement and the consequent shock at 20:00 due to the FOMC news release.

Trading Opportunities

Both shocks, from UK CPI and FOMC news, were intraday signalling retracement expectations and ended at some point as depicted by the Fibonacci expansion tool. As depicted, the price retraced even more than 50% of the movement.

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NASDAQ – NDX) 4-Day Chart Summary

Price Movement

The US index consisting of non-financial companies has been gaining ground for the last 4 days moving above the 30-period moving average. The coordinated actions to resolve the US banking turmoil have restored a semblance of order. At the same time, we notice that on the 22nd of March at 20:00, the release of the FED rate figure caused huge volatile moves with a resulting drop in stocks.

NAS100 (NASDAQ – NDX) 22.03.2023 Chart Summary

Price Movement

The price of the index was moving within a range, showing low volatility. This is something to expect before the Stock Exchange opening at 16:30 (GMT+2). After the Stock market opening, more volatility prevailed while investors were expecting the FED rate release. The market moved first upwards, then found resistance which resulted in a drop.

Trading Opportunities

The index price after the big drop resulted in a price reversal as the price now is moving below the 30 period MA. This indicates a strong signal for retracement. On the 23rd of March, we expect a correction and thus an upward move in price, at least during the Asia-European session.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

GOLD (XAUUSD) 4-Day Chart Summary

Price Movement

Gold has been showing high volatility during the last 4 days. Its price has been moving above and below the 30 period MA with price deviations from that MA to be 40-50 US Dollars approximately. As concerns about the banking crisis had been arising, Gold has been experiencing high demand and therefore price increase. During the 20th -21st of March, we witnessed price fall as crisis fears eased before the anticipated Fed Rate decision on the 22nd.

GOLD (XAUUSD) 22.03.2023 Chart Summary

Price Movement

The price of Gold was moving within a range, showing low volatility. This is something to expect given the fact that everyone was expecting the FED Rate figure release later during the day. The price was moving first around the 30 period MA with deviations from the MA of 5-6 USD. Later with the FED Rate decision to increase the rate, Gold moved upwards rapidly, likely supported by safe-haven demand during these times.

Trading Opportunities

Gold is usually traded for the long term, however, the turmoil in the US banking sector and the various announcements cause high volatility with its price deviating highly from the MA. With no clear medium-term trend and a sideways path, it creates opportunities for catching retracements and reversals after the price crosses the MA.

______________________________________________________________

News Reports Monitor – Today Trading Day 23 March 2023

- Midnight > Night Session (Asian)

No important figures/release> No major impact.

- Morning – Day Session (European)

At 10:30 (GMT+2) the SNB’s main operating target will be released. The Swiss National Bank is expected to increase its benchmark lending rate for the 4th straight time while problems in the domestic and international banking sectors generate uncertainty. It is estimated to raise its policy rate by 50 basis points to 1.5%. Eyes on CHF pairs for intraday shocks.

At 14:00 the Bank of England is expected to announce an increase in rates. The UK inflation came higher than expected at 10.4%, well above the consensus of a drop to 9.9%. It is estimated to raise the official bank rate by 25 basis points to 4.25%.

Unemployment claims for the US is an interesting figure that is going to be released at 14:30. The number of unemployed people is a key indicator of overall economic health. These figures have been positive with an indication of around 190K-200K for 2023. Approximately 100K less on average than in the year 2022. Some impact is expected on the USD.

General Verdict:

– CHF Pairs to experience an intraday shock due to the rate decision.

– GBP Pairs to experience an intraday shock due to the rate decision.

– In general, volatile markets with high deviations from the MA on major pairs and commodities are expected.

______________________________________________________________