PREVIOUS TRADING DAY EVENTS – 09 May 2023

Announcements:

Biden demanded that Congress raises the debt ceiling unconditionally to avoid a default and the house speaker Mr. McCarthy raised the argument that spending limits should be imposed.

“I made clear during our meeting that default is not an option,” Mr Biden said after the session in the Oval Office. “I repeated that time and again. America is not a deadbeat nation. We pay our bills and avoiding default is a basic duty of the United States Congress.”

He added: “I’m prepared to begin a separate discussion about my budget and spending priorities but not under the threat of default.”

Mr McCarthy said: “I didn’t see any new movement”. He added that he had asked Mr Biden “numerous times” if there were places in the federal budget where they could find cuts. “They wouldn’t give me any,” he said.

Tuesday’s discussion resulted in no agreement. Eventually, both the White House and Mr McCarthy dismissed the idea of a short-term debt ceiling increase at the moment until more discussions take place.

Source: https://www.nytimes.com/live/2023/05/09/us/debt-ceiling-biden-mccarthy

Russia’s Energy Ministry said that the nation’s oil-output cuts almost reached the targeted level in April. Cuts were announced in March causing a shock in the market, expecting the effects to take place in May. Yet, so far, crude flows from ports do not show strong evidence of output cuts.

According to Bloomberg, Russia’s four-week average seaborne shipments rose to the highest in the period until May 5th.

_____________________________________________________________________

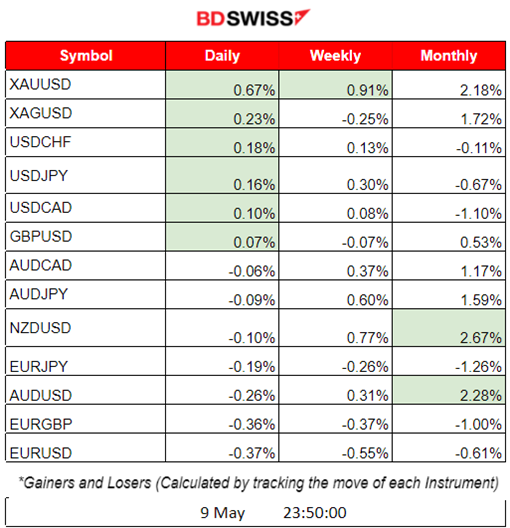

Summary Daily Moves – Winners vs Losers (09 May 2023)

______________________________________________________________________

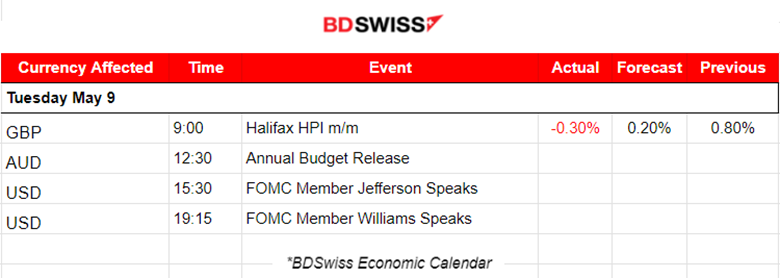

News Reports Monitor – Previous Trading Day (09 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

The UK’s Halifax HPI M/M figure indicates that the U.K. house prices fell for the first time this year, according to a measure released by Halifax as mortgage rates rise.

FOMC: “A sound and resilient banking system”.

There were no other important figure releases.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (09.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Mainly driven by the USD, the pair moved in the opposite path of the DXY. It started the downward path during the European session and retraced eventually with a steady pace.

EURGBP (09.05.2023)Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURGBP experienced an intraday downward trend yesterday. It started to move steadily downwards at midnight, below the 30-period MA, while sliding more than 40 pips, resulting in closing the trading day lower overall without any retracement. More activity is expected to be seen today, the 10th of May, before the major scheduled releases during the European Markets opening with retracement possibly to take place.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The USD gained after the recent U.S. labour data and Stocks gained on the 5th of May. The market settled high and remained on a sideways path experiencing low volatility with the index finding support at 13200 USD.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

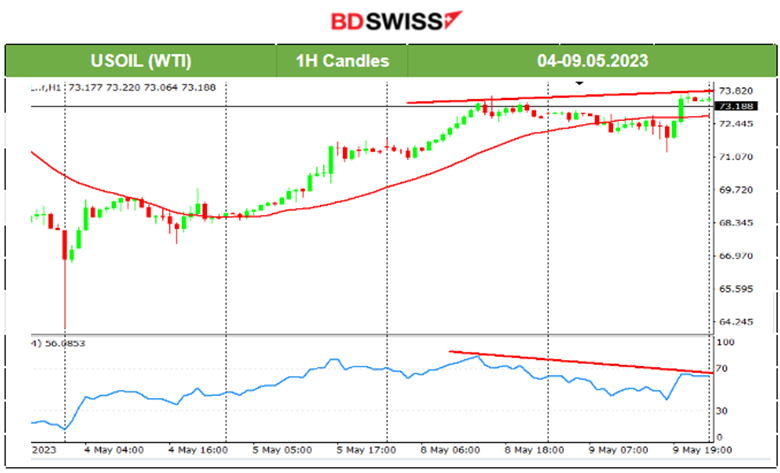

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude experienced a downward movement that ended on the 4th of May. Since then, it reversed moving above the 30-period MA and continued with an upward trend. Yesterday, it moved around the 30-period MA but higher overall.

RSI: Lower Highs, Price: Higher Highs, a bear divergence indicates a possible drop to 72 USD/barrel.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Investor’s risk-off mood pushes Gold higher. On the 5th of May, Gold moved lower and under the 30-period MA, ending the upward trend with the NFP data release. A retracement followed with the price showing less volatility and moving steadily on a short-term upward trend so far after crossing over the 30-period MA.

______________________________________________________________

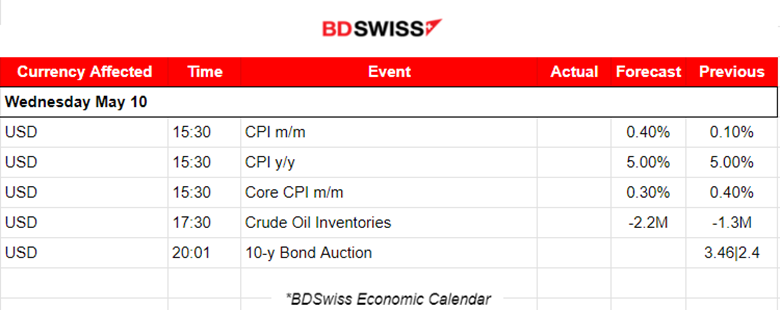

News Reports Monitor – Today Trading Day (10 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news releases and no major scheduled figure releases.

- Morning – Day Session (European)

Inflation-related data for the U.S. are about to be reported at 15:30. Expected monthly CPI change is higher. Yearly calculated inflation expectations show the inflation rate unchanged while Core CPI is expected lower.

With the Fed now declaring that it finished with rate hikes, the inflation data will show if indeed their actions had an impact on prices. If not, then we are expecting a surprise from the Fed for the next rate decision. We will probably see a great impact if expectations are not met and the USD pairs experience an intraday shock.

U.S. Crude oil inventories have been showing fewer and fewer negative changes, meaning that more oil is sold as demand kicks in. Nevertheless, the market is expecting a higher negative increase reported this time, -2.2M versus the previous -1.3M.

General Verdict:

______________________________________________________________