PREVIOUS TRADING DAY EVENTS – 05 May 2023

Announcements:

“Inflation could turn out to be more persistent if productivity growth remains weak, the high inflation environment leads to firms expanding margins as their costs ease, there is greater feedback between higher prices and wages than expected, or if rents increase by more than expected,” said the RBA in the 79-page report.

The RBA expects core inflation to drop to around 4.0% by the end of this year, from the current 6.6% pace.

“The longer inflation remains above target, the greater the risk that inflation expectations rise and price- and wage-setting behaviour might adjust accordingly,” said the RBA.

Swiss headline inflation has remained above the central bank’s target range since February 2022. However, it is much lower than those of other countries, many of which have seen double-digit inflation. The SNB has hiked interest rates at four consecutive policy meetings, bringing its benchmark to 1.5% in March. Recent policymakers’ statements suggest that they are not finished with hikes.

Source: https://www.reuters.com/article/swiss-inflation-idUSL8N37121P

It seems that rate hikes are failing to cool down the labour market. It has experienced its longest run of monthly job gains since 2017. It shows a high level of endurance in the face of high borrowing costs.

“The key point is that there is no evidence that the labour market is softening at all, lending important support for the broader economy,” Douglas Porter, chief economist at the Bank of Montreal, said in a report to investors. “If this persists through the spring, the Bank of Canada may yet be forced to rethink its rate pause.”

“We’re now over a year into the Bank of Canada’s rate hike cycle,” Brendon Bernard, an economist at Indeed Canada, said on BNN Bloomberg Television. “Overall, big picture, the rate hikes aren’t really showing up in these jobs numbers.”

The data show that employment continued to trend up with hiring and workers’ pay accelerated in April. While fears of a recession were growing with high interest rates, inflation and tightening credit conditions, the data surprisingly showed signs of labour-market resilience.

U.S. Stocks moved higher and Metals lower while Oil was not affected much.

“The labor market remains extremely tight,” said Diane Swonk, chief economist at KPMG LLP. “The Fed left the door open to additional rate hikes for a reason. This data is not as reassuring on a pause as we would like.”

“April’s surprisingly robust jobs print shows that banking-sector strains since the collapse of Silicon Valley Bank haven’t yet affected the labor market… That said, it takes time for tighter credit conditions to flow through to the real economy, something the central bank will take into account,” said Anna Wong, Stuart Paul and Eliza Winger, economists.

______________________________________________________________________

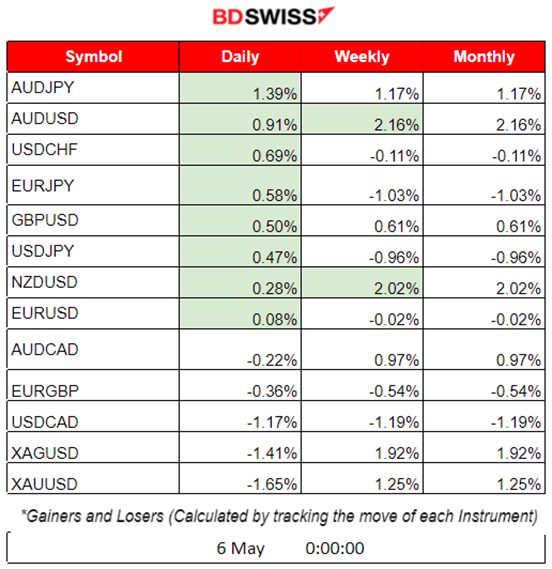

Summary Daily Moves – Winners vs Losers (05 May 2023)

______________________________________________________________________

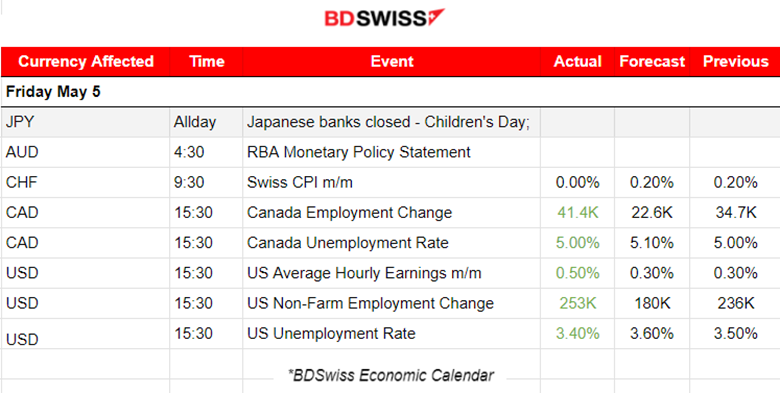

News Reports Monitor – Previous Trading Day (05 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

The RBA (Reserve Bank of Australia) released its monetary policy statement. The market has already reacted heavily last time with the rate figure release. No major impact this time.

- Morning – Day Session (European)

CHF pairs experienced a shock during the release of the CPI figure at 9:30. CHF depreciated.

The most important news of the month is the NFP, at 15:30, caused the USD to appreciate with the strong labour figures. Low unemployment rate and a way-more- than-expected employment change created intraday shocks. USDJPY jumped, XAUUSD dropped and U.S. Stocks gained eventually by the end of the trading day.

Canada Labour data caused a similar impact in the markets as they were also strong. High volatility with CAD pairs to move in one direction after breaking important levels. The USDCAD experienced a short shock at the time of the release but not moving in one direction since both CAD and USD were gaining demand, competing with each other. However, CAD won, eventually bringing the pair down by more than 100 pips.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

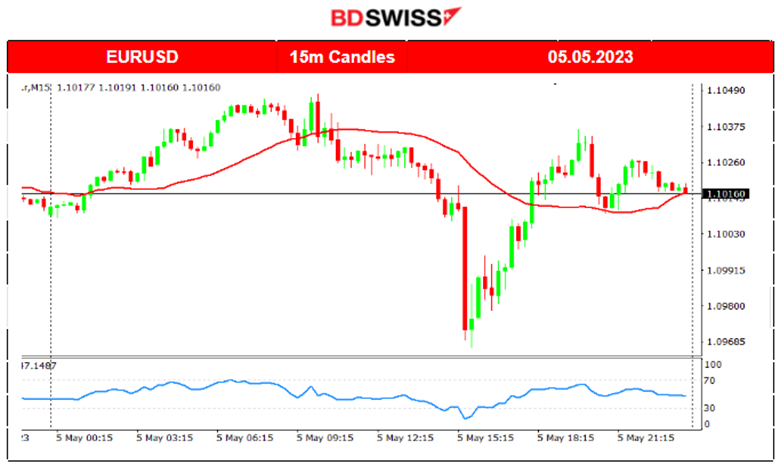

EURUSD (05.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The NFP data was released at 15:30 and caused the appreciation of the USD, forcing the pair to experience an intraday shock while moving downwards rapidly. At the time of the release, USD appreciated greatly against the EUR and when it found essential support, it later depreciated causing a full retracement of EURUSD, back to the mean.

USDCAD (05.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USDCAD was experiencing a downward trend since the beginning of the trading day. While volatility was low, it grew after the release of the Labour news for Canada and the U.S. However, the data were strong for both currencies and the pair did not experience a huge deviation from the mean in one direction at the time of the release since both currencies were competing with each other in appreciation. The pair eventually moved steadily downwards as the CAD gained against the USD until the end of the trading day without any retracement taking place.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

During the figure releases that took place on the 2nd and 3rd of May, we see that the index experienced a dive during both events. Fears of a U.S. recession were growing fast, affecting investors’ decisions and switching to a risk-off mood. Rate Hikes have been slowing down the Labour market, however, the Fed stated that a pause will follow. NFP data released on the 5th of May, showing a high employment change figure, with future expectations changed. The USD gained and U.S. Stocks were pushed upwards. This was in line with our expectations mentioned in the previous report, that there was a bullish divergence formed.

Price: Lower Lows, RSI: Higher Lows (Bullish Divergence). A Jump eventually resulted.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

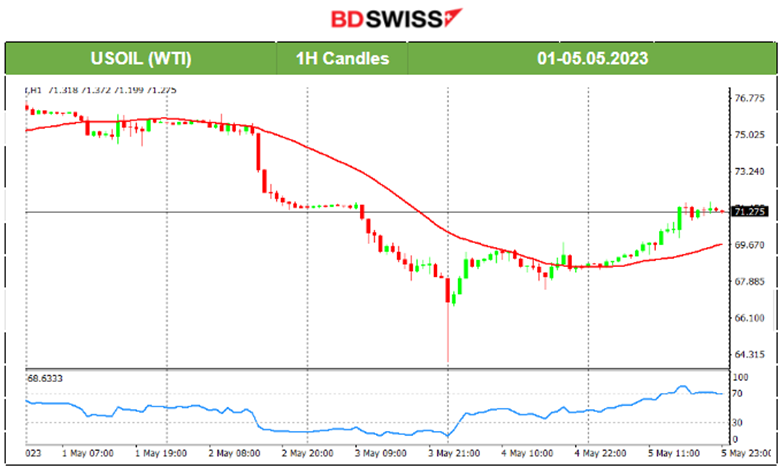

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude Oil was moving downwards. The last report regarding Crude Inventory Data showed a decline of 1.3M barrels reported on the 3rd of May but it was a lower decline than the previous 1.5M. The USD depreciation and the pessimistic expectation of future business activity have affected demand. Since the 4th of May, it started to show signs of reversal. On the 5th of May, it was moving above the 30-period MA and the NFP data seemed to not have a major impact on its price.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Since the 2nd of May, Gold has been moving higher because the USD fire releases were causing depreciation and also because investors’ preferences shifted to safer assets such as metals. On the 5th of May, Gold moved lower and under the 30-period MA ending the upward trend with the release of the NFP data. Labour data were strong causing the USD to appreciate heavily and Gold denominated in USD to lose ground. U.S. Stocks gained but Metals lost on this one.

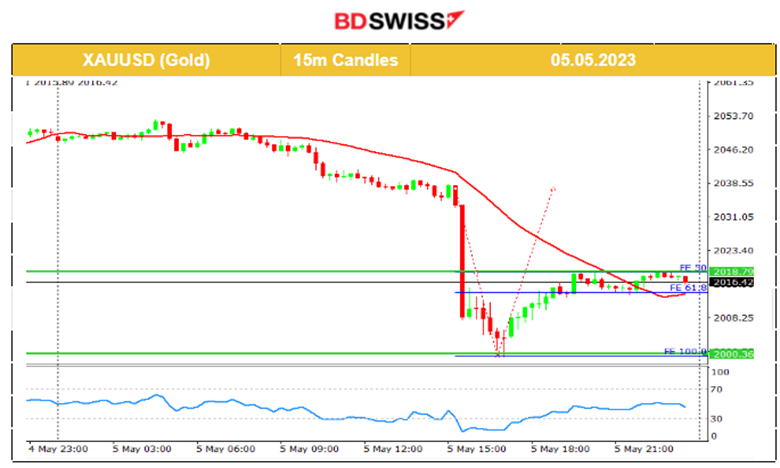

XAUUSD (Gold) 05.05.2023 Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Low volatility until the release of NFP at 15:30. XAUUSD experienced a sharp drop with the USD appreciation. It eventually settled at the support level of 2000 USD and then it retraced back to the 30-period MA after the shock ended. The Fibonacci expansion tool shows that retracement took place even beyond the 61.8% level, to 50%, half of the move downwards.

______________________________________________________________

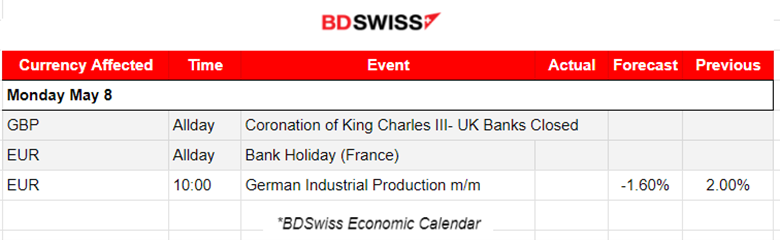

News Reports Monitor – Today Trading Day (08 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

U.K. banks will be closed in observance of the coronation of King Charles III. The coronation of Charles III and his wife, Camilla, as king and queen of the United Kingdom and the other Commonwealth realms is to take place on 6 May 2023, however, the Economic Calendar shows us that Banks will take a holiday on 8th May. Low liquidity and irregular volatility for GBP pairs.

Now other important figure releases, so we do not expect intraday shocks.

General Verdict:

______________________________________________________________