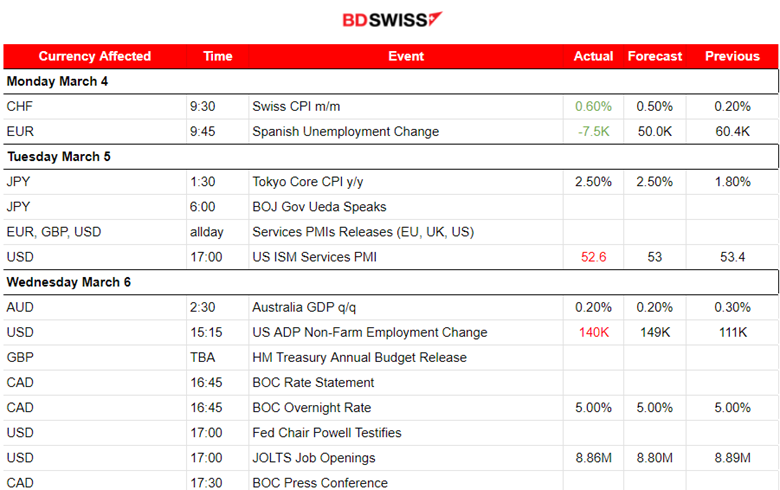

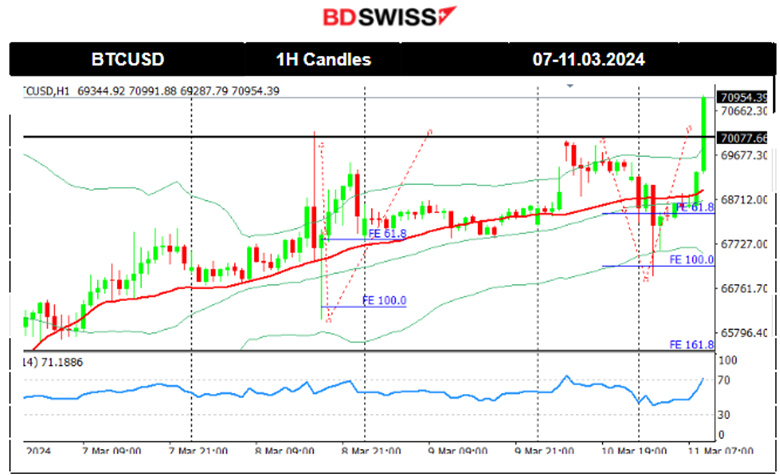

PREVIOUS WEEK’S EVENTS (Week 04 – 08.03.2024)

Announcements:

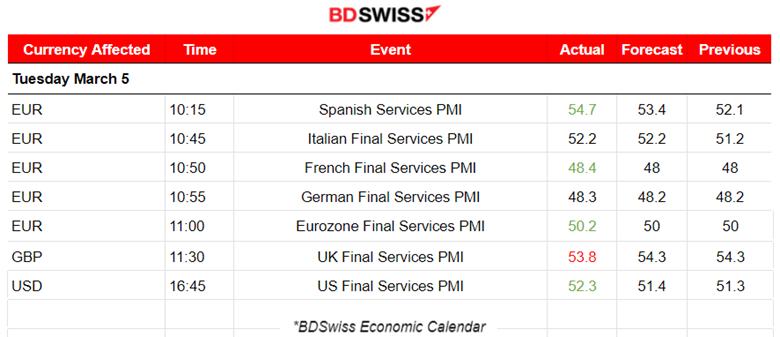

Crypto

Bitcoin continued with the uptrend beating 68K USD last week. Today it reached over 72K USD.

The Financial Conduct Authority said in a notice that it would not object to requests from recognized investment exchanges to create a U.K.-listed market segment for crypto-backed exchange-traded notes, or ETNs.

The London Stock Exchange acknowledged the FCA’s announcement, saying that it would accept applications for the admission of Bitcoin and Ether ETNs from the second quarter of this year.

U.S. Economy

According to the ISM report last week, the U.S. services industry grew but slower in February. The ISM said its non-manufacturing PMI slipped to 52.6 last month from 53.4 in January amid a decline in employment. The PMI figure, however, was consistent with continued economic expansion.

There were also no signs that inflation was picking up after a jump in prices at the start of the year, welcome news for Federal Reserve officials. Though financial markets expect the U.S. central bank to start cutting interest rates this year, the timing is uncertain because inflation remains high, with most of the price pressures coming from services.

U.S. job openings fell marginally in January according to the JOLTS report, while the number of workers quitting their jobs dropped to a three-year low, indicating that labour market conditions were gradually easing.

Powell said policymakers expected “inflation to come down, the economy to keep growing,” but shied away from committing to any timetable for interest rate cuts.

A separate report from the Fed said “labour market tightness eased further,” in February, but noted that “difficulties persisted attracting workers for highly skilled positions.

Fed’s Chair Jerome Powell

We’re waiting to become more confident that inflation is moving sustainably at 2%,” Powell said while answering questions from the Senate Banking Committee last week. “When we do get that confidence — and we’re not far from it — it’ll be appropriate to begin to dial back the level of restriction.”

Powell repeated his testimony of the previous day: that it would likely be appropriate to cut interest rates “at some point this year,” but made clear officials are not ready yet. Policymakers need more evidence that inflation is heading sustainably to the central bank’s 2% goal before acting, he said.

The U.S. dollar has been weakening against a basket of currencies quite significantly.

______________________________________________________________________

Interest Rates

BOC

The Bank of Canada (BoC) kept its key overnight rate steady at 5% as expected saying underlying inflation is still high and no cuts are considered yet, causing the CAD to appreciate significantly at the time of the news release.

Overall inflation stands at 2.9%, still well above the bank’s 2% target. Shortly after the rate announcement, data showed that Canadian money markets saw a 23% chance of a rate cut in April, down from 43%.

ECB

The European Central Bank (ECB) kept borrowing costs at record highs with the decision to hold all three key rates steady, saying it had made good progress in bringing down inflation and that cuts could take place this year.

New forecasts are pointing to lower inflation and growth. ECB policymakers are preparing for a first cut in interest rates, probably in June, provided incoming data, especially on wages, confirms the trend.

“We did not discuss cuts for this meeting, but we are just beginning to discuss the dialling back of our restrictive stance,” ECB President Christine Lagarde told a press conference.

______________________________________________________________________

Sources:

https://www.cnbc.com/2024/03/11/bitcoin-btc-tops-71000-as-uk-fca-opens-door-to-crypto-etns.html

https://www.reuters.com/world/europe/ecb-hold-rates-take-baby-steps-towards-first-cut-2024-03-06/

https://www.reuters.com/markets/us/us-services-sector-cools-february-ism-survey-shows-2024-03-05/

https://www.reuters.com/markets/bank-canada-keeps-rates-hold-says-too-early-consider-cut-2024-03-06/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 04 – 08.03.2024)

Server Time / Timezone EEST (UTC+02:00)

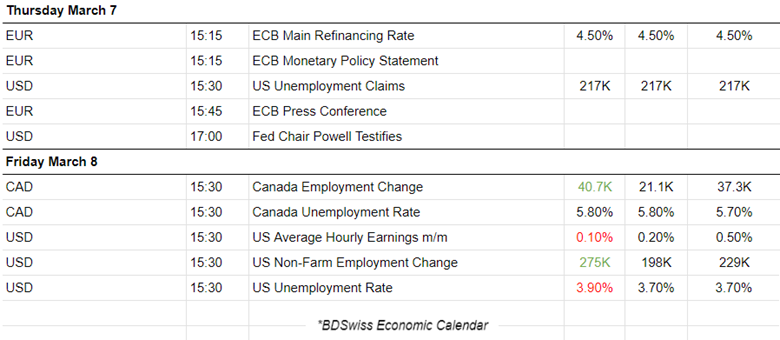

Services PMI Releases:

Eurozone PMIs:

In Spain, the services sector is expanding as it recorded a positive performance in February with a good PMI figure of 54.7 points. Both activity and new business are rising at their best rates since May 2023. Expectations for the future are improved. Firms took on additional staff at a solid pace.

In February, the Italian service sector showed sustainable growth with a PMI reported at 52.2 points. New business, increase in new work and rising activity. Improvement in demand conditions with new job creation.

The French PMI was reported in contraction but at least showed improvement. The service sector downturn cools with demand getting back on track. New export sales expanded for the first time since last May. More optimism towards the outlook for business activity, with growth expectations reaching a seven-month high.

Germany is suffering as services business activity remains under pressure. Reporting services PMI in contraction at 48.3 points. However, firms’ expectations for activity over the year ahead improved to the highest since last April resulting in job creation growth. Notable to say that rates of increase in input costs and output prices reached the highest for ten and six months respectively.

U.K PMI:

In the U.K. the service sector output growth was maintained in February. Reporting PMI at 53.8 in expansion. A sustained increase in business activity in February, supported by stronger new order growth and aided by another modest rise in employment.

U.S. PMIs:

Sustained expansion in February for the U.S. services sector with a recorded PMI figure at 52.3, an improvement from the previous period. Output rose for a thirteenth successive month. New business inflows have now risen for four straight months.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar index moved downwards at a steady pace. That is quite remarkable when we take into account that the Fed is actually not sure if inflation is lowering and thus towards the target 2% level. They state that they need more evidence of that. Despite this, the market decided to unload U.S. dollars and invest in other alternative assets. We saw a surprising Gold strengthening and U.S. Stock demand last week. The NFP showed higher employment, beating expectations but also higher unemployment rate. This mixed data puzzled the market causing a U.S. dollar weakening slowdown.

EURUSD

EURUSD

The pair moved to the upside significantly last week but experienced a quite volatile path along the way. Despite the obvious dollar weakening driving the pair to higher levels, the EUR has been also experiencing some strength as the market responded with occasional appreciation due to the fact that the ECB did not clearly state that cuts will indeed take place soon. The ECB kept the interest rates steady on the 7th March and that caused moderate EUR weakening. However, expectations changed soon after and with the dollar experiencing significant weakening the EURUSD jumped above the 30-period MA and remained high. This may change soon. The Eurozone clearly sees inflation retreat while the U.S. does not. In addition, the Eurozone economy suffers from the worst PMIs, especially in Germany. We could see significant EUR depreciation soon and further Fed cut delays could bring down the EURUSD.

USDCAD

USDCAD

The pair experienced a drop on the 6th of March when the BOC decided to announce that they would keep interest rates steady. The U.S. dollar had already started to weaken against other currencies and the CAD experienced strength during that time. As the dollar weakened further during the rest of the week, the pair moved further downwards until when the employment data releases for the U.S. and Canada took place on the 8th of March. The strong NFP data caused more uncertainty about the U.S. dollar keeping it strong while the CAD depreciated moderately causing an overall retracement of the USDCAD to the upside.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin continues with the uptrend. Just passed the 70K resistance aggressively and jumped further breaking all-time highs without any indication of a significant resistance at the moment. Technically it could rapidly increase by 4K before any notable retracement takes place.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

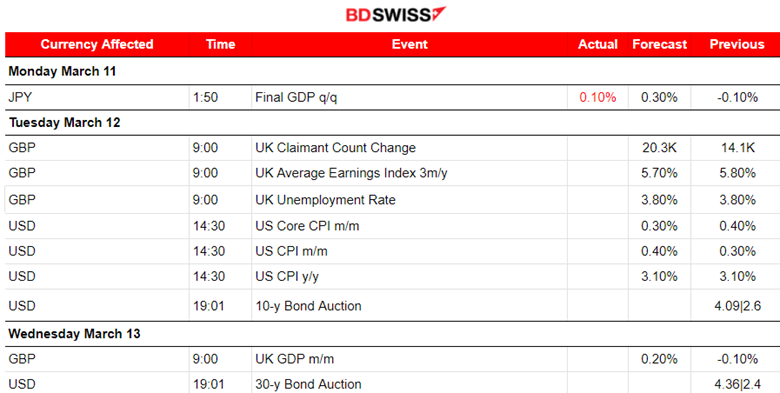

NEXT WEEK’S EVENTS (11 – 15.03.2024)

Coming up:

U.K.’s labour data release includes the Average Earnings, Claimant Count and Unemployment rate figures.

U.S. inflation rate monthly plus annual figures will probably shake the markets.

U.S. PPI figures are expected to be reported at the same time as the retail sales reports figures. These are expected to be reported higher and could affect the dollar positively at that time significantly if the PPI figures also show an unexpected increase.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 6th of March, a surprise increase in the price took place causing a breakout of the depicted channel with the price reaching the resistance at near 80 USD/b before retracing and back to the 30-period MA. On the 7th of March, the price was on a quite volatile path but closed the trading day higher. Crude oil fell rapidly from the 8th March peak of 79.5 to 76.85 USD/b. Considering that deviations from means are roughly 10 USD currently the retracement about that amount to the 61.8 Fibo level is quite probable. Now, the fundamentals: Demand from China looks to be lagging causing the dive, however, supplies have remained on the tighter side given OPEC’s production cuts and Russian sanctions slowing exports causing price resilience excluding the probabilities of sharp drops, keeping price in balance.

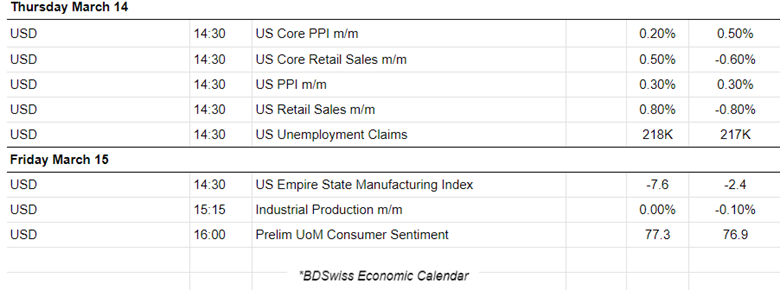

Gold (XAUUSD)

Gold (XAUUSD)

On the 6th of March, support remained strong and the dollar depreciation pushed Gold to higher and higher levels reaching over 2,150 USD/oz. On the 7th of March, the RSI continued with lower highs but the USD weakening kept Gold stable and leaning more to the upside instead. On the 8th of March, Gold climbed further aggressively upon the NFP release and after it found resistance it retraced to the 61.8 Fibo Level. Currently, it is quite uncertain if the price will see a strong reversal.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 7th of March, the market moved to the upside as future borrowing costs could lower significantly and as Powell reassures that cuts will take place as long as the economy continues to show resilience and progress in regards to inflation. The dollar weakened significantly while stocks gained. The index jumped out of the triangle formation reaching the resistance near 18,350 USD before retracing to the 61.8 Fibo. As predicted in our previous analysis, the index moved higher before the NFP report release and soon later after the exchange opening it fell rapidly and heavily to the support near 17,980 USD. Retracement is possible to follow, back to the 30-period MA and 61.8 Fibo level if support is kept strong.

______________________________________________________________