PREVIOUS TRADING DAY EVENTS – 08 June 2023

Announcements:

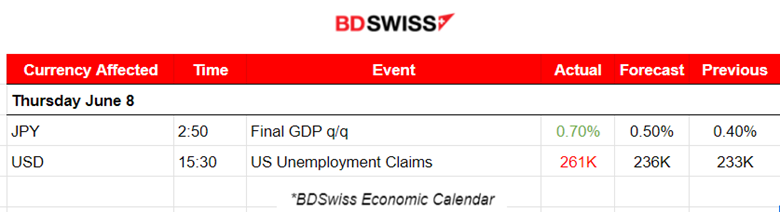

“The jump in claims could be a sign of a pickup in layoffs, but given the volatility of claims from week-to-week, it is too soon to reach that conclusion,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

“The narrowness of the increase in claims by the state is a further factor suggesting we should wait for additional confirmation before concluding layoffs have picked up, especially given the fraud in Massachusetts recently.”

Recent Labor Market Data for the U.S. have been indicating that the market is still strong and exhibits remarkable resilience. NFP data showed a high positive change in employment while the unemployment rate increased slightly. However, with no further statements from policymakers regarding interest rates, the Federal Reserve is expected to keep its policy rate unchanged next Wednesday for the first time since March 2022.

“Claims remain well below our estimate of 305,000 to be consistent with no monthly job growth, and it will take a more sustained increase in the level of claims to influence the Fed’s monetary policy,” said Matthew Martin, a U.S. economist at Oxford Economics in New York.

The interesting part now is to see what the Fed is actually going to decide on rates. A surprise is possible just like the RBA and BOC cases.

Source:

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-more-than-expected-2023-06-08/

______________________________________________________________________

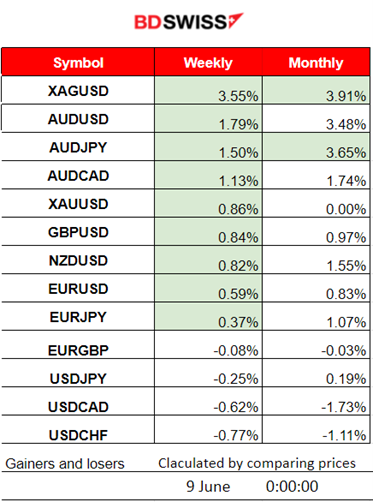

Summary Daily Moves – Winners vs Losers (08 June 2023)

- XAGUSD is at the top this week with 3.55% gains and remarkably is also at the top this month so far.

- The AUD pairs with AUD as base currency have reached the top as AUD appreciates greatly due to the surprise rate hike by the RBA.

- The U.S. dollar yesterday lost a lot of ground.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (08 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Japan’s economy grew more than initially thought in January-March, revised data showed today, June 8th at 2. The pairs with JPY as quote currency started moving upwards with the opening of the European Markets. It was a steady upward movement for these pairs.

- Morning – Day Session (European)

At 15:30 the U.S. Unemployment Claims figure was released, 261K, an increase of 28K from the previous week’s revised level. The previous week’s level was revised up by 1K from 232K to 233K. At the time, an intraday shock took place but with no high degree. Later on, the market reacted with a steady U.S. dollar depreciation until the end of the trading day.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (08.06.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move steadily upwards until the end of the trading day, moving nearly 80 pips upwards overall. It is mirroring the path of the DXY because it is the USD that was the main driver of the pair. 1.07870 is a potential resistance level that signals the end of the movement and the start of a potential retracement as per the Fibo tool. 1.07550 is the 61.8 Retracement Level that the market might retrace to.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 moved sideways this week with low volatility. On the 7th of June, the index crashed after 17:00, near a 300 USD drop. This was after the BOC rate figure release at that time and the USD appreciation that followed immediately after. The S&P500 also experienced a similar drop after that time. NAS100 dropped further following the next day, the 8th of June, founding significant support at nearly 12245 USD. It later retraced during the day back to the mean. With the release of the high U.S. Unemployment claim figures, the index moved rapidly upwards settling at nearly 14500 USD. All U.S. benchmark indices experienced the same upward path after the release.

Breaking the 14450 USD support would trigger a retracement probably.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

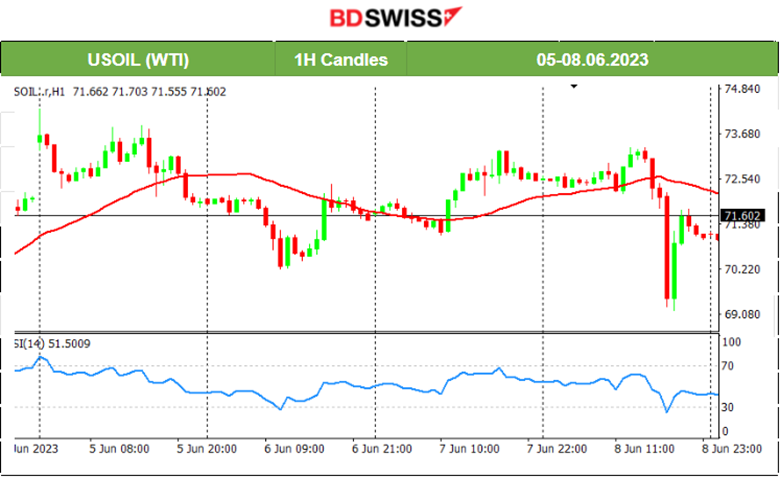

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price of Crude was steady the last few days with sideways movement around the 30-period MA. Yesterday after the U.S. Unemployment claims figures were released, the price dropped rapidly finding resistance at 69 USD/b before retracing significantly. The claims were higher than the forecast, shifting the expectations towards a pause in hikes. The Fed had not proceeded to any statements that a hike would eventually take place, however, the market participants were looking at the strong labour data speculating that the pause might not eventually happen. This weak data caused turmoil and USD depreciated while actually crude dropped.

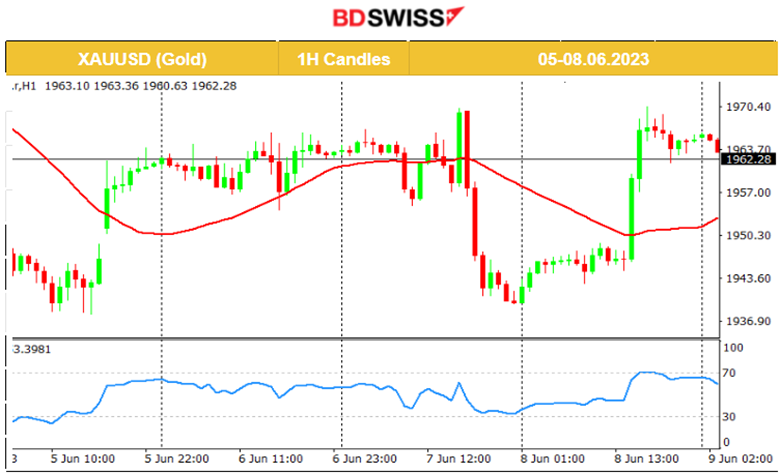

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold’s price continued with a sideways path experiencing a period of consolidation until the 7th of June. On that day, after 17:00, the USD appreciated greatly causing Gold’s price to crash and test the 1938 USD/oz support. Later, it retraced fully back to the 61.8 Fibo level and even jumped further upwards when the USD depreciated greatly on the 8th of June after the high unemployment claims figures were released that day.

______________________________________________________________

News Reports Monitor – Today Trading Day (09 June 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements, no special scheduled releases.

- Morning – Day Session (European)

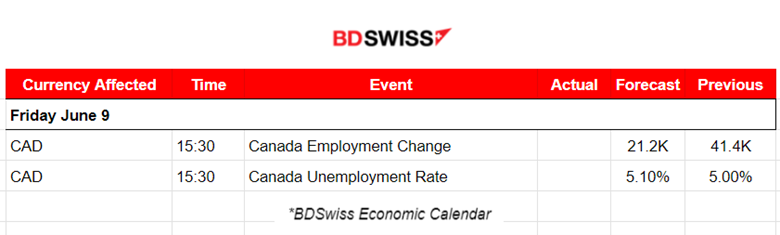

At 15:30 the important Labor Market data for Canada is going to be released. The employment change and unemployment rate data. People expect that the unemployment rate will not change much, by 0.10%. The employment change though is expected to drop to 21.2K versus the previous 41.4K figure.

A surprise there will probably cause an intraday shock affecting the CAD pairs. The impact might not be so big in order to create retracement opportunities. If the market trades other major currencies creating higher than-normal volatility, opportunities will arise.

General Verdict:

______________________________________________________________