PREVIOUS TRADING DAY EVENTS – 11 April 2023

Announcements:

Policymakers “commented that recent developments in the banking sector were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring and inflation,” the minutes said.

Economists estimate that the Fed will proceed with a rate increase followed by an extended pause. However, credit tightening on the economy might be a problem.

Yearly inflation still remains high. It’s the first time in over two years that the core came in above the overall measure, which was up by 5%. The Fed is closely monitoring the economy for signs that the recent banking turmoil still has an effect. The labour market looks strong still. Taking everything into consideration, the Fed will probably raise interest rates at least once more.

“A strong disinflationary push is expected from shelter over the summer. Even so, given ongoing strength in the labor market and the OPEC+ cuts — as well as pressure from labor-intensive services industries — we expect the FOMC to hike rates by another 25 basis points when it meets next month.”

— Jonathan Church and Stuart Paul, economists

______________________________________________________________________

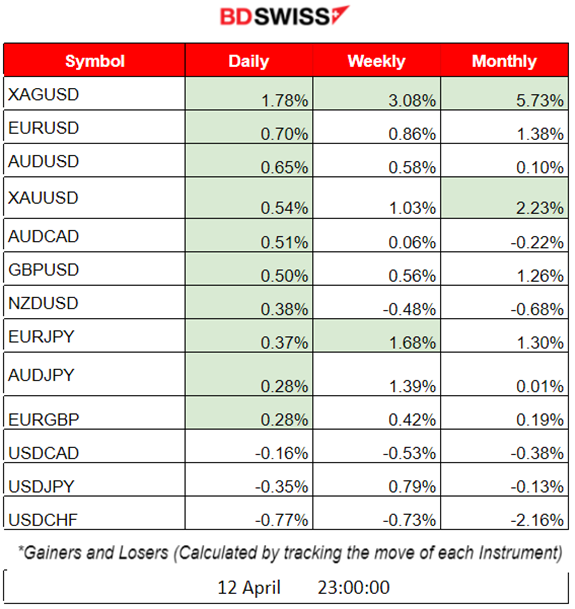

Summary Daily Moves – Winners vs Losers (12 April 2023)

______________________________________________________________________

News Reports Monitor – Previous Trading Day (12 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news. No important scheduled releases.

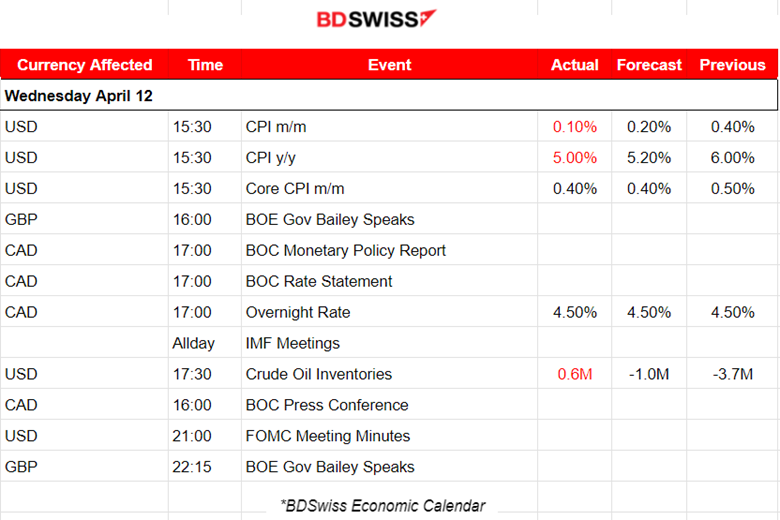

- Morning – Day Session (European)

Important figure releases started at 15:30, with U.S. inflation-related data (i.e. Core CPI). The market experienced a shock since inflation dropped significantly. In March, it dropped to 0.10%, which was less than expected, keeping the yearly rate at 5%. These figures caused the USD to drop greatly. EURUSD experienced more than 60 pips rapid upward movement intraday.

The Bank of Canada (BOC) released its monetary policy report and rate statement. The rate was kept at 4.5%. At that time, a small intraday shock brought the USDCAD down more than 25 pips. The USD-related data had a larger impact with higher deviations.

The U.S. Crude Oil inventories report was released at 17:30. The change was positive against expectations but relatively small, at 0.6M. With the U.S. inflation-related data release, the price of oil moved significantly higher reaching more than 83 USD/barrel.

- Evening – Night Session (N. American)

The FOMC statement release at 21:00 had no significant impact. The market responded greatly to the U.S. CPI change release, leaving no room for FOMC to have any effect.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 10th of April, the EURUSD pair moved further down when the expectation of future rate hikes by the FED peaked. USD appreciated greatly intraday when it moved downwards rapidly. It started to retrace on the same day, eventually leading to form a reversal as it crossed the 30-period MA on the 11th of April and continued to move upwards. The market experienced another shock on the 12th of April, with the release of the significantly lower inflation figures. The expectations changed causing the USD to depreciate and move the pair further upwards.

EURUSD (12.04.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was experiencing low volatility during the Asian and the early European Sessions, as the market was expecting the release of the U.S. CPI data. Inflation data was released at 15:30 causing the USD to depreciate greatly.

Trading Opportunities

The intraday shock caused by the CPI-related figures opens the opportunity for a retracement. The pair eventually found resistance and stopped the upwards movement. The Fibonacci expansion tool could be used to identify where the market could retrace, as shown below. The least is 61.8% of the total move.

____________________________________________________________________

EQUITY MARKETS MONITOR

US30 (Dow Jones) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

US30 has been on an upward trend path since the 10th of April. It is moving above the 30-period MA, reaching higher levels. On the 12th of April, the U.S. inflation-related data caused high volatility. The index moved in both directions and eventually settled downwards. U.S. stocks have been experiencing remarkable resilience during the banking crisis and the rate hikes. Even though the index moved below the MA, it is probably not a signal for a downtrend.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

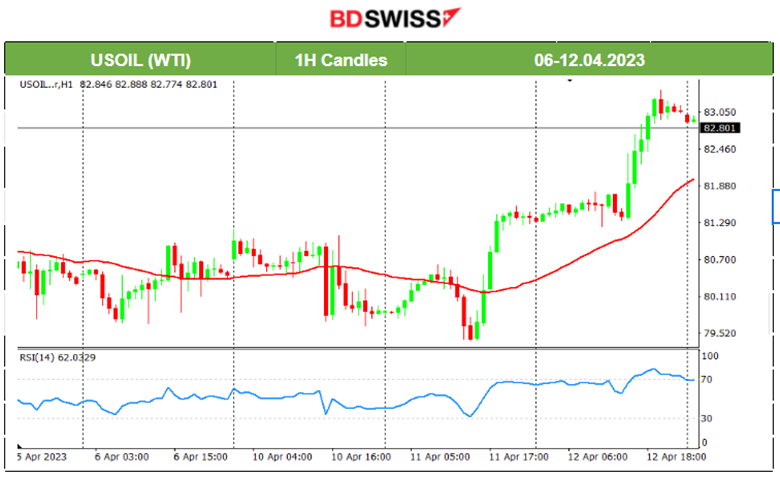

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude’s price started to deviate from the 5-day mean (30-period MA) over 1 USD deviation. We see that on the 11th, there was a reversal taking place that held until the end of the trading day, the 12th of April. Yesterday, oil moved further upwards with the U.S. CPI data release and the USD depreciation. The OPEC+ announced that production cuts are expected to take place in May. A further price increase is expected as we move towards May. However, oil is quite volatile and the path upwards will probably not be direct but rather around the mean (MA) and with large deviations from it.

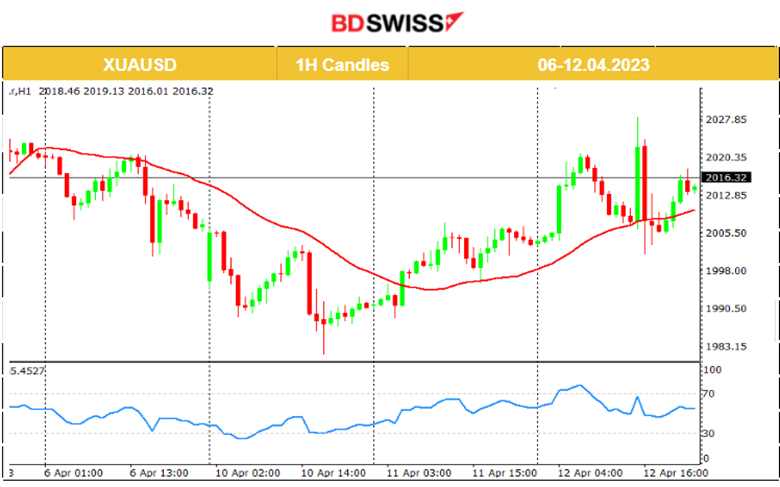

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Lately, the main driver of the path of Gold was USD. Important news and figure releases affecting the USD caused Gold to move accordingly. We see a similar reversal with the EURUSD happening on the 11th of April when Gold crosses the 30-period MA and moves further upwards on a medium-term upward trend.

On the 12th, the CPI figure releases had their high impact, causing Gold to jump and soon reverse intraday, retracing back to MA. This was in line with the indications of the RSI that had lower highs that day while the price had higher highs.

______________________________________________________________

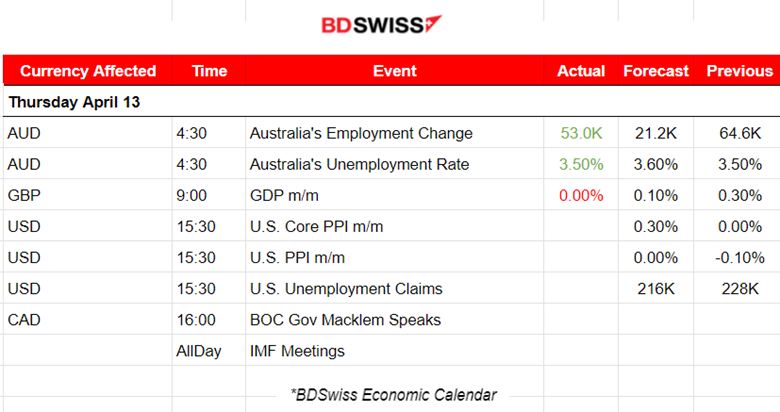

News Reports Monitor – Today Trading Day (13 April 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 4:30, Australia’s Employment Change and Unemployment Rate were released. The AUD/USD pair has climbed more than 25 pips since the reports show that the Australian economy added 53K jobs in March. The number is higher than the consensus of 20K but lower than the previous release of 64.6K. Additionally, the Unemployment Rate remained unchanged at 3.5% but lower than the 3.6% estimates.

- Morning – Day Session (European)

At 9:00, there was no significant impact on the GBP from the release of the monthly GDP figure which was reported to be 0%.

At 15:30, we’re expecting the release of the U.S. PPI-related data, which are expected to be higher, and the U.S. Unemployment claims. At that time, the USD will be affected, probably causing an intraday shock.

General Verdict:

______________________________________________________________