PREVIOUS TRADING DAY EVENTS – 10 August 2023

Now, we have an outlook of a moderate inflation rate, together with a cooling labour market.

“Significant progress on the inflation front has been made, a persistent trend of disinflation is evident,” said Sung Won Sohn, a finance and economics professor at Loyola Marymount University in Los Angeles. “It is time for the central bank to stop its campaign to beat inflation, it should wait and see for a while.”

“Consumers are seeing broad-based relief on prices as the economy operates in lower gear and a small margin of slack opens in the labor market,” said Bill Adams, chief economist at Comerica Bank in Dallas.

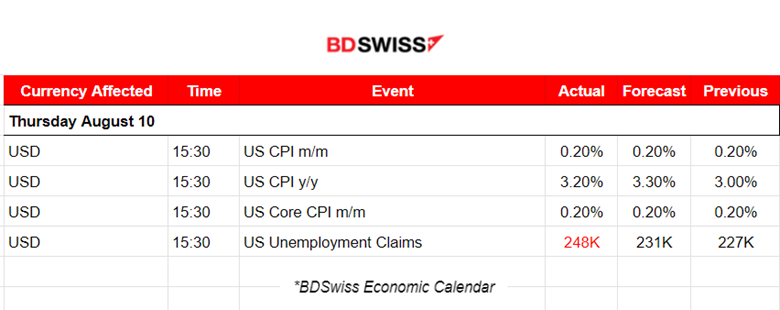

The CPI report is one of two before the Fed’s Sept. 19-20 policy meeting. The majority of the financial market participants expect the central bank to leave its policy rate unchanged at that meeting.

Unemployment claims were reported higher than expected, adding to the idea of the labour market cooling.

______________________________________________________________________

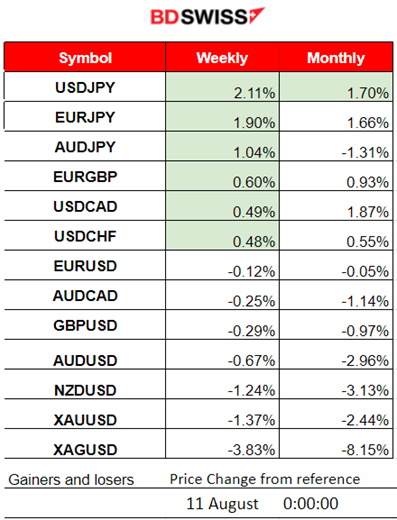

Winners vs Losers

______________________________________________________________________

News Reports Monitor – Previous Trading Day (10 August 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or any special scheduled releases.

- Morning – Day Session (European)

At 15:30, the CPI figures were released showing that the annual inflation rate actually increased. The CPI rose 0.2% in July on a seasonally adjusted basis, which is the same increase as in June. The market reacted with an initial shock for the USD pairs, with USD depreciation and later an appreciation.

U.S. Unemployment Claims were reported higher than expected, signalling that rate hikes are having a strong impact on the labour market; however, not strong enough. With the inflation rate reported roughly unchanged, it increased the probability of another hike, causing the dollar to strengthen.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

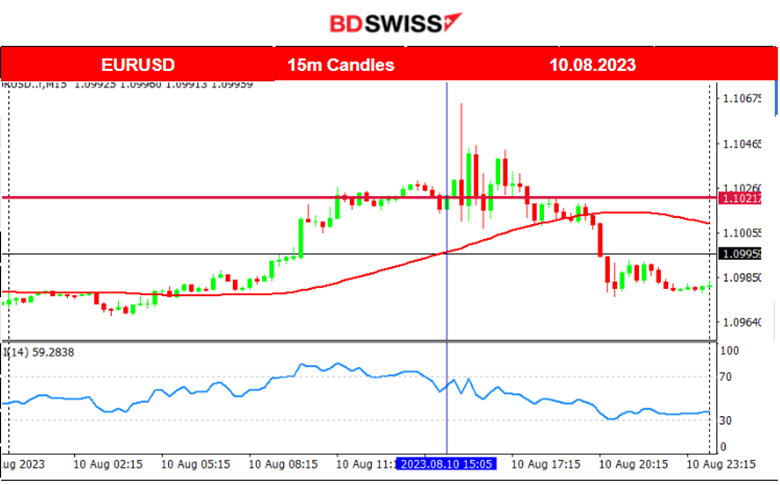

EURUSD (10.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD started to move to the upside early in anticipation of the lower-than- expected U.S. CPI changes. The inflation rate was eventually reported lower than expected but higher than the previous figure. The market reacted with an initial intraday shock, causing the dollar to weaken and, thus, a jump in EURUSD, followed by an immediate Dollar strengthening. The uncertainty finally faded away as the market decided to act in favour of the Dollar and its strengthening finally caused the pair to drop further by the end of the trading day.

USDJPY (10.08.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair continued to move to the upside since the USD strengthened overall yesterday, after the CPI data release. In addition, it is quite important to note that the JPY is also experiencing depreciation, as per the EURJPY and AUDJPY charts, where we see the pair moving higher in all cases.

___________________________________________________________________

EQUITY MARKETS MONITOR

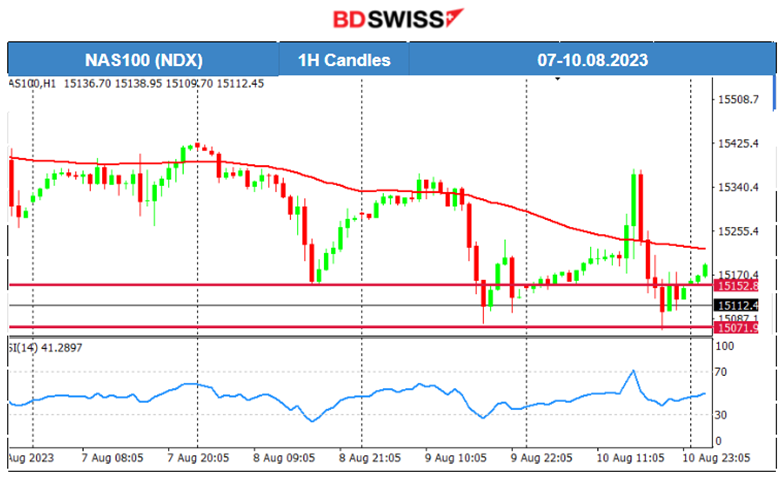

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

After the recent announcements from Fitch Rating and Moody’s, the U.S. stock market suffered a downtrend. The benchmark U.S. indices are moving to the downside but at a highly volatile pace. On every recent market/exchange opening, we see the NAS100 moving rapidly to the downside before retracing back to the mean. The Inflation-related news, released yesterday at 15:30, caused some volatility but the index actually experienced huge moves after the NYSE opening at 16:30. Still remaining below the 30-period MA and testing the support near 15072 USD.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

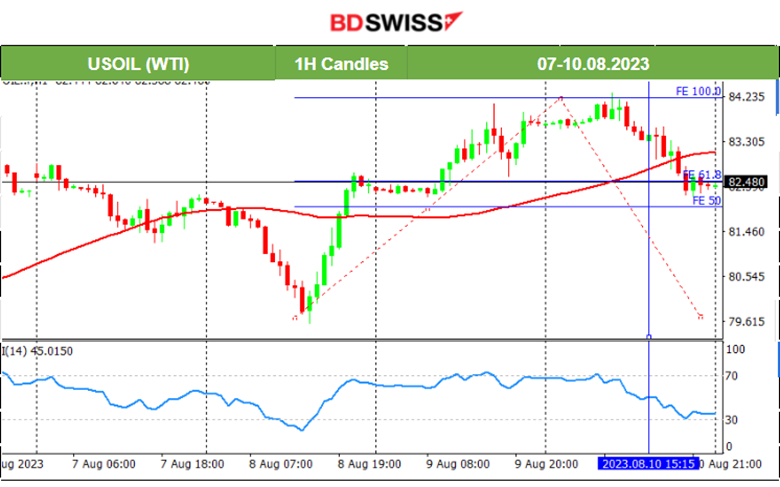

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude is moving higher and higher with the recent announcements for production cuts. It is currently breaking important resistance levels but shows signs of a slowdown. The RSI was in the overbought area and some reversal was expected. Eventually, a retracement took place back to the mean. Crude is probably on a sideways path even though we know that there are fundamental pressures actually pushing it to the upside.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD was gaining more and more strength causing Gold to move lower and lower, breaking important resistance levels. It is currently below the 30-period MA and is moving to the downside on a clear downward trend. Yesterday, the U.S. CPI changes caused a shock for the USD pairs and Gold, pushing it upwards at first, as the USD had initially depreciated and later caused a drop as the USD found its strength until 1911 USD/oz. Currently, it is retracing back to the mean.

______________________________________________________________

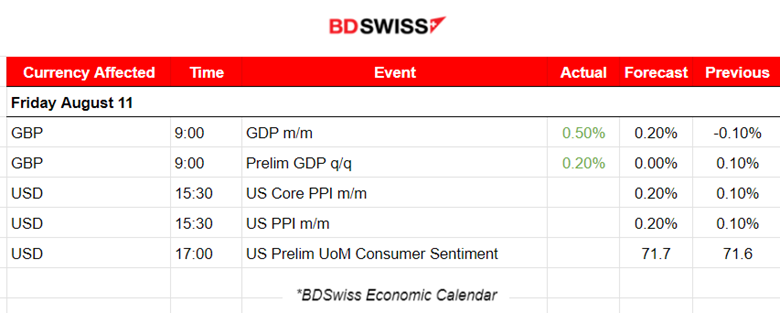

News Reports Monitor – Today Trading Day (11 Aug 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements or any special scheduled releases.

- Morning – Day Session (European and N.American Session)

The monthly real Gross Domestic Product (GDP) is estimated to have grown by 0.5% in June 2023, following a fall of 0.1% in May 2023 and a growth of 0.2% in April 2023. Looking at the broader picture, the GDP has shown 0.2% growth in the three months till June 2023. The market reacted with a low-level intraday shock and some GBP appreciation that lasted only for a while this morning.

The PPI data is about to be released at 15:30, and will potentially cause a low-impact, low-level intraday shock for the USD pairs. The expectation for inflation-related data is again that the figures will be reported higher but surprises are probable to take place.

The U.S. Consumer Sentiment report is expected to be released at 17:00, usually having an effect on USD pairs but not a significant one.

General Verdict:

______________________________________________________________