PREVIOUS TRADING DAY EVENTS – 05 Oct 2023

“Demand in the economy continues to strengthen which can only serve to worry Fed officials even more, and puts the progress in bringing inflation down in jeopardy,” said Christopher Rupkey, chief economist at FWDBONDS in New York.

Data suggest that the labour market is gradually cooling. The government reported on Tuesday that there were 1.51 job openings for every unemployed person in August and unfilled positions increased by the most in two years.

Most economists believe the central bank is done hiking rates. Since March 2022, it has raised its benchmark overnight interest rate by 525 basis points to the current 5.25%-5.50% range.

Nonfarm payrolls likely increased by 170K jobs last month after rising 187K in August. The unemployment rate is forecast to dip to 3.7% from 3.8% in August.

“We look for payrolls to remain firm in September, registering a 210,000 gain,” said Oscar Munoz, chief U.S. macro strategist at TD Securities in New York.

Source:

https://www.reuters.com/markets/us/us-weekly-jobless-claims-rise-moderately-2023-10-05/

______________________________________________________________________

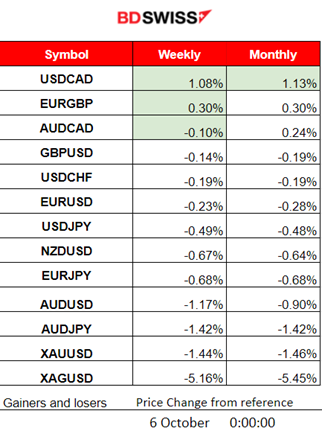

Winners and Losers

USDCAD is still leading with 1.08% this week. Volatility for FX pairs is moderate but movements in one direction were absent except this pair since oil plunged this week. Metals also suffered losses.

News Reports Monitor – Previous Trading Day (05 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

The Construction PMI showed a lower figure this morning indicating contraction, 45 versus the previous 50.8. The GBP depreciated steadily after the release but its effect faded soon.

The U.S. unemployment claims were reported higher at 207K versus the expected 211K. Again evidence of a strong labour market for the U.S. At the time of the release, at 15:30, the impact was not great on the USD. No shock was recorded and the USD started to depreciate against other currencies instead, after the release as per the DXY chart below:

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

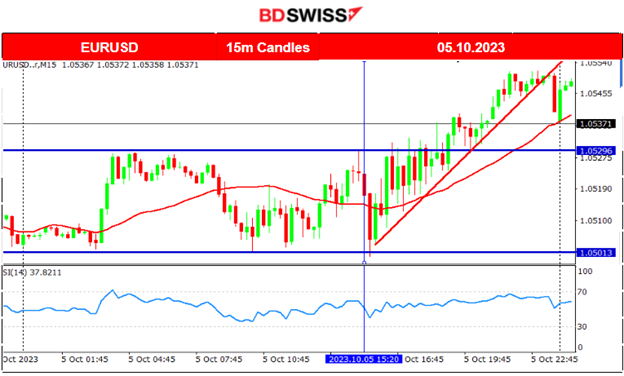

EURUSD (05.10.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD started to move sideways around the 30-period MA until 15:30 when it eventually moved to the upside steadily. The USD started to depreciate after the news release causing the pair to move upwards.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A sudden jump on the 2nd of October caused Bitcoin to move upwards more than 900 USD after breaking the resistance at 27300. The market calmed down after that, moving to lower levels. No other important movement was recorded recently, and the path keeps the sideways direction. It remains in a relatively small range moving sideways.

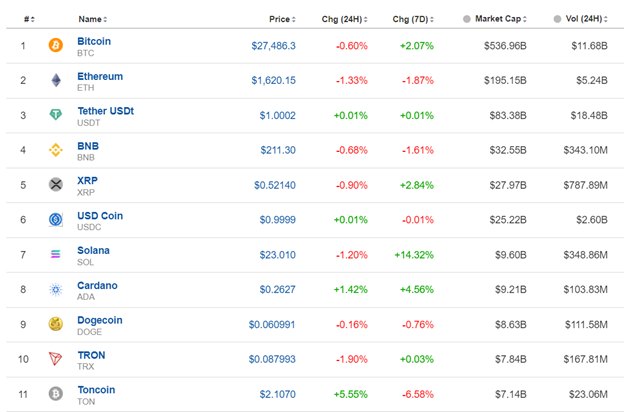

Crypto sorted by Highest Market Cap:

The 7 Days Change in gains is still green for some crypto. The big moves happened on the 2nd but volatility prevails. Solana is leading with 14.32% that period.

The last 24 hours not much is happening in general, however Toncoin seems to move the most and is showing 5.55% gains.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 3rd of October, the index eventually broke the triangle formation that was formed and mentioned in our previous report. After that breakout the index dived, reaching the support at near 14450 before starting to retrace. Retracement reached almost 100%. This was a clear reversal, while the price crossed the 30-period MA on its way up, almost reaching the starting point of the initial drop. On the 5th Oct the index eventually retraced back and more than 61.8% after finding a strong resistance near 14830. Quite volatile market for U.S. stocks recently as they struggle to remain at high levels.

Related Analysis on TradingView:

https://www.tradingview.com/chart/NAS100/FE8YJPav-NAS100-Retracement-Set-05-10-2023/

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude oil finally settles at 81.20 amid NFP. That seems to be an important support level. Possible sharp drop will be the case when it breaks. There is the possibility that after the market reacts to the news and USD is affected, the price of oil will start to reverse from this unusual dive that is most probably caused from extremely recent low levels of demand.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold is on the sideways path. There is no significant data to suggest that there will be a reversal unless important support or resistance levels break. The RSI shows a bullish divergence formation with its higher highs. However, the news is probably going to distort this formation. However, a break of the depicted range to the upside might cause the price to jump even during news.

______________________________________________________________

News Reports Monitor – Today Trading Day (06 Oct 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no scheduled special figure releases.

- Morning–Day Session (European and N. American Session)

The long awaited employment data releases for the U.S. and Canada are released as usual at 15:30. Market participants were waiting all week to trade big volumes and increase activity levels. It is quite probable to see action and shocks taking place at the time of the release for both CAD and USD pairs but also for other major currencies as well like EUR and GBP. The ADP report showed a lot less private employment change. In the NFP case the expected figure is lower but only just. U.S. unemployment rate is expected to drop to 3.7%. Opportunities are on since the markets have a big chance to deviate significantly from the mean during such events.

General Verdict:

______________________________________________________________