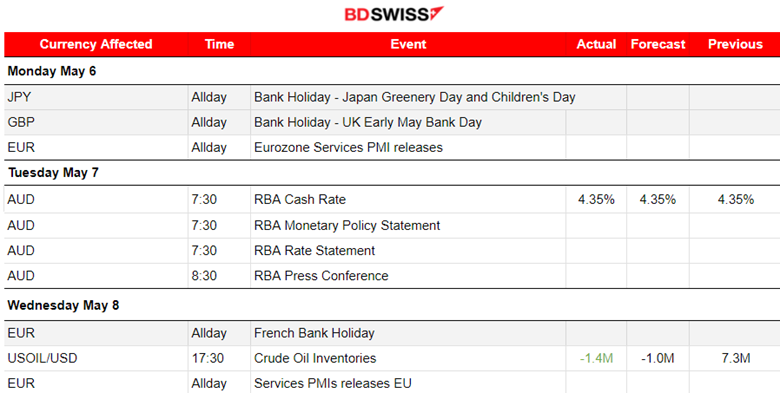

PREVIOUS WEEK’S EVENTS (Week 06-10.05.2024)

U.S. Economy

The number of Americans filing new claims for unemployment benefits rose last week to the highest level in more than eight months, serving as further evidence that the labour market is cooling recently. The figure increased by 22,000 to a seasonally adjusted 231,000 for the week ending May 4th. It follows reports last week which showed the economy added the fewest jobs in six months in April while job openings dropped to a three-year low in March.

Expectations for an interest rate cut from the Federal Reserve at its September policy meeting rose slightly to 50% after the release of weekly jobless claims according to the CME FedWatch tool.

U.S. consumer sentiment was reported down to a six-month low in May as households see a higher cost of living and unemployment in the future. The larger-than-expected drop in sentiment reported by the University of Michigan on Friday was across all age, income and education groups as well as political party affiliations.

The survey’s reading of one-year inflation expectations rose to 3.5% in May from 3.2% in April, remaining above the 2.3%-3.0% range seen in the two years before the COVID-19 pandemic. Its five-year inflation outlook increased to 3.1% from 3.0% in the prior month.

Inflation reaccelerated in the first quarter, but economists believe the disinflation trend will reassert itself in the second quarter. The Fed is unlikely to cut rates unless inflation is clearly headed sustainably to 2%.

Canada Economy

Canada’s employment increased by 90,400 jobs and the unemployment rate unexpectedly held at 6.1%. The strong data suggest that BOC will have a hard time deciding about interest rate cuts. Money markets are fully pricing in a cut in September compared to July before the report was released.

The average hourly wage growth for permanent employees slowed to an annual rate of 4.8% from 5% in March. The slowdown in wages adds to signals that the economy is moving in line with the BoC’s projections.

The bank is looking at a broad range of indicators for evidence that inflation is heading toward a 2% target and said last month that a rate cut in June was possible if a recent cooling trend in prices is sustained.

______________________________________________________________________

Interest Rates

RBA

Australia’s central bank held rates steady but cautioned that inflation risks were on the upside. They kept rates at a 12-year high of 4.35%. This followed a disappointingly high inflation reading in the first quarter and the labour market failed to cool as much as expected, with the jobless rate at 3.8% in March.

The Federal Reserve is now expected to cut less than twice in 2024, a change from about six reductions priced in at the beginning of the year.

BOE

The Bank of England (BoE)’s Monetary Policy Committee kept rates at a 16-year high of 5.25%. The BoE began raising borrowing costs in December 2021 to counter high inflation which peaked at 11.1% in October 2022.

The central bank remains on guard as there is still strong growth in wages and services prices which it expects to temporarily push inflation above 2% later this year.

Governor Bailey: “We need to see more evidence that inflation will stay low before we can cut interest rates,” he said. “I’m optimistic that things are moving in the right direction.”

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-weekly-jobless-claims-increase-more-than-expected-2024-05-09/

https://www.reuters.com/markets/us/us-consumer-sentiment-slides-six-month-low-may-2024-05-10/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 06-10.05.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

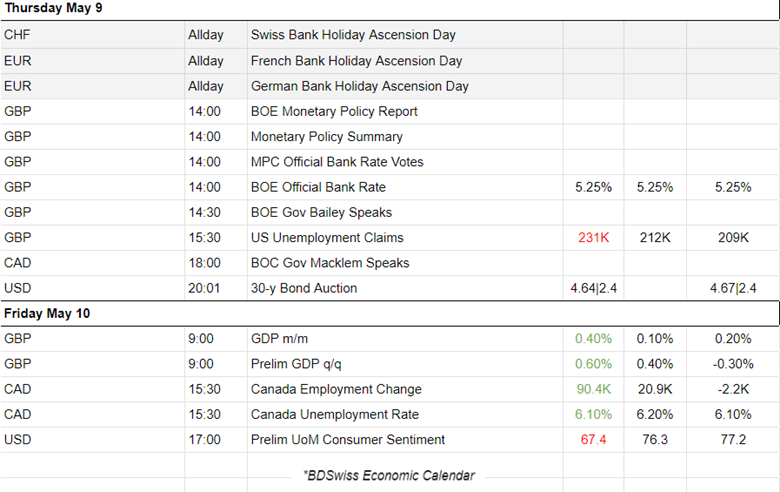

Services PMI Releases

Eurozone:

Eurozone:

The Spanish service sector grew at its fastest rate for just under a year in April. The economy experienced strong output growth due to improvements in market demand and economic conditions. The reported PMI is 56.2, an improvement from the previous figure.

In Italy, there is a sustained expansion of the Italian service sector, with business activity rising for the fourth month running. The reported PMI was also in the expansion territory, at 54.3 points.

In France, the services PMI experienced an improvement, reaching 51.3 points, up from the previous 50.5 points. Services activity grew for the first time since May 2023. It began the second quarter of 2024 in expansion. Higher output levels were reportedly a result of improving demand conditions.

The German service sector entered the second quarter, as German business activity posted its strongest rise for ten months. The upturn was supported by growth in new business. The reported PMI was 53.2, again in expansion territory.

Eurozone PMI was also reported at 53.3 points in expansion indicating that the economy expands at the fastest pace in nearly a year. The Eurozone’s economic recovery progressed further at the start of the second quarter as overall business activity growth accelerated to an 11-month high. In Services, output levels improve solidly and at a slightly faster rate than seen on average. Increased inflows of new business, higher activity, quickest pace of job creation for ten months, while business confidence remained strong.

_____________________________________________________________________________________________

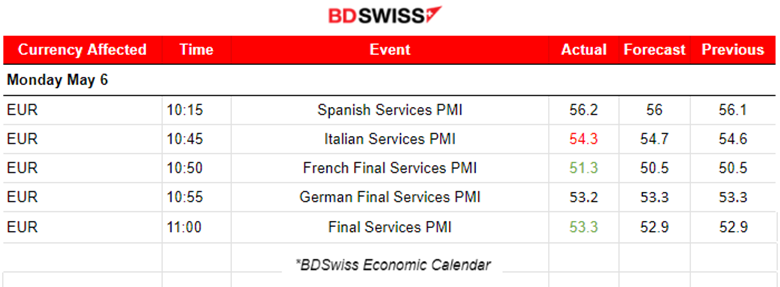

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The dollar was greatly affected last week, importantly by the U.S. news on Unemployment claims and Consumer Sentiment reports. The index experienced an upward movement early in the week. After the strong NFP report on the 3rd of May it weakened but eventually found its strength once more on the 7th of May, rising until the resistance at near 105.80. After the news release on the 9th of May, surprising the market with a jump in Unemployment claims, the dollar weakened and the index fell sharply. It retraced eventually to the 30-period MA. The lower consumer sentiment figure and higher inflation expectations news on the 10th of May helped to push the index higher but it remained roughly stable below the MA. The market now waits for the inflation report next week confirming that it should be lower, confirming the labour market cooling and thus negative impact on prices.

EURUSD

EURUSD

This pair was experiencing a downward movement, obviously because of the steady dollar strengthening until the 9th of May. During the 6th of May, the services PMI figure releases managed to drive the EURUSD higher as the EUR was having a push from the positive news. However, since the 7th it experienced a strong dollar appreciation, thus the fall of the pair to the support at near 1.07240. At the time of the U.S. unemployment figure release, 15:30 on the 9th of May, the EURUSD jumped. The higher-than-expected claims caused a heavy dollar weakening. After finding strong resistance at near 1.07860 the pair retraced to the 61.8 Fibo level and touched the 30-period MA. It is apparent that the USD is the main driver of this path.

USDJPY

USDJPY

The dollar was experiencing strong strengthening early in the week and in combination with JPY weakening, the pair was pushed more to the upside. After a series of interventions by the BOJ, the previous week, the pair was brought significantly downwards falling from 160 to near 151.90. This JPY strengthening due to the interventions eventually stopped and the JPY started again weakening while the dollar was gaining more ground. On the 9th of May, the U.S. unemployment claims news caused the pair to fall but the impact was not so great on the pair as the JPY continued to weaken. Currently, it remains close to 156 and is in the consolidation phase waiting for the U.S. inflation report to be released this week.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

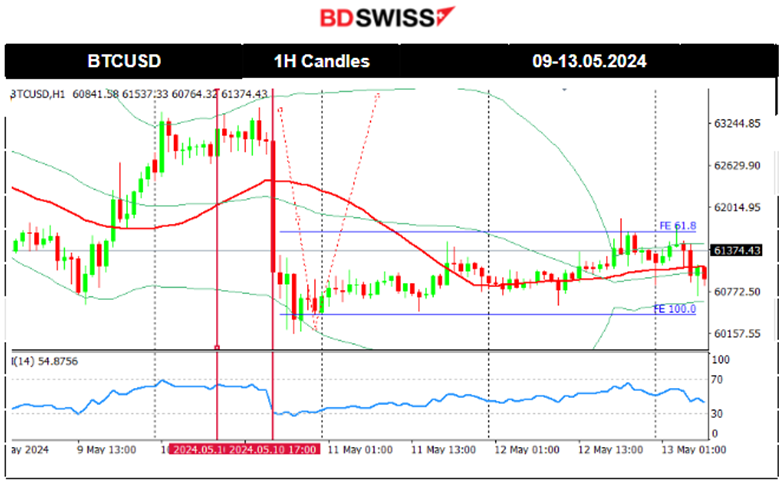

BTCUSD

A triangle formation was breached on the 7th of May and this caused its price to drop to near 62K. This downside movement was a retracement to the 61.8% of the rapid large movement that started on the 2nd of May and from the support at near 56.5K USD.

A clear downward channel for Bitcoin and possible triangle formation has been broken on the 9th causing the price to jump to around 63K. On the 10th of May, Bitcoin saw a huge drop after the news release at 17:00 causing the sudden U.S. dollar strengthening and the trigger of a risk-off mood.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

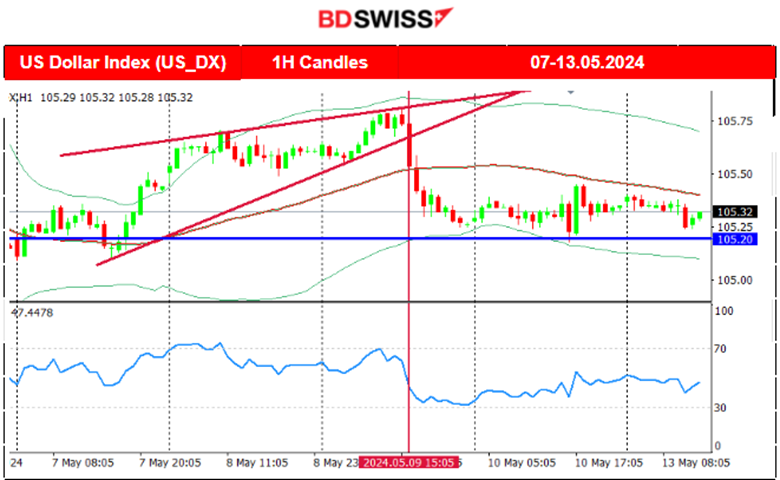

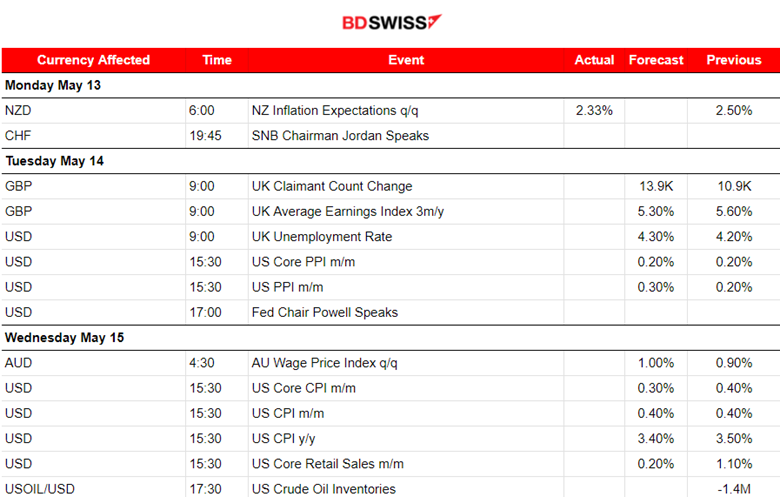

NEXT WEEK’S EVENTS (Week 13 – 17.05.2024)

Coming up:

Labour market data for the U.K. will determine how the BOE will decide on the interest rate cut timing. The unemployment rate is expected to be reported higher and inflation seems to head towards the target level.

Labour data are released for Australia as well and the market expects a positive change in both employment and unemployment rate.

U.S. PPI and CPI inflation data will be released and probably will shake the markets if the figures do not show any decline.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

It seems that Crude oil was following a downward channel while moving around the 30-period MA. That channel broke with the next support being reached on the 8th of May at near 76.70 USD/b. The price reversed remarkably on the same day to the upside breaking the channel to the upside. The upward movement continued but found resistance at near 79.5 USD/b. On the 10th of May, the price dropped heavily after the U.S. news at 17:00, a near 2-dollar drop to 77.37 before retracement started to take place. An upward movement is expected with a max target level near 78.3 USD/b.

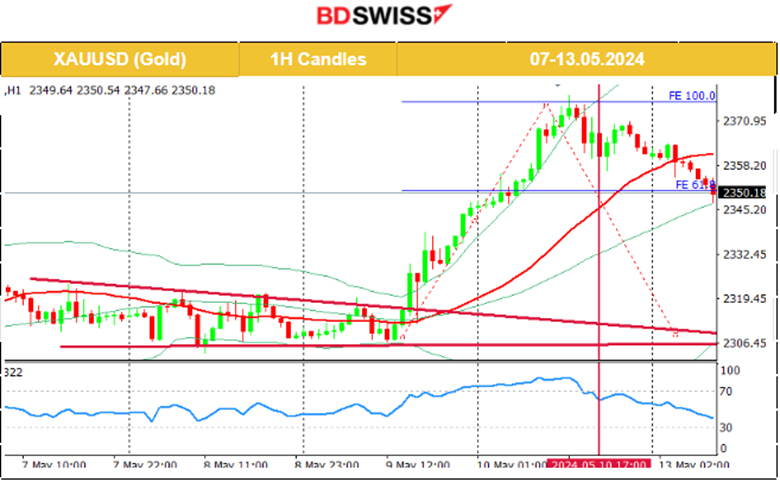

Gold (XAUUSD)

Gold (XAUUSD)

A consolidation phase broke on the 9th of May after the U.S. unemployment claims figure release. Gold’s price jumped after USD depreciation took place and broke the consolidation, reaching the resistance of 2,330 USD/oz as predicted in our previous analysis. Later that resistance broke as well causing the price to jump further to the upside. The price reached a peak at 2,378 USD/oz, on Friday 10th of May, before retracing to the 61.8 Fibo level at near 2,350 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

A triangle formation is apparent when moving into the 9th of May. That triangle formation broke as the price moved to the upside after the U.S. Unemployment claims figure release, causing indices to experience a jump. On the 10th of May, the index dropped upon release of the U.S. news for Consumer sentiment and inflation expectations. That news release caused dollar appreciation at that time and the index to fall around 20 dollars. It eventually reversed to the upside steadily after touching the 30-period MA and the 61.8 Fibo level.

______________________________________________________________