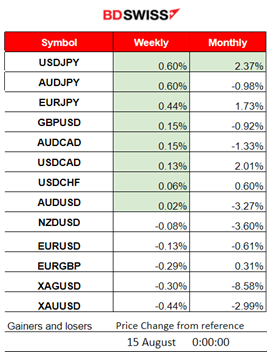

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (14 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or any special scheduled releases.

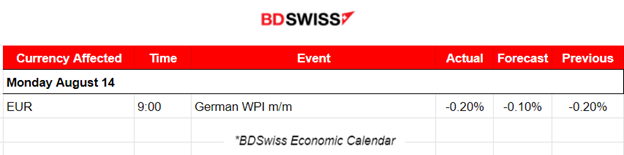

- Morning – Day Session (European and N.American Session)

No important news announcements or any special scheduled releases.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

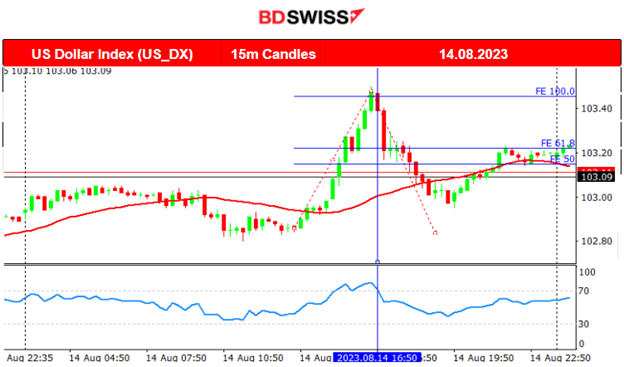

EURUSD (11.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD moved with low volatility on a sideways path during the Asian session and the early European session. After 14:00, it started to show more volatility and the USD experienced significant strengthening. The EURUSD started to fall rapidly until it found resistance near 1.08770 before retracing back to the 30-period MA and continuing sideways soon after.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 moved eventually above the 30-period MA indicating the end of the long downtrend that was observed recently. 14974 serves as an important support but the index is now above the MA and it will probably follow a sideways path until we have more important U.S.-related news announcements. Currently, the indices are suffering a pre-market drop which indicates high volatility. Will the index remain near its intra-day mean? Let’s see.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude shows signs of a slowdown. A retracement took place back to the mean early last week, finalising it on the 10th of August. Crude is probably on a sideways path which is actually quite volatile with no clear direction. The important support levels are depicted on the chart. They are near 81.22 USD/b. A triangle formation is apparent and since fundamentals play an important role in price direction (Saudi Arabia production cuts), the triangle breakout on the upside will probably cause it to jump to higher levels.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

As the USD is gaining strength, we see Gold moving lower and lower. A downtrend is apparent, the MA is obviously going down. It is again testing support levels, this time 1903 USD/oz which was the support tested yesterday.

______________________________________________________________

News Reports Monitor – Today Trading Day (15 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

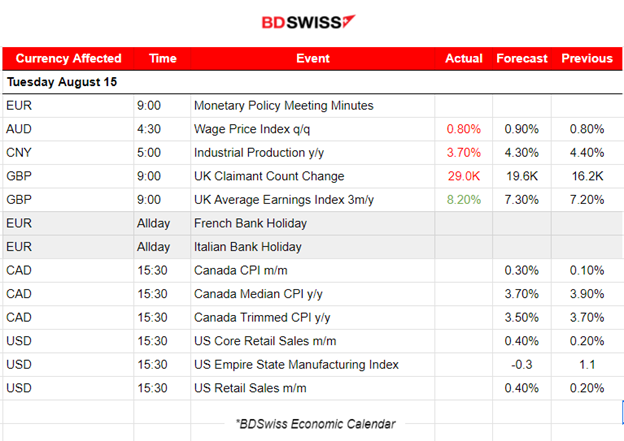

- Midnight – Night Session (Asian)

According to the Wage Price Index report for Australia at 4:30, Q2 Wage Price Index eases to 0.8% QoQ, which was less than expected, 3.6% YoY. AUD/USD dropped 25 pips before retracing back to the mean quickly.

At 5:00, annual Industrial production for China was reported lower than expected at 3.70%. No major impact was observed on FX pairs.

- Morning – Day Session (European and N.American Session)

The U.K. Unemployment benefits-related (Claimant Count) figures were reported lower than expected and had an impact on the GBP pairs, causing GBP appreciation. The Average Earnings were reported higher than expected. However, the shock was not great. GBPUSD moved up near 30 pips before retracing back to the mean. Important data are released for the U.K. this week, including key points that could be pivotal for determining how much the BOE will hike at its next meeting, such as CPI changes and Retail Sales figures.

Canada’s CPI data release will probably have a major impact on CAD pairs. An intraday shock is expected at that time. At 15:30, we might see way more volatility affecting the other major currencies as well.

At 15:30, we also have the release of the U.S. retail sales. USD pairs are probably going to be affected at that time with a shock as well, although we expect to be moderate.

General Verdict:

______________________________________________________________