PREVIOUS TRADING DAY EVENTS – 28 Sep 2023

The markets are facing a sticky inflation and strong labour market with the number of Americans filing new claims for unemployment benefits rising slightly. Expectations for future rate hikes are rising.

“The big news is not that nothing has changed, but that the economy remains resilient, inflation remains elevated and the Fed’s worst-case scenario, stagflation, has been avoided for now,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance in Charlotte, North Carolina. “Given how much the Fed has raised rates, it’s impressive that the economy is still growing at this pace.”

The reports show that the U.S. Gross Domestic Product (GDP) increased at an unrevised 2.1% annualised rate last quarter, in line with economists’ expectations. The economy is expanding at a pace well above what Fed officials regard as the non-inflationary growth rate of around 1.8%.

“Overall it now looks like there is more ‘excess saving’ currently left over for consumers than we had seen before the latest revisions, which is a favourable sign for the economy,” said Daniel Silver, an economist at JPMorgan in New York. “Upward revisions to recent data on corporate profits also are a favourable sign with respect to the durability of the expansion.”

Labour market resilience is apparent. Jobless claims have this month stayed low, at 204K.

“The job market is in good shape,” said Bill Adams, chief economist at Comerica in Dallas. “The unemployment rate’s increase in August is unlikely to be a warning of the economy weakening.”

Bitter infighting among Republicans in the U.S. House of Representatives over spending could lead however to a government shutdown damaging the economy and distorting expectations. Goldman Sachs estimated that the shutdown would reduce fourth-quarter GDP growth by two-tenths of a percentage point for each week it lasts.

______________________________________________________________________

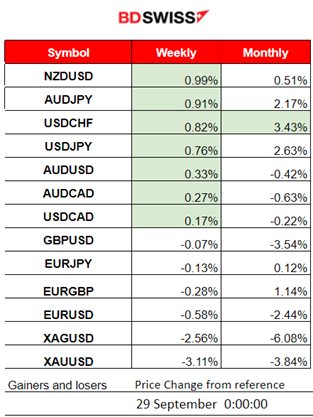

Winners vs Losers

NZDUSD moves to the top of this week’s winners list having 0.99% gains so far followed by AUDJPY having 0.91% gains for the week. Significant AUD appreciation against other currencies is apparent.

This month USDCHF leads with 3.43% gains so far followed by USDJPY. The USD keeps on gaining strength this week.

______________________________________________________________________

News Reports Monitor – Previous Trading Day (28 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Australia’s monthly Retail Sales change figure was reported lower than expected at 0.20% vs. the previous 0.50%. No major shock was observed in the market at the time of the release.

- Morning–Day Session (European and N. American Session)

The monthly German Preliminary CPI change was reported at 0.3%, unchanged while the Spanish Flash yearly CPI figure was reported higher and as expected at 3.50%. No major shock was recorded on EUR pairs at that time.

At 15:30 the quarterly GDP for the U.S. was reported at 2.10%, same as the previous figure. GDP is growing at a pace even as the Federal Reserve continuously hiked interest rates to counter inflation. The Unemployment claims report showed a figure of 204K, an increase of 2K from the previous week’s revised level. These figures are low enough to confirm that resilience in the U.S. labour market continues to hold. No major shock was recorded since the figure had no important effect on the USD.

General Verdict:

____________________________________________________________________

FOREX MARKETS MONITOR

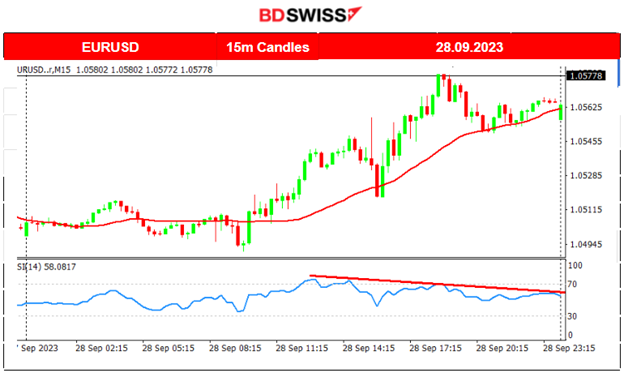

EURUSD (28.09.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD was steadily going upwards mainly as a result of the USD depreciation. The pair experienced some small shocks on the way up but kept its path above the 30-period MA.

___________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Another burst of volatility yesterday was observed after 16:00. Bitcoin Jumped near 800 USD finding resistance at 27300 before retracing to the 61.8 Fibo level (around 26850). The truth is that the DXY had depreciated yesterday explaining some of the BTCUSD movement to the upside. The pause in interest rate hikes and the retreat of the price of oil (yesterday) had their role to play as well on how the crypto asset experienced the sudden jump over the 27K USD threshold.

Crypto sorted by Highest Market Cap:

We have seen how BTCUSD (Bitcoin) suddenly jumped yesterday reaching higher levels. The 7-day column shifted to green since almost all crypto have experienced a similar path. The gains for the last 24 hours make that statement more clear and confirm their correlation to Bitcoin. Most reached more than 2% in gains. Tron’s gains reached over 3% that period, while for the last 7 days, they reached almost 5%.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

This week the index fell to its lowest at 14440 following a long period of a downward path. All benchmark indices were following the same path breaking more and more important support levels. Now we see that the path changed and it coincides with the signals given by the RSI, of an oversold territory. On the 27th, the market reversed and started to move to the upside aggressively breaking resistance levels such as the 14660 showing a strong momentum upwards.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

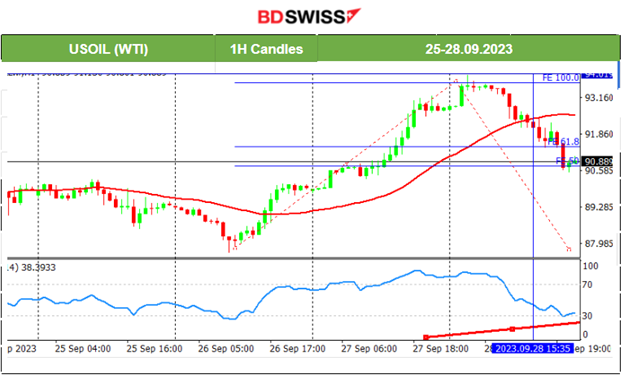

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

A short-term shock caused the price of Crude oil to move rapidly to the upside but it was not meant to last. It was following a reversal in price and the chances for a retracement increased the more it moved to the upside. A strong resistance near 94 USD/b stopped its momentum and served as the end of the shock upwards. Soon a retracement followed with a drop reaching even below 91 USD/b.

Related Analysis and Retracement Idea on TradingView

https://www.tradingview.com/chart/USOIL/4P4As2Hf-USOIL-Is-it-the-Upward-END-28-09-2023/

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold has been moving to the downside significantly. This is partly due to the USD strength. However, we start now to see signals of a bullish divergence and breakout of important resistance levels. After finding some strong support near 1860 USD/oz, Gold’s price reversed crossing the 30-period MA and moving to the upside rapidly. The main driver is the USD which started to suffer with depreciation in the last 2 days.

______________________________________________________________

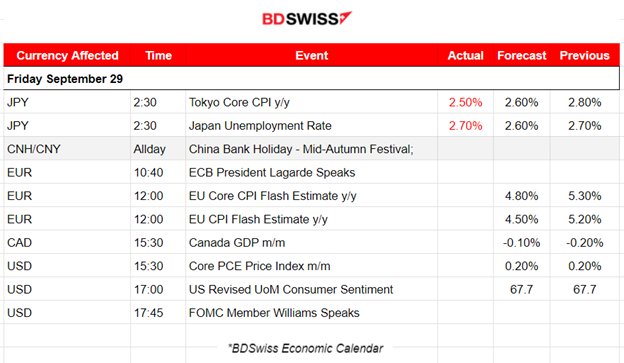

News Reports Monitor – Today Trading Day (29 Sep 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Tokyo’s annual Core CPI change was reported to be 2.5% lower than expected. It seems to have slowed for the third straight month due to falling fuel costs. Japan’s unemployment rate was reported at 2.70% which shows that actually remains unchanged since the previous report. There was no shock recorded in the market when these figures were released. However, we currently observe that volatility is increasing for JPY pairs.

- Morning–Day Session (European and N. American Session)

The yearly changes in CPI Flash estimates could cause more volatility at 12:00 regarding the Euro pairs and other related currencies. These are inflation-related data that are carefully observed by major market participants. These figures are expected to lower since people expect that rising rates by the ECB has a long-lasting effect on inflation thus affecting these figures negatively.

At 15:30 more possible moves in one direction for USD and CAD caused by the release of the scheduled figures. We have the monthly GDP change for Canada that will bring some light to the growth situation in that region and the Core PCE figure for the U.S. that could confirm the stable price changes in that region. Rising oil prices along with the better-than-expected business conditions in the U.S. could outbeat expectations creating a moderate shock and opportunities to trade the USD pairs. Let’s see.

The Revised UoM Consumer Sentiment report is also taking place at 17:00 expected to give the same index figure as the previous, 67.7. Currently, the market sees sticky inflation and the possibility for future rate hikes to rise.

General Verdict:

______________________________________________________________