Previous Trading Day’s Events (05 Feb 2024)

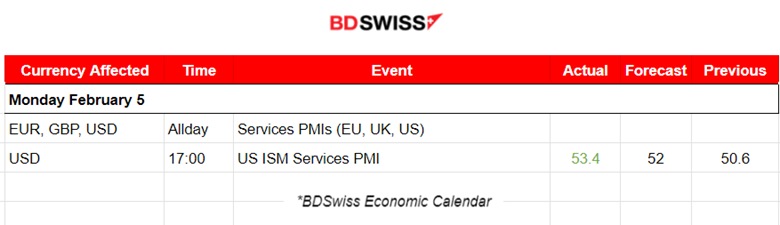

The services PMI increased to 53.4 last month from 50.5 in December. A reading above 50 indicates growth in the services industry, which accounts for more than two-thirds of the economy.

The report suggests that economic growth momentum from the fourth quarter continues, reassuring that cuts in March will not take place. The Federal Reserve left interest rates unchanged last week, but Chair Jerome Powell told reporters that rates had peaked.

Services: https://www.reuters.com/markets/us/us-service-sector-growth-picks-up-january-ism-survey-2024-02-05/

______________________________________________________________________

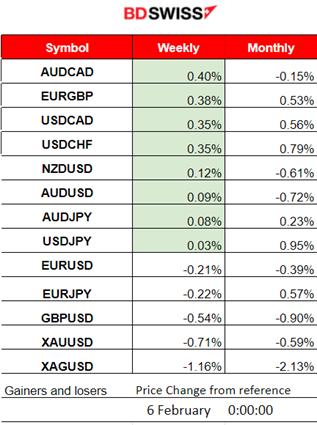

Winners vs Losers

AUDCAD leads with 0.4% gains this week while the USDJPY is leading for the month with near 1% gains already, as the USD gains more strength after the NFP news.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (05 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

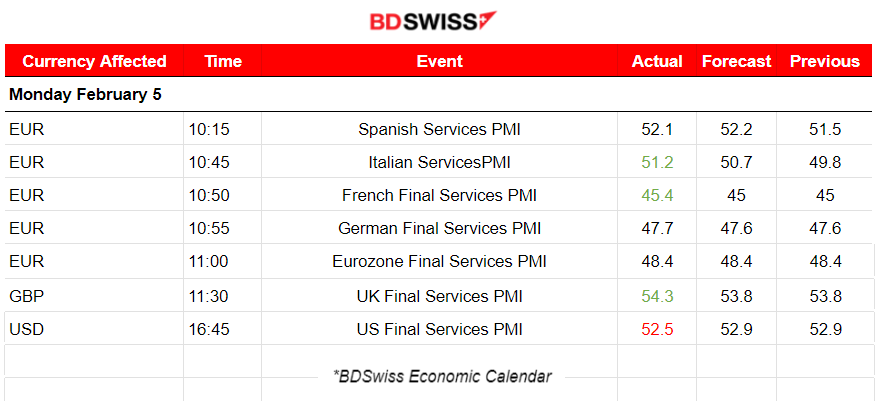

Services PMIs Releases:

Eurozone PMIs:

Spanish services remain in expansion, with a PMI figure of 52.1. The growth of the Spanish service sector improved during January amid better market conditions and higher sales. Job growth picked up, accelerating to its best level since May 2023.

In Italy, the PMI shows a turn to the expansion area as it was reported above the 50 threshold, 51.2 from the previous 49.8 points. A sign of recovery across the Italian service sector economy. It experienced improved overall demand conditions and a rise in workforce numbers in January, the third increase in successive months.

The French services sector saw more contraction instead. The downturn extended into January, marking its longest period of contraction in over a decade. Businesses faced generally subdued demand conditions, lower activity and no new business opportunities. However, business confidence ticked up.

The German service sector business activity also contracted for the fourth consecutive month in January. The sector faces an ongoing weakness in demand. Firms improved expectations for activity in the coming year though having a positive impact on labour.

The Eurozone downturn continues, however, at a slower pace. PMI remains at 48.4 points. Contractions in business activity and new orders softened, while growth expectations strengthened to a nine-month high.

United Kingdom PMIs:

The U.K. sees the strongest service sector performance since May 2023. A significant increase in business activity extended the current period of expansion to three months. Higher levels of output, rise in new orders and improved confidence among clients due to strengthening economic conditions and expected interest rate cuts.

United States PMI:

The U.S. business activity continues to grow aggressively. The services PMI reported in the expansion area once more, at 52.5 points. The U.S. services business activity expanded at the fastest pace since June 2023. A quicker rise in new orders, improved demand conditions and an increase in export orders.

U.S. ISM Services PMI is showing expansion at its fastest pace in four months.

General Verdict:

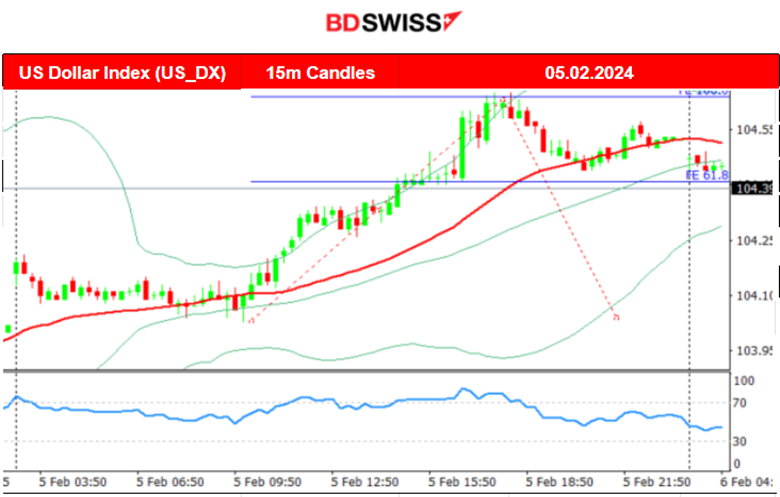

- Monday mood, Services PMIs moved the markets a bit but it was the dollar that was affected mostly with appreciation. The dollar index closed higher overall after a steady movement to the upside.

- Gold continued with a drop since the USD strengthened further.

- Crude oil closed flat after a volatile trading day.

- Slight increase in U.S. Indices from yesterday’s quite volatile activity overall.

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (05.02.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Sideways movement with low volatility during the Asian session for the pair. The price remained below the resistance at near 1.07860 and at the start of the European session, the EURUSD started to drop steadily as the USD was appreciating significantly during the trading day. Retracement followed when the pair touched the support at near 1.07230, returning back to the 30-period MA and closing lower.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H Timeframe

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Bitcoin faced a shock during the NFP report release on Friday but closed near flat for the trading day. Volatility levels lowered after that event and a triangle was formed during the weekend. On Sunday, 4th Feb, the price broke the triangle to the downside reaching the support at 42,200 USD. It soon reversed after that, crossing the 30-period MA on its way to the upside and settling near 43,000 USD. On the 5th Feb, it quickly climbed to find the resistance at near 43,500 USD before reversing again quite rapidly and crossing the 30-period MA on its way back, closing the day lower at the support near 42,250 USD. Currently, it experienced another reverse to the upside this time returning back and settling to the level 43,000 USD once more.

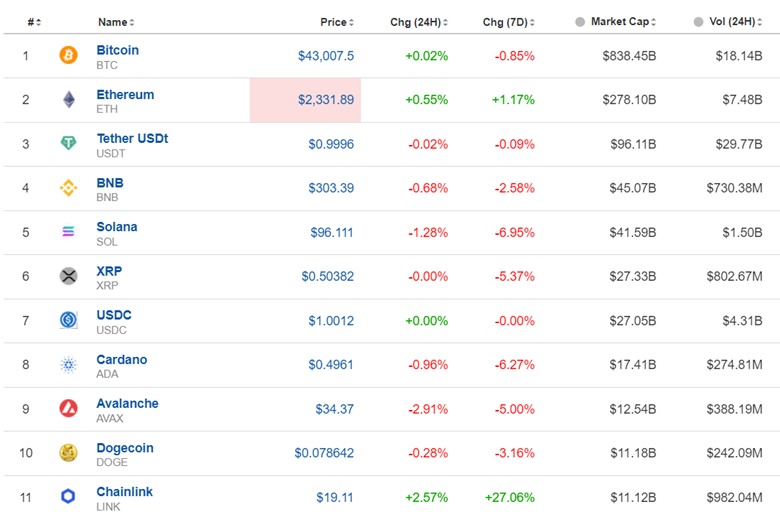

Crypto sorted by Highest Market Cap:

Cryptos experience more volatility after a long period of consolidation but the path remains sideways. Taking into account only a 7-day period, the market faces losses for now, however, it remains stable generally and no major movement has been recorded yet.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

On the 2nd Feb, the NFP news at 15:30 caused an intraday shock that brought the U.S. indices down to lower levels for some time. NAS100 reached support near 17,400 USD before a huge reversal took place. The index reversed, crossing the 30-period MA on the way up and reached the resistance higher at near 17,700 USD before retracing. The RSI was signalling a bearish divergence, as mentioned in our previous analysis, and on the 5th Feb, the index eventually dropped heavily to the next support at near 17,500 USD before reversing back to the mean.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude’s price reversed from the downtrend following the RSI’s signals of bullish divergence, as mentioned in the previous analysis. After it reached 74.5 USD/b on the 5th feb, it reversed to the upside, crossing the 30-period MA on the way up and finding resistance at near 73.2 USD/b before retracing.

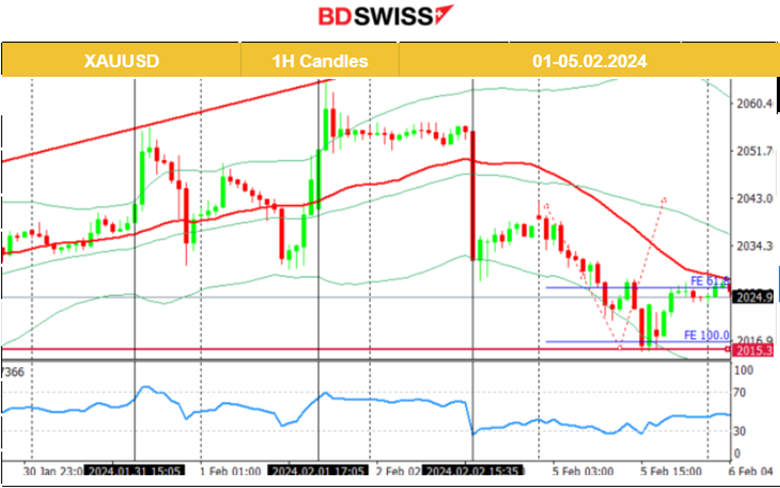

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The market shook on the 2nd Feb, at the release of the NFP news. Gold dropped heavily around 28 USD, found support and soon after it retraced to the 61.8 Fibo level. Obviously, the drop was attributed to USD strengthening and the effect could possibly continue for longer. Gold, on the 5th Feb, broke the 2030 USD/oz support moving lower, reaching the support near 2015 USD/oz. Retracement followed and the price returned back to the 61.8 Fibo, settling at near 2025 USD/oz.

______________________________________________________________

______________________________________________________________

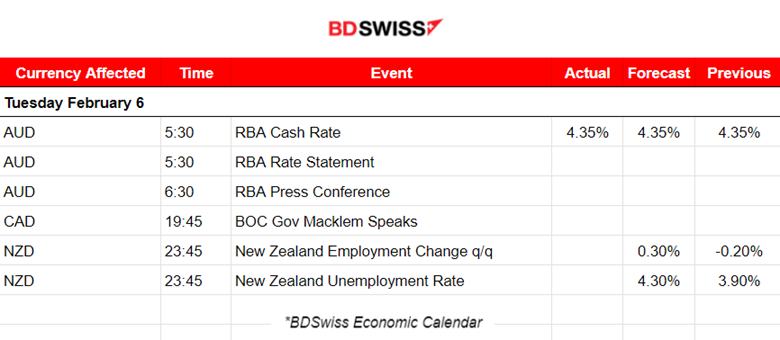

News Reports Monitor – Today Trading Day (06 Feb 2024)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

RBA decided to leave the cash rate target unchanged at 4.35%. The Board stated that inflation continued to ease in the December quarter. Despite this progress, inflation remains high at 4.1%. The market reacted with a low-impact intraday shock that caused some AUD appreciation. The AUDUSD only jumped around 20 pips at that time.

Employment data for New Zealand will be released at 23:45 and are expected to increase volatility. The market expects that employment change or the last quarter is to be released higher, however, the same expectation applies to the unemployment rate. An intraday shock is possible, affecting the NZD pairs highly during that time. Usually, retracements are difficult to complete during that time due to low activity after the news.

General Verdict:

______________________________________________________________