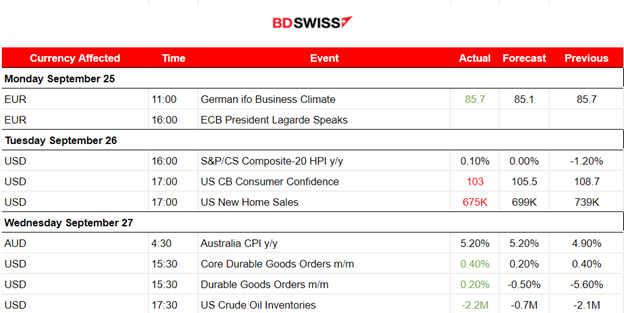

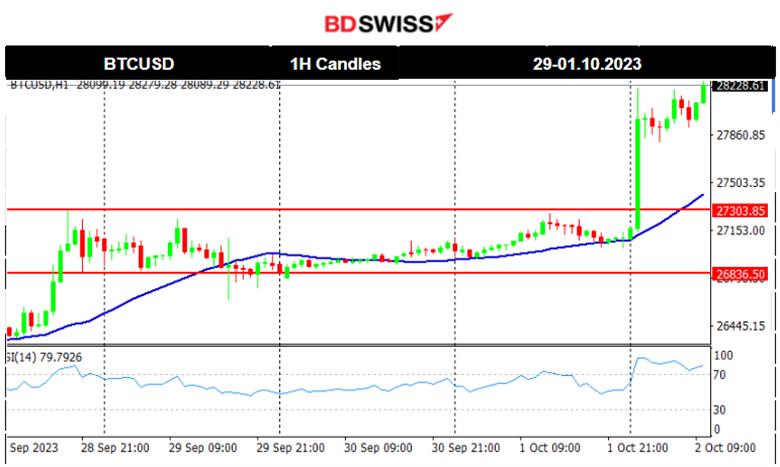

PREVIOUS WEEK’S EVENTS (Week 25 – 29 Sep 2023)

Announcements:

German Economy

German business sentiment worsened in September, falling for the fifth month in a row and underlining recession fears in the Eurozone’s largest economy. The Ifo Institute’s business climate index was reported at 85.7, a decline from a revised August figure of 85.8 but above the 85.2 forecast. This shows a quite weak economy, economists say.

The German economy is risking a second recession in a year after shrinking in the last quarter of 2022 and the first quarter of 2023.

U.S. Economy

The reports last week showed a drop in U.S. consumer confidence to a four-month low in September. The second straight monthly decline in confidence reported by the Conference Board reflects higher interest rates and concerns about the political environment.

Prices are still high despite the data suggesting a significant slowdown in inflation. High-interest rates and political debates are raising concerns and having an impact on how people spend.

The Federal Reserve last week left its benchmark overnight interest rate unchanged at the 5.25%-5.50% range. Though consumers continued to fret over the higher cost of living, their inflation expectations over the next year remained stable.

U.S. Durable Goods Orders reports show that orders rose in August due to an increase in machinery and other products with the rise in business spending on equipment. There is an apparent resilience in both business investment and the overall economy, despite the Federal Reserve’s aggressive monetary policy tightening. The resilience of business investment suggests that the Fed managed to avoid an upcoming recession.

Durable goods inventories rose 0.2%, while unfilled orders increased 0.4% confirming the resilience in the manufacturing sector. Core capital goods shipments rebounded 0.7% after falling 0.3% in July. Shipments of nondefense capital goods soared 1.2%, reversing the prior month’s decline.

The U.S. Economy is growing at a stable and good pace as reports suggest. The GDP growth for the second quarter and activity appears to have accelerated. The markets are however facing a sticky inflation but a strong labour market with the number of Americans filing new claims for unemployment benefits rising slightly. Expectations for future rate hikes are rising.

The economy remains resilient, given how much the Fed has raised rates according to the opinion of many economists. The reports show that the U.S. Gross Domestic Product (GDP) increased at an unrevised 2.1% annualised rate last quarter, in line with economists’ expectations. Labour market resilience is apparent. Jobless claims have this month stayed low, at 204K.

Consumer spending increased by 0.4% and the Core Personal Consumption Expenditures (PCE) Price index was reported lower than expected change. It is signalling that the underlying U.S. inflation moderated in August.

The PCE price index, excluding the volatile food and energy components, edged up 0.1% last month. That was the smallest rise since November 2020 and followed a 0.2% advance in July.

The University of Michigan showed that consumers’ 12-month inflation expectations fell to 3.2% for the month, the lowest since March 2021, from 3.5% in August. Consumers’ long-run inflation expectations slipped to 2.8% from 3.0% last month.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose 0.4% last month after surging 0.9% in July. It is actually cooling.

US Congress avoided a government shutdown, which would place thousands of federal employees on furlough without pay and suspend various government services, as they came to a last-minute deal as per the reports today from various sources.

Canada Economy

According to the Gross Domestic Product (GDP) report for Canada, GDP remained unchanged in July as the manufacturing sector posted its biggest decline in more than two years, but it most likely ticked up 0.1% in August according to Statistics Canada.

The economy has been slowing down after 10 interest rate hikes since early last year.

The manufacturing sector shrank by 1.5% over June, the biggest month-on-month drop since April 2021, largely due to firms drawing down their inventories.

_____________________________________________________________________________________________

Inflation

Australia:

Australia’s inflation was reported higher for August, in line with expectations, putting pressure on the central bank to hike interest rates next month.

Australia’s monthly consumer price index (CPI) rose 5.2% in the year to August, up from 4.9% the previous month but the increase was mostly driven by a surge in fuel prices due to global supply factors. It is expected that the bank will hike one more time before the end of the year, likely in November, after the release of the third-quarter inflation report.

_____________________________________________________________________________________________

Sources:

https://www.reuters.com/markets/europe/german-business-sentiment-worsens-september-ifo-2023-09-25/

https://www.reuters.com/markets/us/us-consumer-confidence-ebbs-september-2023-09-26

https://www.reuters.com/markets/us/us-durable-goods-orders-unexpectedly-rise-august-2023-09-27/

https://www.bbc.com/news/world-us-canada-66973976

https://www.reuters.com/markets/canada-economy-stalled-july-most-likely-grew-by-01-aug-2023-09-29/

https://www.reuters.com/markets/australian-inflation-picks-up-aug-fuel-prices-jump-2023-09-27

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 25 – 29 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

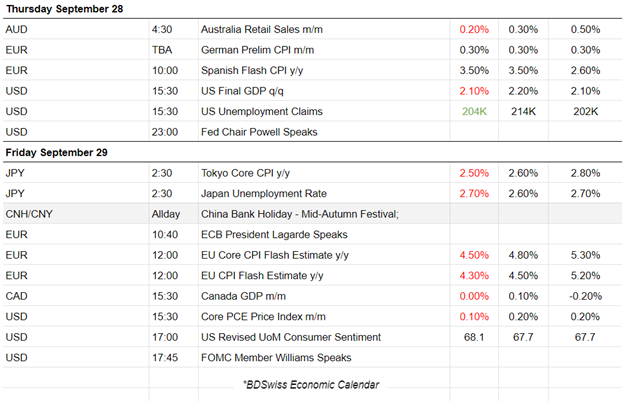

DXY (US Dollar Index)

Overall, the DXY moved sideways overall during the previous week. However, the path was volatile. An upward trend was observed at the beginning that ended on the 27th when it found resistance at 106.85. After that the DXY moved downward crossing the 30-period MA on its way down and moving within a channel until the 29th when it eventually reversed.

EURUSD

The pair experienced high volatility last week with reversals. It started to move to the downside significantly below the 30-period MA until it found support at near 1.04900. After that, a reversal occurred. The pair started to move upwards, crossing the MA on its way up until it found resistance at near 1.06160 before retracing to the mean. Overall we see this sideways but volatile path around the MA.

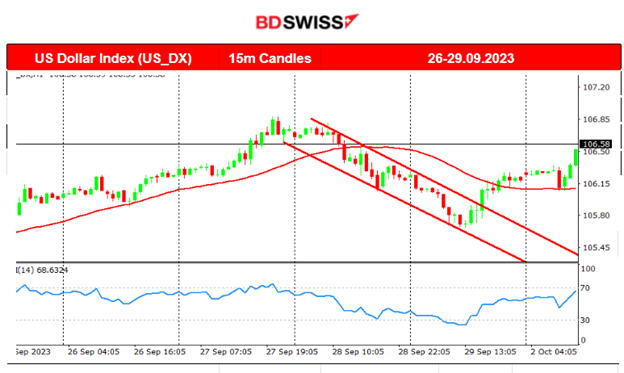

CRYPTO MARKETS MONITOR

BTCUSD

The previous week Bitcoin Jumped near 800 USD finding resistance at 27300 before retracing to the 61.8 Fibo level (around 26850) on the 29th of September. After that, it experienced low volatility during the weekend staying in range. Today a sudden jump is observed at more than 900 USD after breaking the resistance at 27300.

_____________________________________________________________________________________________

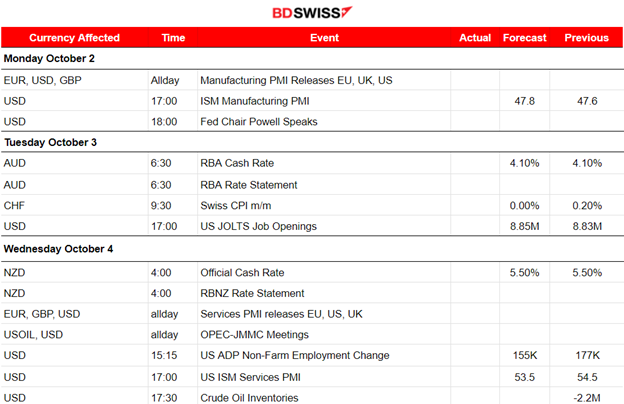

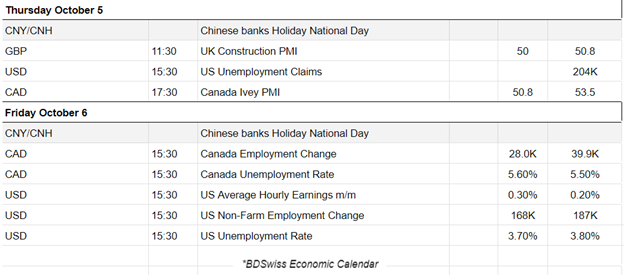

NEXT WEEK’S EVENTS (Week 02 – 06 Oct 2023)

Services and Manufacturing PMI releases next week and the markets will probably experience volatility during the releases.

RBA and RBNZ will decide on rates.

Important labour market-related data releases: U.S. JOLTS report, employment and unemployment rate announcements for both the U.S. and Canada.

OPEC-JMMC Meetings are taking place and could shake the oil market.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

A strong resistance near 94 USD/b stopped Crude’s momentum and served as the end of the shock upwards. Soon a retracement followed with a drop reaching even below 91 USD/b on the 28th Sept. Crude’s price continued on the 29th Sept. to move with high volatility, breaking the support at near 90.5 USD/b and moving further to the downside. 89.70 USD/b serves now as an important support level.

Gold (XAUUSD)

Gold has been moving to the downside significantly. It keeps on breaking important support levels while it is moving on a clear downtrend. Even though the RSI is slowing down staying close to the 30 level, there is no significant data to suggest that there will be a reversal or even halt.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

This week the index fell to its lowest at 14440 following a long period of a downward path. All benchmark indices were following the same path breaking more and more important support levels. Eventually, the path changed and it coincided with the signals given by the RSI, of an oversold territory. On the 27th, the market reversed and started to move to the upside aggressively breaking resistance levels such as the 14660 showing a strong momentum upwards. It is more clear that the path remains on an upward channel. The other U.S. indices are facing slightly different paths, more sideways as it seems instead of upwards.

______________________________________________________________