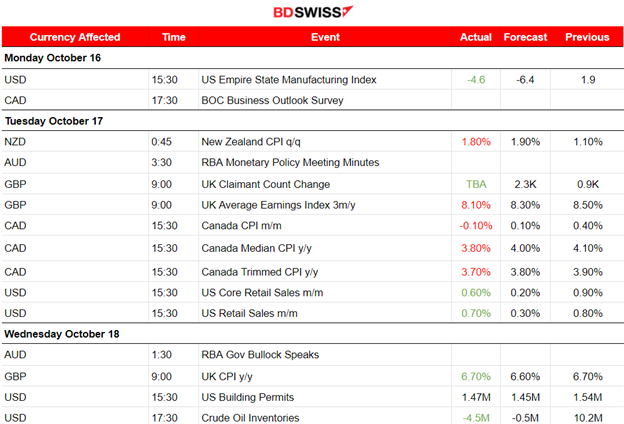

PREVIOUS WEEK’S EVENTS (Week 16 – 20 Oct 2023)

Announcements:

U.S. Economy

The Empire State index (General business conditions index) has gone back into negative territory. The headline general business conditions index fell seven points to -4.6. Labour market indicators pointed to a slight increase in both employment and the average workweek.

US retail sales increased in September more than expected, suggesting durable household demand as the third quarter drew to a close. The value of retail purchases, unadjusted for inflation, increased 0.7% after an upwardly revised 0.8% gain in August. Excluding gasoline, September sales advanced 0.7%.

The labour market remains generally strong, offering Americans resources for spending. A continued strength in consumer spending still takes place. While inflation is still running well above the Fed’s 2% target, the prices of key consumer goods including apparel and furniture fell sharply last month.

New claims for unemployment benefits number fell to a nine-month low last week at 198K, indicating that the labour market remains tight. The data suggest that the Federal Reserve could keep interest rates higher for longer. The labour market is showing strength despite the U.S. central bank raising its benchmark overnight interest rate by 525 basis points to the current 5.25% to 5.50% range since March 2022.

Financial markets expect the Fed will leave rates unchanged at its Oct. 31-Nov. 1 policy meeting, according to CME Group’s FedWatch Tool, given the surge in Treasury yields.

Australia Economy

Employment data for Australia are showing that the labour market is losing steam. Underlying figures suggest vacancies are being filled and openings are declining. Employment change was reported just 6.7K from the expected 20.6K.

The participation rate, at 66.7% in September, is at its lowest level since February, suggesting fewer people are looking for work. Had that not been the case, Australia’s jobless rate would have jumped last month as per economists’ statements.

U.K. Economy

Change in Retail sales figures for the U.K. was reported way more negative than expected, -0.90%. Retailers reported that the fall over the month was because of continuing cost of living pressures. Retail sales volumes were 1.4% lower than a year earlier and lower than the forecasts for a 1.2% decline.

The BoE halted its increase in borrowing costs, saying it saw signs of an economic slowdown.

Canada Economy

Canadian retail sales fell by 0.1% in August from July. Core retail sales figures actually increased by 0.1%. Analysts were expecting a 0.3% decline from July instead. Growth in Canada has remained halted.

The data enforce the view that the Bank of Canada is done hiking rates.

______________________________________________________________________

Inflation

New Zealand:

New Zealand inflation slowed more than what economists expected in the third quarter and this caused the market to react with NZD depreciation. Consumer prices advanced 1.8% from three months earlier, less than the 1.9% median estimate.

The RBNZ maintained the Official Cash Rate at 5.5% and said that policy may need to be restrictive for a sustained period of time to get inflation back into its 1-3% target range by the second half of 2024.

Canada:

CPI data for Canada showed that the annual inflation rate unexpectedly slowed in September and underlying core measures also eased. Two of the Bank of Canada’s (BoC’s) three core measures of underlying inflation also decelerated. CPI-median edged down to 3.8% from 4.1% in August, while CPI-trim decreased to 3.7% from 3.9%.

The central bank is unlikely to raise rates when it announces its policy decision on Oct. 25 based on these reports. However, at 3.8%, inflation is still nearly double the bank’s 2% target. The central bank does not anticipate inflation slowing to its 2% target until mid-2025. The bank will issue new forecasts alongside its rate announcement next week.

U.K. :

The U.K.’s yearly inflation figure was reported higher than expected at 6.7% in September, remaining the highest of any major advanced economy. This raises the possibility that the BOE will keep rates elevated or even proceed to hike rates in the near future.

Petrol prices kept rising between August and September and this was the main factor pausing a fall in the annual rate.

Consumer prices in Britain have risen 17% in the past two years, an increase that would normally take almost a decade. Wednesday’s data showed core inflation fell less than expected to 6.1% in September from August’s 6.2%. Services price inflation increased to 6.9% in September from 6.8%.

_____________________________________________________________________________________________

Sources:

https://www.newyorkfed.org/survey/empire/empiresurvey_overview

https://www.reuters.com/markets/us/us-weekly-jobless-claims-unexpectedly-fall-2023-10-19/

https://www.reuters.com/world/uk/british-retail-sales-rise-by-04-august-2023-09-22

https://www.reuters.com/world/uk/uk-inflation-rate-holds-67-september-2023-10-18

https://www.reuters.com/markets/canada-annual-inflation-rate-edges-down-38-september-2023-10-17/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 16 – 20 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The dollar index was moving with low levels of volatility at the start of the wheel but soon showed higher levels, especially after the 18th Oct. The USD showed strength, thus moving to the upside and over the 30-period MA until it found resistance. On the 19th it moved to the downside returning back to the mean. After the announcement of the low Unemployment Claims figures it showed some retarcement to the upside and continued with the sideways path.

EURUSD

The EURUSD found support at near 1.05255. It moved to the upside overall and over the 30-period MA. After the 19th Oct a triangle formation was recorded but the price made a false breakout upwards. Now resistance seems to be the level 1.06150 while the support is near 1.059. The USD seems to have had a moderate impact on the pair’s path last week. However recently we see the dollar losing strength while the pair moves upwards.

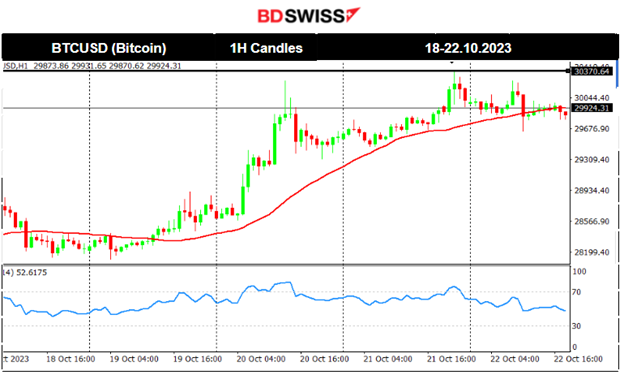

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin continued to the upside leaving the level of 28K USD and going back over the 30K USD after breaking 29800. It even reached levels near 30370 before reversing back to the mean. It is not clear if this upward trend will remain. As people ditch stocks as they are considered risky at the moment due to geopolitical tensions, and funds move to other assets we see some gains for those assets, such as metals and crypto instead.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

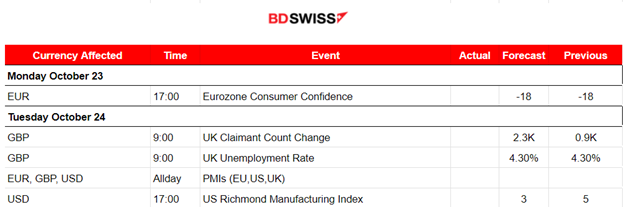

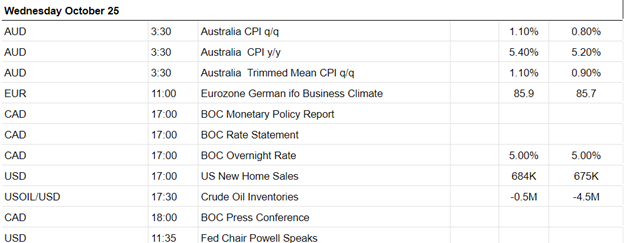

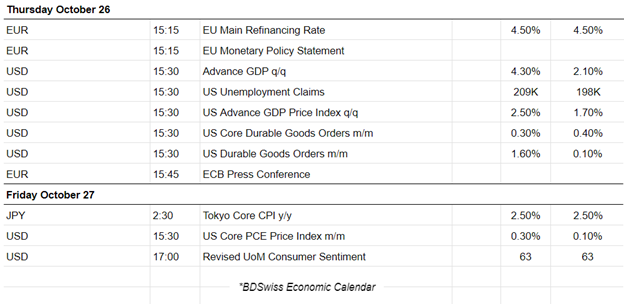

NEXT WEEK’S EVENTS (Week 23 – 27 Oct 2023)

This week we have PMI releases for both the Manufacturing and services sector.

Some Inflation reports for Australia and Tokyo.

Long-waited rate decisions from BOC and ECB.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

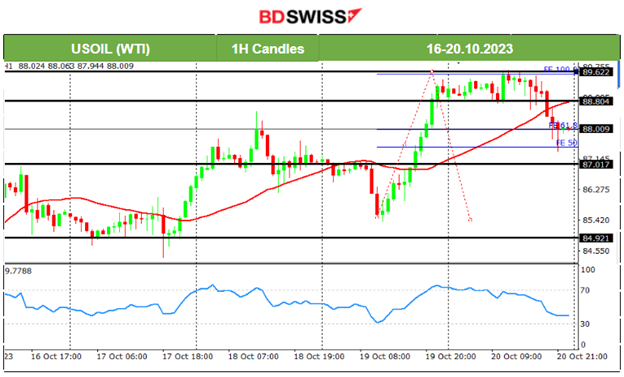

U.S. Crude Oil

After a period of retracement back at 84.5 USD/b, Crude finally moved higher breaking the channel that was formed. On the 17th of Oct., it crossed the 30-period MA on its way up and moved higher, reaching the next peak for the week at nearly 88.5 USD before retracing again to the mean. Volatility seems high. On the 19th of Oct., its price moved rapidly to the upside reversing significantly and crossing the MA on its way up reaching the next resistance at 89.4 USD/b. It eventually retraced to 88 USD/b as per the forecast in the previous report.

Gold (XAUUSD)

The price was moving to the upside rapidly reaching the next resistance at nearly 1960 USD/oz by the 18th of Oct. That resistance broke and Gold moved further upward reaching 1980 USD/oz. On Friday, it continued with the upside movement until it reached near the important psychological resistance level at 2000 USD/oz before retracing. It is quite remarkable that fundamentals are pushing Gold to higher and higher levels. While tensions and warfare still exist, market participants are buying more safe haven metals, ditching risky assets such as stocks.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 17th of Oct., the index eventually dropped heavily until the support at 14940 USD before a remarkable full retracement that took place soon after. It showed amazing volatility with big deviations from the mean. Eventually, we see that the downside prevails as the stock market is currently suffering losses. All benchmark indices follow the same path to the downside. NAS100 crashed when it broke significant support levels yesterday such as the 14945 USD and moved lower even to 14825. After Powell’s speech last week, the market crashed again. It dropped near the support 14700 and after breaking that support it dropped rapidly to the downside. While risky assets such as stocks are not preferred currently, metals gain instead.

______________________________________________________________