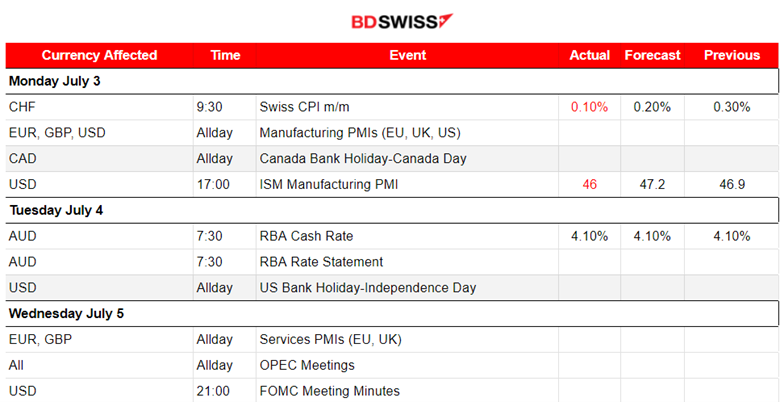

PREVIOUS WEEK’S EVENTS (Week 03-07 July 2023)

Announcements:

Swiss Economy

The monthly Swiss CPI change figure showed that consumer prices increased just by 0.1%. Swiss inflation dropped but economists still expect the Swiss National Bank to raise interest rates at least once more.

The annual core inflation was 1.8%, down from 1.9% in May. Even though below 2%, analysts still believe in a future hike.

U.S. Economy

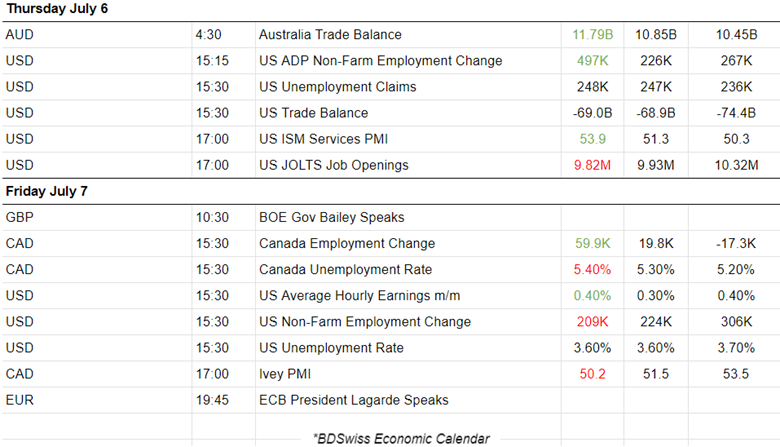

The ISM’s manufacturing PMI report showed that U.S. manufacturing declined further. The PMI stayed below the 50 threshold for the eighth straight month, in the manufacturing contraction area. This gives reason for suspecting a shortly upcoming recession.

Last week, the FOMC’s most recent meeting minutes which took place on June 13-14, showed that while almost all officials deemed it “appropriate or acceptable” to keep rates unchanged in a 5% to 5.25% target range, many had supported the idea of an increase instead. A clear divergence of opinions.

A strong majority of policymakers thought that it is appropriate to raise interest rates two or more times by the end of the year as inflation pressures continue to run high. The U.S. economy shows great resilience with a strong labour market. It is a positive sign that recession could be avoided. However, it raises concerns about how fast the inflation rate will drop, weakening the effects of hikes on inflation.

According to the ADP National Employment Report released on the 6th of July, the U.S. Private Sector Employment increased by 497K Jobs in June, way more than expected. This indicates that the labour market is actually pretty strong. Initial jobless claims were reported high again, almost as expected. However, these are significantly lower numbers than the ones reported in the middle of June, showing 260K.

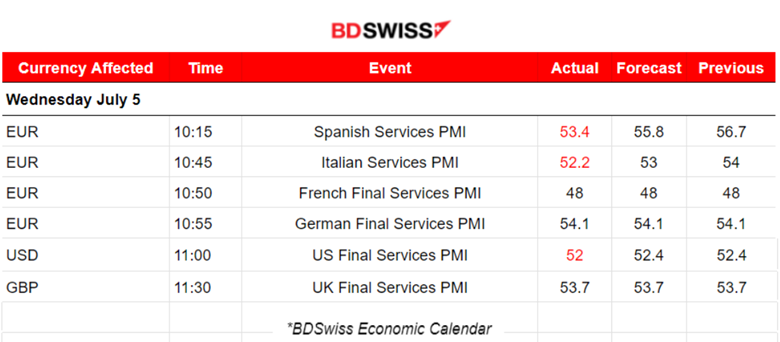

The U.S. ISM Services PMI was reported at 53.90, up from 50.30 last month. The U.S. services sector grew faster than expected in June as new orders picked up. The sector remains and grows in the expansion area, above 50 indicating that inflation in that sector is expected to grow.

The NFP report was released on Friday. A surprisingly low figure, far away from the ADP report, showing that the U.S. economy added only 209K jobs in June. Higher borrowing costs are playing a huge role in the economy explaining the drop in job openings as per the relevant report (JOLTS) last week. However, the pace of job growth remains strong.

Eurozone Economy

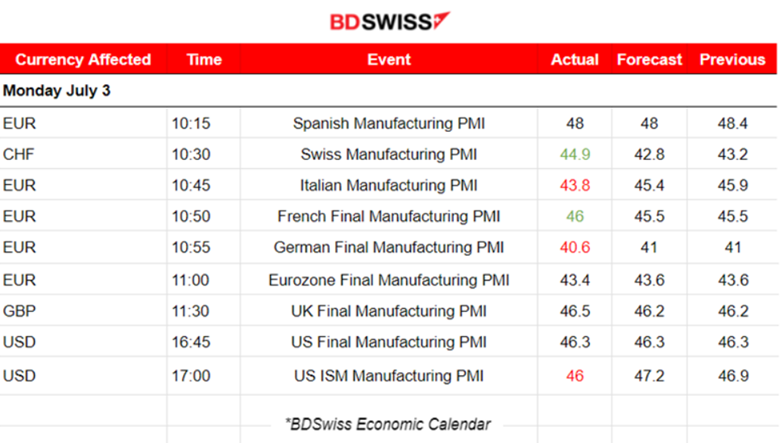

Eurozone manufacturing activity contracted fast in June as persistent policy tightening by the European Central Bank. HCOB’s final manufacturing Purchasing Managers’ Index (PMI) fell to 43.4 from May’s 44.8.

As per the PMI report yesterday, Germany’s manufacturing sector contracted fast as output and new orders moved to lower levels. The HCOB final Purchasing Managers’ Index (PMI) for manufacturing fell to 40.6 from 43.2 in May, marking the 5th consecutive monthly drop.

U.K. Economy

According to the figures, there was a decline in the U.K. manufacturing sector as well. The S&P Global/CIPS U.K. Manufacturing Purchasing Managers’ Index (PMI) fell to 46.5 from 47.1 in May. The 11th consecutive month in contraction territory.

Weak domestic and export market conditions had their effect on producers, along with lower spending on the client side and generally weak demand in the sector.

Canada Economy

The Canada Job report on Friday showed high, way-more-than-expected figures in June. The Jobless Rate rose to 5.4% from 5.2%. Analysts are now expecting another Bank of Canada (BoC) interest rate hike next week, as more people searched for work, according to Friday’s Canada Statistics data.

A second consecutive 25-basis-point rate increase is coming next week as a response to a resilient economy and persistent inflationary pressures.

_____________________________________________________________________________________________

Interest Rates

Australia: The Reserve Bank of Australia (RBA) decided to keep rates unchanged, stating that more time is needed to assess the impact of past hikes. However, it made it clear that further tightening might be needed to bring down inflation.

RBA Governor Philip Lowe highlighted the warning that some further tightening of monetary policy might be required as “inflation is still too high and will remain so for some time yet.”

Economic data over the past month have been mixed. Inflation cooled but the strong jobs report and retail sales are pushing for more hikes. Data suggest that financial conditions might have not been tight enough.

The central bank currently forecasts headline inflation to return to the top of its target range of 2-3% by mid-2025.

_____________________________________________________________________________________________

Energy

OPEC Meetings took place last week. OPEC+, a group comprising the Organization of the Petroleum Exporting Countries and Allies, including Russia, which pumps around 40% of the world’s Crude, has been cutting oil output since November.

The Russia-Saudi oil cooperation is still going strong as part of the OPEC+ alliance, which will do “whatever necessary” to support the market, Saudi Energy Minister Prince Abdulaziz bin Salman stated at the conference. Saudi Arabia and Russia deepened oil supply cuts at the beginning of the week in an effort to set prices higher.

The United States, the biggest oil producer outside OPEC+, has repeatedly called on the group to boost production to help the global economy. OPEC+ says it does not have a price target and is seeking to have a balanced oil market to meet the interests of both consumers and producers. Prince Abdulaziz said that new joint oil output cuts agreed by Russia and Saudi Arabia this week have again proven sceptics wrong.

The International Energy Agency: expects the oil market to tighten in the second half of 2023, partly because of OPEC+ cuts.

_____________________________________________________________________________________________

Source:

https://www.reuters.com/markets/australias-central-bank-holds-interest-rates-41-2023-07-04/

https://www.reuters.com/markets/us/us-manufacturing-extends-slump-june-ism-survey-2023-07-03/

https://www.reuters.com/markets/us/us-private-payrolls-beat-expectations-june-adp-2023-07-06/

https://www.reuters.com/markets/us/slower-still-strong-us-job-growth-expected-june-2023-07-07/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (03-07 July 2023)

Eurozone: The manufacturing sector was already in a contraction area but it looks like it worsened in June. The Eurozone PMI fell to 43.4 in June, less than expected. Germany had the same fate with a worse PMI, since it fell to 40.6, down from the consensus of 41.0 points. Spain, Italy and France also reported readings below 50, all remaining in the contraction area.

U.K.: The U.K. manufacturing sector remains in contraction territory with declining levels of output, new orders and employment. The PMI fell to a six-month low of 46.5 in June, down from 47.1 in May.

U.S.: Economic activity in the manufacturing sector contracted in June for the eighth consecutive month. The U.S. ISM Manufacturing PMI was released at 17:00, reported at 46 points, lower than the expected 47.2 points, remaining well in the contraction area. The market reacted with a small shock at the time of the release, affecting USD pairs.

UK: June Services PMI data indicated a sustained upturn in the U.K. service sector output.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

EURUSD had been moving downwards since the USD was the one carving the pairs path and specifically its strength. It was following a downward trend as it moved below the 30-period MA but eventually reversed on the 6th of July. The ADP job report showed a quite high figure that caused the market to react with USD appreciation at the time of the release. That effect soon faded as the pair reversed quickly. The next day the NFP report showed a quite low figure that caused the USD to depreciate instead. That caused the EURUSD to start the upward movement that lasted until the end of the trading day and with a signal that a retracement would probably take place next.

USDCAD

This pair was experiencing an obvious upward trend while, even though showing high volatility, the USD strengthening and CAD weakening had driven the pair significantly upwards. The U.S. ADP Employment report reported on the 6th caused the pair to jump, while the NFP caused it to drop heavily, reversing and crossing the 30-period MA on the way down. It found important support near 1.32650 before retracing back to the mean.

DXY (US Dollar Index)

The DXY has been experiencing low volatility but the Dollar was steadily gaining strength on its path around the 30-period MA. However, on the 6th and 7th of July, the U.S. Employment data caused shocks and market participants reacted greatly with USD appreciation on the 6th and USD depreciation on the 7th. Friday’s NFP data had a long-lasting effect on the whole trading day. The low NFP figure caused the DXY to drop heavily. This sign of labour market cooling from the report is not strong enough to support that the Fed is going to change the decision for a hike this month. Nevertheless, the market preferred to sell the USD.

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS (10 – 14 July 2023)

This week, the Reserve Bank of New Zealand and the Bank of Canada are going to decide on rates.

We also have the release of the U.S. CPI change report which is going to give important information to the Fed regarding inflation expectations. PPI change figures will also be reported adding to that information.

Will hikes continue? Let’s see how the market will react to these changes and if the Unemployment Claim figures will coincide with the recent NFP data.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

The USD was significantly affected by the ADP Employment data report on the 6th of July with an appreciation. Crude fell dramatically at the time of the release. However, its price fully retraced in the end. On the next day, the 7th of July, the NFP caused Dollar depreciation and Crude moved upwards before eventually retracing. Overall, we see that our initial expectation, that the oil price will eventually follow an upward path formed by the OPEC meetings’ recent statements, holds.

Gold (XAUUSD)

The 6th and 7th of July had a great impact on Gold due to the USD-related reports. The ADP and the NFP Employment data had an effect on the USD which, in turn, had an effect on the XAUUSD (Gold) price. On the 6th of July, the price dropped since the high ADP figure caused USD appreciation. However, on the 7th of July, the NFP figure was way different, causing USD depreciation, thus Gold jumped before eventually retracing back to the mean.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The U.S. Stock market noted a drop in the short term again. The data finally signal the beginning of a downward trend. The U.S. employment data were released on Friday and the USD depreciated heavily. All U.S. benchmark indices moved higher due to the shock but later reversed significantly. Now, resilience to the upside is obvious. The index now stubbornly wants to remain below the 30-period MA. 14980 support is broken and I am curious to see what will happen on the NYSE market opening at 16:30 today. An initial drop will probably be sustainable.

______________________________________________________________