PREVIOUS TRADING DAY EVENTS – 09 Oct 2023

- The Palestinian Islamist group Hamas launched a devastating attack, enabling a force using bulldozers, hang gliders and motorbikes to take on the Middle East’s most powerful army.

The worst breach in Israel’s defences since Arab armies waged war in 1973 was Saturday’s assault. While Israel was led to believe it was containing a war-weary Hamas by providing economic incentives to Gazan workers, the group’s fighters were being trained and drilled.

“Hamas used an unprecedented intelligence tactic to mislead Israel over the last months, by giving a public impression that it was not willing to go into a fight or confrontation with Israel while preparing for this massive operation,” a source said.

Israel concedes it was caught off guard by an attack timed to coincide with the Jewish Sabbath and a religious holiday. Hamas fighters stormed into Israeli towns, killing 700 Israelis and abducting dozens. Israel has killed more than 400 Palestinians in its retaliation on Gaza since then.

Oil prices rise following Hamas attack on Israel. The attack on Israel also boosted gold and the demand for more safe-haven assets.

Source:

______________________________________________________________________

Winners and Losers

This week NZDUSD has taken over leading with 0.69% so far. XAUUSD leads for the month with just a 0.47% price change.

News Reports Monitor – Previous Trading Day (09 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

No scheduled special figure releases.

Middle East stock markets fall on Israel-Gaza violence. This was the market’s sharpest fall in more than three years. Other stock markets beyond Israel also felt the shock waves. Commodities climbed to high levels because of the war.

General Verdict:

- Volatility for FX pairs was low yesterday.

- Gold and Oil reached new higher levels since the market reacted to the recent Israel-Hamas conflict.

- The U.S. Stock market rose in value. Indices climbed significantly breaking resistance levels.

- The dollar is stable for now, DXY moves sideways around the mean but leaning to the downside mostly.

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (09.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD started to move sideways and around the 30-period MA with very low volatility. Quite normal since there was an absence of significant scheduled releases affecting the EURO or the USD. The USD which is the main driver most of the days, was not affected much, only weakened slightly and that is why the pair climbed a bit as well. However, the overall result looks flat for the trading day.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Despite the highly volatile market conditions on Friday during the most important news for the month affecting the USD, the price of bitcoin did not deviate much from the MA. There was a drop at 15:30 but soon after, bitcoin’s price reversed. It continued to move sideways within a range and around the mean. Significant support now is at 27150 and the resistance level at 28200. Yesterday we observed a drop that started during the European session around 10:00. The USD was not the driver of the fall. It found support and remained in range, retracing back to the 30-period MA.

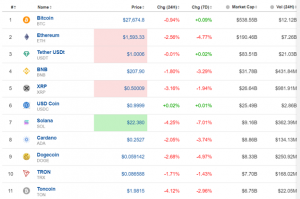

Crypto sorted by Highest Market Cap:

Yesterday, Monday 9th Oct, bitcoin experienced weakness as mentioned above and due to the fact that all crypto are correlated the same effect seems to have happened to the others. The 24-hour column is indeed red.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the NFP release the NAS100 index moved to the downside but soon reversed and got out of the range with a breakout to the upside instead reaching to near 15000. All benchmark indices experienced similar paths. Later the U.S. stock market picked up momentum and caused the indices to move to higher levels. The Israel-Hamas conflict has affected the markets greatly and the NAS100 is now on an uptrend.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude oil jumped on the 9th Oct due to the events happening in Israel. The Hamas-Israel conflict erupted into a war affecting oil prices. It is currently in consolidation and if the resistance is broken it is expected to move into higher levels. We are talking about the upside because Crude oil’s price has been falling for quite a long period of time recently and rapidly as demand eased. Currently, there are signs of retracement backed up by these sad events.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold broke the consolidation and moved rapidly to the upside. It is currently on a clear upward trend. RSI shows signs of the price slowing down, a bearish divergence. However, the fundamentals are currently at work. The Hamas-Israel conflict is pushing prices to new higher levels. Support levels must break in order for the price to drop and currently, there are not enough data to suggest a halt or even a drop.

______________________________________________________________

News Reports Monitor – Today Trading Day (10 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

No important news announcements, no scheduled special figure releases. We have several speeches this week from FOMC members that might cause more volatility than typical.

General Verdict:

- The absence of special releases keeps FX volatility at relatively low levels.

- Commodities are in consolidation at the moment after yesterday’s jump.

- The U.S. indices seemed to have gained momentum to the upside.

______________________________________________________________