Previous Trading Day’s Events (11 Dec 2023)

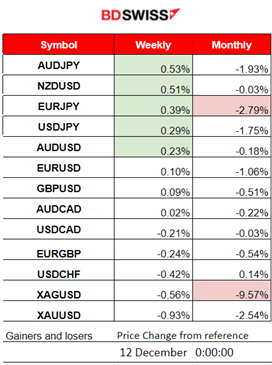

Winners vs Losers

The JPY pairs (JPY as quote) seem to have regained ground with AUDJPY reaching the top of the week’s winners’ list with 0.53% gains. Metals reached the bottom this month, especially silver.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (11 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

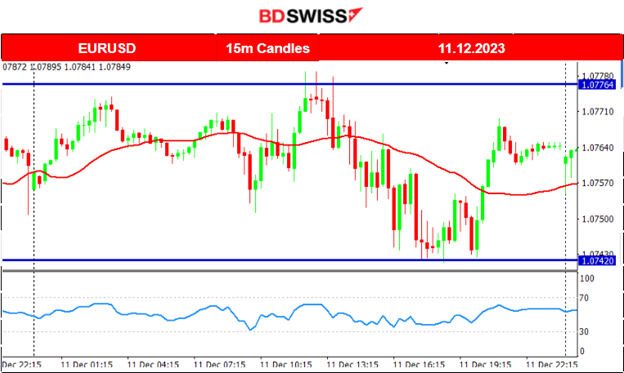

EURUSD (11.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair experienced low volatility in general since there was an absence of important scheduled releases. It moved on a sideways path around the 30-period MA overall, closing almost flat. During the European and N. American session, it experienced strong support and resistance levels that caused reversals keeping the price close to the mean and in range.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin fell significantly during the Asia session yesterday, falling under $41K wiping out significant performance during the past week. This was a sudden 6.5% drawdown from 43K USD to as low as near 40K USD in a span of 20 minutes. It seems that technicals and posts from analysts caused the recent downturn. After a quick retracement, it dropped again, testing the 40300 USD level once more before finally retracing to the 30-period MA and the 61.8 Fibo level. Price currently settled near 42K USD.

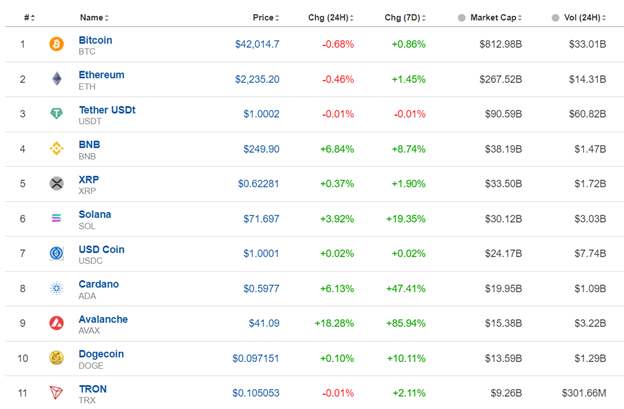

Crypto sorted by Highest Market Cap:

All cryptos suffered losses recently the same way as Bitcoin, however they also experienced a correction the last 24 hours. Avalanche now records near 86% gains for the last 7 days.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

In general, all benchmark indices were recently in a state of consolidation that from yesterday seems to not hold anymore. The market eventually broke the consolidation by moving further upwards. The index broke the 16000 USD resistance level and moved further upward reaching the 16100 USD level. Yesterday the market showed that this consolidation breakout was strong enough to cause the index to continue the uptrend forming a channel as depicted on the chart with red lines.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil finally reversed last week after testing the support near 69 USD/b. It eventually retraced back to the 61.8 Fibo level and settled at near 71 USD/b. Later it eventually kept moving steadily upwards reaching eventually the 72 USD/b level. An upward wedge was formed that eventually broke yesterday causing the price to drop until the support at 70.5 before the price eventually reversed continuing with the path to the upside again. Now we see another triangle formation as volatility levels are lowering.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

When the NFP report was released last week, Gold’s price dropped heavily near 30 USD, reaching 1995 USD/oz. Yesterday it continued with another drop reaching to the next support at near 1975 USD/oz before retracing to the 30-period MA. Since the price touched the mean of the MA there is no apparent signal that further retracement will take place. The RSI was showing higher lows and a bullish divergence was suggested that eventually took place as it seems. Looking at the 4H chart, the MA is currently high enough suggesting that Gold could see more upside movement if no further support is broken.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (12 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

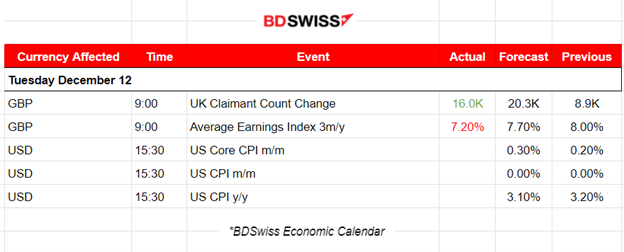

- Morning–Day Session (European and N. American Session)

U.K. Claimant Count change was reported lower than expected, 16K. The estimated number of vacancies in the UK fell by 45K in the quarter, falling for the 17th consecutive period, the longest consecutive run of quarterly falls ever recorded but still above pre-coronavirus (COVID-19) pandemic levels.

Annual growth in regular pay (excluding bonuses) in the U.K. was 7.3% from August to October 2023. Annual growth in employees’ average total pay (including bonuses) was 7.2%. The market reacted with a moderate shock that caused the GBP to depreciate initially but the effect soon faded. At around 9:30, the GBP started to show depreciation again causing the GBPUSD to drop more than 30 pips so far.

General Verdict:

______________________________________________________________