PREVIOUS TRADING DAY EVENTS – 06 July 2023

Despite the Fed’s fastest monetary policy tightening campaign in more than 40 years, the labour market is showing remarkable resilience.

Initial jobless claims were reported high again, almost as expected. 248K Americans filed for first-time unemployment claims last week. These are significantly lower numbers than the ones reported in the middle of June showing 260K. These recent data suggest lower and lower numbers in claims adding to the evidence for labour market strengthening.

Source: https://www.reuters.com/markets/us/us-private-payrolls-beat-expectations-june-adp-2023-07-06/

“Demand for new hires remains elevated and employers are still holding onto the workers they have,” said Nick Bunker, research director at Indeed Hiring Lab. “The data continue to make a soft-landing scenario increasingly likely.”

“An anticipated rise in layoffs on more restrictive monetary policy is not yet appearing in the data,” said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York. “A tight labour market will keep the rate path on an upward trajectory until policymakers see a material rebalancing in supply and demand.”

According to a Reuters survey of economists, nonfarm payrolls likely increased by 225,000 jobs last month after rising 339,000 in May. The unemployment rate is forecast to slip to 3.6% from 3.7% in May.

The manufacturing sector PMIs reported a fall in business activity recently. ISM Manufacturing PMI remained stuck below the 50 threshold in June for the eighth straight month.

With the labour market still tight and inflation elevated, the U.S. central bank is expected to resume raising rates this month.

______________________________________________________________________

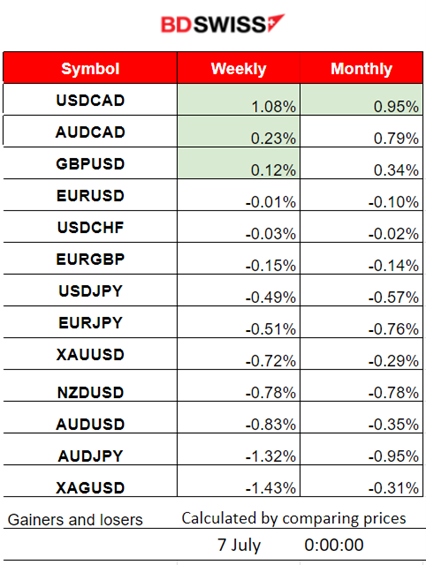

Summary Daily Moves – Winners vs Losers (06 July 2023)

- USDCAD has significantly moved on the upside this week reaching the top with 1.08%. It also remains on top this month with 0.95% gains so far.

______________________________________________________________________

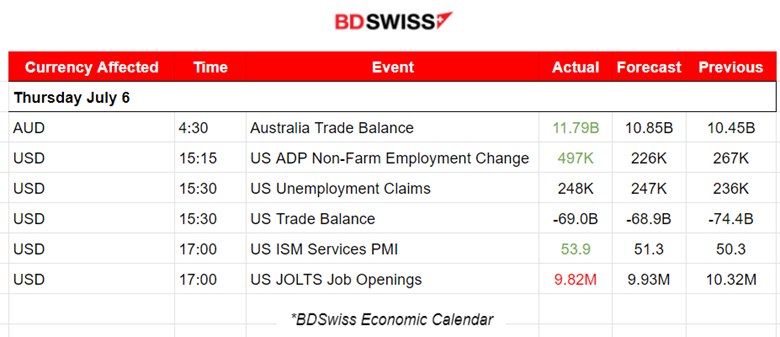

News Reports Monitor – Previous Trading Day (06 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s seasonally adjusted balance on goods and services surplus increased by 1,337M USD in May. Some AUD strengthening was observed around that time but it soon faded with pairs retracing. However, the upward momentum continued again during the European session.

- Morning – Day Session (European)

The ADP NF Employment Change and Unemployment claims along with the Trade Balance for the U.S. were released yesterday. At 15:15 the employment change was reported to be quite higher than expected causing intraday shocks for the USD pairs since the USD was preferred instead, while other assets such as stocks and metals dropped. The DXY jumped at the time of the release. Unemployment claims increased as expected.

At 17:00 the release of the ISM Services PMI and the JOLTS Job Openings report took place. The PMI figure was reported higher than expected and Job Openings were reported lower. Nevertheless, the market reacted with USD appreciation again at the time of the release. As the Job Openings figure was reported lower than expected, it signalled mixed data and created confusion as far as the overall labour market picture is concerned.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

AUDUSD (06.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move higher after 4:30 and then sideways with high volatility until 15:15. At that time the Employment news release caused the pair to drop as the USD appreciated heavily against major currencies, reversing and crossing the 30-period MA moving downwards. The news at 17:30 pushed the pair even further to the downside before finally retracing.

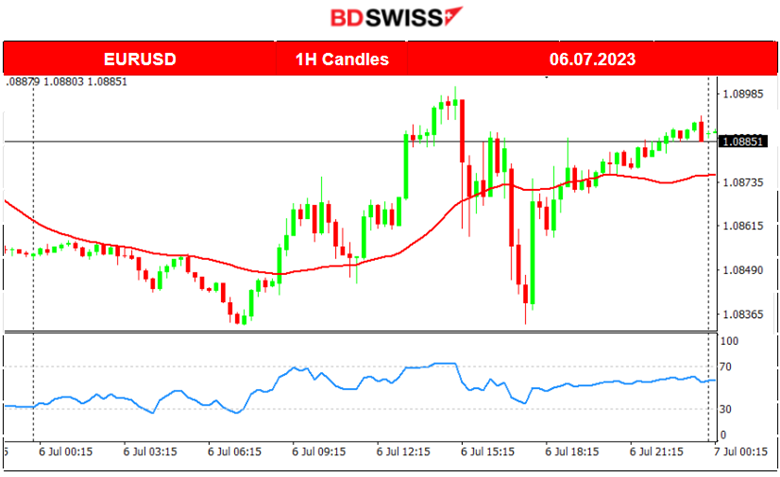

EURUSD (06.07.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair has shown volatility during all sessions yesterday since the market started to be active even before the employment data releases. EURUSD was moving rapidly upwards during the start of the European session until 15:15 when the news came out. At the time of the ADP NF Employment change the USD appreciated greatly causing the pair to drop sharply, returning back to the 30-period MA. Later during the news at 17:00, the USD appreciated greatly again as the ISM Services PMI was reported higher. The pair hit the previous support at 1.08330 before retracing quickly back to the mean again and beyond.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The 15116 acted as an important support level. The index broke that yesterday and dropped significantly near to 15000. In fact, all the U.S. benchmark indices experienced the drop as the market participants are now adjusting their portfolios to holding more USD and less risky assets. Expectations for future hikes from the Fed are now too high as employment data signal no labour market cooling. Future Inflation expectations are changing and it’s obvious. The U.S. Stock market noted a drop in the short term again. However, will it be sustained? Recent historical data show that resilience is high. More data is needed to confirm that we have a sustainable start of a downward trend. Sideways movement is more probable for now. At least until the Fed rate decision meeting.

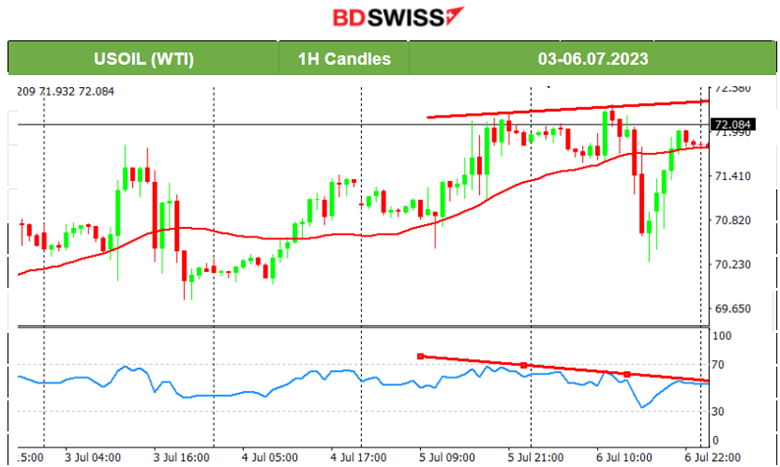

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude has been moving upwards this week with high volatility. OPEC Meetings have taken place with highlights: “Increase in oil demand in 2024 will be much lower than 2023,” “Why are OPEC+ supply cuts failing to boost oil prices?”, “Saudi Arabia says new oil cuts show teamwork with Russia”. It is expected that in the long run, oil price will eventually move to the upside for some time as a result of the cuts. Yesterday, the USD was affected greatly with appreciation and oil price fell dramatically at the time of the employment data release at that time. Its price though retraced eventually fully. We expect the price to remain high and move at least sideways.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was moving upwards steadily this week and volatility started to ease until the 5th of July. On that day the PMI data releases caused increased volatility and Gold moved lower, under the 30-period MA. Yesterday, the USD appreciated greatly during the employment data releases for the U.S., thus Gold dropped heavily before finally retracing. The RSI shows signs of bullish divergence (higher lows).

______________________________________________________________

News Reports Monitor – Today Trading Day (07 July 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No major news announcements, no significant scheduled releases.

- Morning – Day Session (European)

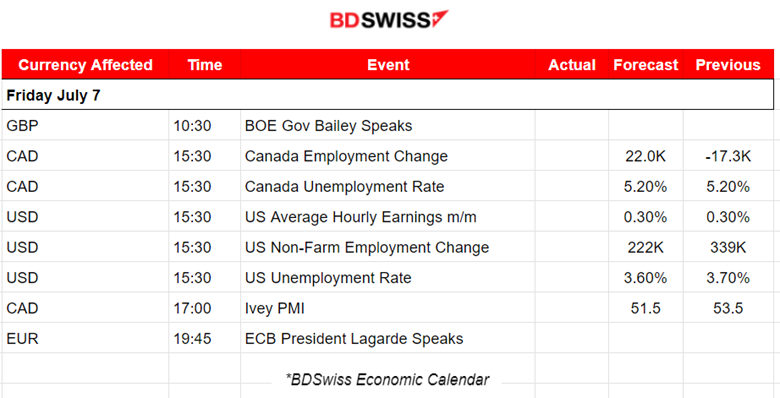

Today, The most important news of the month and probably for the quarter is taking place at 15:30. The Employment Change and Unemployment Rate data for Canada will be released at the same time as the NF Employment Change and Unemployment Rate for the U.S. CAD and USD pairs will be affected greatly. USDCAD has a chance of deviating greatly from the 30-period MA if i.e. USD appreciates and CAD depreciates.

Yesterday the ADP Employment change figure was reported way higher than expected and today’s NFP is expected to show a surprise as well. Intraday shocks are almost certain. These reports will have an effect probably on Metals and Stocks just like yesterday.

General Verdict:

______________________________________________________________