PREVIOUS TRADING DAY EVENTS – 03 May 2023

Announcements:

Inflation in Australia is at 7% and policymakers of course stated that it’s still too high. A further increase in interest rates is inevitable if inflation is ever going to return to the target level. This unexpected rise caused the AUD to appreciate highly.

“Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range,” said Governor Philip Lowe.

“Given the importance of returning inflation to target within a reasonable timeframe, the Board judged that a further increase in interest rates was warranted today.”

Inflation is expected to slow by 4.5% this year, compared to the previous forecast of 4.75%.

“This is an awfully long time for inflation to exceed target, and runs the risk that higher inflation expectations will become embedded,” said Sean Langcake, Head of Macroeconomic Forecasting for BIS Oxford Economics.

“This would ultimately lead to even higher interest rates, which the Bank is looking to avoid as it seeks to keep some momentum in the economy”.

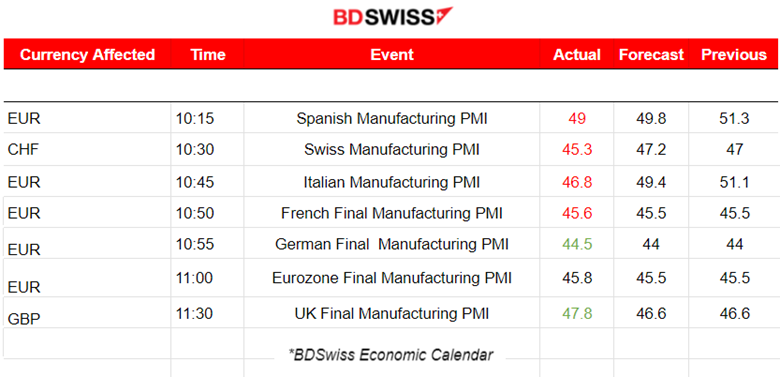

“This decline has been fairly broad-based across the eurozone, with regional PMI indices in France and Italy also showing a drop in output, while output in Germany and Spain was nearly stagnant,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

The downturn in the U.K. manufacturing sector continued at the start of the second quarter. British factory output and new orders contracted.

Source: https://www.reuters.com/markets/europe/euro-zone-factory-downturn-deepened-april-pmi-2023-05-02/

The Central Bank is expected to raise its benchmark overnight interest rate by another 25 basis points to the 5.00%-5.25% range on Wednesday, before potentially pausing hikes.

“The decline in the ratio of job vacancies to unemployment in the last three months represents a reduction in the excess demand for labour that will be welcomed by the Fed,” said Conrad DeQuadros, senior economic advisor at Brean Capital in New York.

U.S. Stocks were trading lower. The dollar fell against a basket of currencies. U.S. Treasury prices rose.

According to Reuters, Nonfarm payrolls are expected to have increased by 179,000 jobs last month – the smallest gain since December 2020, after rising 236,000 in March.

______________________________________________________________________

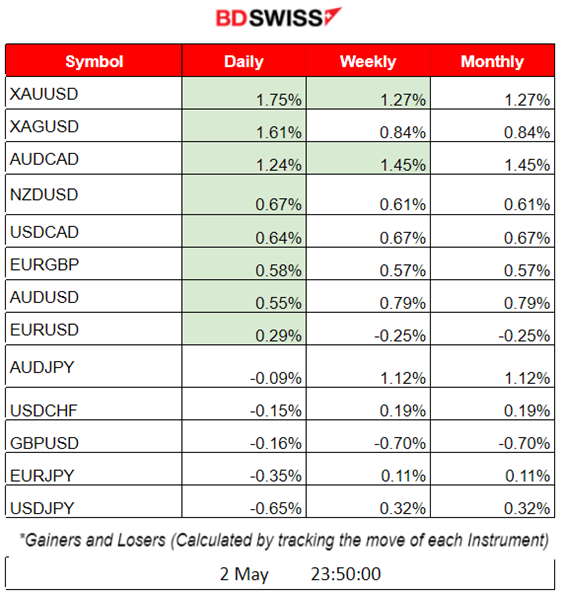

Summary Daily Moves – Winners vs Losers (02 May 2023)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (02 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

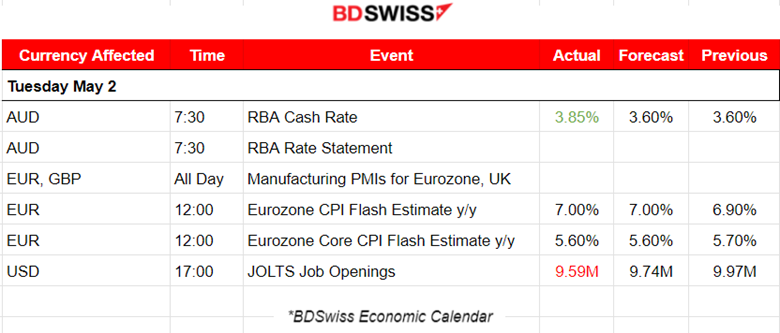

During the Asian Session at 7:30, the RBA Cash Rate and Rate Statement took place causing intraday shock to the AUD pairs. Policymakers hiked to 3.85% from 3.6%. AUDUSD moved more than 60 pips upwards since the AUD appreciated greatly at that time.

- Morning – Day Session (European)

The PMIs for the Manufacturing sector were released affecting major pairs, like the EUR and GBP.

EU: The manufacturing sector experienced a sharp deterioration in operating conditions. New orders in Eurozone manufacturing declined at the fastest rate in four consecutive months.

UK: Manufacturing was down to a three-month low of 47.8 in April, from 47.9 in March, but above the earlier flash estimate of 46.6.

At 12:00, the inflation-related data, CPI Flash Estimate and Core CPI Flash Estimate were released as per estimates. The EUR was not affected significantly at that time.

At 17:00, the USD pairs experienced an intraday shock as USD depreciated after the important labour data were released. JOLTS Job Openings data showed 9.59M Jobs. The figure was lower than estimated.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (02.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD moved lower after the European Markets opened below the 30-period MA. After the U.S. JOLTS Job Openings, the USD was affected pushing the pair upwards over the MA.

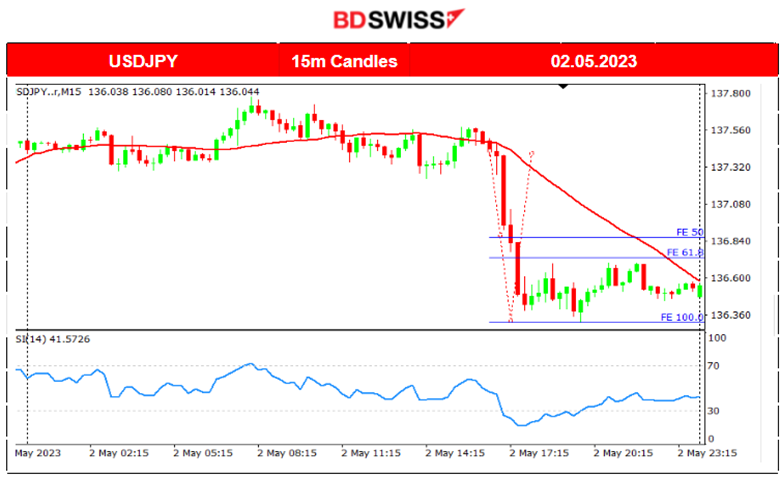

USDJPY (02.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

USDJPY was experiencing low volatility the whole trading day until the U.S. JOLTS Job Openings figure was released. The USD depreciation caused the pair to drop more than 90 pips.

This drop event was in line with the estimate that the USDJPY cannot move upward for a long time due to the JPY depreciation that took place after the BOJ news. A retracement was expected, as per the 4H chart below. The USDJPY went back to the 61.8% Fibo Level.

USDJPY 12 April – 02 May Chart Summary

Server Time / Timezone EEST (UTC+03:00)

AUDUSD (02.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair experienced an intraday shock with the release of the RBA cash rate at 7:30. The AUD experienced an appreciation and the AUDUSD jumped more than 85 pips. Retracement followed after some time, finalising during the European session.

Trading Opportunities:

Related TradingView analysis with a focus on EURAUD:

https://www.tradingview.com/chart/EURAUD/osK4814G-EURAUD-back-after-AU-hike-02-05-2023/

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

U.S. Stocks experienced a decline yesterday with the release of the U.S. JOLTS Job Openings figure. The Stock market was moving sideways the last couple of days. RSI showed signs of the index price declining. With the job openings figure released yesterday, all main U.S. indices dropped. The NAS100 fell more than 170 USD before retracing to the mean the same day, pushing the index below the 30-period MA officially signalling the end of the uptrend.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

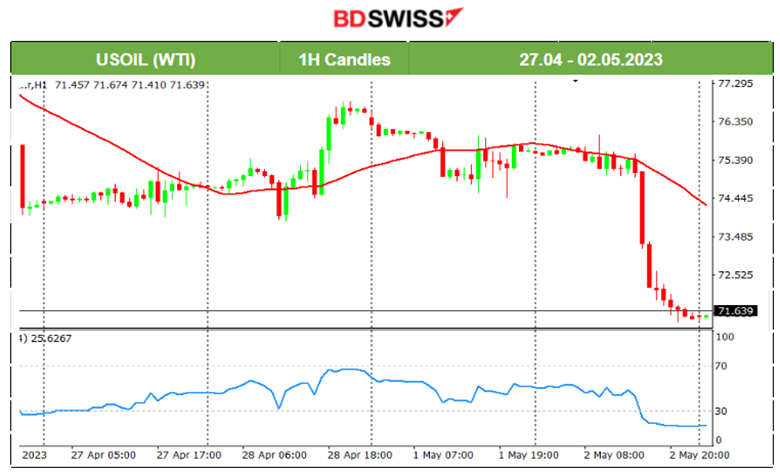

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After settling around the 30-period MA and the mean level of 75.5 USD, Crude moved significantly yesterday around 15:30. It started falling rapidly by more than 3.8 USD and experienced no retracement.

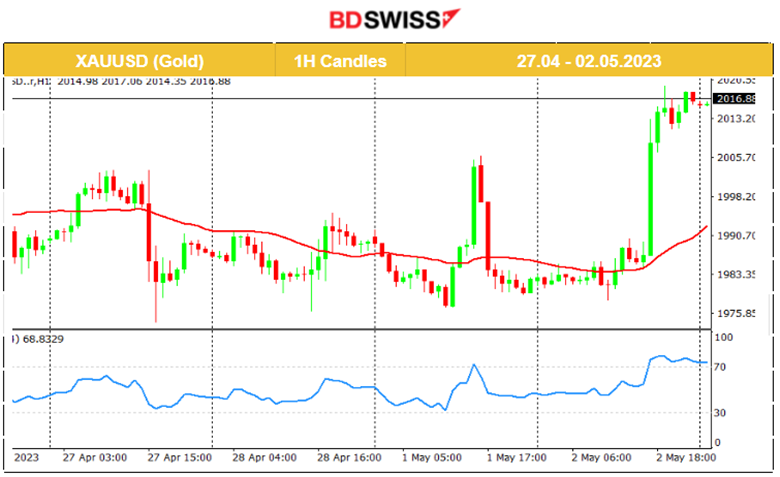

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was moving in a sideways channel around the 30-period MA. It was experiencing high volatility and was testing both resistance and support levels. After the job-related data release at 17:00, the USD was affected with depreciation and Gold jumped more than 30 USD, breaking the 2006 USD support up to nearly 2017 USD.

______________________________________________________________

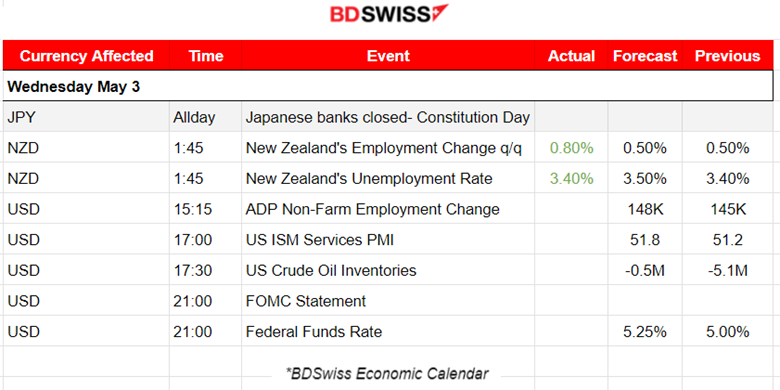

News Reports Monitor – Today Trading Day (02 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

During the Asian Session, New Zealand’s Labour data came out. The unemployment rate remained unchanged at 3.4% and employment change for the last quarter was more than expected, at 0.8%. NZD experienced a small shock at that time. NZDUSD moved rapidly upwards before retracing immediately.

- Morning – Day Session (European)

At 15:25, the U.S. ADP Non-Farm Employment Change figure will be released and will probably have an impact on the USD pairs with an intraday shock. However, the Services PMI and FOMC statement, along with the Fed Rate, are about to be released too and depending on what the market feels is more important there is going to be huge movement. The market might eventually wait for the Fed Rate before moving significantly.

General Verdict:

______________________________________________________________