PREVIOUS TRADING DAY EVENTS – 18 July 2023

“Inflation is definitely moving in the right direction, but we’re seeing stickier and more persistent core measures,” said Michael Greenberg, senior vice president and portfolio manager at Franklin Templeton Investment Solutions.

The average of two of the Bank of Canada’s (BoC) core measures of underlying inflation, CPI-median and CPI-trim, came in at 3.8% compared with 3.9% in May.

“The Bank of Canada’s preferred measures of core inflation, which exclude significant moves in individual categories, show that underlying price pressures remain sticky,” said Royce Mendes, head of macro strategy at Desjardins Group.

Canada’s Finance Minister Chrystia Freeland highlighted to reporters the fact that inflation was lower in Canada than in any other G7 country.

The Bank of Canada last week raised rates to a 22-year high of 5.0%, its tenth-rate increase since last March and expects inflation to remain around 3% over the next year before dropping to the bank’s 2% target by mid-2025.

“The forces meant to hold back real spending power after 16 months of Fed tightening – drawdowns in pandemic savings, high inflation, higher borrowing costs – fell short of meaningfully slowing consumption,” said Will Compernolle, macro strategist at FHN Financial in New York.

“The resilient consumer shows the Fed has very little reason to think its tightening has gone too far at this point.”

Spending has remained strong despite frequent and high-interest rate hikes from the Fed since March 2022. A tight labour market continues to boost wages while consumers’ purchasing power is slowly rising as inflation drops.

Stocks on Wall Street jumped. The dollar was steady versus a basket of currencies. U.S. Treasury yields fell.

“The economy is plodding along without overheating,” said David Russell, vice president of Market Intelligence at TradeStation. “This is modestly positive news for investors worried about the Fed needing to hike after July.”

______________________________________________________________________

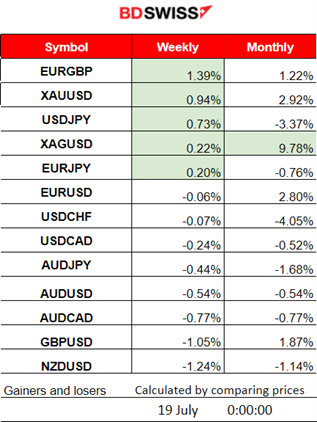

Winners vs Losers

______________________________________________________________________

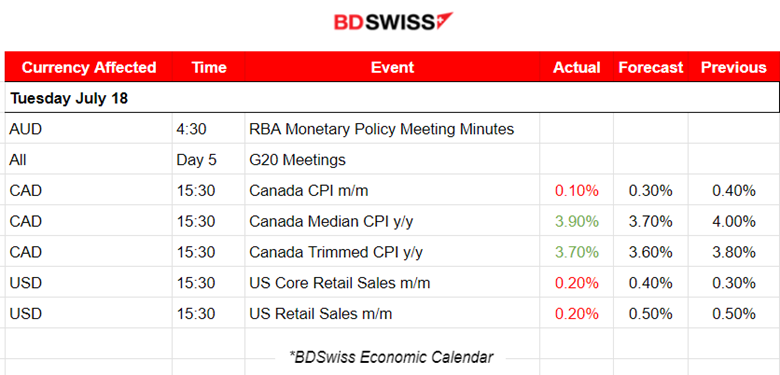

News Reports Monitor – Previous Trading Day (18 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The release of the RBA Monetary Policy Meeting Minutes had a low impact on the AUD causing weakening. A small intraday shock was observed as the members discussed that the year-ended rate had declined and inflation remained quite above central banks’ targets in most advanced economies. The Board agreed that some further tightening may be required as this would be reconsidered during the August meeting.

- Morning – Day Session (European)

At 15:30, Canada’s CPI data suggested that inflation is slowing down, however, the market did not react much to the reported figures. Monthly CPI change dropped to 0.10% versus the expected 0.30%. Instead, the USD showed some signs of strengthening for a while after the release.

Retail sales data for the U.S. were reported lower, coinciding with the region’s recent economic data. Less spending is expected since the Fed managed to have a great effect on cooling economic activity and cause a significant drop in inflation.

General Verdict:

____________________________________________________________________

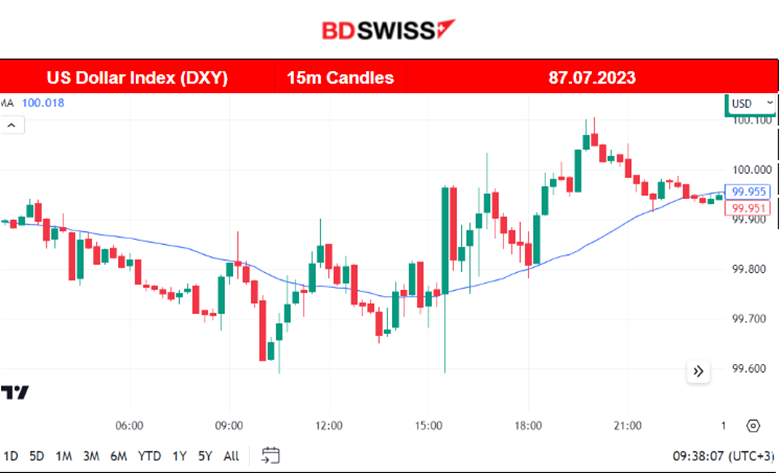

FOREX MARKETS MONITOR

USDCAD (18.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

It is clear that more volatility was observed after 15:30 when Canada’s CPI figures were released. There was not a big shock taking place as the USD was driving the pair mostly. The U.S Retail Sales data were also reported and were lower than expected. At first, the pair moved to the upside since USD strengthened for a while before eventually reversing. The pair moved downwards crossing the 30-period MA during the N. American session and a retracement followed back to the mean as depicted using the Fibo Expansion.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The U.S. labour market data and the inflation-related data have caused an unusual uptrend for the benchmark indices lately and a market reaction that seems to keep indices high enough. The RSI showed signals of bearish divergence and on the 18th of July, the index moved to the downside at first as soon as the NYSE opened. It however found strong resistance and reversed fully, surprisingly climbing to higher and higher levels. Risk-on mood!

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The Oil price followed an upward path formed by the OPEC meetings’ recent statements and other factors. The trend continued until the 14th of July when eventually the price reversed crossing the 30-period MA on its way down. On Monday, 17th of July the price continued the downward movement. Weaker-than-expected Chinese economic growth raised doubts over the strength of demand for that region. It eventually found support showing higher lows as it moved to the 18th of July when we see a rapid upward movement after the start of the N. American session and stock exchange opening for the U.S. This was a reversal leaving the MA way lower and with higher chances of a short retracement to take place.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold moves steadily on the downside with high volatility while being below the 30-period MA. On the 17th of July, the price reversed crossing the MA on its way up and continued on the 18th of July with an exponential increase until it reached the resistance near the 1984 USD/oz. It of course retraced after that level back to the 61.8 Fibo level which is close to the mean (30-period MA on the hourly chart).

______________________________________________________________

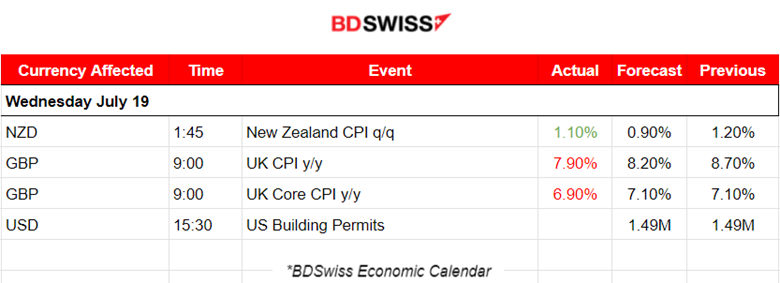

News Reports Monitor – Today Trading Day (19 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

New Zealand’s CPI change quarterly figure was reported lower but higher than expected. The NZD strengthened moderately but the shock was not so great. NZDUSD moved upwards nearly 20 pips before reversing significantly.

- Morning – Day Session (European)

U.K. inflation was reported lower than expected. This was the expected result after BOE aggressively increased rates to respond to the 2-digit inflation, way higher than other rich countries. The GBP inevitably suffered heavy depreciation since the market reacted immediately to the news. 90 pips drop in GBPUSD after the release. EURGBP moves more than 50 pips so far on the upside.

General Verdict:

______________________________________________________________