PREVIOUS TRADING DAY EVENTS – 09 August 2023

Brent crude rose by 0.3%, to 87.81 USD/b, hitting its highest since the 23rd of January. West Texas Intermediate (WTI) crude also gained 0.3%, to 84.65 USD/b, a price last seen in November 2022.

Supply tightness due to tensions between Russia and Ukraine and the extended production cuts by Saudi Arabia are causing rising prices.

“Oil prices have been resilient to a weak economic showing out of China in recent weeks, with market participants choosing to place their focus on the tighter supplies conditions from Saudi Arabia and Russia’s output cuts to continue their unwind from previous bearish positioning,” wrote Yeap Jun Rong, a market analyst at IG, in a note.

Saudi Arabia’s plans were announced recently, involving the extension of its voluntary production cut of 1M barrels per day for another month to include September. Russia also said it will cut oil exports by 300K bpd in September.

The market has eyes on the Consumer Price Index (CPI) from the United States, which should provide further information to the Federal Reserve for making decisions regarding future monetary policy.

“Ahead in the day oil investors will be widely watching the US Inflation print which is anticipated to reflect a slight rebound, a scenario likely to spur fears of more rate hikes,” said Priyanka Sachdeva, senior market analyst from Phillip Nova, in a note.

______________________________________________________________________

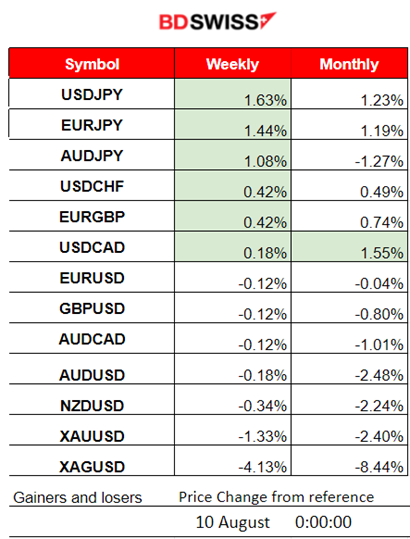

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (09 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

According to China’s CPI changes, China’s consumer prices dropped for the first time in over 2 years. We see a negative figure of -0.30%. No major shock was recorded for the AUD pairs.

- Morning – Day Session (European)

No major scheduled releases except for the U.S. Crude oil inventories figures. A remarkable positive figure for inventories, a surprise, after the previously reported high negative change. Oil volatility is high, large changes taking place, and announcements for production cuts recently pushed oil to higher price levels.

General Verdict:

____________________________________________________________________

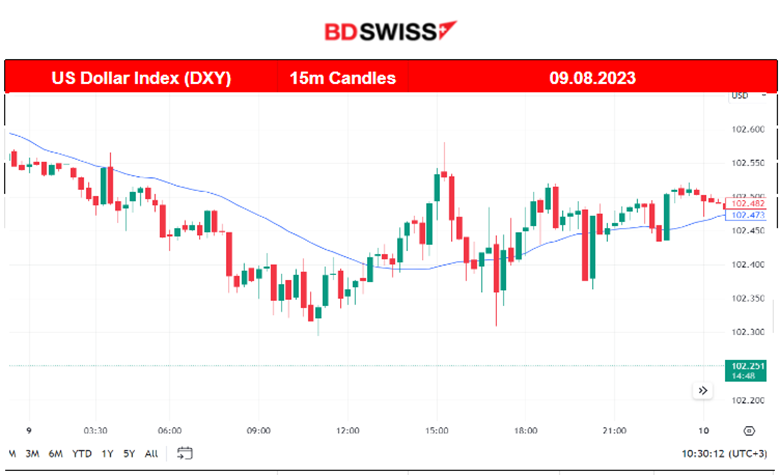

FOREX MARKETS MONITOR

EURUSD (09.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Less volatility due to the absence of scheduled important releases. The pair moved more to the upside at first but later, during the European session, it continued with the sideways path around the mean, moving in a small range.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the recent announcements from Fitch Rating and Moody’s, the U.S. stock market suffered a downtrend. The benchmark U.S. indices are moving to the downside but at a highly volatile pace. On every recent market/exchange opening, we see the NAS100 moving rapidly to the downside before retracing back to the mean. The RSI currently shows signs of a bullish divergence as it shows higher lows. This means that we would expect a probable volatile sideways path next. Inflation-related news today at 15:30 for the U.S. would have an impact on the USD and could affect the stock market, especially after the NYSE opening.

______________________________________________________________________

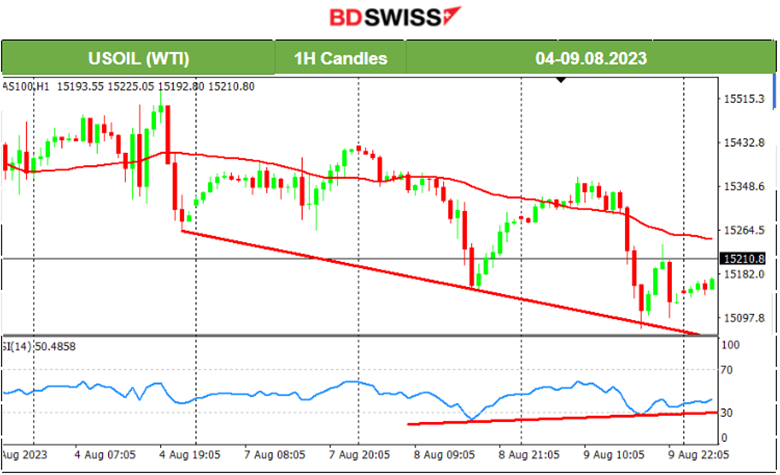

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude is moving higher and higher with the recent announcements for production cuts. It is currently breaking important resistance levels but shows signs of a slowdown. The RSI is in the overbought area, some reversal is expected because the upward movement cannot be rapid due to the nature of the asset.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

As the Dollar gains more strength, Gold moves lower and lower, breaking important resistance levels. It is currently below the 30-period MA and is moving to the downside on a clear downward trend. U.S. CPI changes are going to be released today and will be important in determining the future path of its price.

______________________________________________________________

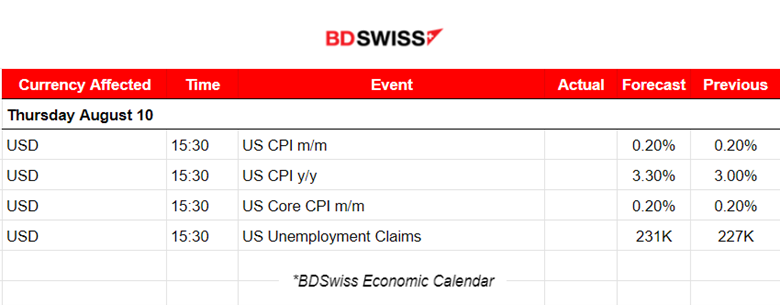

News Reports Monitor – Today Trading Day (10 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or any special scheduled releases.

- Morning – Day Session (European)

Important releases at 15:30. Inflation-related data are probably going to cause huge volatility and intraday shocks for USD pairs.

General Verdict:

______________________________________________________________