Previous Trading Day’s Events (08 Dec 2023)

Annual wages rose moderately last month and inflation has been cooling in recent months. The U.S. central bank is expected to keep rates unchanged next Wednesday.

“This was a relatively healthy report and will help to push back some of the excitement around imminent and aggressive rate cuts,” said Richard de Chazal, macro analyst at William Blair in London.

Financial markets lowered their bets of a rate cut in March. Traders saw higher odds of a cut in May.

The University of Michigan’s survey on Friday showed that consumers’ 12-month inflation expectations plunged to 3.1% in December, the lowest reading since March 2021, from 4.5% in November.

______________________________________________________________________

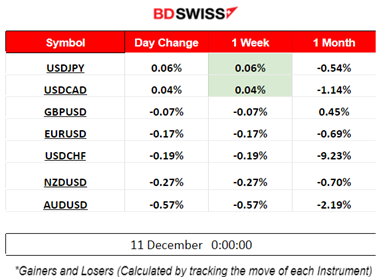

Winners vs Losers

The USD experienced strength overall last week. Major pairs have moved to the upside (USD as base)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (08 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

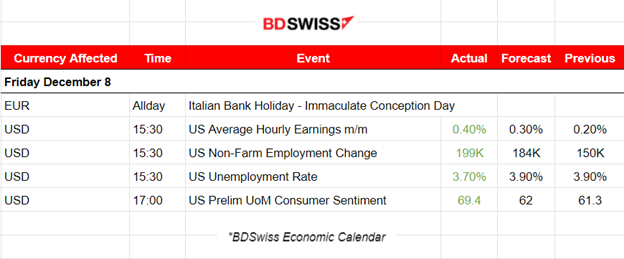

- Morning–Day Session (European and N. American Session)

The monthly average hourly earnings change for the U.S. was reported 0.40%, higher than expected. The NF Employment change was also reported 199K higher than expected, surprising everyone and causing a huge impact in the market. The unemployment rate was reported surprisingly significantly lower, at 3.70% versus the previous 3.90% indicating that the labour market is not cooling as much as they think.

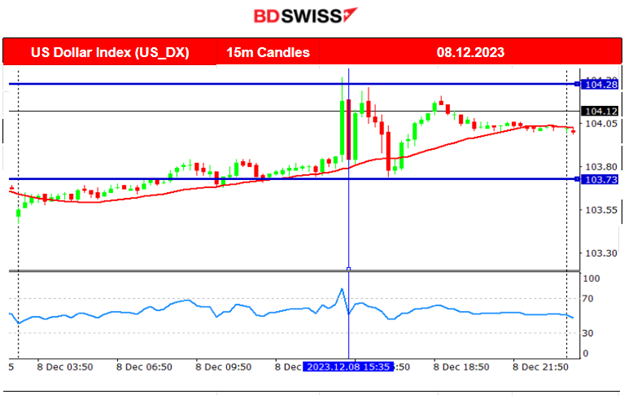

This data is showing that the Fed has actually more work to do and rate cuts should probably have to wait a long time more. The U.S. dollar has experienced high volatility with the dollar index showing high deviations from the mean but the path was roughly sideways for the index. 104.3 served as an important resistance not allowing the index to move significantly upwards, however the dollar experienced strength overall.

Interestingly, according to the UMich report at 17:00, the U.S. December UMich consumer sentiment was reported 69.4 vs the expected 62.0. UMich inflation expectations (one year ahead) collapsed to 3.1% in preliminary December data after soaring to 4.5% in November. Medium-term inflation expectations also dropped, from 3.2% to 2.8%. At the time of the report the USD experienced weakness and the dollar index fell rapidly but remained close to the intraday mean.

General Verdict:

____________________________________________________________________

____________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (08.12.2023) Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

The pair was moving to the downside steadily with low volatility until the U.S. Labour market reports came out. The USD at first experienced appreciation against other currencies, thus the pair moved rapidly downwards. The market participants were expecting that there is a chance for rate cuts soon, however the labour market shows no signs of significant cooling thus troubling both the Fed and the market as a whole causing this appreciation. Later the UMich consumer sentiment report and consumer inflation expectations figures releases (lower) caused USD depreciation, thus the pair reversed to the 30-period moving average. The pattern continued later on as the volatility returned to normal levels.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

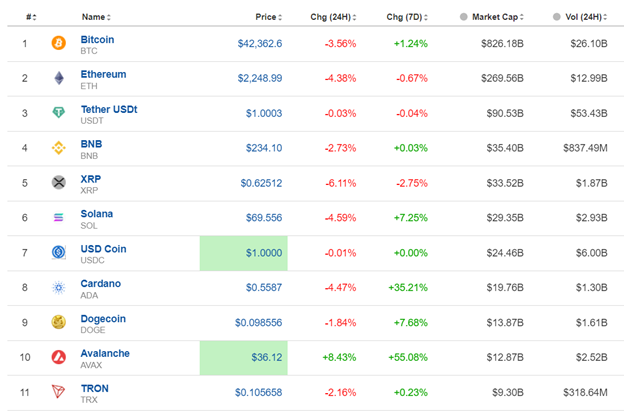

Bitcoin fell significantly today during the Asia session, falling under $41K wiping out significant performance during the past week. This was a sudden 6.5% drawdown from 43K USD to as low as near 40K USD in a span of 20 minutes. It seems that technicals and posts from analysts caused the recent downturn.

Crypto sorted by Highest Market Cap:

All cryptos suffered losses over the last 24 hours except Avalanche that still shows positive 8.4% gains. Cardano remains on the top of the winner’s list for the last 7 days having 35.2% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4Hour Timeframe Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

In general, all benchmark indices were recently in a state of consolidation that from yesterday seems to not hold anymore. The market eventually broke the consolidation by moving further upwards. The index broke the 16000 USD resistance level and moved further upwards reaching the 16100 USD level. However the RSI shows lower highs indicating that the volatile up-and-down moves might continue, thus causing the price to reverse significantly.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

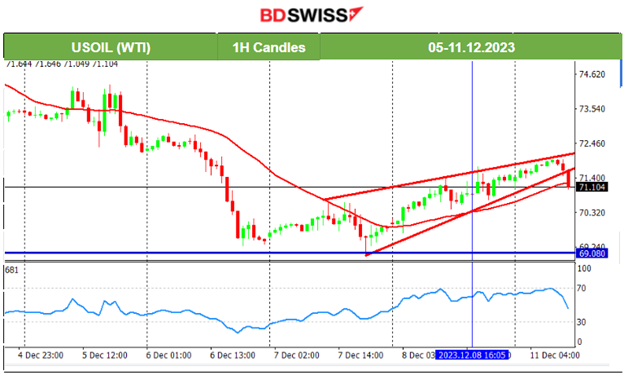

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Crude oil finally reversed last week after testing the support near 69 USD/b. It eventually retraced back to the 61.8 Fibo level and settled at near 71 USD/b. Yesterday it eventually kept moving steadily upwards reaching eventually the 72 USD/b level. An upward wedge was formed that seems now to have been broken while the price moves downwards today. This might be a signal for a further intraday drop.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+02:00)

Price Movement

Gold eventually broke the consolidation. A triangle formation was apparent as well as depicted with the red and blue lines as discussed in our previous report. When the NFP report was released Gold’s price dropped heavily near 30 USD, reaching 1995 USD/oz, before eventually retracing back to the 61.8 Fibo level. Now it currently remains close to the support near 1994 USD/oz and quite away from the 30-period MA. Even though the RSI shows higher lows, we still need more evidence to support a reversal again back to the mean, thus an upward movement. Let’s see.

______________________________________________________________

______________________________________________________________

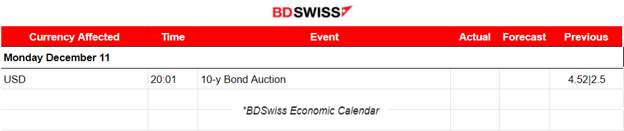

News Reports Monitor – Today Trading Day (11 Dec 2023)

Server Time / Timezone EEST (UTC+02:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

______________________________________________________________