Previous Trading Day’s Events (02 Feb 2024)

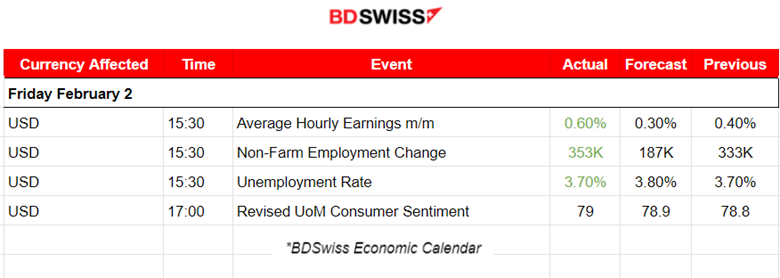

The NF Employment change was reported surprisingly at 353K, higher than the previous 333K for December, while the market was actually expecting lower figures. The unemployment rate was reported steady at 3.7% last month, remaining below 4% for two consecutive years.

Average hourly earnings increased 0.6% in January, the biggest gain since March 2022, after rising 0.4% in December, supporting views that the Fed will not move quickly to lower borrowing costs.

“Given the Fed now wants strong job growth, as (Fed Chair) Jerome Powell told us just two days ago, this report should not discourage the Fed from cutting rates,” said Chris Low, chief economist at FHN Financial in New York. “By the same token, however, it is not going to encourage them to rush into rate cutting.”

Source: https://www.reuters.com/markets/us/us-job-growth-surges-january-wages-rise-2024-02-02

______________________________________________________________________

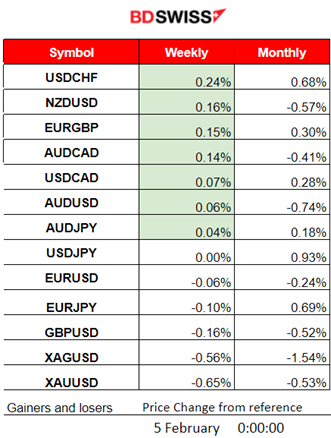

Winners vs Losers

The USDHCF currently leads this week with 0.24% gains. The month has just started and the market looks stable after the shock on Friday’s NFP.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (02 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

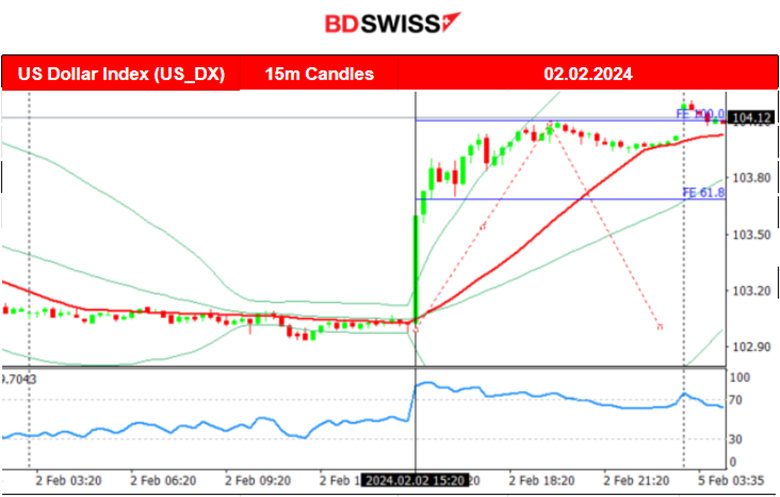

The figures on Friday, 2nd Feb, took everyone by surprise and caused an intraday shock with a huge impact on the USD and related assets, extending to the stock market and more.

The monthly Average Hourly Earnings change was reported higher than expected, at 0.6% versus the 0.3% expected figure, the NF Employment change was reported amazingly at 353K versus the expected change at 187K, while the unemployment rate was reported stable at 3.70%.

A huge sign of U.S. strong labour conditions that puzzles the markets, changes expectations and further supports the data that suggest economic resilience. The labour market is indeed hotter than anticipated. In addition, inflation is not on the right path either as there is no clear downtrend. The Fed will have to assess the data with great detail before proceeding with any comments or even decisions on future interest rate policy or any decision on rate cuts. It could be the case that interest rates should be kept elevated. What does the market think?

The market reacted with great dollar appreciation against other currencies, clearly seen in the dollar index. USD pairs (USD as Quote) dropped heavily at the time of the figure releases. EURUSD dropped around 100 pips. Gold dropped near 28 USD/oz. The U.S. Indices dropped at the time of the releases but reversed soon after the exchange opening, continuing to the upside and closing higher overall. No significant retracement took place on the same day for FX pairs even when support/resistance was reached. This reaction signals that the market expects the Fed to keep interest rates high for longer and increases uncertainty about how much longer the economy is going to face high borrowing costs.

Chair Jerome Powell said in an interview broadcast Sunday night that the Federal Reserve remains on track to cut interest rates three times this year, a move that’s expected to begin as early as May.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (02.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair obviously was on the sideways path around the mean at the beginning of the Asian session. Volatility levels started to increase as the start of the European session was approaching and just before the 15:30 U.S. news the market calmed, settling close to the 30-period MA. At 15:30 a huge intraday shock occurred with great USD appreciation against other currencies causing the EURUSD to drop near 100 pips. It found support at near 1.07785 before retracing slightly, but not completely. The MA was reached though and this signals that dollar strengthening might continue for longer.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

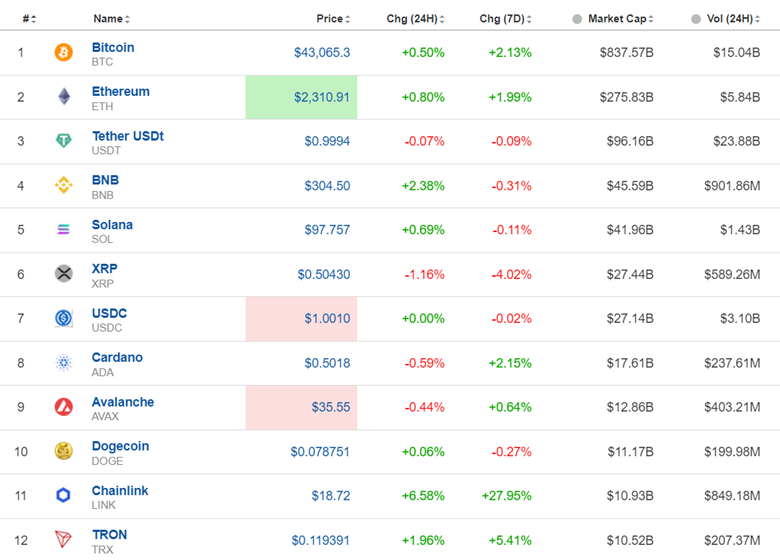

Bitcoin faced a shock during the NFP report release on Friday but closed near flat for the trading day. Volatility levels lowered after that event and a triangle was formed during the weekend. On Sunday, 4th Feb, the price broke the triangle to the downside reaching the support at 42200 USD. It soon reversed after that crossing the 30-period MA on its way to the upside and remains currently settled near 43000 USD.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

Cryptos remain stable for now, even after important events, such as labour market data for the U.S., shake the markets. Volatility has lowered significantly with prices now being closer to the moving averages (Daily Timeframe). Mixed gains appear when looking 7 days back. Soon the market will have to move greatly to one side. Let’s see if Bitcoin will test 46,000 USD once more and the next, the highest for the year at near 49,000 USD.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

NAS100 reversed on the 1st Feb, moving to the upside crossing the 30-period MA and reaching the resistance at 17,550 USD. After some sideways movement with low volatility early on the 2nd Feb, the NFP news at 15:30 caused an intraday shock that brought the U.S. indices down to lower levels for some time. NAS100 reached support near 17,400 USD before a huge reversal took place. The index reversed, crossing the 30-period MA on the way up and reached the resistance higher at near 17,700 USD before retracing. The RSI is currently signalling a bearish divergence, however the market is about to test that intraday resistance for now.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude’s price signalled a downward movement and on the 31st it dropped to the support of 75.5 USD/b, before retracing back to the mean. On the 1st of February, it tested that support and successfully broke it, coming down to near 73.6 USD/b before retracing. On the 2nd Feb, the price was stable until the NFP news was released. Then the price saw a rapid drop breaking the support at 73.6 USD/b moving towards the next at near 71.8 USD/b before retracing to the 61.8 Fibo level. A clear downtrend as it seems for now. However, that might end soon while crude shows resilience to fall further and the RSI signals bullish divergence (higher lows).

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold on the 31st broke the resistance, reaching 2055 USD/oz prior to the FOMC news. The heavy reversal followed and increased volatility after the USD was affected positively by the Fed’s statements. On the 1st of February Gold tested the support near 2031 USD/oz unsuccessfully and reversed with a jump upwards reaching the resistance near 2065 USD/oz before retracing. The market shook on the 2nd Feb, at the release of the NFP news. Gold dropped heavily around 28 USD, found support and soon after it retraced to the 61.8 Fibo level. Obviously, the drop was attributed to USD strengthening and the effect could possibly continue for longer. Currently Gold broke the 2030 USD/oz support moving lower, possibly towards the next support at near 2015 USD/oz.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (05 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

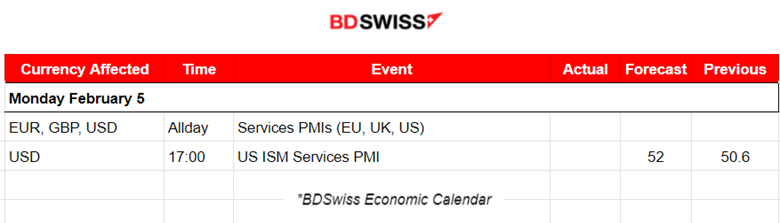

Services PMIs will shed some light in regards to the Services sector and get a better picture of the economic situation in these important regions after the manufacturing PMI releases last week.

The ISM Services PMI figure is in the expansion area coinciding with the U.S. data that show economic resilience, supported by the recent hot labour market figures. It is expected to be reported higher today. USD pairs could see some increased volatility during that time and the possible dollar strengthening in case of a surprise increase.

General Verdict:

______________________________________________________________