PREVIOUS TRADING DAY EVENTS – 17 August 2023

Other data reported this week showed an actual increase in retail sales in July. Demand is on the move and steady raising the risk that the Federal Reserve could hike interest rates once more.

“The labour markets are not imploding,” said Christopher Rupkey, chief economist at FWDBONDS in New York. “The economy may be heating up instead of cooling down as the monetary medicine of higher 5.5% interest rates is not slowing aggregate demand like the economics textbooks say it should.”

The minutes of the Fed’s July 25-26 meeting were published on Wednesday noting that further progress toward a balancing of demand and supply in the labour market was needed, expecting that additional softening in labour market conditions would take place as time passes.

Most economists believe the rate hiking cycle is likely over, given the recent moderation in inflation.

“The labour market is still strong but much more balanced than during the severe worker shortages of the early recovery from the pandemic,” said Bill Adams, chief economist at Comerica Bank in Dallas.

______________________________________________________________________

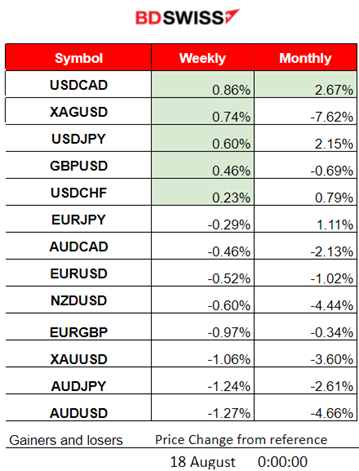

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (17 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

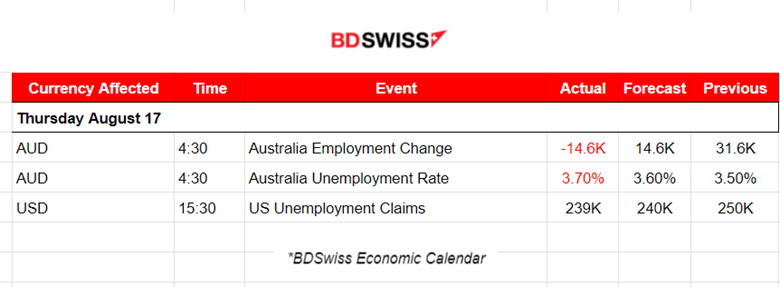

The Labour data for Australia was reported at 4:30 and showed that Australia’s unemployment rate has risen to 3.7% for July, up from 3.5% in June. Meanwhile, the employment change was actually negative, -14.6K, which is a huge decline. The AUD had depreciated greatly at that time but the shock was not great. The AUDUSD only fell near 30 pips before retracing back to the mean.

- Morning–Day Session (European and N.American Session)

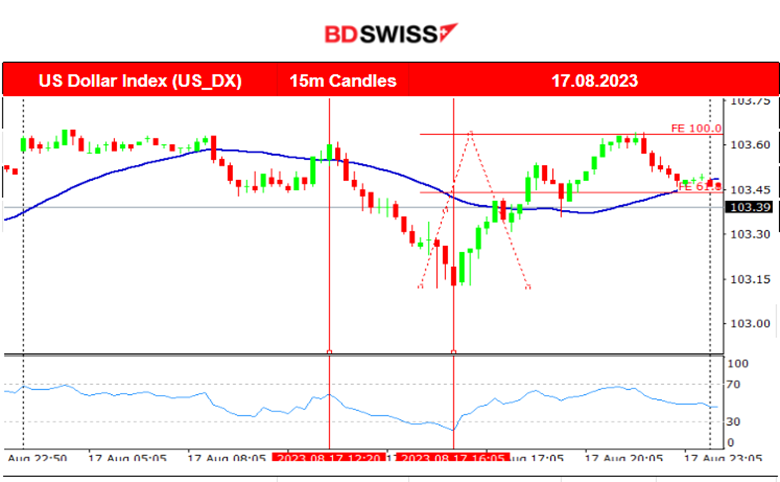

The U.S. Unemployment Claims were released at 15:30, showing roughly the same figure, just 1K off the expected figure and a decrease of 11K from the previous week’s revised level. The impact on the market was minimal.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

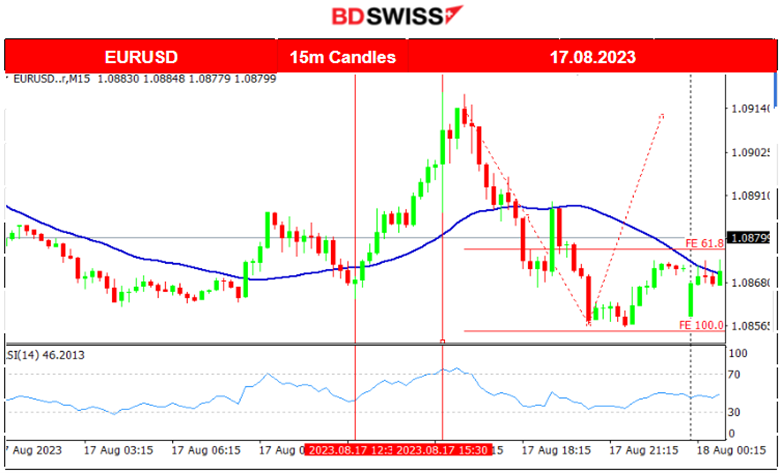

EURUSD (17.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The volatility started to kick in after 10:00 when the European Session is active and the pair was moving to the upside steadily until the scheduled figure releases at 15:30. The impact from the Jobless Claims was low and only a short shock took place at that time without pushing the pair to any other direction. The pair found resistance at 1.09175 before reversing to the downside after the news. After a rapid movement downwards, it found support 1.08560 before retracing again to the mean.

___________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

NAS100 clearly shows high volatility, just like the other benchmark U.S. indices. The indices have been on the upside for quite a while recently but eventually, the U.S. stock market was hit by the Fitch and Moody’s Ratings causing it to crash intraday several times. The downturn continues as the market continues to underperform breaking important support levels. It might be a seasonal effect. After August, the price path could see drastic changes until the end of the year.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The path is steady and under the 30-period Moving Average. It is currently testing the 78.60 USD/b level. The downward trend was short-term and it seems that it ended somehow. However, the 30-period MA has only now shown a slowdown and volatility is still expected to be high. This means that if the path is sideways, price deviations from the mean are expected to be high.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

As the USD is gaining strength, we see Gold moving lower and lower. A downtrend is apparent, the MA is obviously going down. It broke the 1900 USD/oz and even dropped until 1896 USD/oz before reversing quickly on the 15th of August. As the USD strengthened more, Gold dropped further to the strong support of 1890 USD/oz which broke and the price eventually moved even lower. No signs of reversing are apparent.

______________________________________________________________

News Reports Monitor – Today Trading Day (18 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning–Day Session (European and N.American Session)

The U.K. Retail Sales Change was actually negative, a decline that beat expectations causing the GBP to depreciate at the time of the release. GBPUSD fell more than 30 pips.

General Verdict:

____________________________________________________